5 Powerful Steps to Unlock Your Financial Freedom: Understanding Your Goals

Introduction

With great pleasure, we will explore the intriguing topic related to 5 Powerful Steps to Unlock Your Financial Freedom: Understanding Your Goals. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Powerful Steps to Unlock Your Financial Freedom: Understanding Your Goals

In today’s fast-paced world, it’s easy to get caught up in the daily grind and lose sight of the bigger picture. We work, we consume, we repeat. But what about our financial future? Are we truly in control of our financial destiny, or are we simply drifting along, hoping for the best?

The truth is, achieving financial freedom requires a conscious effort, a clear vision, and a well-defined plan. This plan starts with understanding your financial goals. Without them, you’re like a ship without a rudder, aimlessly navigating the turbulent seas of financial uncertainty.

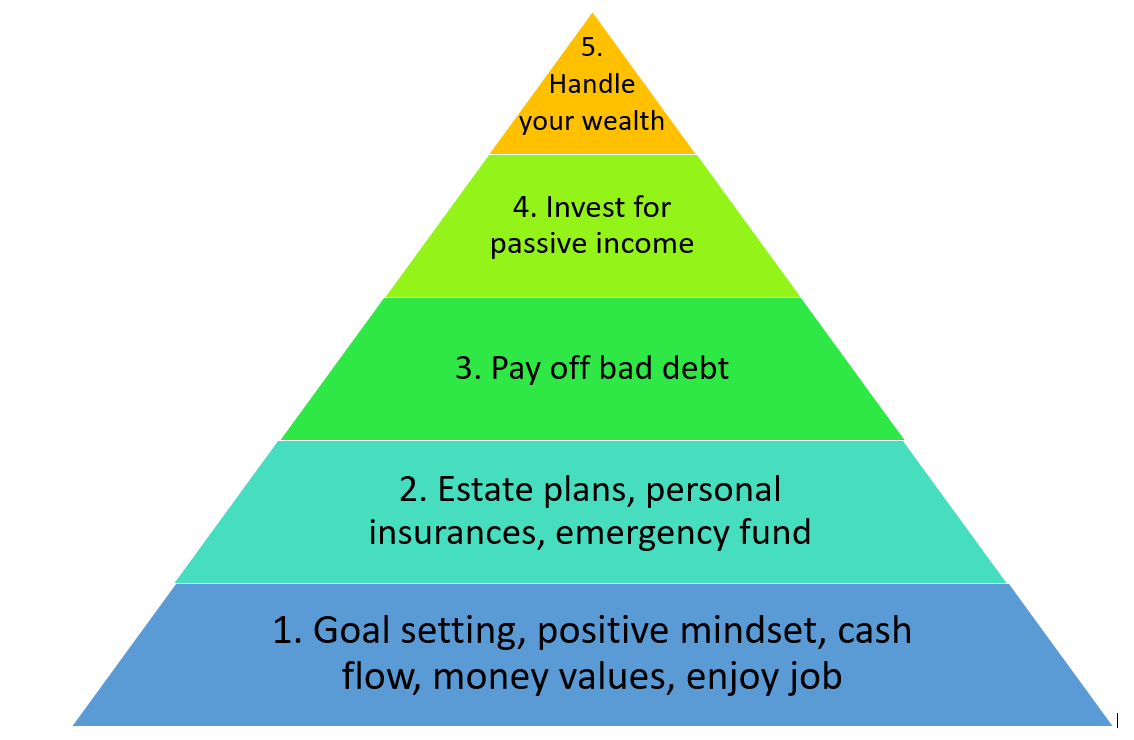

This article will guide you through five powerful steps to unlock your financial freedom by defining and understanding your financial goals. These steps are not just about numbers; they are about building a solid foundation for a secure and fulfilling financial future.

1. Define Your "Why": The Foundation of Financial Motivation

Before diving into the details of your financial goals, it’s crucial to understand your "why." Why are you pursuing financial freedom? What does it mean to you? Is it about retiring early and traveling the world? Is it about providing a secure future for your family? Or maybe it’s about simply having the peace of mind that comes with financial stability.

