5 Unstoppable High Dividend Stocks to Supercharge Your Portfolio

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Unstoppable High Dividend Stocks to Supercharge Your Portfolio. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Unstoppable High Dividend Stocks to Supercharge Your Portfolio

In the world of investing, seeking high returns is a constant pursuit. But what if we told you there’s a strategy that can not only deliver strong potential for growth but also provide a steady stream of income? We’re talking about high dividend stocks – the unsung heroes of portfolio diversification.

These stocks, issued by companies committed to sharing their profits with shareholders, offer a compelling proposition: the chance to earn both capital appreciation and regular dividend payments. In essence, you’re not just buying a piece of a company; you’re becoming a partner in its success, reaping the rewards of its profitability.

However, the world of high-dividend stocks isn’t without its complexities. While the allure of substantial payouts is undeniable, it’s crucial to approach this investment strategy with a discerning eye.

Decoding the Dividend Landscape

Before diving into specific stock recommendations, let’s first understand the key factors that shape the dividend landscape:

- Dividend Yield: This metric, expressed as a percentage, reflects the annual dividend payment as a proportion of the stock’s current price. A higher dividend yield generally indicates a more generous payout, but it’s important to remember that it’s not the sole determinant of a stock’s attractiveness.

- Dividend Growth: Consistent dividend increases are a sign of a company’s financial health and its commitment to rewarding shareholders. Look for companies with a history of steady dividend growth, as this suggests a sustainable payout policy.

- Payout Ratio: This ratio represents the percentage of a company’s earnings that are distributed as dividends. A high payout ratio might signal a mature company with limited growth opportunities, while a lower ratio could indicate a company reinvesting its earnings for future expansion.

- Financial Stability: A company’s ability to maintain its dividend payments depends heavily on its financial health. Analyze factors like debt levels, cash flow, and earnings stability to ensure the dividend is sustainable.

- Industry Trends: The industry in which a company operates plays a significant role in its dividend prospects. Sectors like utilities, real estate, and consumer staples often feature companies with consistent dividend payouts.

5 High Dividend Stocks to Consider

Now, let’s explore five high-dividend stocks that stand out for their potential to deliver both income and growth:

1. Realty Income Corporation (O):

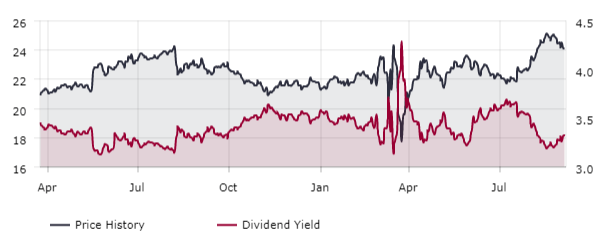

- Dividend Yield: Approximately 4.5%

- Industry: Real Estate Investment Trust (REIT) specializing in commercial properties.

- Why it’s compelling: Realty Income boasts a remarkably consistent track record of dividend payments, having increased its dividend for 27 consecutive years. The company’s diversified portfolio of over 12,000 properties across various industries provides a stable revenue stream. Its focus on long-term leases with reputable tenants further strengthens its financial resilience.

2. AT&T Inc. (T):

- Dividend Yield: Approximately 6.5%

- Industry: Telecommunications

- Why it’s compelling: AT&T is a telecommunications giant with a long history of dividend payments. Its massive network infrastructure and diverse portfolio of services, including wireless, broadband, and entertainment, provide a solid foundation for continued dividend growth. The company’s recent divestitures and focus on 5G technology are positioning it for future growth.

3. Chevron Corporation (CVX):

- Dividend Yield: Approximately 4%

- Industry: Oil and Gas

- Why it’s compelling: Chevron is a global energy giant with a strong track record of dividend payments. The company’s extensive reserves and production capabilities make it a reliable source of energy, while its commitment to renewable energy initiatives positions it for long-term sustainability.

4. Johnson & Johnson (JNJ):

- Dividend Yield: Approximately 2.5%

- Industry: Healthcare

- Why it’s compelling: Johnson & Johnson is a healthcare behemoth with a diversified portfolio of products and services, ranging from pharmaceuticals and medical devices to consumer health products. The company’s strong brand recognition, global reach, and consistent innovation make it a reliable dividend payer.

5. Coca-Cola Consolidated, Inc. (COKE):

- Dividend Yield: Approximately 2.5%

- Industry: Beverages

- Why it’s compelling: Coca-Cola Consolidated is a leading bottler and distributor of Coca-Cola products in the United States. The company benefits from a strong brand, a loyal customer base, and a resilient demand for its beverages. Its focus on operational efficiency and strategic acquisitions positions it for continued growth and dividend payments.

Navigating the High-Dividend Landscape

While these stocks offer compelling dividend prospects, it’s essential to remember that no investment is without risk. Here are some key considerations:

- Risk Tolerance: High-dividend stocks often come with higher volatility compared to lower-yielding stocks. Assess your risk tolerance before investing in these companies.

- Company Fundamentals: Don’t solely focus on dividend yield. Dive deeper into a company’s financial health, debt levels, and growth prospects to ensure the dividend is sustainable.

- Diversification: Spread your investments across different sectors and industries to mitigate risk. Don’t put all your eggs in one basket, even if a particular stock looks promising.

- Long-Term Perspective: High-dividend stocks are best suited for long-term investors. Don’t expect to get rich quickly. Patience and a long-term mindset are crucial for maximizing returns.

Conclusion: Harnessing the Power of Dividends

High-dividend stocks can be a powerful tool in your investment arsenal, offering the potential for both capital appreciation and regular income. By carefully selecting companies with strong fundamentals, a history of dividend growth, and a commitment to shareholder value, you can build a portfolio that generates both income and long-term wealth.

Remember, investing in high-dividend stocks requires a balanced approach, combining thorough research, careful consideration of risk, and a long-term perspective. By embracing these principles, you can harness the power of dividends to supercharge your portfolio and achieve your financial goals.

Closure

Thus, we hope this article has provided valuable insights into 5 Unstoppable High Dividend Stocks to Supercharge Your Portfolio. We hope you find this article informative and beneficial. See you in our next article!

google.com