5 Powerful Strategies to Crush Your Mortgage and Achieve Financial Freedom

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 5 Powerful Strategies to Crush Your Mortgage and Achieve Financial Freedom. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Powerful Strategies to Crush Your Mortgage and Achieve Financial Freedom

Owning a home is a cornerstone of the American Dream, but the mortgage that comes with it can feel like a heavy weight on your shoulders. The good news is, you don’t have to be stuck in mortgage purgatory for decades. By implementing strategic financial moves, you can crush your mortgage and achieve financial freedom sooner than you think.

This article will explore five powerful strategies that can help you pay off your mortgage early and unlock a world of possibilities.

1. The Power of Extra Payments: Turbocharging Your Paydown

The most straightforward way to accelerate your mortgage payoff is by making extra payments. Every dollar you throw at your principal chips away at the overall loan amount, reducing your interest burden and shortening your repayment timeline.

Here are a few ways to incorporate extra payments into your budget:

- Bi-weekly Payments: Instead of making one monthly payment, split it into two equal payments and make them every two weeks. This equates to an extra monthly payment per year, significantly accelerating your payoff.

- Round Up Payments: Round up your monthly payment to the nearest hundred or even thousand dollars. This seemingly small change can accumulate to substantial extra payments over time.

- Annual Lump Sum Payments: Use tax refunds, bonuses, or other windfalls to make larger, one-time payments towards your principal. These strategic bursts can drastically shorten your mortgage term.

2. Refinancing: Harnessing Lower Interest Rates

If interest rates have dropped since you took out your mortgage, refinancing could be a powerful tool to save money and accelerate your payoff. By securing a lower interest rate, you’ll pay less interest overall, freeing up more cash flow to allocate towards your principal.

However, refinancing comes with its own set of considerations:

- Closing Costs: Refinancing involves closing costs, which can offset some of the initial savings. Carefully evaluate the overall cost-benefit analysis before proceeding.

- Loan Term: Consider whether a shorter loan term is beneficial for you. While it will require larger monthly payments, it will also significantly reduce your overall interest payments.

- Current Market Conditions: Refinancing is most advantageous when interest rates are significantly lower than your current rate. Keep an eye on market trends to determine the optimal time for refinancing.

3. The Magic of Home Equity: Leveraging Your Investment

As you pay down your mortgage, you build equity in your home. This equity represents your ownership stake and can be a valuable asset. You can leverage this equity to accelerate your mortgage payoff through various strategies:

- Home Equity Line of Credit (HELOC): A HELOC allows you to borrow against your equity, offering a flexible line of credit with variable interest rates. You can use this line of credit to make lump sum payments towards your primary mortgage, effectively paying it down faster.

- Cash-Out Refinancing: This type of refinancing allows you to borrow a larger amount than your current mortgage balance, effectively extracting a portion of your equity. You can use this cash to pay down your mortgage or for other financial goals.

- Selling and Downsizing: If you’re looking for a more drastic approach, consider selling your current home and downsizing to a smaller, more affordable property. The proceeds from the sale can be used to pay off your existing mortgage and potentially even buy a new home with a lower mortgage balance.

