5 Unstoppable Strategies to Unlock Your Wealth Potential

Related Articles: 5 Unstoppable Strategies to Unlock Your Wealth Potential

- Conquer The Stock Market: 5 Powerful Strategies For Success

- Conquer The 5-Year Spending Trap: How To Avoid Lifestyle Inflation And Secure Your Financial Future

- Conquer Debt: 5 Powerful Strategies To Achieve Financial Freedom Faster

- Essential 5-Step Credit Monitoring: Unlocking Your Financial Power

- Mastering retirement planning

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Unstoppable Strategies to Unlock Your Wealth Potential. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Unstoppable Strategies to Unlock Your Wealth Potential

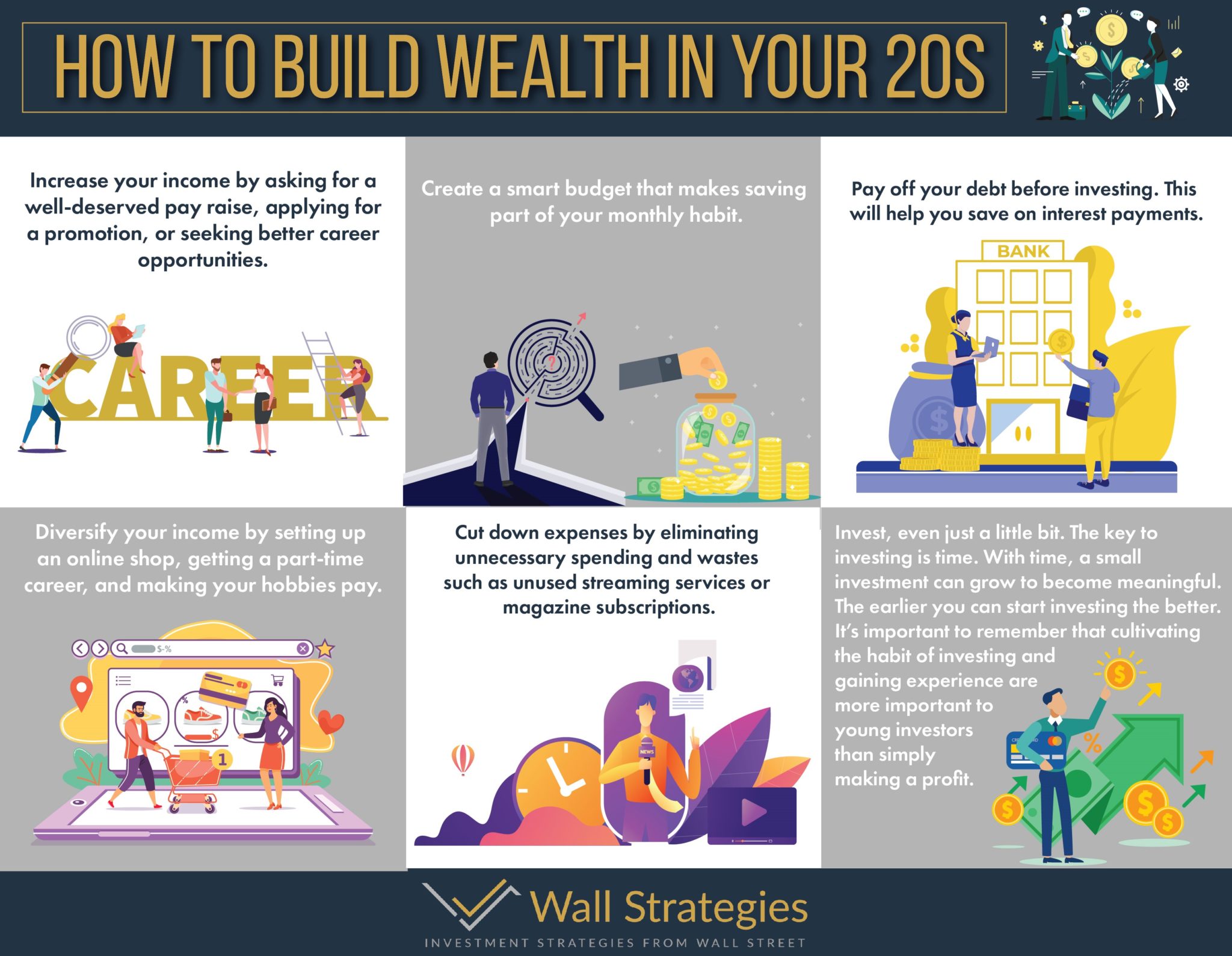

The pursuit of wealth is a journey that can feel daunting, fraught with uncertainty and complex financial jargon. Yet, the desire for financial security and freedom is a universal one. While there’s no magic formula for instant riches, there are proven strategies that, when implemented consistently, can propel you towards a life of abundance. This article will delve into 5 unstoppable strategies to unlock your wealth potential, empowering you to build a solid financial foundation and achieve your financial goals.

1. Embrace the Power of Compound Interest: Your Silent Partner in Wealth Building

Albert Einstein famously called compound interest “the eighth wonder of the world,” and for good reason. This powerful force allows your money to grow exponentially over time, working for you even while you sleep.

Understanding the Magic:

Compound interest works by earning interest not only on your initial investment but also on the accumulated interest. Imagine investing $10,000 at a 10% annual return. In the first year, you earn $1,000. But in the second year, you earn 10% on the initial $10,000 and the $1,000 earned in the first year, resulting in $1,100 in interest. This snowball effect continues, accelerating your wealth growth over time.

