5 Amazing Peer-to-Peer Lending Platforms to Boost Your Investments in 2023

Introduction

With great pleasure, we will explore the intriguing topic related to 5 Amazing Peer-to-Peer Lending Platforms to Boost Your Investments in 2023. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Amazing Peer-to-Peer Lending Platforms to Boost Your Investments in 2023

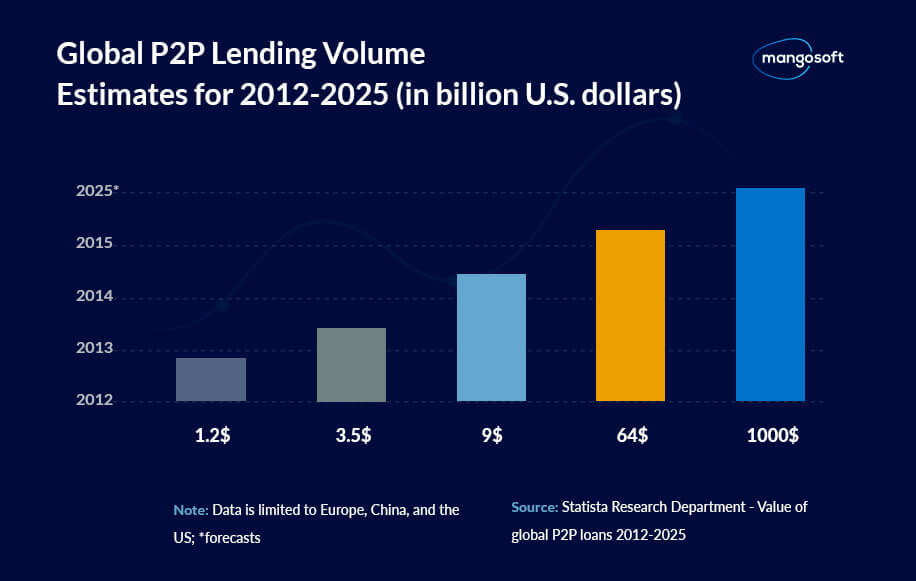

Peer-to-peer (P2P) lending has exploded in popularity in recent years, offering investors a unique opportunity to diversify their portfolios and potentially earn higher returns than traditional savings accounts. But with so many platforms vying for your attention, choosing the right one can feel overwhelming.

This article aims to guide you through the exciting world of P2P lending, highlighting five top platforms that offer a range of features and benefits. We’ll explore their key characteristics, including interest rates, loan types, investment minimums, and fees, to help you make an informed decision about where to invest your hard-earned money.

Understanding Peer-to-Peer Lending

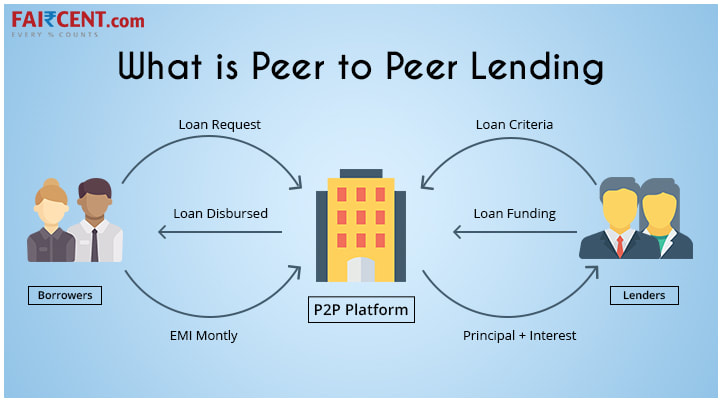

Before we dive into specific platforms, let’s quickly recap the basics of P2P lending. In essence, it involves connecting borrowers directly with lenders, bypassing traditional financial institutions like banks. This streamlined process often translates to lower interest rates for borrowers and potentially higher returns for lenders.

How Does P2P Lending Work?

- Borrowers apply: Individuals or businesses seeking financing submit loan applications to P2P platforms.

- Platforms assess risk: Platforms evaluate borrowers’ creditworthiness and financial history to determine their risk profile.

- Investors choose loans: Investors browse available loans and select those that align with their risk tolerance and investment goals.

- Funds are disbursed: Once a loan is funded, the platform disburses the funds to the borrower.

- Investors receive payments: Borrowers make regular payments to the platform, which distributes the interest and principal to investors.

Key Factors to Consider When Choosing a P2P Lending Platform

- Interest Rates: Compare the average interest rates offered on different platforms. Higher rates generally indicate higher risk, but also potentially higher returns.

