5 Powerful Budgeting Apps That Can Transform Your Couple’s Finances

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 5 Powerful Budgeting Apps That Can Transform Your Couple’s Finances. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Powerful Budgeting Apps That Can Transform Your Couple’s Finances

Navigating finances as a couple can be a delicate dance. Between shared expenses, individual goals, and the occasional disagreements about spending habits, managing money together can feel like a constant uphill battle. But it doesn’t have to be this way. With the right tools, you can transform your couple’s finances from a source of stress into a path to financial freedom and shared dreams.

Enter the world of budgeting apps – digital companions that can help you track your spending, set financial goals, and communicate effectively about money. While many apps cater to individual users, a growing number are specifically designed to address the unique needs of couples. These apps offer features that go beyond simple expense tracking, fostering collaboration, transparency, and accountability, ultimately strengthening your financial partnership.

Here are five powerful budgeting apps that can transform your couple’s finances:

1. Mint:

Mint is a popular choice for couples seeking a comprehensive budgeting solution. This app is a powerhouse of features, including:

- Automatic Categorization: Mint automatically categorizes your transactions, saving you time and effort.

- Budgeting and Goal Setting: Create budgets for different categories and set financial goals, like saving for a down payment or paying off debt.

- Bill Tracking and Reminders: Stay on top of bills with timely reminders and avoid late fees.

- Credit Monitoring: Monitor your credit score and receive alerts for suspicious activity.

- Shared Accounts: Link both of your bank accounts and credit cards to get a holistic view of your combined finances.

Pros:

- User-friendly interface and robust features.

- Free to use, with a premium version offering additional features.

- Excellent for couples who want a comprehensive budgeting solution.

Cons:

- Can be overwhelming for users who prefer a simpler approach.

- Limited customization options for shared budgets.

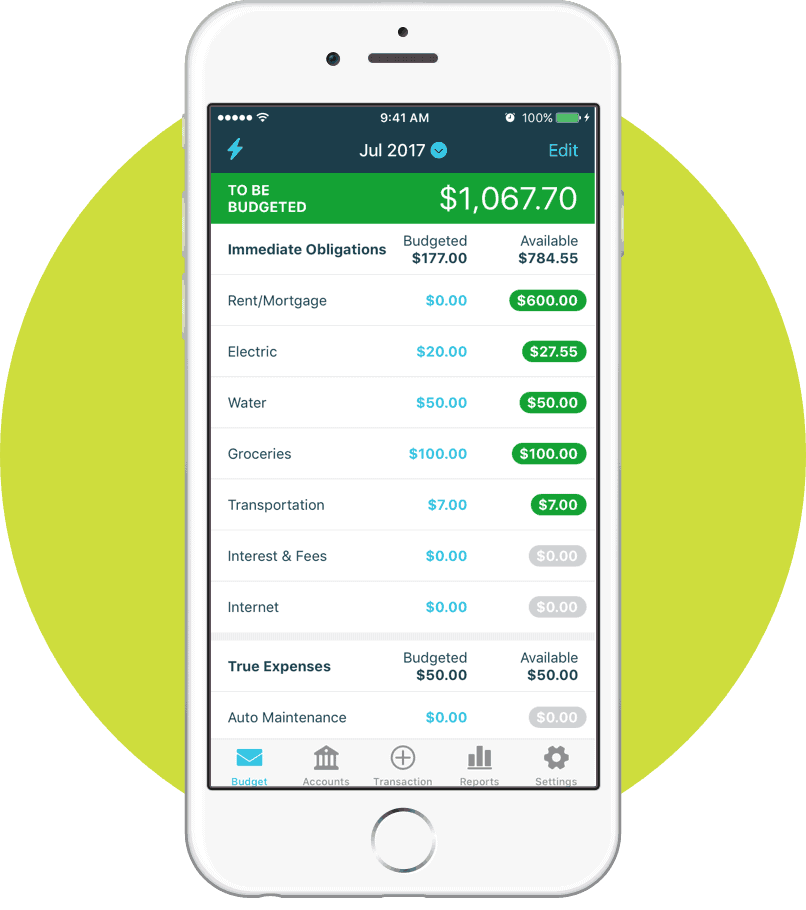

2. YNAB (You Need a Budget):

YNAB takes a unique approach to budgeting, focusing on intentional spending and prioritizing your financial goals. Here’s what makes YNAB stand out:

- Zero-Based Budgeting: YNAB encourages you to allocate every dollar of your income, leaving no room for overspending.

- Goal-Oriented Approach: Prioritize your financial goals and track your progress towards achieving them.

