5 Unbeatable Money Market Accounts: Unlocking Your Savings Potential

Introduction

With great pleasure, we will explore the intriguing topic related to 5 Unbeatable Money Market Accounts: Unlocking Your Savings Potential. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Unbeatable Money Market Accounts: Unlocking Your Savings Potential

In today’s turbulent economic climate, finding a safe haven for your hard-earned savings is paramount. While traditional savings accounts offer minimal returns, money market accounts (MMAs) emerge as a compelling alternative, providing a balance of accessibility and potential growth. But with so many options available, how do you choose the best MMA for your unique needs?

This article delves into the world of money market accounts, highlighting five unbeatable options that stand out from the crowd. We’ll explore key features, compare interest rates, and reveal the hidden gems that can truly unlock your savings potential.

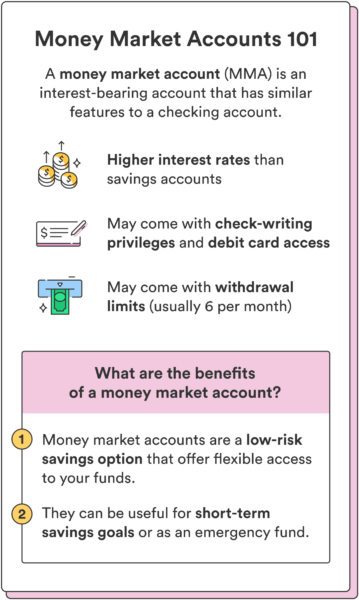

What is a Money Market Account?

Money market accounts are FDIC-insured deposit accounts offered by banks and credit unions. They offer a higher interest rate than traditional savings accounts while maintaining the accessibility of your funds. MMAs typically come with a few key features:

- Higher Interest Rates: MMAs generally offer higher interest rates than savings accounts, allowing your money to grow faster.

- FDIC Insurance: Your deposits are insured up to $250,000 per depositor, per insured bank, providing peace of mind.

- Limited Transactions: MMAs typically have a limited number of transactions per month, usually six or less. This helps maintain the higher interest rates.

- Check-Writing Privileges: Some MMAs allow you to write checks, providing flexibility for larger purchases or bill payments.

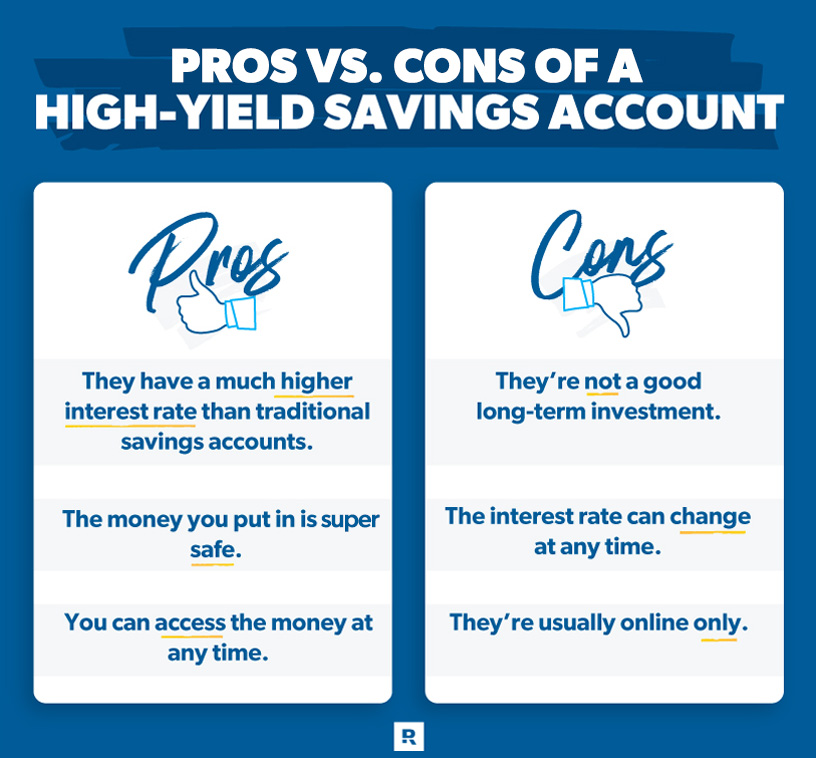

- Variable Interest Rates: Interest rates on MMAs are typically variable, meaning they fluctuate based on market conditions.

Why Choose a Money Market Account?

- Safety and Security: MMAs are FDIC-insured, guaranteeing the safety of your deposits.