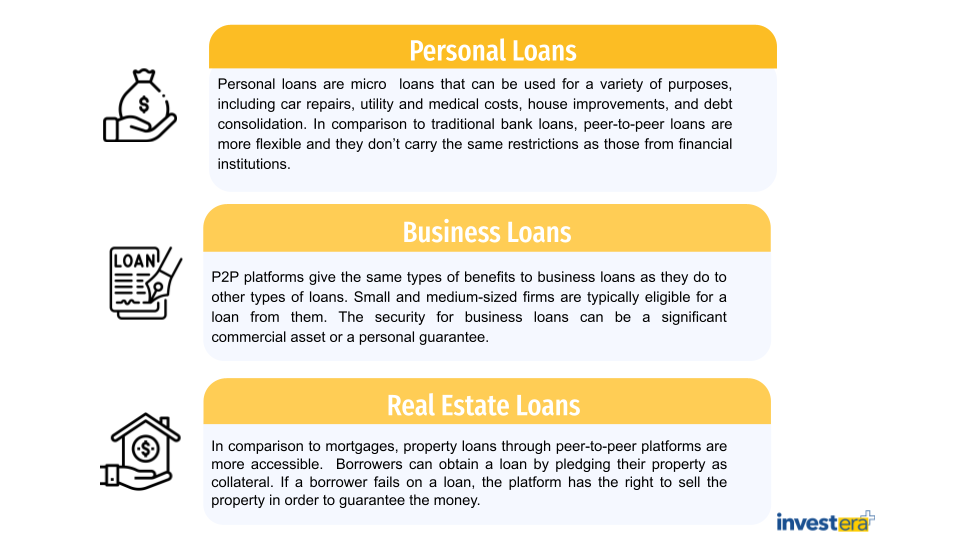

- Loan Types: Determine which types of loans are available, such as personal loans, business loans, or real estate loans.

- Investment Minimums: Consider the minimum investment amount required to start investing. Some platforms have lower minimums than others.

- Fees: Be aware of any fees associated with investing, such as origination fees, platform fees, or late payment fees.

- Risk Assessment: Understand how the platform assesses the risk of borrowers and what measures are in place to protect investors.

- Security: Choose a platform with robust security measures to protect your personal and financial information.

- Customer Service: Evaluate the platform’s customer service responsiveness and helpfulness.

Top 5 Peer-to-Peer Lending Platforms in 2023

1. LendingClub

LendingClub is one of the largest and most established P2P lending platforms in the United States. It offers a wide range of loan types, including personal loans, business loans, and auto loans.

- Pros:

- Well-established platform with a strong track record.

- Wide variety of loan types to choose from.

- Competitive interest rates.

- Robust risk assessment and security measures.

- Cons:

- Higher investment minimums compared to some other platforms.

- Fees can be higher than average.

2. Prosper

Prosper is another popular P2P lending platform that focuses on personal loans. It allows investors to choose from a variety of loan terms and interest rates based on their risk appetite.

- Pros:

- Flexible investment options with different loan terms and interest rates.

- Transparent and detailed loan information for investors.

- Competitive returns for investors.

- Cons:

- Higher risk profile compared to some other platforms.

- Limited loan types available.

3. Peerform

Peerform is a relatively newer P2P lending platform that stands out for its focus on personal loans with shorter terms. It offers investors a unique opportunity to diversify their portfolios with smaller, shorter-term investments.

- Pros:

- Low investment minimums, making it accessible to a wider range of investors.

- Focus on shorter-term loans, potentially reducing risk for investors.

- Competitive interest rates for borrowers.

- Cons:

- Limited loan types available.

- Smaller platform with less experience compared to some others.

4. Funding Circle

Funding Circle is a leading P2P lending platform specializing in business loans. It connects small and medium-sized businesses with investors seeking to support entrepreneurship.

- Pros:

- Focus on business loans, offering investors exposure to a different asset class.

- Potential for higher returns compared to personal loans.

- Strong track record of successful business loans.

- Cons:

- Higher risk profile compared to personal loans.

- Higher investment minimums.

5. Upstart

Upstart is a relatively new P2P lending platform that uses artificial intelligence (AI) to assess borrowers’ creditworthiness. It offers personal loans with competitive interest rates and flexible repayment options.

- Pros:

- Innovative use of AI to assess borrowers’ creditworthiness.

- Offers competitive interest rates for borrowers.

- Flexible repayment options.

- Cons:

- Relatively new platform with limited experience.

- Higher risk profile compared to some other platforms.

Important Considerations for P2P Lending

- Risk Tolerance: P2P lending involves risk, and the potential for losses exists. It’s crucial to invest only what you can afford to lose.

- Diversification: Diversifying your investments across different platforms and loan types can help mitigate risk.

- Due Diligence: Research each platform thoroughly before investing, paying attention to fees, risk assessment methods, and customer reviews.

- Investment Strategy: Develop a clear investment strategy that aligns with your financial goals and risk tolerance.

- Liquidity: P2P loans are not as liquid as traditional investments, so consider your need for quick access to your funds.

Conclusion

Peer-to-peer lending presents an exciting opportunity for investors seeking to diversify their portfolios and potentially earn higher returns. However, it’s essential to approach P2P lending with caution, understanding the inherent risks involved. By carefully researching platforms, considering your risk tolerance, and developing a well-defined investment strategy, you can navigate the world of P2P lending and potentially unlock significant financial benefits.

Closure

Thus, we hope this article has provided valuable insights into 5 Amazing Peer-to-Peer Lending Platforms to Boost Your Investments in 2023. We hope you find this article informative and beneficial. See you in our next article!

google.com