- Budgeting for the Future: YNAB helps you plan for future expenses, like holiday gifts or vacations.

- Shared Budgeting Features: YNAB offers a shared account feature, allowing you to collaborate on budgets and track your joint finances.

Pros:

- Powerful and effective budgeting methodology.

- Strong emphasis on financial goals and future planning.

- Excellent customer support and active community.

Cons:

- Can be more complex than other apps.

- Requires a paid subscription.

3. Honeydue:

Honeydue is specifically designed for couples, offering a collaborative and transparent approach to managing money together. Here are some of its key features:

- Shared Spending: Track all your joint expenses in one place, including recurring bills and shared purchases.

- Customizable Budget: Create a budget together that reflects your shared financial goals and priorities.

- Financial Conversations: Honeydue provides a platform for open and honest conversations about money, helping you stay aligned on financial decisions.

- Bill Splitting: Easily split bills and track who owes whom money.

- Debt Management: Track and manage your shared debt, including loans and credit card balances.

Pros:

- Designed specifically for couples, with features that facilitate collaboration and communication.

- User-friendly interface and intuitive navigation.

- Free to use with a premium version offering additional features.

Cons:

- Limited features compared to some other apps.

- May not be suitable for couples with complex financial situations.

4. PocketGuard:

PocketGuard is a popular budgeting app known for its simplicity and user-friendly interface. It offers features that make managing your finances easy, including:

- Spending Insights: PocketGuard analyzes your spending habits and provides insights into where your money is going.

- Budgeting Tool: Create budgets for different categories and track your progress towards your financial goals.

- Debt Management: Track your debt and prioritize payments to accelerate your debt-free journey.

- Saving Goals: Set saving goals and track your progress towards achieving them.

- Shared Accounts: Connect both of your bank accounts and credit cards to see a comprehensive view of your finances.

Pros:

- Simple and intuitive interface.

- Powerful budgeting tools that help you track your spending and manage your debt.

- Free to use with a premium version offering additional features.

Cons:

- Limited features for shared budgeting and collaboration.

- May not be suitable for couples with complex financial situations.

5. EveryDollar:

EveryDollar is a budgeting app based on the envelope system, a traditional budgeting method that encourages you to allocate your income to specific categories. Here’s what EveryDollar offers:

- Envelope Budgeting: Assign your income to different spending categories, just like you would with physical envelopes.

- Budgeting and Tracking: Create budgets for different categories and track your spending to stay within your limits.

- Financial Planning: Set financial goals and track your progress towards achieving them.

- Debt Management: Track your debt and prioritize payments to pay it off faster.

- Shared Accounts: Connect both of your bank accounts and credit cards to get a holistic view of your finances.

Pros:

- Simple and effective budgeting method.

- Focus on financial planning and goal setting.

- Free to use with a premium version offering additional features.

Cons:

- May not be suitable for couples who prefer a more flexible budgeting approach.

- Limited features for collaboration and communication.

Choosing the Right App for Your Couple:

With so many great budgeting apps available, it’s important to choose one that aligns with your couple’s needs and preferences. Consider the following factors:

- Complexity: Do you prefer a simple app with basic features or a more complex app with advanced capabilities?

- Features: What features are most important to you, such as budgeting tools, goal setting, debt management, or shared accounts?

- Cost: Are you looking for a free app or are you willing to pay for a premium version with additional features?

- User Experience: Does the app have a user-friendly interface that is easy to navigate?

- Collaboration: Does the app offer features that facilitate communication and collaboration between you and your partner?

Beyond the App: The Power of Communication:

While budgeting apps can be powerful tools, they are not a magic bullet for financial success. Open and honest communication about money is essential for a healthy financial partnership. Here are some tips for fostering effective communication about finances:

- Schedule Regular Financial Discussions: Make time to discuss your finances on a regular basis, whether it’s weekly, monthly, or quarterly.

- Be Transparent and Honest: Share your financial information openly and honestly with your partner.

- Set Financial Goals Together: Work together to set financial goals that align with your shared dreams and aspirations.

- Listen Actively and Empathize: Listen attentively to your partner’s concerns and perspectives on money.

- Seek Professional Help: If you’re struggling to communicate about finances, consider seeking advice from a financial advisor or therapist.

Conclusion:

Budgeting apps can be invaluable tools for couples seeking to transform their finances and build a stronger financial partnership. By choosing the right app and fostering open communication, you can achieve your financial goals, create a secure future, and enjoy the journey together.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Budgeting Apps That Can Transform Your Couple’s Finances. We thank you for taking the time to read this article. See you in our next article!

google.com