Conquer the 5 Biggest Mortgage Myths: Demystifying the Home Loan Process

Introduction

With great pleasure, we will explore the intriguing topic related to Conquer the 5 Biggest Mortgage Myths: Demystifying the Home Loan Process. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquer the 5 Biggest Mortgage Myths: Demystifying the Home Loan Process

The prospect of buying a home can be both exciting and daunting. Navigating the mortgage process, with its complex jargon and intricate details, can feel overwhelming. This is where myths and misconceptions often creep in, causing unnecessary anxiety and potentially hindering your homeownership dreams.

This article aims to empower you with knowledge, debunking 5 common mortgage myths and providing a clear, concise guide to understanding this crucial financial step.

Myth #1: You Need a Perfect Credit Score

While a good credit score is beneficial, it’s not an absolute requirement for securing a mortgage. Lenders consider various factors beyond just your credit score, such as your debt-to-income ratio (DTI), employment history, and down payment.

- Reality: Even if your credit score isn’t perfect, you can still qualify for a mortgage.

- Action: Focus on improving your credit score over time, but don’t let a less-than-perfect score deter you from pursuing homeownership.

Myth #2: You Need a 20% Down Payment

The widely-held belief that you need a 20% down payment is a myth that can discourage many first-time homebuyers.

- Reality: There are numerous loan programs available that require less than 20% down, such as FHA loans (3.5% down), VA loans (0% down for eligible veterans), and USDA loans (0% down for rural properties).

- Action: Research different loan programs and explore options that align with your financial situation.

Myth #3: Mortgage Rates Are Always Fixed

While fixed-rate mortgages offer stability and predictable monthly payments, they are not the only option.

- Reality: Adjustable-rate mortgages (ARMs) can offer lower initial rates, which can be attractive to borrowers seeking a lower monthly payment in the early years. However, ARMs have interest rates that can fluctuate over time, potentially leading to higher payments later on.

- Action: Carefully consider your financial goals and risk tolerance when deciding between a fixed-rate or adjustable-rate mortgage.

Myth #4: Closing Costs Are a Surprise Expense

Closing costs, the fees associated with finalizing a mortgage, can seem like an unexpected expense. However, they are a standard part of the homebuying process.

- Reality: Closing costs typically range from 2% to 5% of the loan amount and include various fees like appraisal fees, title insurance, and loan origination fees.

- Action: Inquire about closing costs upfront and factor them into your budget. Many lenders offer options to roll closing costs into the loan amount, but this can increase your overall interest payments.

Myth #5: Mortgages Are Only for New Homes

The misconception that mortgages are solely for new construction is a common barrier for potential homebuyers.

- Reality: Mortgages are available for both new and existing homes.

- Action: Don’t hesitate to explore the possibility of purchasing an existing home, as it can offer potential cost savings and a wider range of choices.

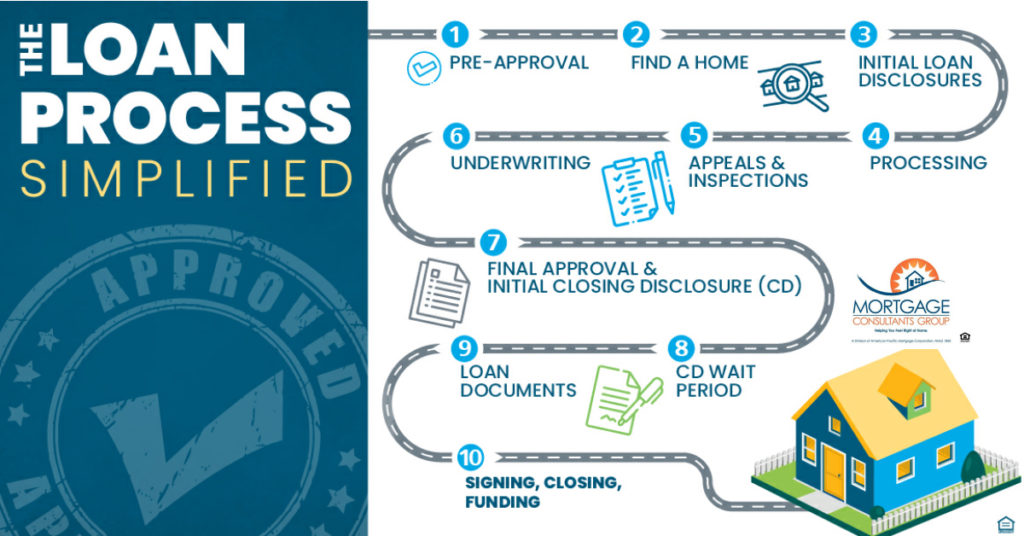

Understanding the Mortgage Process

Now that we’ve debunked common myths, let’s delve into the key steps involved in securing a mortgage:

1. Pre-Approval:

- Importance: Pre-approval provides you with an estimated loan amount and interest rate, giving you a clearer picture of your affordability and strengthening your negotiating power when making an offer on a home.

- Process: Contact multiple lenders to compare rates and terms. Provide your financial information, including income, credit history, and assets. The lender will review your application and issue a pre-approval letter.

2. Finding a Home:

- Importance: With a pre-approval in hand, you can start your home search with confidence, knowing your budget and financing options.

- Process: Work with a real estate agent to identify homes that meet your criteria.

3. Making an Offer:

- Importance: Submitting a strong offer that aligns with your pre-approved loan amount increases your chances of securing the property.

- Process: Your real estate agent will draft an offer based on your pre-approval and negotiate with the seller.

4. Home Appraisal:

- Importance: An appraisal determines the fair market value of the property, ensuring that the loan amount aligns with the home’s worth.

- Process: The lender will arrange for a licensed appraiser to assess the property.

5. Loan Underwriting:

- Importance: Underwriting is a comprehensive review of your financial situation and the property details to determine your eligibility for the loan.

- Process: The lender will verify your income, credit history, and employment. They will also review the appraisal and title report.

6. Closing:

- Importance: This is the final step where you sign all necessary documents and receive the keys to your new home.

- Process: You will meet with a closing attorney or title company to finalize the transaction.

Tips for a Successful Mortgage Process:

- Improve your credit score: Pay your bills on time, reduce your credit utilization, and avoid opening new credit accounts.

- Save for a down payment: Start saving early and explore different down payment assistance programs.

- Shop around for lenders: Compare rates and terms from multiple lenders to find the best deal.

- Get pre-approved: This gives you a clear understanding of your borrowing power and strengthens your negotiating position.

- Work with a reputable real estate agent: A knowledgeable agent can guide you through the process and help you find the right home.

- Understand the closing costs: Inquire about closing costs upfront and factor them into your budget.

Conclusion

Securing a mortgage can be a significant financial decision. By understanding the process, debunking common myths, and following the tips outlined above, you can navigate this journey with confidence and achieve your homeownership dreams. Remember, knowledge is power, and with the right information, you can conquer the mortgage process and unlock the door to your future home.

Closure

Thus, we hope this article has provided valuable insights into Conquer the 5 Biggest Mortgage Myths: Demystifying the Home Loan Process. We thank you for taking the time to read this article. See you in our next article!

google.com