5 Steps to an Unstoppable Financially Successful Future

Related Articles: 5 Steps to an Unstoppable Financially Successful Future

- Master Your Finances: A 5-Step Guide To Creating A Powerful Family Budget

- Essential 5 Reasons Why Financial Literacy Is Crucial For A Thriving Future

- 5 Powerful Steps To Unlock Your Financial Future: A Guide To Mastering The Basics

- Unleash Financial Freedom: 7 Powerful Steps To Master Your Monthly Budget

- Unleash Your Financial Freedom: 10 Powerful Strategies To Conquer Healthcare Costs

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 5 Steps to an Unstoppable Financially Successful Future. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

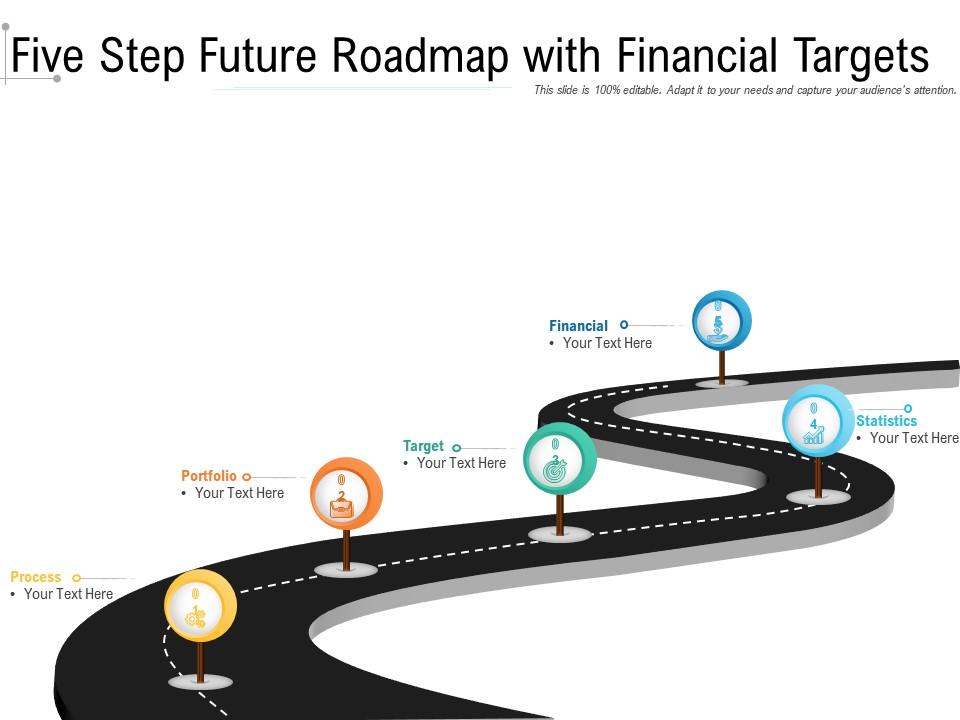

5 Steps to an Unstoppable Financially Successful Future

The pursuit of financial success is a universal desire. It fuels dreams, provides security, and opens doors to countless opportunities. But achieving financial freedom is not a lottery ticket – it’s a journey that requires a conscious and strategic approach. This article outlines 5 powerful steps to help you build an unstoppable financial future, one that empowers you to live life on your own terms.

1. Define Your Financial Goals:

The journey to financial success begins with clarity. Without specific goals, you’re adrift in a sea of possibilities, making it difficult to chart a course. Start by asking yourself:

- What does financial freedom look like for you? Is it early retirement, a comfortable lifestyle, financial independence, or the ability to pursue your passions?

- What are your short-term and long-term financial aspirations? Do you want to buy a house, start a business, travel the world, or simply have a healthy emergency fund?

- What are your financial fears and anxieties? Identifying these fears can help you develop strategies to overcome them.

Once you’ve defined your goals, quantify them. Instead of saying “I want to be financially secure,” aim for “I want to have $1 million in savings by age 50.” Specific, measurable goals provide the motivation and direction you need to stay focused.

2. Create a Realistic Budget:

A budget is not a restrictive tool, but a powerful tool for control. It empowers you to understand where your money goes and make informed decisions about how to allocate it.

