5 Powerful Strategies for Mastering Your Money and Achieving Financial Freedom

Related Articles: 5 Powerful Strategies for Mastering Your Money and Achieving Financial Freedom

- 7 Brilliant Ways To Slash Your Monthly Expenses And Boost Your Financial Freedom

- Master Your Finances: A 5-Step Guide To Creating A Powerful Spending Plan

- 5 Unstoppable Tips For Building A Stellar Credit History

- Unleashing The Power Of 1000: A Comprehensive Guide To Understanding Mutual Funds

- 5 Unstoppable Strategies To Unlock Your Wealth Potential

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 5 Powerful Strategies for Mastering Your Money and Achieving Financial Freedom. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Powerful Strategies for Mastering Your Money and Achieving Financial Freedom

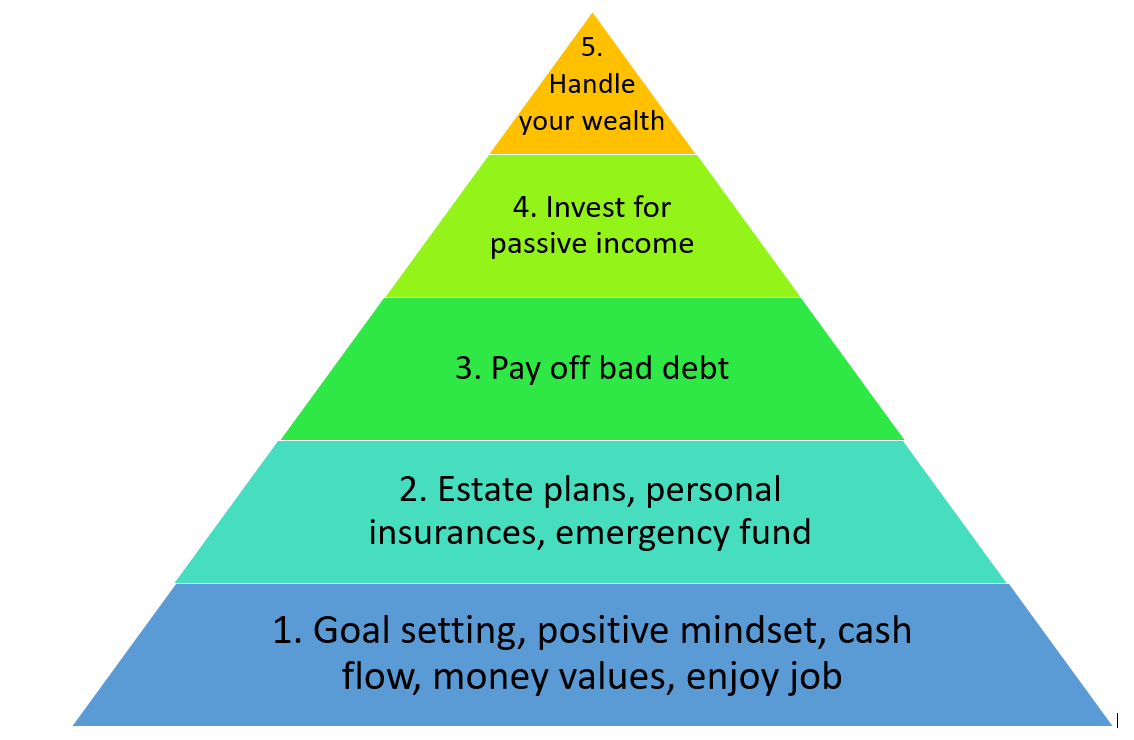

Navigating the complex world of finances can feel like a daunting task, especially when faced with the ever-present pressures of rising costs and economic uncertainty. But it doesn’t have to be a constant source of stress. By adopting a proactive approach and implementing effective strategies, you can gain control of your finances and set yourself on a path towards financial freedom. This article will delve into five powerful strategies that can empower you to master your money and build a secure financial future.

1. Embrace the Power of Budgeting:

At the heart of sound financial management lies the art of budgeting. A budget acts as a roadmap, guiding your spending and ensuring your money is allocated wisely. Here’s how to create an effective budget:

- Track Your Spending: The first step is to understand where your money is going. For a month or two, meticulously track every dollar you spend. Utilize a spreadsheet, budgeting app, or even a simple notebook. This exercise will reveal your spending habits and highlight areas where you might be overspending.

- Categorize Your Expenses: Group your spending into categories such as housing, transportation, food, entertainment, and debt payments. This categorization will provide valuable insights into your spending patterns and help you identify areas for potential savings.

