5 Crucial Steps to Master Your Financial Emergency Plan

Related Articles: 5 Crucial Steps to Master Your Financial Emergency Plan

- Unleash The Power Of 10: A Beginner’s Guide To Navigating The Thriving World Of Forex Trading

- 5 Unstoppable Financial Goals To Crush In Your 20s

- Unbreakable: 5 Steps To Craft A Powerful Financial Plan For Your Business

- 5 Brilliant Ways To Maximize Your Credit Card Rewards

- 5 Powerful Strategies To Unleash Your Money’s Unstoppable Growth

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 5 Crucial Steps to Master Your Financial Emergency Plan. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Crucial Steps to Master Your Financial Emergency Plan

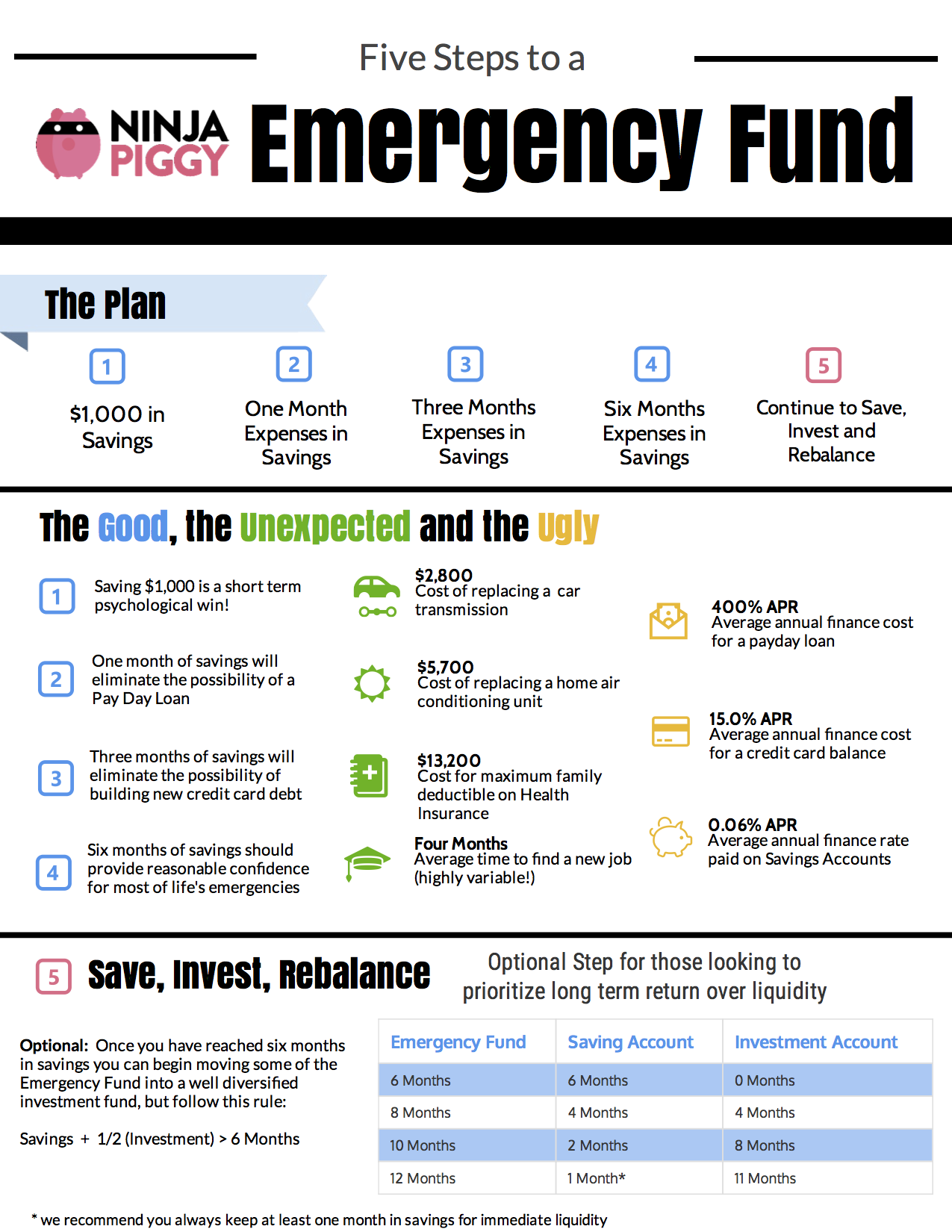

Life throws curveballs. Job loss, unexpected medical bills, car repairs – these unforeseen events can wreak havoc on your finances, leaving you scrambling for solutions. But, it doesn’t have to be this way. With a well-crafted financial emergency plan, you can face these challenges with confidence and stability.