-

- Track your expenses. For a month, diligently record every dollar you spend. This step might seem tedious, but it provides invaluable insight into your spending habits.

- Categorize your expenses. Identify your essential expenses (housing, food, utilities) and discretionary expenses (entertainment, dining out, subscriptions). This allows you to see where your money is going and prioritize your spending.

- Identify areas for improvement. Look for areas where you can cut back on unnecessary expenses or find more cost-effective alternatives.

- Allocate your income. Once you understand your spending patterns, create a budget that allocates your income towards your goals. This might include saving for retirement, paying down debt, or investing in your future.

Remember, a budget is not set in stone. It should be a flexible tool that adapts to your changing needs and goals.

3. Manage Your Debt Strategically:

Debt can be a significant drag on your financial progress. It’s crucial to manage it strategically to avoid crippling interest payments and regain control of your finances.

- Prioritize high-interest debt. Focus on paying down debt with the highest interest rates first, such as credit card debt or payday loans. This minimizes the amount of interest you pay over time.

- Consider debt consolidation. If you have multiple high-interest debts, consolidating them into a single loan with a lower interest rate can simplify your payments and save you money.

- Negotiate with creditors. Don’t be afraid to reach out to your creditors and negotiate lower interest rates or payment plans. Many are willing to work with borrowers in good faith.

- Avoid taking on new debt. Once you’ve started paying down your debt, resist the temptation to accumulate more. This will help you stay on track and avoid falling back into a cycle of debt.

4. Build a Robust Investment Portfolio:

Investing is the key to long-term wealth creation. By putting your money to work, you can take advantage of the power of compounding and grow your wealth over time.

- Diversify your investments. Don’t put all your eggs in one basket. Invest in a variety of asset classes, such as stocks, bonds, real estate, and commodities, to reduce your risk.

- Invest for the long term. Avoid short-term market fluctuations and focus on long-term growth. The stock market has historically delivered strong returns over time, but it requires patience and a long-term perspective.

- Consider a professional advisor. If you’re unsure where to begin, consider working with a qualified financial advisor who can help you develop a personalized investment strategy.

5. Continuously Educate Yourself:

The financial landscape is constantly changing, so it’s essential to stay informed and continuously educate yourself about financial concepts and strategies.

- Read books and articles. There are countless resources available to help you learn about personal finance, investing, and wealth management.

- Attend workshops and seminars. These events provide valuable insights and practical advice from experts in the field.

- Network with other financially savvy individuals. Surround yourself with people who are passionate about personal finance and share their knowledge and experience.

- Embrace a lifelong learning mindset. Financial success is a journey, not a destination. Be open to new ideas, adapt to changing circumstances, and never stop learning.

Building an Unstoppable Financial Future:

Creating a financially successful future is a journey that requires discipline, patience, and a commitment to continuous learning. By defining your goals, creating a realistic budget, managing your debt strategically, building a robust investment portfolio, and continuously educating yourself, you can set yourself on the path to financial freedom and live a life filled with possibilities.

Additional Tips for Financial Success:

- Practice delayed gratification. Avoid impulsive purchases and focus on saving for your long-term goals.

- Negotiate your salary. Don’t be afraid to ask for what you’re worth. A higher salary can significantly impact your financial future.

- Build a strong credit score. A good credit score unlocks lower interest rates on loans, credit cards, and other financial products.

- Take advantage of tax benefits. There are many tax benefits available to individuals and families, such as deductions for mortgage interest, charitable contributions, and student loan interest.

- Protect your assets. Consider purchasing insurance policies to protect yourself from unforeseen events, such as accidents, illnesses, or natural disasters.

- Give back to your community. Sharing your wealth with others can bring immense satisfaction and create a positive impact on the world.

Conclusion:

Achieving financial success is not about overnight riches or quick fixes. It’s about taking control of your finances, making informed decisions, and building a solid foundation for a secure and prosperous future. By following these five steps and embracing a lifelong learning mindset, you can create an unstoppable financial future that empowers you to live life on your own terms.

Closure

Thus, we hope this article has provided valuable insights into 5 Steps to an Unstoppable Financially Successful Future. We thank you for taking the time to read this article. See you in our next article!

google.com