5 Powerful Strategies for a Thriving Retirement: Don’t Let Your Dreams Fade Away

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Powerful Strategies for a Thriving Retirement: Don’t Let Your Dreams Fade Away. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Powerful Strategies for a Thriving Retirement: Don’t Let Your Dreams Fade Away

Retirement. It’s a word that evokes a range of emotions – excitement, trepidation, and perhaps even a hint of fear. For many, it represents the culmination of a lifetime of hard work, a chance to finally relax and pursue passions that were once sidelined by the demands of a career. But for others, retirement can feel like an uncertain future, a looming void filled with anxieties about finances, health, and purpose.

The truth is, retirement can be whatever you make it. It’s a blank canvas upon which you can paint your dreams, your passions, and your aspirations. But to ensure that your retirement is a truly fulfilling experience, it requires careful planning and a proactive approach.

This article will explore 5 powerful strategies that can help you achieve a thriving retirement, one where you are not just surviving, but truly living life on your own terms.

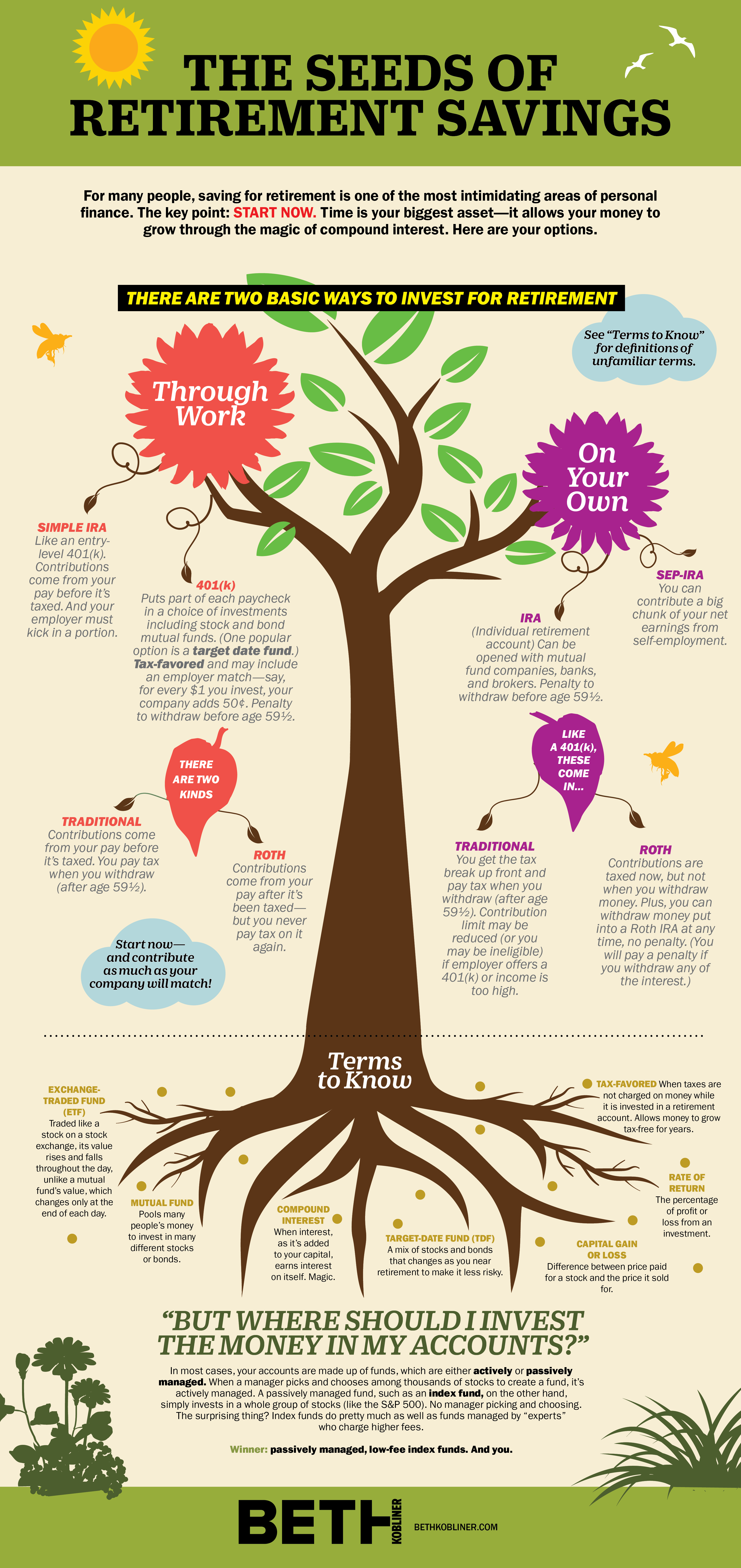

1. Start Early and Stay Consistent: The Power of Compounding

The earlier you begin saving for retirement, the more time your money has to grow. This is the magic of compounding, where earnings from your investments generate further earnings, creating a snowball effect that accelerates your wealth accumulation.

Here’s a simple illustration:

- Imagine you start saving $500 per month at age 25, earning an average annual return of 7%. By age 65, you’ll have accumulated over $1 million.

- If you wait until age 35 to start saving the same amount, you’ll only have accumulated around $500,000 by age 65.

This stark difference highlights the power of starting early. Even small, consistent contributions can make a significant difference over time.

