5 Unstoppable Tips for Building a Stellar Credit History

Related Articles: 5 Unstoppable Tips for Building a Stellar Credit History

- 5 Strategic Steps To Conquer Unexpected Expenses And Achieve Financial Peace

- 10 Unbreakable Rules For Mastering Your Finances: A Beginner’s Guide To Financial Freedom

- Mastering The Unexpected: 5 Powerful Strategies For Conquering Financial Surprises

- The Ultimate Guide To Conquering The Stock Market: 5 Steps To Smart Investing For Beginners

- The Pros And Cons Of Leasing Vs Buying A Car

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Unstoppable Tips for Building a Stellar Credit History. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Unstoppable Tips for Building a Stellar Credit History

In the modern world, a good credit score is like a golden key, unlocking doors to financial opportunities, from securing loans with favorable interest rates to renting your dream apartment. But building a strong credit history takes time, patience, and a strategic approach. It’s not something that happens overnight, but by following these five unstoppable tips, you can set yourself on the path to a stellar credit score and a brighter financial future.

1. Start Early and Stay Consistent:

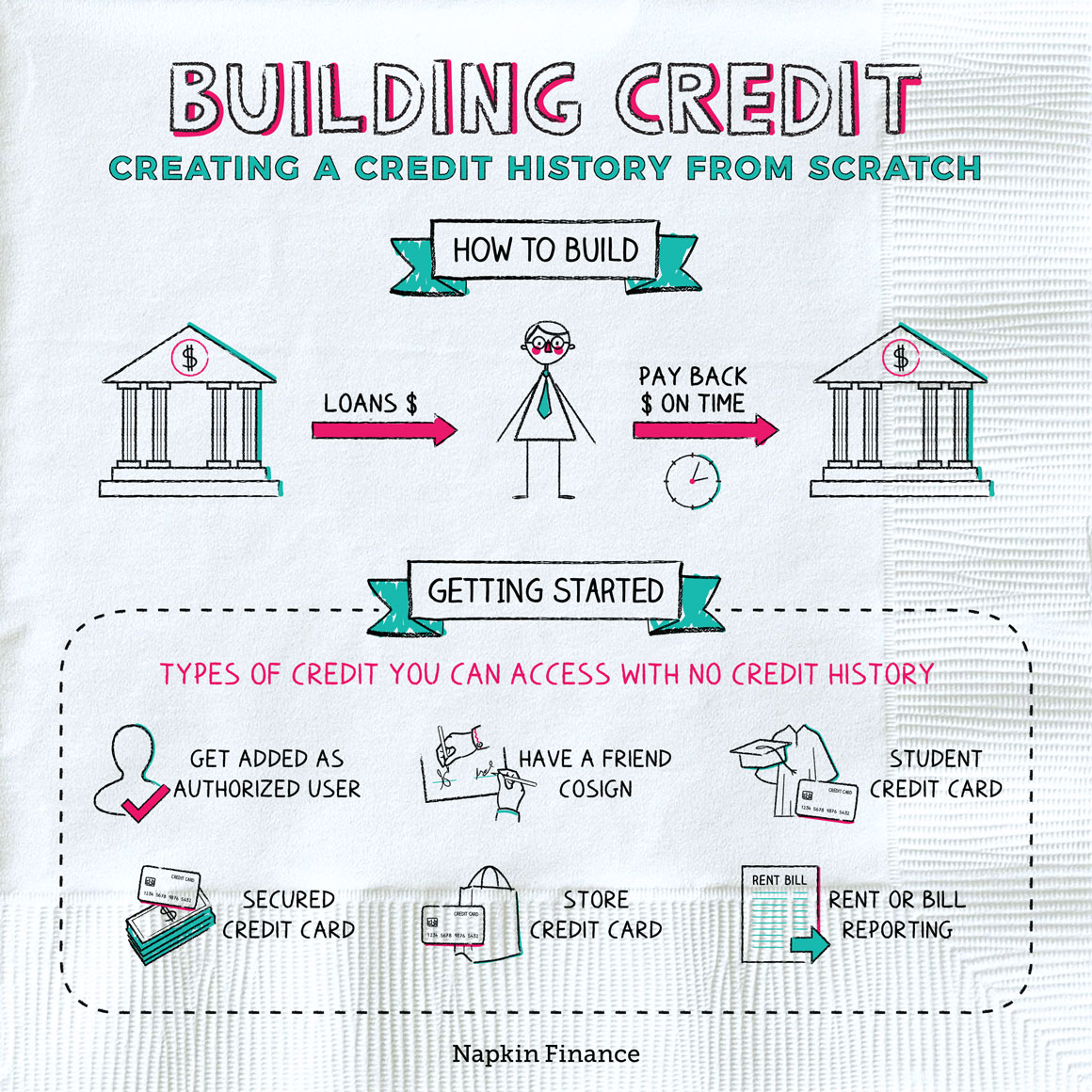

The sooner you begin building your credit history, the better. Even if you’re young, there are several ways to get started:

- Become an authorized user on a parent’s or guardian’s credit card: This allows you to benefit from their positive credit history without having to apply for your own card. However, it’s important to ensure they maintain a good credit score and responsible spending habits.

