5 Strategic Steps to Conquer Unexpected Expenses and Achieve Financial Peace

Related Articles: 5 Strategic Steps to Conquer Unexpected Expenses and Achieve Financial Peace

- 5 Powerful Budgeting Tips To Conquer Student Debt And Achieve Financial Freedom

- Holiday shopping archives

- 10 Unbreakable Rules For Mastering Your Finances: A Beginner’s Guide To Financial Freedom

- Budgeting Tips For The Future

- Worried about being abducted by aliens?

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 5 Strategic Steps to Conquer Unexpected Expenses and Achieve Financial Peace. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Strategic Steps to Conquer Unexpected Expenses and Achieve Financial Peace

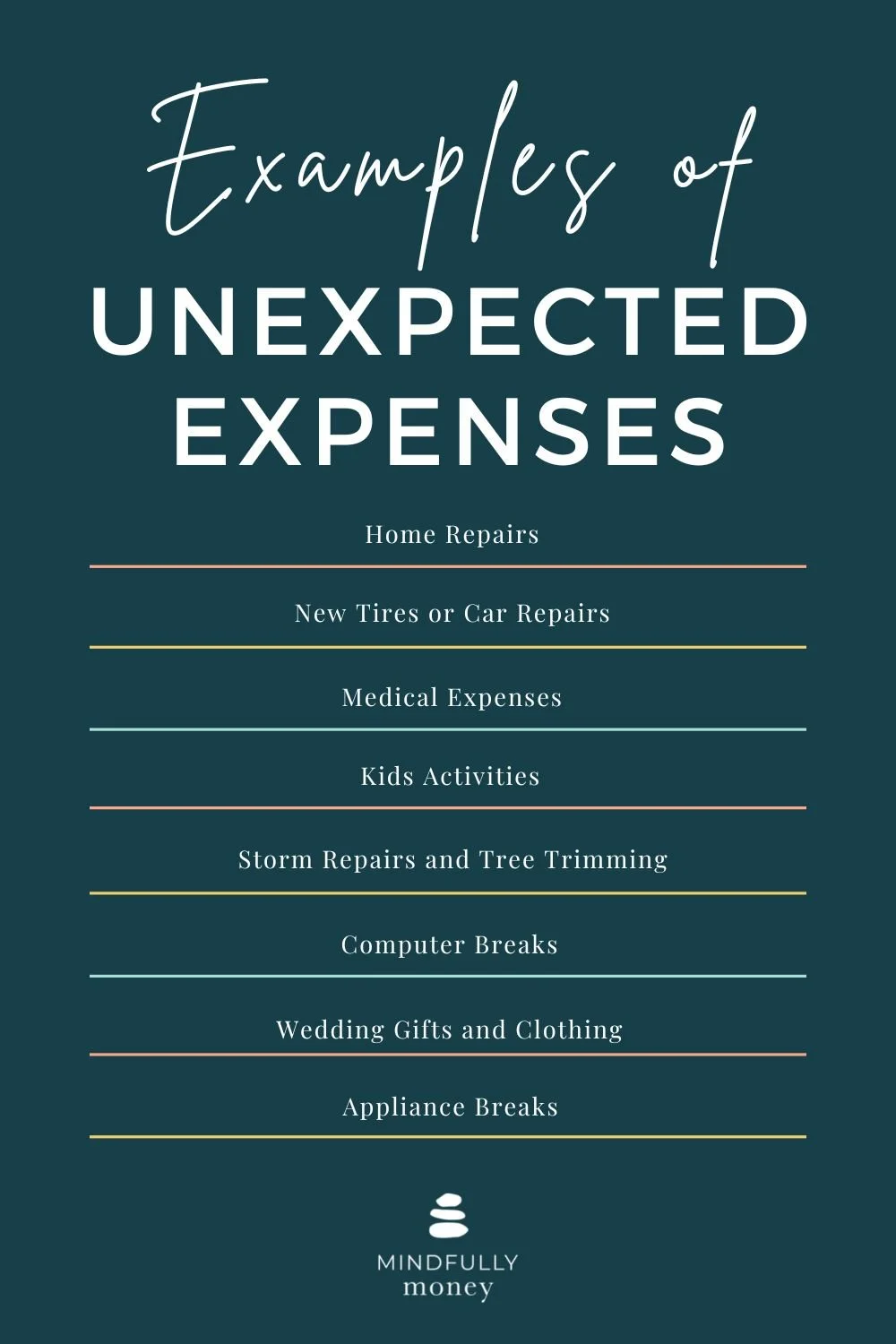

Life throws curveballs. Just when you think you have everything under control, an unexpected expense pops up, threatening to derail your carefully laid financial plans. A burst pipe, a car repair, a medical emergency – these are just a few examples of the financial curveballs that can knock you off balance. But fear not! By adopting a proactive approach and implementing a few strategic steps, you can effectively conquer unexpected expenses and maintain financial peace.

