5 Powerful Strategies for Unstoppable Money Management

Related Articles: 5 Powerful Strategies for Unstoppable Money Management

- The Crucial Power Of 5 Key Financial Literacy Skills

- 5 Powerful Steps To Unleash Your Financial Freedom: Building A Thriving Lifestyle

- 7 Unstoppable Strategies To Crush Financial Stress

- The Unleashing Power Of 5 Crucial Financial Education Benefits

- 5 Crucial Reasons Why Essential Financial Checkups Are Non-Negotiable

Introduction

With great pleasure, we will explore the intriguing topic related to 5 Powerful Strategies for Unstoppable Money Management. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Powerful Strategies for Unstoppable Money Management

In today’s world, where financial pressures are constantly mounting, effective money management is no longer a luxury but a necessity. The ability to control your finances empowers you to achieve your goals, build a secure future, and live a life free from the shackles of debt and worry. While the journey of mastering money management can feel daunting, it doesn’t have to be. This article will equip you with five powerful strategies that can transform your relationship with money, turning you into a confident and capable financial steward.

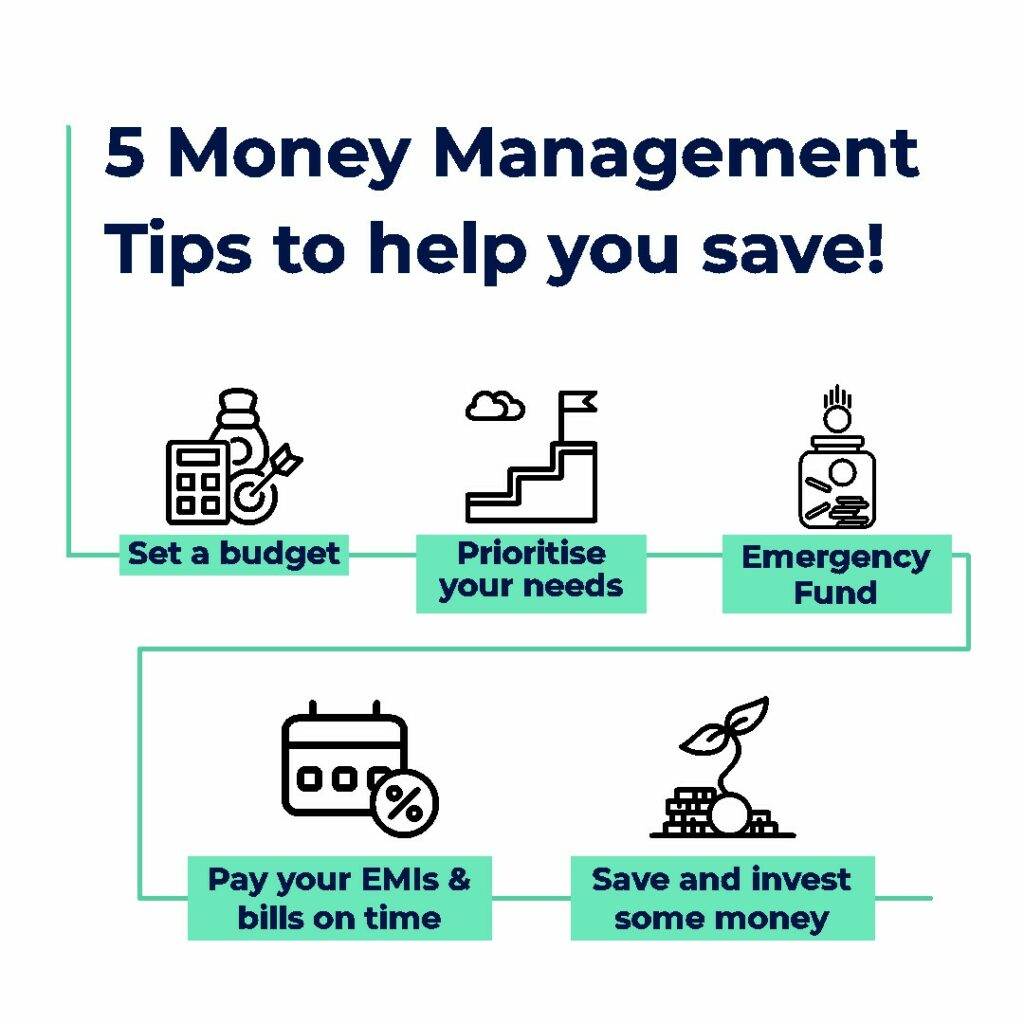

1. Embrace the Power of Budgeting: A Roadmap to Financial Freedom

The foundation of effective money management lies in understanding where your money goes. A budget is not a restrictive prison but a roadmap to financial freedom. By meticulously tracking your income and expenses, you gain invaluable insights into your spending habits and identify areas for improvement.

Creating a Budget that Works for You:

-

- Track Your Spending: For a period of at least one month, meticulously track every dollar that comes in and out of your life. Use a spreadsheet, budgeting app, or even a simple notebook. This data will provide a clear picture of your current financial landscape.

- Categorize Your Expenses: Once you have gathered your spending data, categorize it into essential needs (housing, utilities, groceries), wants (dining out, entertainment), and debt payments. This categorization helps you understand where your money is going and identify areas for potential adjustments.

- Set Realistic Goals: Your budget should align with your financial goals. Whether it’s saving for a down payment, paying off debt, or building an emergency fund, define your goals and allocate funds accordingly.

- Prioritize Your Needs: Focus on meeting your essential needs first. This ensures financial stability and allows you to gradually allocate more funds towards your wants and goals as your income increases.

- Review and Adjust: Your financial situation is constantly evolving. Regularly review your budget, making adjustments as needed to reflect changes in income, expenses, and goals.

