5 Revolutionary Personal Finance Apps That Will Transform Your Money Management

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Revolutionary Personal Finance Apps That Will Transform Your Money Management. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Revolutionary Personal Finance Apps That Will Transform Your Money Management

In today’s digital age, managing your finances effectively is no longer a daunting task. A plethora of personal finance apps have emerged, offering powerful tools and insights to help you take control of your money. These apps, designed for both novice and seasoned financial gurus, can simplify budgeting, track expenses, invest wisely, and even help you reach your financial goals.

This article will delve into the top 5 personal finance apps that are revolutionizing the way people manage their money. These apps are not just about keeping track of your spending, they are designed to empower you to make informed financial decisions, build a secure future, and achieve financial freedom.

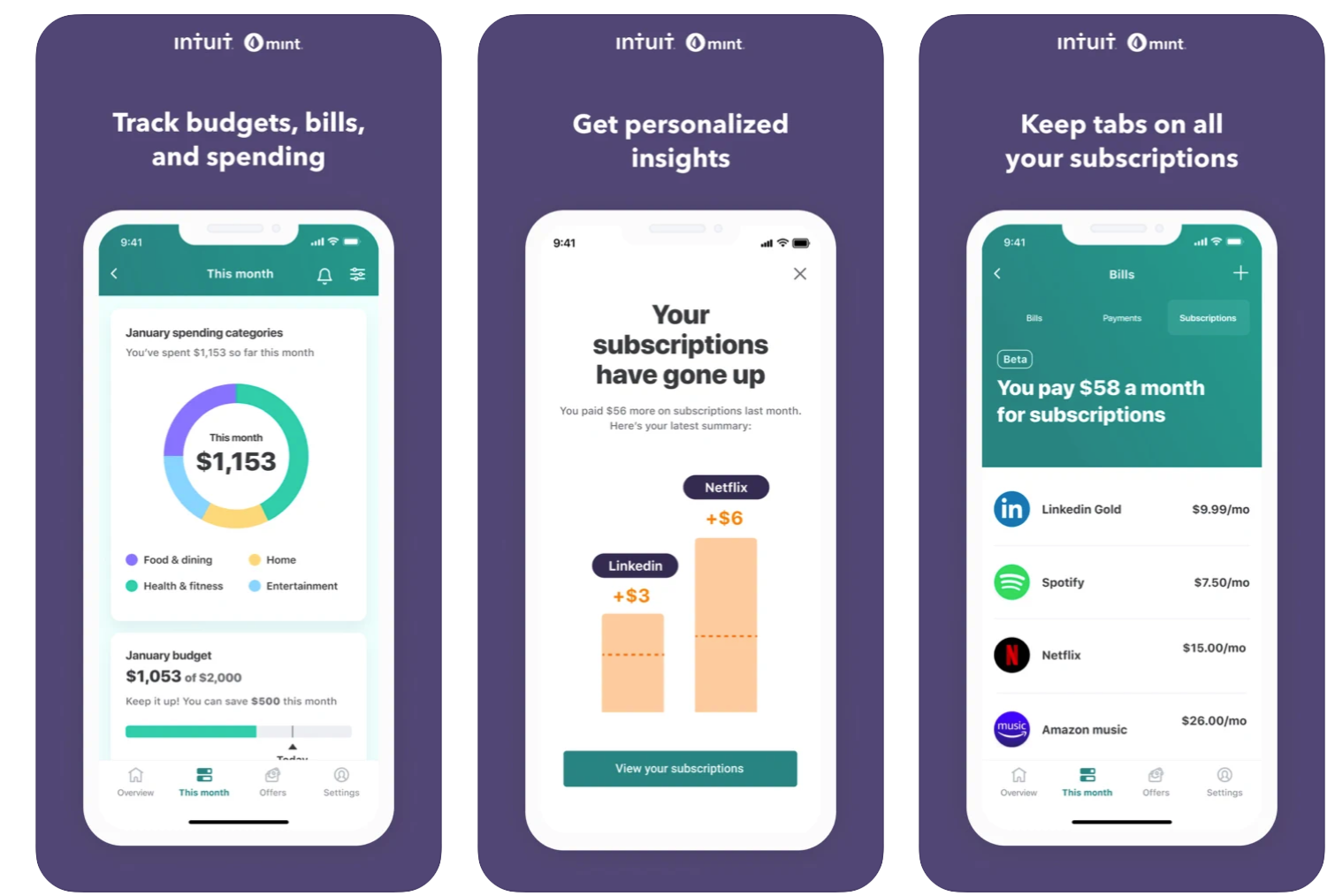

1. Mint: The All-in-One Financial Management Powerhouse

Mint, owned by Intuit, is a comprehensive personal finance app that consolidates all your financial accounts in one place. It seamlessly connects to your bank accounts, credit cards, loans, and investment accounts, providing a clear and detailed picture of your overall financial health.

Here’s what makes Mint stand out:

- Automatic Budget Creation: Mint analyzes your spending patterns and automatically creates a budget tailored to your needs. You can customize this budget by setting spending limits for different categories and receive alerts when you approach your limits.

- Expense Tracking: Mint automatically categorizes your transactions, making it easy to track where your money goes. You can also manually categorize transactions and add notes for better clarity.

- Bill Payment Reminders: Never miss a bill payment again. Mint sends you timely reminders, allowing you to pay your bills on time and avoid late fees.

- Credit Score Monitoring: Mint provides you with a free credit score and report, helping you stay informed about your creditworthiness.

- Investment Tracking: Mint can track your investment portfolio, providing insights into your investment performance and helping you make informed decisions.

- Goal Setting: Set financial goals, such as saving for a down payment or paying off debt, and Mint will help you track your progress and stay motivated.

Pros:

- Comprehensive features: Mint offers a wide range of features, making it a one-stop shop for all your financial needs.