1. Build a Robust Emergency Fund:

The cornerstone of financial preparedness is a robust emergency fund. This is your financial safety net, designed to cushion you from the impact of unexpected expenses. The general rule of thumb is to aim for 3-6 months’ worth of living expenses in your emergency fund. This may seem like a daunting goal, but even starting small and building gradually can make a significant difference.

Here’s how to build your emergency fund:

- Set a Realistic Savings Goal: Determine your monthly living expenses (housing, utilities, food, transportation, etc.) and multiply it by the desired number of months (3-6). This will give you your target emergency fund amount.

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account. This ensures consistent contributions without you having to actively remember.

- Prioritize Savings: Treat saving for your emergency fund like a non-negotiable expense. Allocate a specific portion of your income each month to this purpose.

- Consider a High-Yield Savings Account: Look for a savings account with a higher interest rate to maximize your savings growth.

2. Embrace the Power of Budgeting:

Budgeting is not about deprivation; it’s about taking control of your finances. A well-crafted budget helps you understand where your money is going and allows you to allocate funds strategically. This includes identifying areas where you can cut back and prioritize saving for your emergency fund.

Here’s how to create a practical budget:

-

- Track Your Expenses: For a few months, diligently track every expense, big or small. This will provide a clear picture of your spending habits.

- Categorize Your Expenses: Organize your expenses into categories like housing, transportation, food, entertainment, and savings.

- Allocate Your Income: Assign a specific amount of money to each category based on your priorities and financial goals.

- Review and Adjust Regularly: Life is dynamic, and so are your expenses. Regularly review your budget and adjust it to reflect changes in your income or spending patterns.

3. Explore Insurance Coverage:

Insurance is a safety net against unforeseen events. It can help mitigate the financial impact of unexpected expenses, providing peace of mind and financial stability.

Here are some key insurance policies to consider:

- Health Insurance: Protect yourself from exorbitant medical bills in case of an illness or accident.

- Homeowners or Renters Insurance: Provides coverage for damage to your property due to fire, theft, or natural disasters.

- Auto Insurance: Protects you against financial losses in case of an accident, theft, or damage to your vehicle.

- Disability Insurance: Provides income replacement if you are unable to work due to an injury or illness.

4. Leverage Credit Wisely:

Credit cards can be a valuable tool for managing unexpected expenses, but only if used responsibly. Avoid relying on credit cards for everyday spending and focus on building a strong credit history.

Here are some tips for using credit responsibly:

- Use Credit Cards Sparingly: Only use credit cards for emergencies or planned expenses that you can afford to repay quickly.

- Pay Your Bills on Time: Late payments can negatively impact your credit score, making it harder to secure loans or credit in the future.

- Keep Your Credit Utilization Low: Aim to keep your credit utilization ratio (the amount of credit you’re using compared to your total credit limit) below 30%.

- Shop Around for the Best Rates: Compare interest rates and fees from different credit card providers to find the most favorable terms.

5. Develop a Financial Plan:

A comprehensive financial plan is the roadmap to financial security. It outlines your financial goals, including saving for retirement, paying off debt, and building an emergency fund.

Here’s how to create a financial plan:

- Define Your Goals: Identify your short-term and long-term financial goals.

- Assess Your Current Financial Situation: Evaluate your income, expenses, assets, and liabilities.

- Develop a Strategy: Create a plan to achieve your goals, including specific steps and timelines.

- Monitor Your Progress: Regularly review your financial plan and make adjustments as needed.

Beyond the Basics: Additional Strategies for Conquering Unexpected Expenses:

- Negotiate: Don’t be afraid to negotiate with service providers or creditors for lower rates or payment plans.

- Explore Financial Assistance: If you’re struggling to cover unexpected expenses, consider options like government assistance programs, charitable organizations, or hardship programs offered by your creditors.

- Seek Professional Advice: If you feel overwhelmed by your finances, consult with a financial advisor for personalized guidance and support.

Conclusion:

Unexpected expenses are a part of life, but they don’t have to derail your financial goals. By building a robust emergency fund, embracing budgeting, exploring insurance coverage, leveraging credit wisely, and developing a comprehensive financial plan, you can conquer these unexpected expenses and achieve financial peace. Remember, proactive planning and a strategic approach are your most powerful weapons in the battle against financial surprises.

Closure

Thus, we hope this article has provided valuable insights into 5 Strategic Steps to Conquer Unexpected Expenses and Achieve Financial Peace. We appreciate your attention to our article. See you in our next article!

google.com