5 Essential Financial Tools to Conquer Your Finances

Introduction

With great pleasure, we will explore the intriguing topic related to 5 Essential Financial Tools to Conquer Your Finances. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Essential Financial Tools to Conquer Your Finances

Navigating the complex world of personal finance can feel overwhelming. Between budgeting, saving, investing, and managing debt, it’s easy to feel lost and discouraged. However, with the right tools, you can gain control of your financial life and build a secure future. This article will explore five essential financial tools that can empower you to take charge of your money and achieve your financial goals. These aren’t just tools; they’re weapons in your arsenal against financial insecurity.

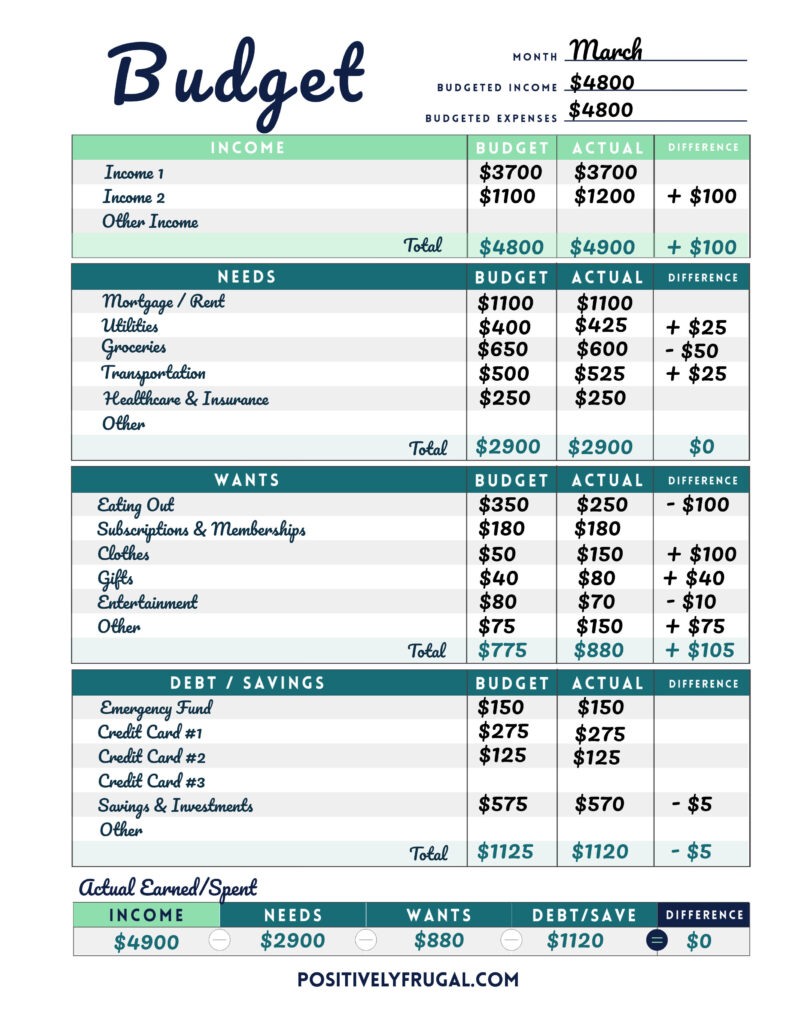

1. Budgeting Apps: The Foundation of Financial Freedom

A budget is the cornerstone of sound financial management. While you can create a budget using a spreadsheet, budgeting apps offer a streamlined and user-friendly experience. These apps automate many tedious tasks, making budgeting less of a chore and more of a proactive strategy. Several excellent options exist, each with its own strengths and weaknesses.

-

Mint: A popular choice, Mint offers a comprehensive overview of your finances, connecting to your bank accounts, credit cards, and investment accounts. It automatically categorizes your transactions, making it easy to track your spending habits. Its features include budgeting tools, bill reminders, and credit score monitoring. While free, it’s supported by advertising.