This article outlines a five-step approach to building a robust emergency fund that will empower you to weather any storm.

1. Define Your Emergency Fund Target:

The first step in building an emergency fund is to determine how much you need. There’s no one-size-fits-all answer, as the ideal amount depends on your individual circumstances.

- General Recommendation: Most financial experts recommend having 3-6 months’ worth of essential living expenses saved. This includes rent or mortgage payments, utilities, groceries, transportation, and debt payments.

- Consider Your Situation: Factors like your job security, dependents, and overall financial stability can influence your target amount. For example, if you work in a volatile industry or have a high-risk tolerance, you might aim for a larger emergency fund.

2. Track Your Spending:

Before you can effectively save for emergencies, you need to understand where your money is going. This involves tracking your spending meticulously for at least a month.

- Budgeting Tools: Leverage budgeting apps or spreadsheets to categorize your expenses. This will reveal areas where you can cut back and free up more funds for your emergency fund.

- Identify Non-Essential Spending: Once you have a clear picture of your spending habits, identify areas where you can reduce costs. This might include cutting back on subscriptions, eating out less, or finding cheaper alternatives for entertainment.

3. Create a Savings Strategy:

Now that you know your target amount and have a handle on your spending, it’s time to create a savings plan.

-

- Automatic Transfers: Set up automatic transfers from your checking account to your savings account on a regular basis. This creates a consistent savings habit and ensures you don’t forget to save.

- “Pay Yourself First”: Treat saving for emergencies as a non-negotiable expense. Before you allocate funds for anything else, make a contribution to your emergency fund.

- Utilize “Found Money”: Unexpected windfalls like tax refunds, bonuses, or gifts can be directly channeled into your emergency fund.

4. Choose the Right Savings Account:

Not all savings accounts are created equal. Choosing the right one can maximize your savings potential.

- High-Yield Savings Accounts (HYSA): These accounts offer higher interest rates than traditional savings accounts, allowing your money to grow faster.

- Money Market Accounts (MMA): MMAs offer slightly higher interest rates than HYSAs, but may come with a few more restrictions.

- Certificates of Deposit (CDs): CDs offer fixed interest rates for a set period of time. They can be a good option if you have a large lump sum to save, but you won’t be able to access the funds until the CD matures.

5. Review and Adjust Regularly:

Your financial situation is constantly evolving. It’s crucial to review your emergency fund plan regularly to ensure it remains relevant and effective.

- Reassess Your Needs: As your income, expenses, and life circumstances change, your emergency fund target may need to be adjusted.

- Monitor Your Progress: Track your savings progress and make adjustments to your savings strategy as needed.

- Evaluate Your Savings Account: Shop around for better interest rates and consider switching to a different account if necessary.

Beyond the Basics: Additional Strategies for Building Your Emergency Fund:

While the five steps outlined above provide a solid foundation, there are additional strategies you can implement to accelerate your savings journey:

- Side Hustles: Consider taking on a part-time job or freelance work to supplement your income and boost your savings.

- Sell Unused Items: Declutter your home and sell unwanted items online or at consignment shops to generate extra cash.

- Negotiate Bills: Call your utility providers, insurance companies, and other service providers to negotiate lower rates.

- Cut Down on “Lifestyle Creep”: As your income increases, it’s easy to fall into the trap of spending more. Be mindful of lifestyle creep and resist the urge to upgrade your lifestyle prematurely.

The Power of a Financial Emergency Plan:

A well-crafted financial emergency plan isn’t just about saving money; it’s about peace of mind. It provides a safety net that can help you navigate life’s unexpected turns with confidence and resilience.

Benefits of a Financial Emergency Fund:

- Financial Security: An emergency fund provides a buffer against unexpected expenses, reducing financial stress and anxiety.

- Reduced Debt: With an emergency fund, you’re less likely to rely on credit cards or loans to cover unexpected costs, helping you avoid debt accumulation.

- Improved Credit Score: By avoiding high-interest debt, you can improve your credit score, making it easier to secure loans and credit cards in the future.

- Greater Financial Freedom: Having a financial safety net empowers you to make more informed financial decisions, allowing you to pursue your financial goals with greater confidence.

Conclusion:

Building a financial emergency fund is an essential step towards achieving financial stability and security. By following the five steps outlined in this article, you can create a robust plan that will protect you from unforeseen events and empower you to face the future with confidence. Remember, it’s never too late to start building your emergency fund. Even small, consistent contributions can make a significant difference over time. Take control of your finances and build a resilient financial foundation for a brighter future.

Closure

Thus, we hope this article has provided valuable insights into 5 Crucial Steps to Master Your Financial Emergency Plan. We thank you for taking the time to read this article. See you in our next article!

google.com