Putting it into Action:

-

- Start Early: The earlier you begin, the more time compound interest has to work its magic. Even small, consistent investments can yield significant returns over decades.

- Maximize Your Returns: Seek investments with higher potential returns, such as stocks, real estate, or index funds, while balancing risk with your investment goals.

- Minimize Fees and Taxes: High fees and taxes can eat away at your returns. Choose low-cost investment options and consider tax-advantaged accounts like 401(k)s or IRAs.

2. Cultivate a Mindset of Abundance: Shifting Your Perspective for Financial Success

Your mindset plays a crucial role in your financial journey. A scarcity mindset, characterized by fear and a belief that resources are limited, can hinder your ability to attract wealth. In contrast, an abundance mindset, focused on possibilities and believing in your ability to create wealth, empowers you to take bold actions and attract financial opportunities.

Shifting Your Perspective:

- Challenge Limiting Beliefs: Identify negative thoughts and beliefs about money and replace them with empowering affirmations.

- Focus on Gratitude: Appreciate what you already have, fostering a sense of abundance and attracting more prosperity.

- Visualize Success: Imagine yourself achieving your financial goals, solidifying your belief in their possibility.

- Embrace a Growth Mindset: Be open to learning new skills and strategies, continuously expanding your financial knowledge and capabilities.

3. Mastering the Art of Budgeting: Taking Control of Your Finances

Without a clear understanding of your income and expenses, it’s impossible to make informed financial decisions. Budgeting is the cornerstone of financial control, allowing you to track your spending, identify areas for improvement, and allocate your resources strategically.

Building a Solid Budget:

- Track Your Expenses: Use a budgeting app, spreadsheet, or notebook to meticulously record all your income and expenses for a month.

- Categorize Your Expenses: Identify your spending habits, allocating your expenses into categories like housing, food, transportation, and entertainment.

- Set Financial Goals: Define your short-term and long-term financial goals, such as saving for a down payment, paying off debt, or investing for retirement.

- Prioritize Essential Expenses: Allocate your budget to essential needs, such as housing, utilities, and food, while minimizing discretionary spending.

- Regularly Review and Adjust: Your financial situation is constantly evolving, so it’s essential to review and adjust your budget regularly to reflect your changing needs.

4. The Power of Investing: Growing Your Wealth Through Strategic Allocation

Investing is the key to building long-term wealth. By allocating your savings wisely, you can harness the power of compound interest and outpace inflation, allowing your money to grow over time.

Understanding Investment Options:

- Stocks: Ownership in publicly traded companies, offering potential for high returns but also carrying higher risk.

- Bonds: Loans to governments or corporations, providing a steady stream of income with lower risk than stocks.

- Real Estate: Ownership of physical property, offering potential for appreciation and rental income.

- Index Funds: Mutual funds that track a specific market index, offering diversification and low-cost investment.

Building a Diversified Portfolio:

- Assess Your Risk Tolerance: Determine your comfort level with potential losses, guiding your investment choices.

- Diversify Your Portfolio: Spread your investments across different asset classes to mitigate risk and enhance returns.

- Rebalance Regularly: Periodically adjust your portfolio to maintain your desired asset allocation, ensuring your investments remain aligned with your goals.

5. Building a Solid Financial Foundation: Establishing a Strong Safety Net

Financial stability is not solely about accumulating wealth; it’s also about safeguarding your financial well-being. Building a solid financial foundation involves establishing an emergency fund, managing debt responsibly, and securing adequate insurance coverage.

Creating a Financial Safety Net:

- Emergency Fund: Aim to save 3-6 months of living expenses in a readily accessible account, providing a buffer for unexpected events.

- Debt Management: Prioritize paying down high-interest debt, such as credit card debt, to minimize interest charges and improve your credit score.

- Insurance Coverage: Secure adequate health, life, disability, and property insurance to protect yourself and your loved ones from financial hardship in the event of unforeseen circumstances.

The Journey to Financial Freedom:

Building wealth is not a sprint, but a marathon. It requires discipline, patience, and a commitment to continuous learning and improvement. Embrace these 5 unstoppable strategies, and you’ll be well on your way to unlocking your wealth potential and achieving financial freedom.

Beyond the Strategies:

While these strategies provide a solid framework for building wealth, it’s important to remember that success is not solely dependent on financial knowledge.

- Seek Professional Guidance: Consult with a financial advisor to create a personalized plan tailored to your specific needs and goals.

- Stay Informed: Stay updated on economic trends, financial markets, and investment strategies to make informed decisions.

- Network and Connect: Surround yourself with like-minded individuals who share your financial goals and can provide support and inspiration.

- Celebrate Your Progress: Acknowledge your accomplishments along the way, motivating yourself to stay focused on your financial journey.

The Power of Action:

Knowledge is power, but it’s only through action that you can truly unlock your wealth potential. Take the first step today, implement these strategies, and watch your financial future transform. Remember, the journey to financial freedom is within your reach. With the right mindset, strategies, and unwavering commitment, you can create a life of abundance and financial security for yourself and your loved ones.

Closure

Thus, we hope this article has provided valuable insights into 5 Unstoppable Strategies to Unlock Your Wealth Potential. We appreciate your attention to our article. See you in our next article!

google.com