5 Powerful Strategies to Conquer Financial Setbacks

Related Articles: 5 Powerful Strategies to Conquer Financial Setbacks

- 5 Unstoppable Tips For Building A Stellar Credit History

- 5 Powerful Strategies To Weather A Financial Crisis

- The Crucial Role Of Financial Advisors: 5 Ways They Can Transform Your Financial Future

- 5 Reasons Why Strategic Early Retirement Planning Is Your Ultimate Freedom Ticket

- Crush 5 Common Financial Goal Mistakes: A Powerful Guide To Realistic Planning

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 5 Powerful Strategies to Conquer Financial Setbacks. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Powerful Strategies to Conquer Financial Setbacks

Life is rarely predictable, and financial setbacks are an unfortunate reality for many. Whether it’s a sudden job loss, unexpected medical bills, or a market downturn, these challenges can feel overwhelming and leave you questioning your financial future. However, it’s crucial to remember that financial setbacks are not the end of the road. With a proactive and strategic approach, you can conquer these obstacles and emerge stronger than before.

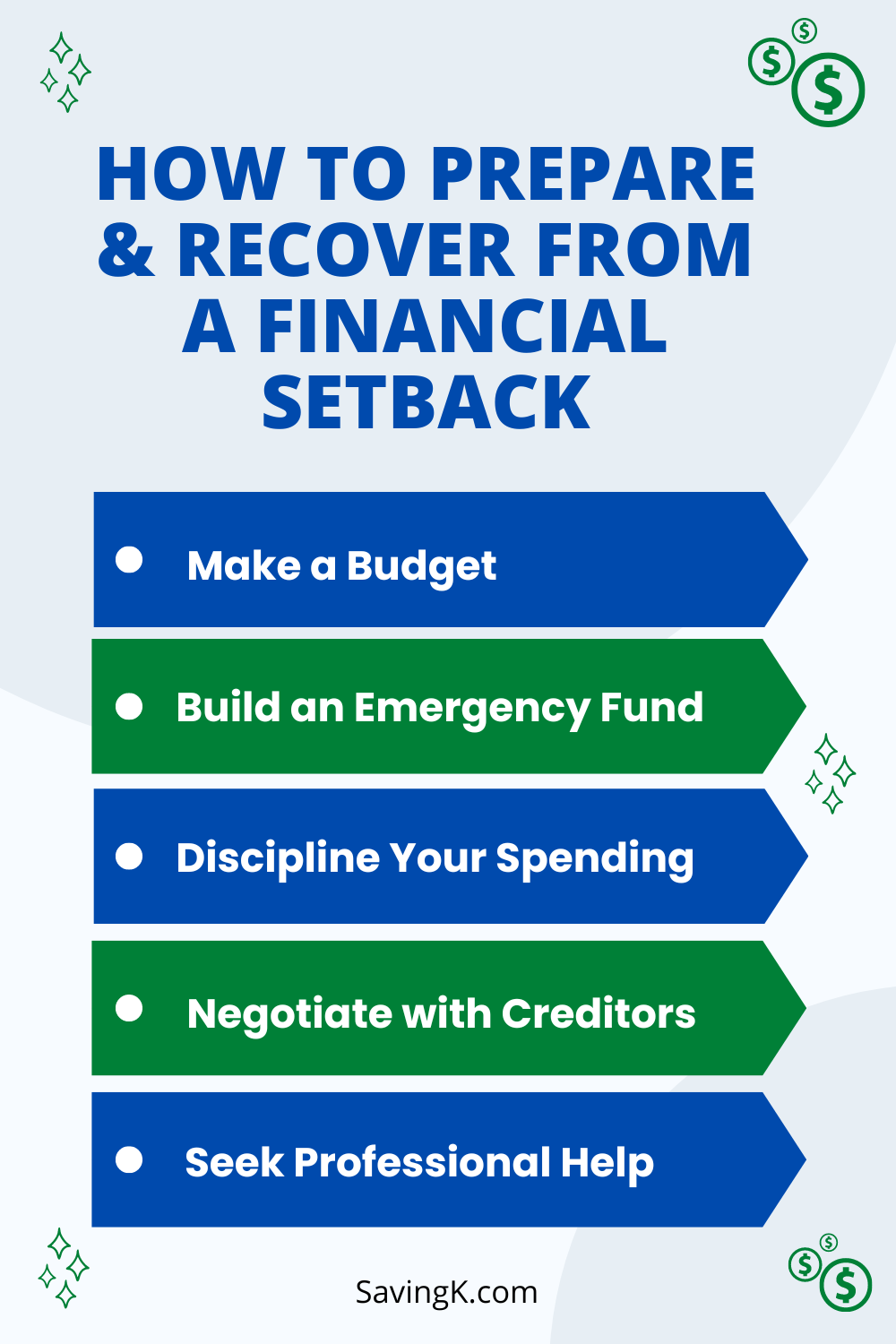

This article outlines five powerful strategies to help you navigate financial setbacks and regain control of your finances:

1. Acknowledge and Accept the Situation:

The first step towards overcoming any challenge is acknowledging its existence. Don’t try to bury your head in the sand or pretend the setback isn’t happening. Instead, take a deep breath and acknowledge the reality of the situation. This might be a difficult step, but it’s essential for moving forward.