- User-friendly interface: The app is easy to navigate and use, even for beginners.

- Free to use: Mint is completely free to download and use.

Cons:

- Limited customization: Some users may find the automatic budgeting feature too restrictive and prefer more customization options.

- Data security concerns: Like all online financial services, Mint relies on secure data transmission and storage, but users should be aware of potential security risks.

2. Personal Capital: The Investment Management Expert

Personal Capital, known for its sophisticated investment management tools, is a popular choice for investors seeking to optimize their portfolios. It offers a free, comprehensive financial dashboard that provides a holistic view of your finances.

Here’s what makes Personal Capital stand out:

- Investment Portfolio Management: Personal Capital provides detailed insights into your investment portfolio, including asset allocation, performance analysis, and risk assessment.

- Retirement Planning: Personal Capital offers a powerful retirement planning tool that helps you estimate your future retirement income and identify potential gaps.

- Investment Fee Analysis: The app analyzes your investment fees, helping you identify areas where you can potentially save money.

- Cash Flow Management: Personal Capital tracks your income and expenses, providing a clear picture of your cash flow and helping you identify areas for improvement.

- Financial Advice: Personal Capital offers access to certified financial advisors who can provide personalized financial advice.

Pros:

- Sophisticated investment tools: Personal Capital provides advanced investment management features, making it ideal for investors.

- Free financial dashboard: The app’s core features are free to use, making it accessible to a wider audience.

- Access to financial advisors: Personal Capital offers the option to connect with certified financial advisors for personalized guidance.

Cons:

- Limited budgeting features: While Personal Capital offers cash flow management, its budgeting features are not as robust as other apps.

- Investment management fees: For users who opt for Personal Capital’s investment management services, there are fees associated with managing their investments.

3. YNAB (You Need a Budget): The Budgeting Mastermind

YNAB, known for its unique budgeting philosophy, emphasizes mindful spending and prioritizes your financial goals. It’s not just an app, it’s a system that helps you take control of your money and build a brighter financial future.