- Higher Returns: MMAs typically offer higher interest rates than savings accounts, helping your money grow faster.

- Liquidity: You can access your funds quickly and easily, making them suitable for short-term savings goals.

- Flexibility: Some MMAs offer check-writing privileges, providing greater flexibility for managing your finances.

Factors to Consider When Choosing an MMA:

- Interest Rate: The most crucial factor is the interest rate offered. Look for accounts with competitive rates and favorable terms.

- Minimum Deposit: Some MMAs require a minimum deposit to open an account. Choose an account with a minimum deposit that fits your budget.

- Fees: Be aware of any monthly fees, transaction fees, or other charges associated with the account.

- Accessibility: Consider how easily you can access your funds, whether through online banking, mobile apps, or ATMs.

- Features: Evaluate the features offered, such as check-writing privileges, overdraft protection, and automatic transfers.

5 Unbeatable Money Market Accounts:

Here are five top-performing money market accounts that offer a compelling blend of high interest rates, low fees, and user-friendly features:

1. Ally Bank Money Market Account:

- Interest Rate: Ally Bank consistently offers competitive interest rates, currently exceeding the national average.

- Minimum Deposit: $100

- Fees: No monthly maintenance fees.

- Features: Online banking, mobile app, overdraft protection, automatic transfers.

Why Ally Bank Stands Out: Ally Bank is known for its exceptional customer service, user-friendly online platform, and competitive interest rates. Their commitment to providing a seamless digital experience makes it an excellent choice for tech-savvy savers.

2. Discover Bank Money Market Account:

- Interest Rate: Discover Bank offers competitive interest rates and frequently runs promotional offers.

- Minimum Deposit: $500

- Fees: No monthly maintenance fees.

- Features: Online banking, mobile app, ATM access, overdraft protection.

Why Discover Bank Stands Out: Discover Bank’s focus on customer satisfaction and its commitment to offering competitive rates make it a strong contender. Their user-friendly online platform and convenient ATM access add to its appeal.

3. Capital One 360 Money Market Account:

- Interest Rate: Capital One 360 offers a tiered interest rate structure, rewarding larger balances with higher rates.

- Minimum Deposit: $100

- Fees: No monthly maintenance fees.

- Features: Online banking, mobile app, ATM access, overdraft protection, automatic transfers.

Why Capital One 360 Stands Out: Capital One 360’s tiered interest rate structure can be advantageous for those with larger savings. Their extensive ATM network and convenient online platform make managing your account a breeze.

4. CIT Bank Money Market Account:

- Interest Rate: CIT Bank consistently offers competitive interest rates, particularly for larger balances.

- Minimum Deposit: $100

- Fees: No monthly maintenance fees.

- Features: Online banking, mobile app, ATM access, overdraft protection, automatic transfers.

Why CIT Bank Stands Out: CIT Bank is known for its high interest rates and its commitment to providing a secure and user-friendly online banking experience. Their focus on providing competitive returns makes them an attractive option for serious savers.

5. Marcus by Goldman Sachs Money Market Account:

- Interest Rate: Marcus by Goldman Sachs offers competitive interest rates and a straightforward account structure.

- Minimum Deposit: $1

- Fees: No monthly maintenance fees.

- Features: Online banking, mobile app, ATM access, overdraft protection, automatic transfers.

Why Marcus by Goldman Sachs Stands Out: Marcus by Goldman Sachs is known for its user-friendly platform, competitive interest rates, and lack of fees. Their reputation for financial expertise and their commitment to providing a seamless online experience make them a compelling choice.

Tips for Maximizing Your MMA Returns:

- Shop Around: Compare interest rates from different institutions to find the best deal.

- Maximize Your Balance: Consider transferring funds from low-yielding savings accounts to increase your MMA balance and earn higher interest.

- Take Advantage of Promotional Offers: Some banks offer promotional bonuses or higher interest rates for new account holders.

- Automate Savings: Set up automatic transfers from your checking account to your MMA to ensure consistent contributions.

Conclusion:

Choosing the right money market account can be a crucial step in maximizing your savings potential. By considering factors like interest rates, fees, and features, you can find an MMA that aligns with your financial goals and helps your money grow faster. The five unbeatable MMAs highlighted in this article offer a compelling blend of high returns, low fees, and user-friendly features, making them ideal options for both seasoned savers and those just starting their financial journey. Remember, your savings deserve the best, so choose wisely and watch your money flourish.

Closure

Thus, we hope this article has provided valuable insights into 5 Unbeatable Money Market Accounts: Unlocking Your Savings Potential. We hope you find this article informative and beneficial. See you in our next article!

google.com