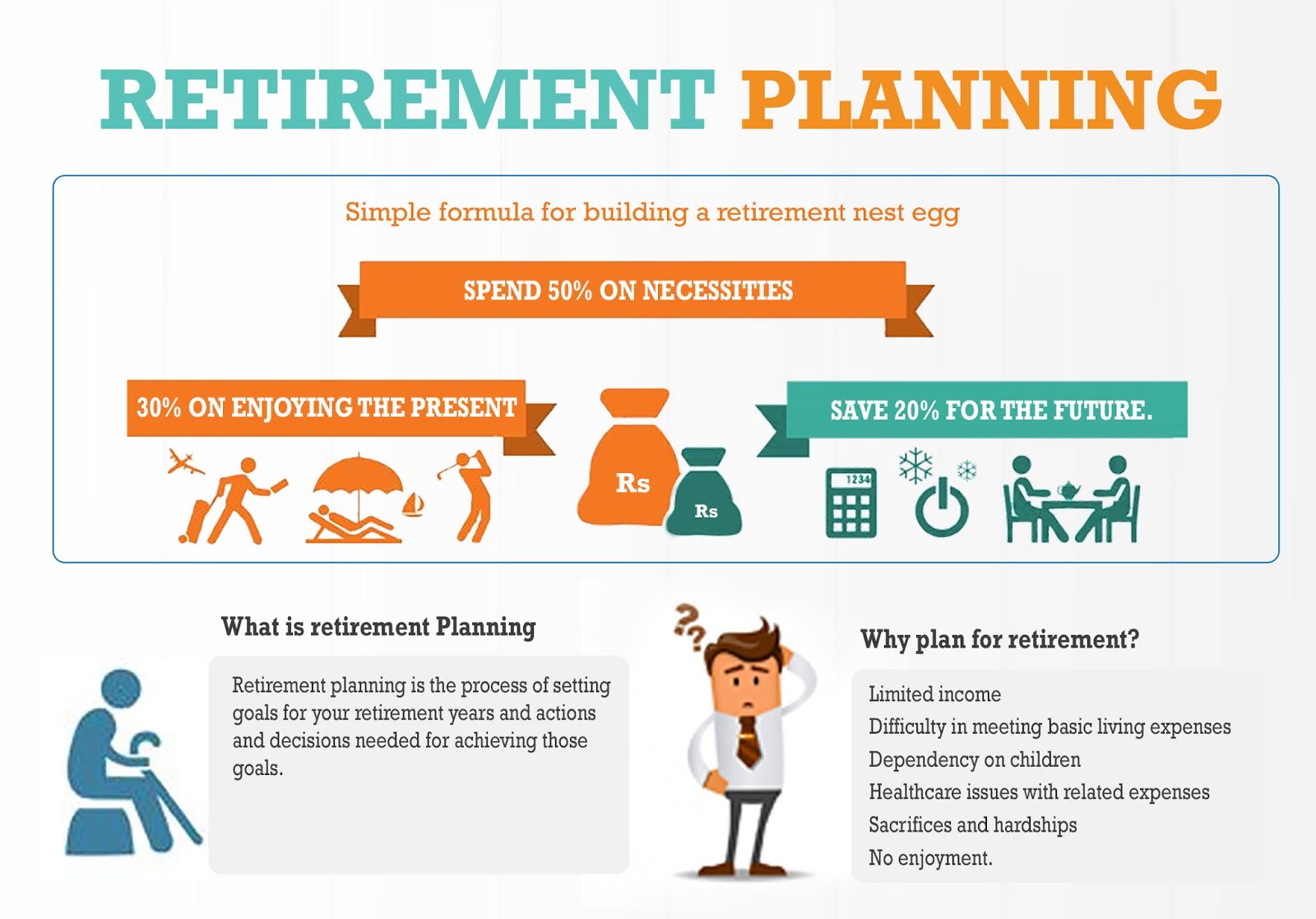

2. Define Your Retirement Goals: Beyond the Numbers

Retirement planning often focuses on financial goals, like having a certain amount of savings or generating a specific income stream. While these are important, it’s equally crucial to define your non-financial goals, which will shape the quality of your retirement experience.

Ask yourself:

- What do you envision your retirement life to be like? Do you dream of traveling the world, pursuing hobbies, spending more time with family, volunteering, or starting a new business?

- What are your passions and interests? How can you incorporate them into your daily life in retirement?

- What kind of lifestyle do you desire? Do you want to live in a bustling city, a peaceful suburb, or a remote countryside?

By defining your goals beyond the numbers, you’ll gain a clearer picture of what truly matters to you and how to prioritize your financial planning accordingly.

