10 Unstoppable Financial Tips to Transform Your Life

Introduction

With great pleasure, we will explore the intriguing topic related to 10 Unstoppable Financial Tips to Transform Your Life. Let’s weave interesting information and offer fresh perspectives to the readers.

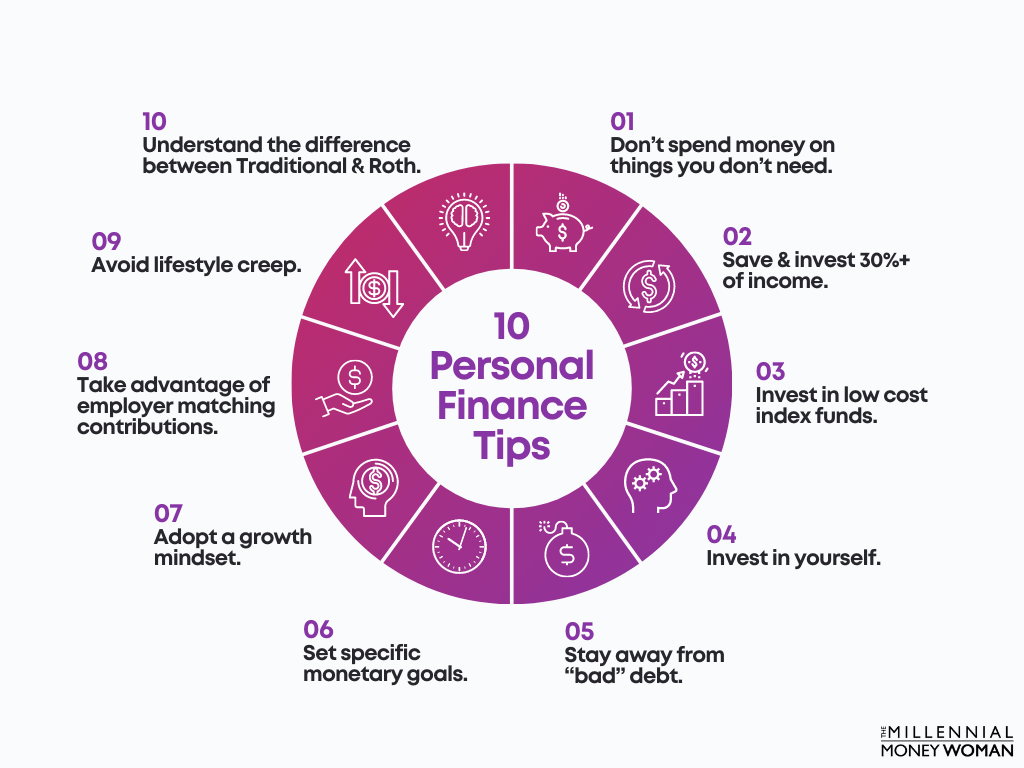

10 Unstoppable Financial Tips to Transform Your Life

The pursuit of financial security is a journey, not a destination. It’s a continuous process of learning, adapting, and making smart choices with your money. While the path can be challenging, it’s ultimately rewarding. By implementing sound financial strategies, you can achieve financial freedom, build a solid foundation for your future, and live a life free from financial stress.

This article will equip you with ten powerful financial tips that can help you navigate the complexities of money management and set yourself up for a brighter financial future.

1. Embrace the Power of Budgeting:

The foundation of any successful financial plan is a solid budget. A budget acts as a roadmap, guiding your spending and ensuring you stay on track with your financial goals.

Here’s how to create a budget that works for you:

- Track your spending: For a month, meticulously record every penny you spend. Use a spreadsheet, a budgeting app, or even a simple notebook.

- Categorize your expenses: Once you have your spending data, categorize it into different areas like housing, food, transportation, entertainment, and savings.

- Identify areas for improvement: Analyze your spending habits and identify areas where you can cut back or make adjustments.

- Set realistic goals: Determine your financial goals, such as paying off debt, saving for a down payment on a house, or investing for retirement.

- Allocate your income: Divide your income into different categories based on your goals and priorities.

2. Conquer Your Debt:

Debt can be a significant financial burden, hindering your ability to achieve financial freedom. Tackling debt effectively is crucial.

Here are some effective strategies for debt management:

- Prioritize high-interest debt: Focus on paying down debt with the highest interest rates first, such as credit cards, as they accumulate interest quickly.

- Debt consolidation: Consider consolidating multiple debts into a single loan with a lower interest rate, simplifying your payments and potentially saving on interest.

- Snowball method: Start by paying off the smallest debt first, regardless of interest rate, and then use that momentum to tackle larger debts.

- Debt avalanche method: Focus on paying down the debt with the highest interest rate first, regardless of size. This method saves you the most money in the long run.

