5 Powerful Financial Tools and Apps That Can Transform Your Finances

Related Articles: 5 Powerful Financial Tools and Apps That Can Transform Your Finances

- 5 Brilliant Ways To Maximize Your Credit Card Rewards

- 7 Powerful Strategies For A Radiant Retirement: Securing Your Future With Confidence

- 5 Powerful Reasons Why Automatic Savings Plans Are A Game-Changer For Your Financial Future

- Continuous Demand Finance Careers from now to 100 years into the future

- The Ultimate Guide To 5 Essential Cryptocurrency Concepts

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 5 Powerful Financial Tools and Apps That Can Transform Your Finances. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Powerful Financial Tools and Apps That Can Transform Your Finances

In today’s digitally driven world, managing your finances effectively is no longer a daunting task. A plethora of powerful financial tools and apps are available at your fingertips, offering a range of features to help you budget, save, invest, and even track your spending. These tools can be game-changers for anyone looking to take control of their financial future and achieve their financial goals.

Understanding the Power of Financial Tools

Financial tools and apps are designed to simplify and streamline your financial management. They provide you with insights, automation, and personalized recommendations, ultimately empowering you to make informed decisions about your money.

Here’s a breakdown of how these tools can benefit you:

-

- Increased Financial Awareness: By tracking your income, expenses, and net worth, these tools provide a clear picture of your current financial standing. This transparency allows you to identify areas where you can save, cut back on unnecessary spending, and make better financial choices.

- Enhanced Budgeting and Savings: Financial tools offer budgeting features that allow you to set spending limits, track progress towards your savings goals, and create personalized budgets based on your income and expenses.

- Streamlined Investment Management: Many apps provide investment tracking, portfolio analysis, and even automated investment options like robo-advisors, making it easier to manage your investments and grow your wealth.

- Improved Credit Management: Tools can help you monitor your credit score, identify potential issues, and track your credit card usage, ultimately helping you build and maintain good credit.

- Financial Planning and Goal Setting: Financial tools can assist you in setting financial goals, creating a roadmap for achieving them, and tracking your progress over time.

5 Powerful Financial Tools and Apps to Enhance Your Financial Life

Here are five powerful financial tools and apps that can transform your financial management and empower you to achieve your financial goals:

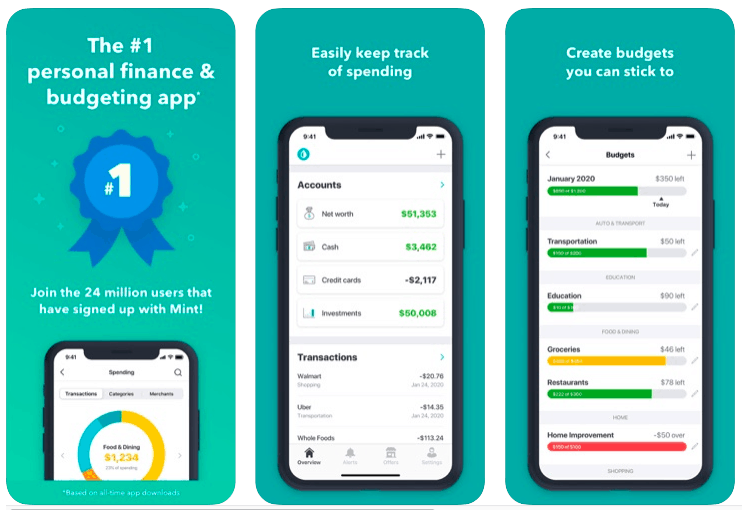

1. Mint: Your All-in-One Financial Dashboard

Mint is a comprehensive personal finance management app that aggregates all your financial accounts, including bank accounts, credit cards, loans, investments, and even bills, in one central location. This allows you to monitor your spending, track your net worth, and set budgets with ease.

Key Features:

-

- Account Aggregation: Mint connects to all your financial accounts, giving you a consolidated view of your finances.

- Budgeting and Spending Tracking: Create personalized budgets, set spending limits, and track your spending across categories.

- Bill Payment Reminders: Receive timely reminders for upcoming bills, preventing missed payments and late fees.

- Credit Score Monitoring: Track your credit score and receive alerts about potential issues, helping you maintain good credit.

- Financial Goals and Progress Tracking: Set financial goals, such as saving for a down payment or paying off debt, and track your progress towards achieving them.

2. Personal Capital: A Comprehensive Financial Management Platform

Personal Capital is a powerful financial management platform that goes beyond basic budgeting and tracking. It offers investment management, retirement planning, and even financial advice from certified financial advisors.

Key Features:

- Investment Management: Track your investment portfolio, analyze its performance, and receive personalized investment recommendations.

- Retirement Planning: Estimate your retirement needs, project your future income, and create a personalized retirement plan.

- Financial Advice: Access financial advice from certified financial advisors, either through the platform or through scheduled consultations.

- Net Worth Tracking: Track your net worth, including assets and liabilities, to gain a comprehensive understanding of your financial health.

- Cash Flow Analysis: Analyze your cash flow, identify potential spending leaks, and make informed financial decisions.