Beyond the Basics: Incorporating the 50/30/20 Rule

The 50/30/20 rule is a popular budgeting guideline that can simplify the process:

-

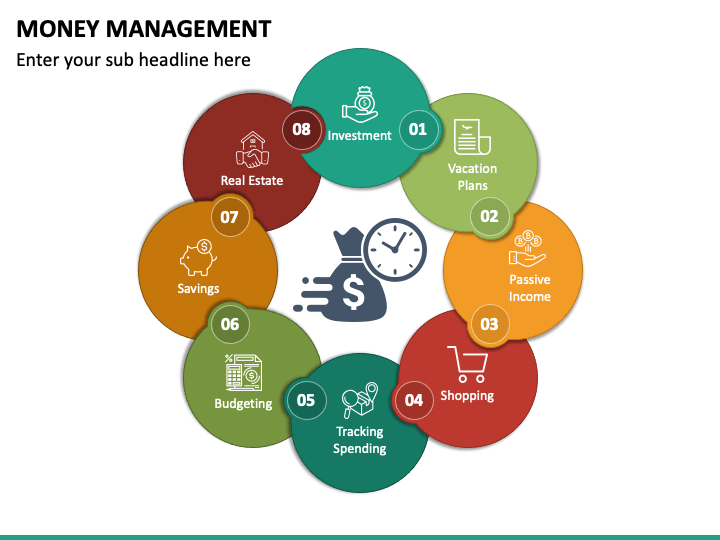

- 50% for Needs: Allocate 50% of your after-tax income towards essential needs like housing, utilities, groceries, transportation, and healthcare.

- 30% for Wants: This portion covers discretionary spending like entertainment, dining out, travel, and hobbies.

- 20% for Savings and Debt: This is crucial for building a healthy financial future. Allocate 10% to savings (emergency fund, retirement, investments) and 10% to debt repayment.

2. Master the Art of Saving: Building a Safety Net for Life’s Uncertainties

Saving money is not just about accumulating wealth; it’s about building a safety net for life’s inevitable uncertainties. Having a solid emergency fund can prevent financial distress during unexpected events like job loss, medical emergencies, or car repairs.

Developing Effective Saving Strategies:

- Establish an Emergency Fund: Aim to have at least 3-6 months’ worth of living expenses saved in an easily accessible account. This provides a buffer for unexpected situations.

- Automate Savings: Set up automatic transfers from your checking account to your savings account on a regular basis. This removes the temptation to spend the money and ensures consistent saving.

- Set Savings Goals: Having clear financial goals can motivate you to save more. Whether it’s a down payment on a house, a dream vacation, or early retirement, define your goals and allocate funds accordingly.

- Explore High-Yield Savings Accounts: Research and choose savings accounts that offer competitive interest rates to maximize your returns.

3. Conquer Debt: Breaking Free from the Cycle of Interest Payments

Debt can be a major obstacle to financial freedom. High-interest debt, such as credit card debt, can quickly spiral out of control, consuming a significant portion of your income.

Strategic Debt Management Techniques:

- Prioritize High-Interest Debt: Focus on paying down the debt with the highest interest rate first, as this will minimize the amount of interest you pay over time.

- Snowball Method: Start by paying off the smallest debt first, regardless of interest rate. This can provide a sense of accomplishment and motivate you to keep going.

- Debt Consolidation: Consider consolidating multiple debts into a single loan with a lower interest rate. This can simplify your payments and potentially save you money on interest.

- Negotiate with Creditors: If you’re struggling to make payments, contact your creditors and explore options for lowering your interest rate or extending your repayment period.

4. Embrace the Power of Investing: Growing Your Wealth over Time

Investing is a crucial aspect of building long-term wealth. By putting your money to work in the market, you can earn returns that outpace inflation and grow your savings over time.

Navigating the Investment Landscape:

- Understand Your Risk Tolerance: Before investing, assess your risk tolerance. Are you comfortable with potential fluctuations in value, or do you prefer a more conservative approach?

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes (stocks, bonds, real estate) to mitigate risk.

- Long-Term Perspective: Investing is a long-term game. Avoid chasing short-term gains and focus on building a diversified portfolio that can weather market fluctuations.

- Seek Professional Advice: If you’re unsure about investing, consider seeking advice from a qualified financial advisor. They can help you develop a personalized investment strategy that aligns with your goals and risk tolerance.

5. Cultivate Financial Discipline: Making Smart Decisions Every Day

Effective money management is not just about strategies; it’s about cultivating financial discipline in your everyday life. This involves making conscious choices that align with your financial goals.

Building Financial Discipline:

- Track Your Spending: Continuously monitor your spending habits and identify areas where you can cut back or make adjustments.

- Resist Impulse Purchases: Before making a purchase, ask yourself if it’s truly necessary or if you’re simply succumbing to an impulse.

- Shop Smart: Compare prices, look for discounts, and negotiate whenever possible. Small savings can add up over time.

- Avoid Unnecessary Debt: Use credit cards responsibly and avoid taking on unnecessary debt.

- Educate Yourself: Continuously learn about personal finance and stay informed about financial trends.

Conclusion: Embracing a Transformative Financial Journey

Effective money management is not a destination but a journey. It requires commitment, discipline, and a willingness to learn and adapt. By embracing the five powerful strategies outlined in this article, you can transform your relationship with money, build a secure financial future, and unlock the power to achieve your dreams. Remember, financial success is not about how much money you make but how wisely you manage it. With a strategic mindset, a disciplined approach, and a commitment to continuous learning, you can become the master of your own financial destiny.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Strategies for Unstoppable Money Management. We thank you for taking the time to read this article. See you in our next article!

google.com