3. Save for a Rainy Day:

Life is unpredictable, and unexpected expenses can arise at any time. Having an emergency fund is essential to navigate these situations without derailing your financial stability.

Here’s how to build an emergency fund:

- Start small: Even if you can only save a small amount each month, start building your emergency fund gradually.

- Automate your savings: Set up automatic transfers from your checking account to your savings account to ensure consistent contributions.

- Aim for 3-6 months of expenses: Ideally, your emergency fund should cover 3-6 months of living expenses.

4. Master the Art of Investing:

Investing is a powerful tool for building wealth and achieving long-term financial goals. It allows your money to grow over time, outpacing inflation and potentially generating significant returns.

Here are some key investing principles:

- Start early: The earlier you begin investing, the more time your money has to grow through compounding.

- Diversify your portfolio: Don’t put all your eggs in one basket. Invest in a variety of asset classes, such as stocks, bonds, real estate, and commodities, to mitigate risk.

- Invest for the long term: Avoid chasing short-term gains and focus on building a diversified portfolio that can weather market fluctuations.

- Seek professional advice: Consider working with a financial advisor to create a personalized investment plan that aligns with your financial goals and risk tolerance.

5. Maximize Your Retirement Savings:

Retirement may seem distant, but it’s never too early to start planning. The earlier you begin saving, the more time your money has to grow, allowing you to enjoy a comfortable retirement.

Here are some tips for maximizing your retirement savings:

- Take advantage of employer-sponsored retirement plans: If your employer offers a 401(k) or similar plan, contribute as much as possible, especially if your employer offers a matching contribution.

- Consider a Roth IRA: A Roth IRA allows you to contribute after-tax dollars and withdraw your earnings tax-free in retirement.

- Invest wisely: Choose investments that align with your risk tolerance and time horizon.

- Review your retirement plan regularly: Adjust your contributions and investment strategy as your financial situation and goals change.

6. Harness the Power of Compound Interest:

Compound interest is the eighth wonder of the world, as Albert Einstein famously said. It’s the magic of earning interest on your initial investment and the interest you earn on that interest.

Here’s how to leverage compound interest:

- Invest early: The longer your money is invested, the more time it has to compound.

- Invest consistently: Regular contributions, even small amounts, can significantly boost your returns over time.

- Avoid unnecessary withdrawals: Resist the temptation to withdraw your investments before they have had time to compound.

7. Negotiate for Better Deals:

Negotiating is a valuable skill that can save you money on everything from car purchases to insurance premiums.

Here are some tips for effective negotiation:

- Be prepared: Research prices, compare offers, and know your worth.

- Be confident and polite: Approach negotiations with confidence and maintain a respectful demeanor.

- Don’t be afraid to walk away: If you’re not getting the deal you want, be willing to walk away and explore other options.

8. Embrace a Frugal Lifestyle:

Frugality is not about deprivation; it’s about making conscious choices to spend your money wisely.

Here are some tips for adopting a frugal lifestyle:

- Cook at home more often: Eating out can be expensive. Cooking at home allows you to control ingredients and save money.

- Shop around for deals: Compare prices, look for coupons and discounts, and take advantage of sales.

- Reduce unnecessary expenses: Identify areas where you can cut back, such as entertainment, subscriptions, or impulse purchases.

9. Educate Yourself on Financial Matters:

Financial literacy is essential for making informed decisions about your money.

Here are some ways to enhance your financial knowledge:

- Read books and articles: There are countless resources available on personal finance, investing, and debt management.

- Attend workshops and seminars: Many organizations offer workshops and seminars on financial topics.

- Take online courses: Numerous online platforms provide courses on personal finance, investing, and other financial subjects.

10. Seek Professional Guidance When Needed:

While you can learn a lot about personal finance on your own, seeking professional guidance from a financial advisor can be invaluable.

Here are some situations where professional advice is beneficial:

- Complex financial situations: If you have a complex financial situation, such as multiple debts, investments, or retirement plans, a financial advisor can help you develop a comprehensive plan.

- Retirement planning: A financial advisor can help you create a retirement plan that meets your needs and goals.

- Investment strategies: A financial advisor can provide personalized investment advice based on your risk tolerance and time horizon.

Conclusion:

Financial success is not about luck; it’s about making informed decisions, embracing good financial habits, and taking control of your money. By implementing these ten unstoppable financial tips, you can transform your financial life, build a solid foundation for your future, and achieve financial freedom. Remember, the journey to financial security is a marathon, not a sprint. Stay committed to your goals, be patient, and enjoy the rewards of your hard work.

Closure

Thus, we hope this article has provided valuable insights into 10 Unstoppable Financial Tips to Transform Your Life. We hope you find this article informative and beneficial. See you in our next article!

google.com