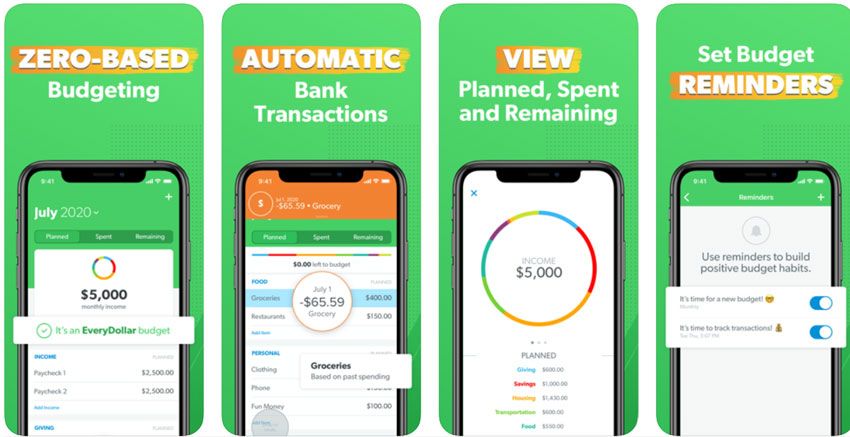

3. YNAB (You Need a Budget): Mastering Budgeting and Saving

YNAB (You Need a Budget) is a popular budgeting app that emphasizes the importance of mindful spending and prioritizing your financial goals. It encourages users to allocate every dollar of their income, ensuring that money is spent intentionally and not wasted.

Key Features:

- Zero-Based Budgeting: YNAB requires you to allocate every dollar of your income, ensuring that all your expenses are covered and you have a clear understanding of where your money is going.

- Goal-Oriented Budgeting: Set specific financial goals, such as saving for a down payment or paying off debt, and allocate money towards them.

- Flexible Budgeting: YNAB allows you to adjust your budget based on your needs and priorities, making it a highly adaptable tool.

- Spending Tracking and Analysis: Track your spending, categorize your expenses, and identify areas where you can cut back.

- Debt Management Features: YNAB provides tools to help you manage and pay down debt effectively.

4. Acorns: Micro-Investing Made Easy

Acorns is a micro-investing app that makes investing accessible and effortless. It automatically rounds up your purchases to the nearest dollar and invests the spare change in a diversified portfolio of ETFs.

Key Features:

- Round-Up Investing: Acorns automatically rounds up your purchases to the nearest dollar and invests the spare change in your chosen investment portfolio.

- Diversified Portfolio: Acorns offers a variety of investment portfolios tailored to different risk tolerances and investment goals.

- Automated Investment: Investing is automated, making it easy to start and maintain a regular investment habit.

- Low Fees: Acorns charges a small monthly fee for its services, making it an affordable option for micro-investing.

- Financial Education Resources: Acorns provides educational resources to help users learn about investing and build their financial knowledge.

5. Credit Karma: Monitor Your Credit and Find Better Financial Products

Credit Karma is a free credit monitoring service that provides users with access to their credit scores and reports from TransUnion and Equifax. It also offers personalized recommendations for financial products, such as credit cards, loans, and insurance.

Key Features:

- Free Credit Monitoring: Access your credit scores and reports from TransUnion and Equifax for free.

- Credit Score Tracking: Track your credit score over time and receive alerts about potential issues.

- Financial Product Recommendations: Receive personalized recommendations for credit cards, loans, and insurance based on your financial profile.

- Debt Management Tools: Credit Karma offers tools to help you manage your debt and make informed decisions about your finances.

- Financial Education Resources: Access educational resources to help you learn about credit, debt, and other financial topics.

Choosing the Right Financial Tools for You

With so many financial tools and apps available, it can be overwhelming to choose the right ones for you. Here are some factors to consider:

- Your Financial Goals: Consider your financial goals and choose tools that align with your needs, whether it’s budgeting, saving, investing, or managing debt.

- Your Budget: Some financial tools are free, while others come with monthly subscriptions. Choose a tool that fits your budget and provides the features you need.

- Your Tech Savviness: Some tools are more user-friendly than others. Choose a tool that you feel comfortable using and that meets your technical skills.

- Your Personal Preferences: Consider your personal preferences and choose a tool that offers the features and interface that you find most appealing.

Tips for Getting the Most Out of Financial Tools

- Start Small: Don’t try to do everything at once. Start with one or two tools that address your most pressing financial needs.

- Be Consistent: Use the tools regularly to track your progress and make informed financial decisions.

- Set Realistic Goals: Set achievable financial goals and track your progress towards achieving them.

- Don’t Be Afraid to Ask for Help: If you’re struggling to use a tool or need financial advice, don’t hesitate to reach out for assistance.

Conclusion

Financial tools and apps have become indispensable for managing your finances in today’s digital age. They offer a range of features to help you budget, save, invest, and track your spending, ultimately empowering you to achieve your financial goals.

By choosing the right tools, setting realistic goals, and using them consistently, you can take control of your finances and build a brighter financial future. Remember, the key is to find tools that work for you and make managing your money easier and more enjoyable.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Financial Tools and Apps That Can Transform Your Finances. We thank you for taking the time to read this article. See you in our next article!

google.com