Once you’ve acknowledged the setback, it’s important to accept it. Acceptance doesn’t mean giving up or resigning yourself to a negative outcome. It means acknowledging the situation for what it is and understanding that you have the power to change your course. This acceptance allows you to move away from denial and towards proactive action.

2. Assess Your Finances and Create a Budget:

Financial setbacks often require a reassessment of your financial situation. Take the time to understand your current financial standing, including your income, expenses, assets, and liabilities. This assessment will help you identify areas where you can cut back and prioritize spending.

Creating a detailed budget is crucial for navigating financial setbacks. Track your income and expenses carefully, and identify areas where you can reduce spending. Consider using budgeting apps or spreadsheets to simplify the process. Be realistic about your expenses and avoid unnecessary spending. Remember, every dollar saved is a dollar towards your financial recovery.

3. Explore Options for Reducing Debt:

Debt can be a significant burden, especially during financial setbacks. If you have high-interest debt, explore options for reducing it. Consider consolidating your debt into a lower-interest loan, negotiating with creditors for a lower interest rate or payment plan, or seeking debt consolidation services.

If you’re struggling to make your debt payments, reach out to your creditors and inform them of your situation. They may be willing to work with you to create a payment plan that fits your current financial circumstances. Don’t hesitate to seek professional financial advice from a certified financial planner or credit counselor who can help you develop a debt reduction strategy.

4. Seek Additional Income Streams:

Financial setbacks often necessitate finding additional income streams to make up for lost income or cover unexpected expenses. Consider taking on a part-time job, freelancing, selling unused items, or exploring online opportunities like online surveys or micro-tasking platforms.

Don’t be afraid to think outside the box and explore creative ways to generate income. Remember, every extra dollar you earn can contribute to your financial recovery and provide you with peace of mind.

5. Build an Emergency Fund:

One of the most important lessons to learn from financial setbacks is the importance of an emergency fund. An emergency fund acts as a safety net, providing a cushion during unexpected events. Aim to save at least three to six months’ worth of living expenses in an easily accessible account.

Building an emergency fund may seem daunting, but even small, consistent contributions can make a significant difference over time. Make it a priority to save regularly, even if it’s just a small amount each month. Once you’ve built a substantial emergency fund, you’ll be better prepared to handle future financial setbacks.

Beyond the Basics: Additional Strategies for Financial Recovery:

While the five strategies outlined above are essential for navigating financial setbacks, there are additional steps you can take to accelerate your recovery and build a stronger financial foundation:

1. Seek Professional Financial Advice:

A certified financial planner can provide personalized guidance and create a comprehensive financial plan tailored to your specific needs and goals. They can help you develop a budget, create a debt reduction strategy, and invest your savings wisely.

2. Negotiate with Creditors:

Don’t be afraid to negotiate with your creditors if you’re struggling to make payments. They may be willing to work with you to create a payment plan or lower your interest rate. Be proactive and communicate openly with your creditors about your situation.

3. Consider a Side Hustle:

A side hustle can provide a significant boost to your income and help you accelerate your financial recovery. Explore opportunities that align with your skills and interests, such as freelance writing, online tutoring, or selling crafts.

4. Review Your Insurance Coverage:

Ensure you have adequate insurance coverage, including health insurance, life insurance, and disability insurance. These policies can provide financial protection during unexpected events.

5. Automate Your Savings:

Setting up automatic transfers from your checking account to your savings account can help you build your emergency fund and invest consistently. This strategy removes the temptation to spend the money and ensures you’re saving regularly.

6. Educate Yourself about Personal Finance:

Financial literacy is essential for managing your finances effectively. Take advantage of online resources, books, and workshops to learn about budgeting, investing, and debt management. The more knowledgeable you are about personal finance, the better equipped you’ll be to make informed financial decisions.

7. Stay Positive and Persistent:

Financial setbacks can be emotionally challenging, but it’s important to maintain a positive outlook. Focus on the steps you’re taking to recover, celebrate your progress, and remember that you have the power to overcome this challenge. Persistence is key to financial success.

The Importance of Patience and Perseverance:

Financial recovery takes time and effort. Don’t expect to bounce back overnight. Be patient with yourself and celebrate every small victory. It’s also crucial to stay persistent in your efforts to rebuild your finances.

Conclusion:

Financial setbacks are a part of life, but they don’t have to define your future. By acknowledging the situation, assessing your finances, reducing debt, seeking additional income streams, and building an emergency fund, you can conquer these challenges and emerge stronger than before. Remember, you have the power to take control of your financial destiny. With a proactive approach, patience, and perseverance, you can overcome any obstacle and build a secure financial future.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Strategies to Conquer Financial Setbacks. We thank you for taking the time to read this article. See you in our next article!

google.com