Unleash Your Financial Freedom: A 5-Step Blueprint to Escape the Rat Race

Related Articles: Unleash Your Financial Freedom: A 5-Step Blueprint to Escape the Rat Race

- 5 Unstoppable Ways To Invest Your Money And Build A Thriving Future

- 5 Powerful Strategies For Unleashing Your Financial Future: Making Informed Decisions

- Ultimate Guide: 5 Powerful Strategies To Secure Your Child’s Education Future

- 5 Crucial Steps To Unbreakable Online Banking Security

- The Unleashing Power Of 5 Crucial Financial Education Benefits

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unleash Your Financial Freedom: A 5-Step Blueprint to Escape the Rat Race. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unleash Your Financial Freedom: A 5-Step Blueprint to Escape the Rat Race

The allure of financial freedom is undeniable. Imagine waking up each morning, not beholden to a demanding job, free to pursue your passions, and secure in the knowledge that your future is financially stable. This isn’t just a dream; it’s a tangible goal you can achieve with a well-defined plan.

This article will guide you through a 5-step blueprint to create your own financial freedom plan, empowering you to break free from the shackles of debt and financial anxiety, and embrace a life of financial independence.

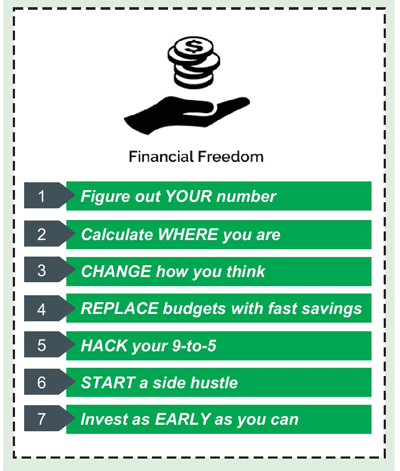

1. Define Your “Freedom Number” and Set Realistic Goals:

The first step is to define your “freedom number,” the amount of money you need to achieve your desired level of financial independence. This number is unique to each individual and depends on your lifestyle, spending habits, and aspirations.

Ask yourself:

- What does financial freedom look like for you? Do you envision early retirement, a life of travel, or simply the ability to pursue your passions without financial stress?

- How much passive income do you need to live comfortably? Consider your current expenses and factor in potential future needs, such as healthcare or education.

- What are your non-negotiable expenses? Identify the essential costs you can’t cut, such as housing, utilities, and healthcare.

Once you have a clear picture of your “freedom number,” set realistic goals to reach it. Don’t be afraid to break down your larger goals into smaller, manageable steps. This will make the journey feel less daunting and keep you motivated.

2. Analyze Your Current Financial Situation:

Before you can build a solid financial freedom plan, you need to understand where you stand. This involves a thorough analysis of your current financial situation.

Here’s how to do it:

- Track your spending: Use budgeting apps or spreadsheets to meticulously track your income and expenses for a few months. This will reveal where your money is going and identify areas for potential savings.

- List your assets: This includes everything you own, such as your home, car, investments, and savings accounts.

- Identify your debts: Make a list of all your outstanding debts, including credit card balances, student loans, and personal loans. Note the interest rates and minimum payments for each debt.

- Calculate your net worth: Subtract your liabilities (debts) from your assets to determine your net worth. This gives you a snapshot of your current financial health.

3. Create a Budget and Stick to It:

A budget is the foundation of financial freedom. It helps you control your spending, allocate your resources effectively, and track your progress towards your goals.

Here are some tips for creating an effective budget:

- Use the 50/30/20 rule: Allocate 50% of your income to needs (housing, utilities, groceries), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

- Automate your savings: Set up automatic transfers from your checking account to your savings account every month. This ensures you prioritize saving even when times are tight.

- Track your progress: Regularly review your budget to see where you’re excelling and where you need to make adjustments.

- Don’t be afraid to cut back: Identify areas where you can reduce spending, such as dining out less, buying used items, or negotiating lower bills.

4. Strategically Manage Your Debt:

Debt can be a major obstacle to financial freedom. It eats away at your income and prevents you from saving and investing.

Here are some strategies for managing debt effectively:

- Prioritize high-interest debt: Focus on paying down debts with the highest interest rates first, such as credit card balances.

- Consider debt consolidation: If you have multiple debts, consider consolidating them into a single loan with a lower interest rate.

- Negotiate with creditors: If you’re struggling to make payments, contact your creditors and see if you can negotiate lower interest rates or a payment plan.

- Explore debt-relief options: In extreme cases, you may consider debt relief programs, such as bankruptcy, but these options should be explored as a last resort.

5. Invest Your Money Wisely:

Investing your money is crucial for building wealth and achieving financial freedom.

Here are some key investment strategies:

- Start early: The earlier you start investing, the more time your money has to grow through compounding.

- Diversify your portfolio: Don’t put all your eggs in one basket. Invest in a variety of asset classes, such as stocks, bonds, real estate, and precious metals.

- Consider a long-term perspective: Don’t panic sell during market downturns. Stay invested for the long haul and let your investments ride out market fluctuations.

- Seek professional advice: If you’re unsure about investing, consult with a financial advisor who can help you create a personalized investment plan.

Unlocking Your Financial Freedom: A Journey of Empowerment

Achieving financial freedom is not an overnight endeavor; it’s a journey that requires discipline, patience, and a commitment to consistent action. By following these five steps, you can create a roadmap to financial independence, empowering yourself to escape the rat race and embrace a life of financial security and freedom.

Remember:

- Your financial freedom plan is a living document: Regularly review and adjust your plan as your circumstances change.

- Stay motivated and focused on your goals: Celebrate your successes along the way and don’t be discouraged by setbacks.

- Seek support and guidance: Don’t be afraid to reach out to financial experts, mentors, or online communities for help and encouragement.

Financial freedom is not just about money; it’s about having the freedom to live your life on your own terms. With a well-defined plan and a commitment to action, you can unlock your financial freedom and create a future that is truly yours.

Closure

Thus, we hope this article has provided valuable insights into Unleash Your Financial Freedom: A 5-Step Blueprint to Escape the Rat Race. We hope you find this article informative and beneficial. See you in our next article!

google.com