Identifying your "why" is the cornerstone of your financial journey. It’s the driving force that will motivate you to stay committed to your goals, even when faced with challenges.

Here are some questions to help you define your "why":

- What are your aspirations for the future?

- What kind of lifestyle do you envision for yourself and your family?

- What financial anxieties or fears are you trying to address?

- What legacy do you want to leave behind?

Once you have a clear understanding of your "why," you’ll be able to set realistic and meaningful financial goals that align with your values and aspirations.

2. Set SMART Goals: Clarity and Direction for Your Financial Future

Now that you’ve established your "why," it’s time to translate those aspirations into concrete financial goals. But setting goals is not enough. They need to be SMART:

- Specific: Your goals should be clearly defined and avoid vague statements. Instead of "save more money," aim for "save $10,000 in the next year."

- Measurable: Quantify your goals so you can track your progress. How much money do you want to save? How much debt do you want to eliminate?

- Achievable: Set goals that are challenging but attainable. Don’t aim for the moon if you haven’t yet mastered walking.

- Relevant: Your goals should align with your overall financial objectives and your "why." Don’t chase goals that don’t resonate with your values.

- Time-bound: Set deadlines for your goals. This creates a sense of urgency and helps you stay on track.

Here are some examples of SMART financial goals:

- Save $5,000 for a down payment on a house within the next two years.

- Pay off $10,000 in credit card debt within the next 12 months.

- Increase your net worth by $20,000 in the next five years.

- Invest $1,000 per month in a retirement account for the next 20 years.

3. Prioritize Your Goals: Focus on What Matters Most

Once you have a list of SMART financial goals, it’s time to prioritize them. Not all goals are created equal. Some may be more important than others, and some may require more immediate attention.

To prioritize your goals, consider the following factors:

- Urgency: Some goals, like paying off high-interest debt, may require immediate action.

- Impact: Which goals will have the biggest positive impact on your financial well-being?

- Timeline: Some goals, like retirement planning, may have a longer timeframe.

By prioritizing your goals, you can focus your energy and resources on the most important objectives first. This helps you make steady progress and avoid feeling overwhelmed.

4. Break Down Your Goals into Actionable Steps:

Large, ambitious financial goals can seem daunting. To avoid feeling overwhelmed, break them down into smaller, more manageable steps. This creates a sense of progress and keeps you motivated.

For example, if your goal is to save $10,000 in the next year, you can break it down into monthly savings targets of $833. Then, you can further break down each monthly target into weekly or even daily savings goals.

This approach allows you to track your progress more closely and celebrate small victories along the way. It also makes it easier to adjust your plan if you encounter unexpected obstacles.

5. Regularly Review and Adjust Your Plan:

Life is dynamic, and your financial goals should reflect that. Your circumstances, priorities, and even your "why" may change over time. It’s essential to regularly review and adjust your financial plan to ensure it remains aligned with your current situation and aspirations.

Here are some questions to ask yourself during your regular reviews:

- Have my priorities changed?

- Have my financial circumstances changed?

- Am I making progress towards my goals?

- Do I need to adjust my savings rate or investment strategy?

- Are there any new goals I want to add to my plan?

By regularly reviewing and adjusting your plan, you can stay on track to achieve your financial goals and adapt to life’s inevitable changes.

Conclusion: Unlocking Financial Freedom Through Goal Setting

Understanding and defining your financial goals is the foundation of a successful financial future. It’s not just about numbers; it’s about creating a roadmap for your financial well-being. By following the five steps outlined in this article, you can unlock your financial freedom, build a secure future, and achieve your dreams.

Remember, financial freedom is not a destination; it’s a journey. It requires commitment, discipline, and a willingness to adapt. But with a clear vision, a well-defined plan, and the right tools, you can navigate the complexities of personal finance and create a life of financial security and abundance. So, start today. Define your "why," set SMART goals, prioritize, break them down, and regularly review your plan. The journey to financial freedom starts with a single step.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Steps to Unlock Your Financial Freedom: Understanding Your Goals. We appreciate your attention to our article. See you in our next article!

google.com