Here’s what makes YNAB stand out:

- Zero-Based Budgeting: YNAB encourages you to allocate every dollar of your income to a specific purpose, leaving no room for unplanned spending.

- Goal-Oriented Budgeting: YNAB helps you set financial goals and track your progress towards achieving them.

- Spending Analysis: The app provides detailed insights into your spending habits, helping you identify areas where you can cut back.

- Debt Management: YNAB offers tools to help you manage your debt, including a debt snowball method calculator.

- Community Support: YNAB has a vibrant online community where users can connect, share tips, and support each other.

Pros:

- Effective budgeting system: YNAB’s zero-based budgeting approach can significantly improve your financial discipline.

- Goal-oriented focus: The app helps you stay motivated by tracking your progress towards your financial goals.

- Strong community support: YNAB’s online community provides valuable resources and support.

Cons:

- Subscription-based: YNAB requires a monthly subscription, which may not be suitable for everyone.

- Steep learning curve: YNAB’s budgeting system can take some time to understand and implement.

4. EveryDollar: The Simple Budgeting App

EveryDollar, created by Dave Ramsey, is a budget-focused app that simplifies financial management with its straightforward approach. It emphasizes the importance of living on a budget and eliminating debt.

Here’s what makes EveryDollar stand out:

- Easy-to-use interface: EveryDollar is designed to be user-friendly, making it accessible to even those with limited financial literacy.

- Detailed budgeting tools: The app provides a comprehensive budgeting framework, allowing you to allocate your income to different categories.

- Debt snowball method: EveryDollar supports the debt snowball method, which helps you pay off your debts faster by starting with the smallest balance.

- Free version available: EveryDollar offers a free version with limited features, allowing you to try the app before committing to a subscription.

Pros:

- Simplicity: EveryDollar’s straightforward approach makes it easy to understand and use.

- Debt focus: The app emphasizes debt elimination, making it a valuable tool for those struggling with debt.

- Free version: The free version allows users to experience the app’s core features before subscribing.

Cons:

- Limited features: Compared to other apps, EveryDollar offers a more limited set of features.

- No automatic transaction syncing: EveryDollar requires manual entry of transactions, which can be time-consuming.

5. Acorns: The Micro-Investing Champion

Acorns is a unique app that focuses on micro-investing, making it easy to invest small amounts of money regularly. It’s a great option for beginners who want to start investing without a large initial capital.

Here’s what makes Acorns stand out:

- Round-up Investing: Acorns automatically rounds up your purchases to the nearest dollar and invests the difference.

- Recurring Investments: You can set up recurring investments, making it easy to save consistently.

- Diversified Portfolios: Acorns offers a range of diversified portfolios tailored to different risk tolerances.

- Low Fees: Acorns charges a small monthly fee for its services, making it an affordable option for micro-investors.

Pros:

- Easy to use: Acorns simplifies investing, making it accessible to beginners.

- Micro-investing: The app allows you to invest small amounts of money, making it a great option for those with limited savings.

- Diversified portfolios: Acorns offers a range of diversified portfolios to suit different investment goals.

Cons:

- Limited investment options: Acorns focuses on micro-investing and offers a limited selection of investment options.

- Monthly fees: Acorns charges a monthly fee for its services, which may not be suitable for everyone.

Conclusion

Choosing the right personal finance app depends on your individual needs and financial goals. Whether you’re looking for a comprehensive financial management solution, a budgeting expert, an investment advisor, or a micro-investing platform, there’s an app out there to help you take control of your finances and build a brighter financial future.

Remember, these apps are just tools. Ultimately, it’s your commitment to financial discipline and informed decision-making that will truly transform your money management. So, explore these apps, find the one that best suits your needs, and embark on your journey towards financial freedom.

Closure

Thus, we hope this article has provided valuable insights into 5 Revolutionary Personal Finance Apps That Will Transform Your Money Management. We thank you for taking the time to read this article. See you in our next article!

google.com