5 Powerful Strategies for Transforming Your Finances

Introduction

With great pleasure, we will explore the intriguing topic related to 5 Powerful Strategies for Transforming Your Finances. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Powerful Strategies for Transforming Your Finances

Navigating the complex world of personal finance can feel overwhelming, but it doesn’t have to be. By adopting smart financial practices, you can build a secure future and achieve your financial goals. This article delves into five powerful strategies that can transform your relationship with money, empowering you to take control and build a brighter financial future.

1. Budgeting: The Cornerstone of Financial Success

The first step towards financial well-being is to understand where your money is going. Budgeting is the process of creating a plan for how you will spend your income, ensuring you allocate funds for essential needs, savings goals, and even occasional indulgences.

- Track Your Spending: The foundation of any effective budget is accurate tracking. Use a budgeting app, spreadsheet, or even a simple notebook to diligently record every penny you spend.

- Create a Realistic Budget: Don’t set unrealistic expectations. Start by analyzing your current spending habits and identify areas where you can cut back. Prioritize essential expenses like housing, food, and transportation, and allocate funds for savings, debt repayment, and discretionary spending.

- Review and Adjust Regularly: Your financial needs and goals will evolve over time. Review your budget every month or quarter to ensure it still aligns with your priorities. Make adjustments as needed to accommodate changes in income, expenses, or goals.

2. Saving: Building a Financial Safety Net

Saving is crucial for achieving financial security and peace of mind. It provides a financial cushion for unexpected expenses, allows you to pursue your goals, and sets you up for a comfortable retirement.

- Emergency Fund: A well-stocked emergency fund is essential. Aim for three to six months’ worth of living expenses, which will cover unexpected events like job loss, medical emergencies, or car repairs.

- Retirement Savings: Start saving for retirement as early as possible. The power of compound interest works in your favor, allowing your investments to grow exponentially over time.

- Goal-Specific Savings: Set aside funds for specific goals, such as a down payment on a house, a vacation, or your child’s education. Having dedicated savings accounts for each goal can help you stay motivated and track your progress.

3. Debt Management: Breaking Free from Financial Shackles

Debt can be a major financial burden, draining your income and hindering your ability to save. Developing a strategic approach to debt management is crucial.

- Prioritize High-Interest Debt: Focus on paying down debt with the highest interest rates first, such as credit card debt or payday loans. This will minimize the amount of interest you pay over time.

- Debt Consolidation: If you have multiple debts, consider consolidating them into a single loan with a lower interest rate. This can simplify your repayments and potentially save you money on interest.

- Snowball Method: This method involves paying off the smallest debt first, building momentum and motivation as you progress. Once one debt is paid off, you roll the payment amount into the next smallest debt, creating a snowball effect.

4. Investing: Growing Your Wealth Over Time

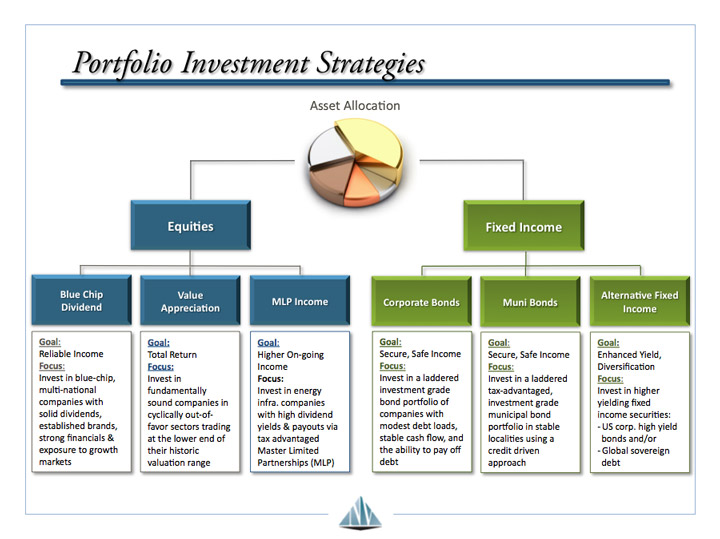

Investing allows your money to work for you, generating potential returns and helping you build wealth over the long term.