-

Personal Capital: A more sophisticated option, Personal Capital provides a detailed financial dashboard, including net worth tracking, investment portfolio analysis, and retirement planning tools. It’s particularly useful for investors, offering insights into portfolio diversification and performance. While offering a free version, its advanced features require a paid subscription.

-

YNAB (You Need A Budget): YNAB takes a different approach, focusing on zero-based budgeting. This method assigns every dollar a specific purpose, ensuring you’re proactively managing your money rather than reacting to it. It emphasizes mindful spending and prioritization of goals. It’s a paid subscription service but is highly regarded for its effectiveness.

Choosing the right budgeting app depends on your individual needs and preferences. Consider factors such as ease of use, features offered, and cost. The key is to find an app that motivates you to consistently track your spending and stay on budget.

2. Investment Apps: Growing Your Wealth Strategically

Investing is crucial for long-term financial security, but it can seem daunting for beginners. Investment apps simplify the process, making it easier to start investing even with a small amount of money.

-

Robinhood: Known for its commission-free trading, Robinhood has made investing more accessible to a wider audience. It offers a user-friendly interface and a wide range of investment options, including stocks, ETFs, and options. However, it’s crucial to understand the risks involved before investing.

-

Acorns: Acorns is designed for beginners, focusing on micro-investing. It allows you to round up your purchases and invest the spare change. It’s a great way to start investing without feeling overwhelmed by large sums of money.

-

Fidelity Go: Fidelity Go offers a robo-advisor service, which means it automatically manages your investments based on your risk tolerance and goals. It’s a good option for those who prefer a hands-off approach to investing.

Remember that investing involves risk, and it’s essential to do your research and understand your investment options before making any decisions. Consider your risk tolerance and investment goals before choosing an app.

3. Debt Management Tools: Tackling Debt Effectively

High-interest debt can significantly hinder your financial progress. Debt management tools can help you organize your debts, create a repayment plan, and track your progress.

-

Debt Snowball Method: While not a tool in the traditional sense, the debt snowball method is a powerful strategy. You pay off your smallest debt first, regardless of interest rate, for motivation. Once that’s paid, you roll that payment amount into the next smallest debt, creating a snowball effect.

-

Debt Avalanche Method: The debt avalanche method prioritizes debts with the highest interest rates first. This strategy saves you money on interest in the long run, but it can be less motivating initially.

-

Spreadsheet or Debt Tracker: A simple spreadsheet or dedicated debt tracker app can help you organize your debts, track payments, and visualize your progress. This allows you to monitor your debt reduction effectively.

The best debt management strategy depends on your personality and financial situation. Consider which method will keep you motivated and help you stay on track.

4. Financial Calculators: Planning for the Future

Financial calculators are invaluable tools for planning various aspects of your financial future. They provide estimates for different scenarios, helping you make informed decisions.

-

Retirement Calculators: These calculators help you estimate how much you need to save for retirement based on your current savings, expected income, and desired retirement lifestyle.

-

Mortgage Calculators: These calculators estimate your monthly mortgage payments based on the loan amount, interest rate, and loan term.

-

Investment Return Calculators: These calculators help you estimate the potential growth of your investments over time, based on different rates of return.

Online calculators are readily available, and many financial websites offer free calculators for various purposes.

5. Personal Finance Tracking Software: A Holistic View

While budgeting apps offer a good overview, comprehensive personal finance software provides a more holistic view of your finances. This type of software often combines budgeting, investment tracking, and debt management features into a single platform. Examples include Quicken and Moneydance. These tools can be particularly useful for those with more complex financial situations or those who prefer a more detailed and integrated approach to financial management.

Conclusion:

The tools discussed above are not mutually exclusive; many people use a combination of these tools to manage their finances effectively. The key is to find the tools that best suit your needs, preferences, and financial goals. By utilizing these powerful tools, you can gain control of your financial life, build a secure future, and achieve your financial aspirations. Remember, the journey to financial success is a marathon, not a sprint, and consistent effort with the right tools will make all the difference.

Closure

Thus, we hope this article has provided valuable insights into 5 Essential Financial Tools to Conquer Your Finances. We thank you for taking the time to read this article. See you in our next article!

google.com