- Get a secured credit card: These cards require a security deposit that acts as collateral, making them a good option for those with limited credit history. They can help you establish a positive credit track record and potentially graduate to an unsecured card later.

- Open a student loan: While student loans are meant for education, they also contribute to your credit history, especially if you make timely payments.

Remember, consistency is key. Make all payments on time, whether it’s for a credit card, student loan, or utility bill. Late payments can significantly damage your credit score, so set reminders and automate payments whenever possible.

2. Utilize Credit Wisely:

Once you have a credit card, it’s crucial to use it responsibly. Here’s how:

-

- Keep your credit utilization ratio low: This ratio represents the percentage of your available credit you’re using. Aim to keep it below 30%, ideally even lower. A high credit utilization ratio can negatively impact your score.

- Pay your balance in full each month: This avoids accruing interest and helps you avoid carrying debt. If you can’t pay the full balance, at least make more than the minimum payment to reduce your debt faster.

- Don’t apply for too many new credit cards: Every time you apply for a new card, an inquiry is made on your credit report, which can temporarily lower your score. Only apply for cards you genuinely need and avoid applying for multiple cards within a short period.

By using credit responsibly and managing your debt effectively, you’ll demonstrate to lenders that you’re a reliable borrower, which will boost your credit score.

3. Diversify Your Credit Portfolio:

Having a variety of credit accounts can improve your credit score. This is because lenders prefer to see a mix of credit types, including:

- Revolving credit: This includes credit cards, where you can borrow up to a certain limit and pay it back over time.

- Installment credit: This involves borrowing a fixed amount of money and repaying it in regular installments over a set period. Examples include car loans, student loans, and personal loans.

- Other credit: This category includes accounts like utility bills and mobile phone bills.

By having a mix of credit types, you demonstrate your ability to manage different types of credit responsibly, which can improve your credit score.

4. Monitor Your Credit Report Regularly:

Your credit report is a detailed record of your credit history, including your payment history, credit utilization, and inquiries. It’s crucial to monitor your credit report regularly for any errors or discrepancies.

- Check your credit report for free at least once a year: You can access your free annual credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com.

- Dispute any errors you find: If you find any inaccuracies on your credit report, contact the credit bureau and file a dispute. You have the right to correct any errors that may be negatively impacting your credit score.

By monitoring your credit report and taking steps to correct any errors, you can ensure that your credit history is accurate and reflects your responsible financial behavior.

5. Be Patient and Persistent:

Building a stellar credit history is a marathon, not a sprint. It takes time and effort to establish a positive credit track record. Don’t get discouraged if you don’t see immediate results.

- Stay consistent with your good financial habits: Continue making payments on time, using credit responsibly, and monitoring your credit report.

- Seek professional advice if needed: If you’re struggling to manage your credit or have questions about building a strong credit history, consider seeking guidance from a financial advisor or credit counselor.

Remember, a good credit score is a valuable asset. By following these five unstoppable tips, you can lay the foundation for a stellar credit history and unlock a world of financial opportunities.

Beyond the Basics: Additional Tips for Credit Score Enhancement

While the five core tips provide a solid foundation, here are some additional strategies to further enhance your credit score:

- Become an authorized user on an account with a long credit history: This can help you benefit from a more established credit history, potentially boosting your score. However, it’s important to ensure the account holder has a good credit history and responsible spending habits.

- Consider a credit-builder loan: These loans are designed to help individuals with limited credit build their credit history by making regular payments.

- Use a credit monitoring service: These services alert you to changes in your credit report, making it easier to detect any potential fraud or errors.

- Avoid closing old credit accounts: While it’s tempting to close accounts with high credit limits, doing so can negatively impact your credit score. It’s generally recommended to keep older accounts open, even if you’re not actively using them.

- Keep track of your credit score: Regularly checking your credit score can help you monitor your progress and identify any potential areas for improvement.

The Power of a Strong Credit History:

A good credit score opens doors to a wide range of financial benefits:

- Lower interest rates on loans: A higher credit score allows you to qualify for lower interest rates on mortgages, auto loans, and personal loans, saving you significant money over the life of the loan.

- Better chances of loan approval: Lenders are more likely to approve your loan application if you have a good credit score, giving you greater access to financing.

- Easier access to credit: A strong credit history makes it easier to obtain credit cards, lines of credit, and other forms of credit when you need them.

- Lower insurance premiums: Some insurance companies offer lower premiums to individuals with good credit scores.

- Improved rental application prospects: Landlords often consider credit scores when evaluating rental applications, making a good credit score essential for securing your dream apartment.

Conclusion:

Building a stellar credit history is a journey that requires patience, discipline, and a strategic approach. By starting early, using credit responsibly, diversifying your credit portfolio, monitoring your credit report, and staying persistent, you can lay the foundation for a strong credit score that will serve you well for years to come. Remember, a good credit score is a valuable asset that opens doors to a brighter financial future.

Closure

Thus, we hope this article has provided valuable insights into 5 Unstoppable Tips for Building a Stellar Credit History. We hope you find this article informative and beneficial. See you in our next article!

google.com