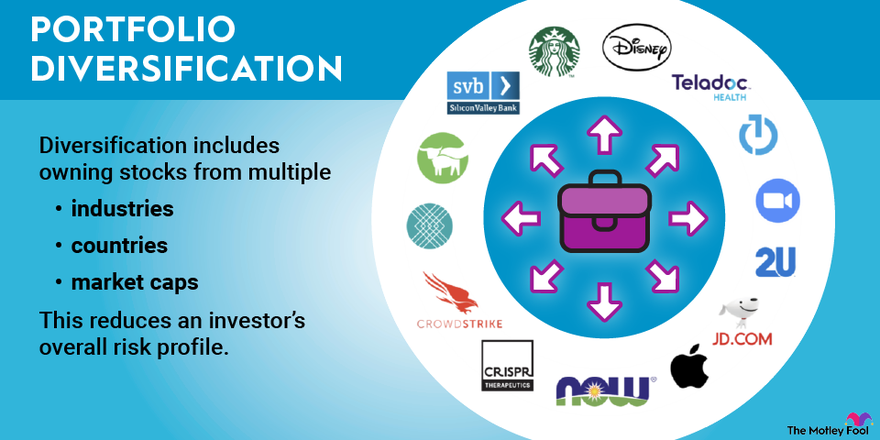

- Diversification: Don’t put all your eggs in one basket. Diversify your investments across different asset classes, such as stocks, bonds, real estate, and commodities. This helps reduce risk and potentially increase returns.

- Long-Term Perspective: Investing is a marathon, not a sprint. Avoid chasing short-term gains and focus on building a diversified portfolio that can weather market fluctuations.

- Start Small and Be Consistent: Even small, regular investments can add up over time. Make investing a habit and contribute to your accounts consistently.

5. Financial Literacy: The Key to Informed Decisions

Financial literacy is the foundation of sound financial decision-making. It involves understanding basic financial concepts, managing your money effectively, and making informed choices about your finances.

- Seek Financial Education: There are numerous resources available to enhance your financial literacy, including books, articles, online courses, and financial advisors.

- Ask Questions: Don’t be afraid to ask questions if you don’t understand something. Financial professionals are there to help you navigate complex financial concepts.

- Stay Informed: Keep up-to-date on current financial news and trends. Understanding market conditions and economic factors can help you make informed decisions about your investments and spending.

Transforming Your Finances: A Journey, Not a Destination

Building a strong financial foundation is an ongoing journey. It requires commitment, discipline, and a willingness to learn and adapt. By embracing these five powerful strategies, you can take control of your finances, achieve your goals, and build a brighter future for yourself and your family.

Remember, financial success is not about how much money you make, but about how you manage it. By adopting these strategies, you can create a sustainable financial plan that empowers you to live a fulfilling life, free from financial stress and anxiety.

Additional Tips for Financial Success:

- Automate Savings: Set up automatic transfers to your savings accounts to ensure consistent contributions.

- Negotiate Bills: Don’t be afraid to negotiate lower rates on your bills, such as cable, internet, or insurance.

- Shop Around for Loans: Compare interest rates and terms from multiple lenders before taking out a loan.

- Use Credit Cards Wisely: Only use credit cards for purchases you can afford to pay off in full each month.

- Avoid Unnecessary Expenses: Cut back on non-essential expenses, such as dining out, entertainment, or subscriptions.

- Seek Professional Advice: Consider working with a financial advisor to develop a personalized financial plan.

By embracing these principles and making informed financial decisions, you can create a secure and prosperous future for yourself and your loved ones. Remember, it’s never too late to start building a strong financial foundation.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Strategies for Transforming Your Finances. We hope you find this article informative and beneficial. See you in our next article!

google.com