- Set Realistic Goals: Determine your financial goals, whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund.

- Create a Spending Plan: Allocate your income to cover your essential expenses, debt payments, and savings goals. Remember, a budget is a living document, so be prepared to adjust it as your financial situation evolves.

2. Prioritize Debt Reduction:

Debt can be a significant financial burden, hindering your ability to save and invest. Tackling debt strategically is essential for achieving financial stability.

-

- Understand the Types of Debt: Differentiate between good debt (e.g., student loans for a degree that increases earning potential) and bad debt (e.g., high-interest credit card debt).

- Prioritize High-Interest Debt: Focus on paying down debts with the highest interest rates first, as these are costing you the most in interest charges.

- Consider Debt Consolidation: If you have multiple debts with high interest rates, consider consolidating them into a single loan with a lower interest rate. This can simplify your payments and potentially save you money on interest.

- Negotiate with Creditors: Don’t be afraid to reach out to your creditors and discuss potential options for lowering your interest rates or extending your repayment terms.

3. Build a Robust Emergency Fund:

Life is unpredictable, and unforeseen expenses can arise at any time. An emergency fund acts as a safety net, providing a financial cushion to navigate unexpected events without resorting to debt.

- Aim for 3-6 Months of Expenses: A general rule of thumb is to have 3-6 months of essential living expenses saved in an emergency fund. This amount should cover necessities like rent, utilities, groceries, and transportation.

- Automate Savings: Set up automatic transfers from your checking account to your savings account. This hands-off approach ensures you consistently contribute to your emergency fund without actively thinking about it.

- Keep Emergency Funds Liquid: Store your emergency fund in a readily accessible account, such as a high-yield savings account or money market account, so you can easily access it when needed.

4. The Power of Investing:

Investing is a powerful tool for building wealth over the long term. By investing your money, you allow it to grow through compounding returns and outpace inflation.

- Understand Your Risk Tolerance: Determine your comfort level with risk before investing. A higher risk tolerance generally means you are willing to invest in assets with the potential for higher returns but also greater volatility.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes, such as stocks, bonds, real estate, and commodities. This reduces your overall risk and potentially enhances returns.

- Start Small and Be Consistent: Even small, regular investments can compound over time. Automate your investments through a robo-advisor or a brokerage account to make investing a consistent habit.

- Seek Professional Advice: Consider consulting with a financial advisor, especially if you are new to investing or have complex financial needs.

5. Optimize Your Income:

Increasing your income is a powerful way to accelerate your financial progress. Explore these strategies to boost your earnings:

- Negotiate Your Salary: Don’t be afraid to negotiate your salary, especially when accepting a new job or during annual performance reviews. Research industry benchmarks and be prepared to justify your desired salary.

- Upskill and Seek Promotions: Continuously invest in your professional development by acquiring new skills and knowledge. This will make you more valuable in the job market and increase your earning potential.

- Explore Side Hustles: Consider starting a side hustle to supplement your income. There are numerous opportunities, from freelance writing and consulting to online teaching and e-commerce.

- Maximize Your Tax Benefits: Take advantage of tax deductions and credits to reduce your tax burden and keep more of your hard-earned money. Consult with a tax professional to ensure you are maximizing your tax benefits.

The Path to Financial Freedom:

Mastering your money is not a one-time event but an ongoing journey. By consistently implementing these strategies and adapting them to your unique financial situation, you can gain control of your finances, achieve your financial goals, and build a secure future. Remember, financial freedom is not about accumulating vast wealth; it’s about having the financial flexibility to live life on your own terms and pursue your dreams without financial constraints.

Beyond the Basics:

While these five strategies provide a strong foundation for financial management, there are additional aspects to consider:

- Retirement Planning: Start saving for retirement early, even if it’s just a small amount. Compounding returns work wonders over time, and the earlier you start, the more time your money has to grow.

- Insurance Coverage: Ensure you have adequate insurance coverage for your health, home, and car. Insurance protects you from financial ruin in case of unforeseen events.

- Estate Planning: Consider your estate planning needs, especially if you have a family or significant assets. This includes creating a will, setting up a trust, and appointing a power of attorney.

Conclusion:

Financial freedom is within your reach. By embracing these five powerful strategies, you can take control of your finances, build a secure financial future, and enjoy the peace of mind that comes with financial stability. Remember, financial management is a lifelong journey, and there will be bumps along the way. But with a proactive approach, consistent effort, and a commitment to learning and adapting, you can master your money and achieve your financial dreams.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Strategies for Mastering Your Money and Achieving Financial Freedom. We thank you for taking the time to read this article. See you in our next article!

google.com