4. Budgeting and Financial Discipline: The Cornerstone of Early Payoff

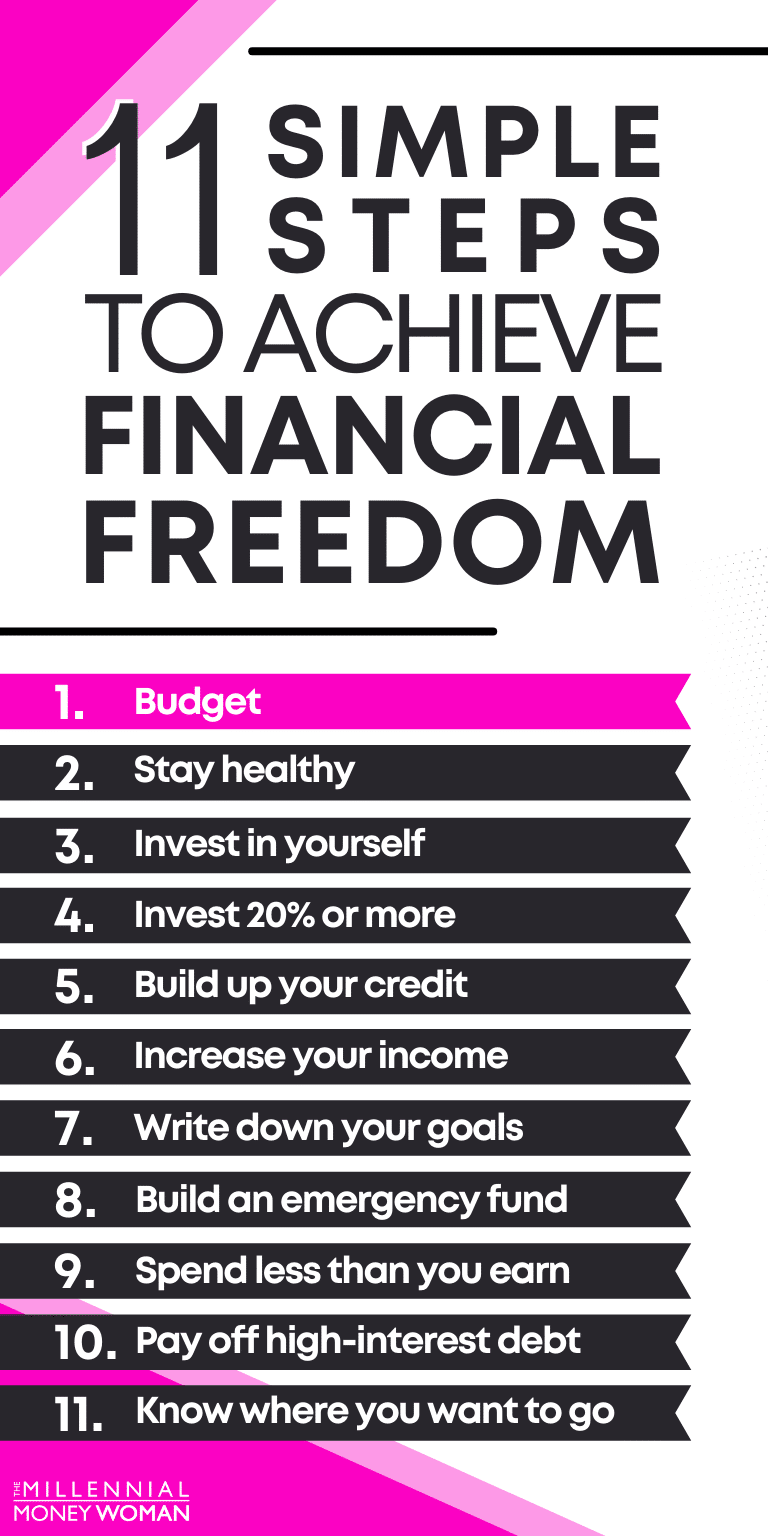

While extra payments and refinancing can significantly impact your mortgage payoff, the foundation of success lies in disciplined budgeting and financial management.

Here are key strategies for optimizing your finances:

- Create a Realistic Budget: Track your income and expenses meticulously to identify areas where you can cut back.

- Reduce Unnecessary Spending: Identify discretionary expenses that can be trimmed, such as dining out, entertainment, or subscriptions.

- Prioritize Savings: Set aside a portion of your income for savings, even if it’s a small amount. These savings can be used for unexpected expenses or as a buffer to make extra mortgage payments.

- Negotiate Lower Bills: Explore ways to reduce your monthly expenses by negotiating lower rates on utilities, insurance, or other recurring bills.

5. The Power of Side Hustles: Generating Extra Income

Boosting your income is a powerful way to accelerate your mortgage payoff. Consider exploring side hustles or freelance opportunities to generate extra cash flow:

- Freelancing: Utilize your skills and expertise to offer services like writing, editing, web design, or virtual assistance.

- Online Teaching: Share your knowledge and expertise through online platforms like Udemy or Coursera.

- E-commerce: Sell products online through platforms like Etsy or Amazon.

- Renting Out a Room: If you have extra space, consider renting out a room to generate additional income.

The Benefits of Early Mortgage Payoff: Unlocking Your Financial Future

Paying off your mortgage early offers a multitude of benefits, empowering you to take control of your financial future:

- Reduced Interest Payments: By paying down your mortgage faster, you significantly reduce the total amount of interest you pay over the life of the loan. This frees up more money for other financial goals.

- Increased Cash Flow: Once your mortgage is paid off, you’ll have more disposable income each month, allowing you to save, invest, or enjoy other financial freedoms.

- Reduced Debt Burden: Carrying a large mortgage can be a significant financial burden. Paying it off early provides peace of mind and reduces financial stress.

- Enhanced Financial Security: With less debt, you’ll be better equipped to handle unexpected expenses or financial emergencies.

- Increased Equity: As you pay down your mortgage, your equity in your home increases. This can provide you with valuable financial resources in the future.

Conclusion: Embracing the Journey to Financial Freedom

Paying off your mortgage early is a significant financial accomplishment that unlocks a world of possibilities. By implementing these five powerful strategies, you can crush your mortgage and achieve financial freedom sooner than you think.

Remember, the journey to early mortgage payoff requires dedication, discipline, and a commitment to smart financial planning. Embrace the challenge, stay focused on your goals, and enjoy the rewards of financial freedom that await.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Strategies to Crush Your Mortgage and Achieve Financial Freedom. We thank you for taking the time to read this article. See you in our next article!

google.com