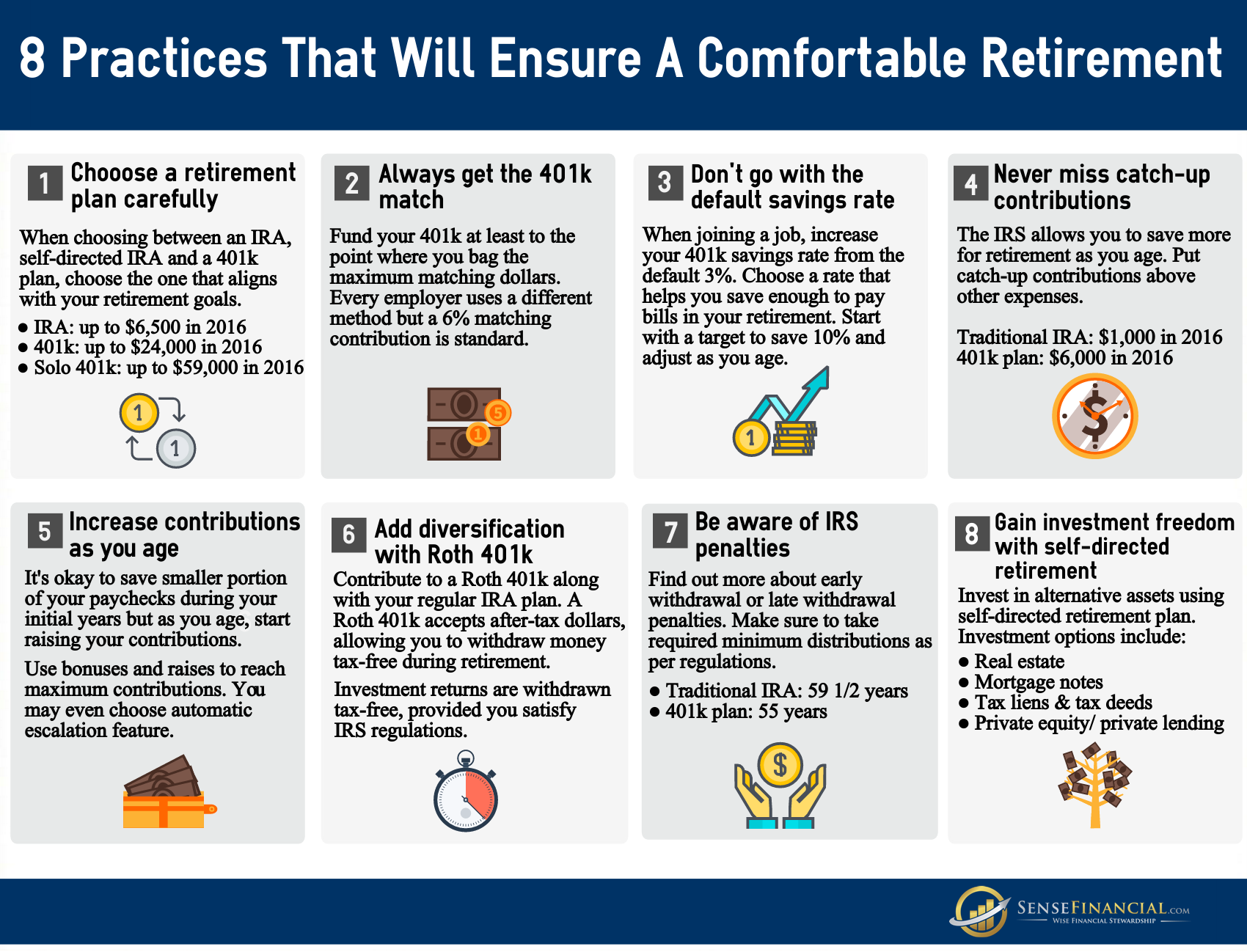

3. Diversify Your Portfolio: Don’t Put All Your Eggs in One Basket

Investing in a diversified portfolio is essential to mitigate risk and ensure the long-term growth of your retirement savings.

Here’s why diversification matters:

- Reduces volatility: By spreading your investments across different asset classes like stocks, bonds, real estate, and commodities, you can reduce the impact of any single asset’s performance on your overall portfolio.

- Increases potential returns: Different asset classes have different growth potential, and diversifying allows you to capitalize on the upside of various markets.

- Protects against inflation: Inflation erodes the purchasing power of your savings over time. Diversifying your portfolio can help you stay ahead of inflation and maintain the real value of your investments.

4. Plan for Healthcare Costs: A Crucial Element of Retirement

Healthcare costs are a significant factor in retirement planning, and they tend to increase as you age.

Consider these strategies:

- Maximize your health insurance coverage: Explore options like Medicare, supplemental insurance, and long-term care insurance to ensure you have adequate coverage for potential medical expenses.

- Maintain a healthy lifestyle: By prioritizing healthy habits like regular exercise, a balanced diet, and stress management, you can reduce your risk of developing chronic illnesses and lower your healthcare costs.

- Explore healthcare savings accounts (HSAs): HSAs offer tax advantages for healthcare expenses and can help you accumulate funds for future medical needs.

5. Embrace a Growth Mindset: Continuously Learn and Adapt

Retirement is not the end of your journey, but a new beginning. Embrace a growth mindset and be open to learning new things, exploring new interests, and adapting to changing circumstances.

Here are some tips for continuous learning:

- Take online courses or workshops: Explore subjects that pique your interest or enhance your skills.

- Join clubs or groups: Connect with like-minded individuals and engage in shared activities.

- Volunteer your time: Give back to your community and gain new perspectives.

- Travel and explore: Broaden your horizons and experience new cultures.

By embracing a growth mindset, you can ensure that your retirement is not just a time for relaxation, but also a time for personal growth and fulfillment.

Conclusion: A Thriving Retirement Awaits

Retirement planning is not about sacrificing your dreams; it’s about making them a reality. By starting early, defining your goals, diversifying your investments, planning for healthcare costs, and embracing a growth mindset, you can create a thriving retirement that is both financially secure and personally fulfilling.

Don’t let your dreams fade away. Take control of your future and start planning for the retirement you deserve.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Strategies for a Thriving Retirement: Don’t Let Your Dreams Fade Away. We thank you for taking the time to read this article. See you in our next article!

google.com