Unlocking the Power of 5: A Comprehensive Guide to Understanding Personal Loans

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unlocking the Power of 5: A Comprehensive Guide to Understanding Personal Loans. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlocking the Power of 5: A Comprehensive Guide to Understanding Personal Loans

Personal loans are a powerful financial tool that can help you achieve your financial goals, whether it’s consolidating debt, funding a home renovation, or taking a dream vacation. However, understanding the intricacies of personal loans is crucial to avoid potential pitfalls and ensure you’re making the most of this financial instrument. This comprehensive guide will equip you with the knowledge you need to navigate the world of personal loans confidently.

1. Defining Personal Loans: A Simple Explanation

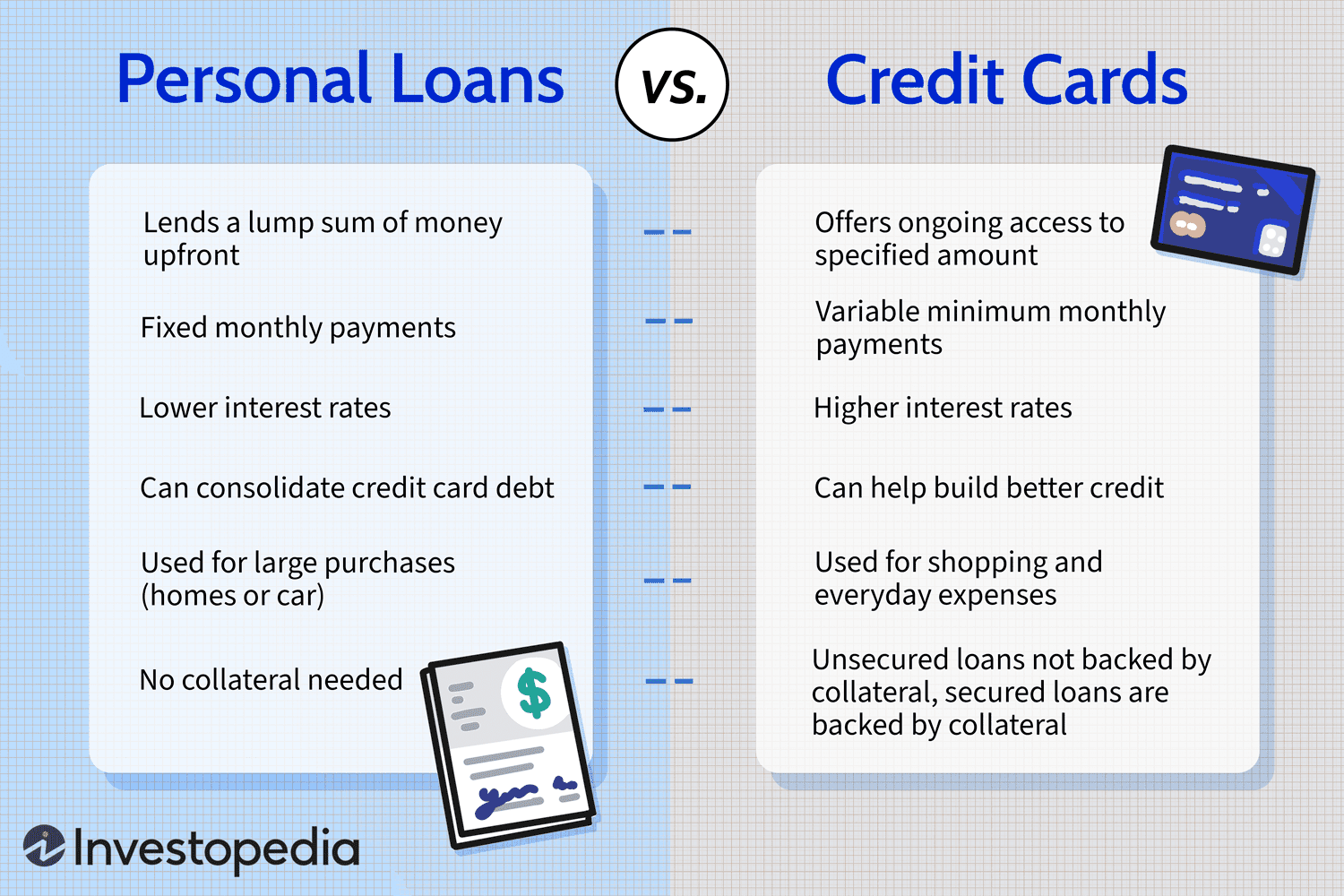

A personal loan is a type of unsecured loan that allows you to borrow a lump sum of money from a lender, typically a bank or credit union. Unlike secured loans, such as mortgages, personal loans don’t require collateral, meaning the lender doesn’t have a claim on any of your assets if you default on the loan. This makes them a versatile option for a wide range of needs.

2. Understanding the Mechanics of Personal Loans

- Loan Amount: The amount you can borrow depends on your creditworthiness and the lender’s policies.

- Interest Rate: This is the cost of borrowing money, expressed as a percentage of the loan amount. Interest rates vary based on your credit score, loan term, and lender.

- Loan Term: This refers to the duration of the loan, typically ranging from a few months to several years.

- Monthly Payments: These are fixed amounts you pay back to the lender each month, covering both principal and interest.

- Origination Fee: This is a one-time fee charged by the lender for processing your loan application.

3. The 5 Key Factors to Consider Before Applying

Before you jump into applying for a personal loan, take the time to evaluate your financial situation and consider these five crucial factors:

1. Credit Score: Your credit score plays a significant role in determining your eligibility for a personal loan and the interest rate you’ll receive. A higher credit score translates to better loan terms.

2. Loan Purpose: Clearly define the purpose of the loan. Lenders may offer different rates or terms depending on the intended use.

3. Loan Amount: Determine the exact amount you need to avoid borrowing more than necessary. Overborrowing can lead to higher interest payments and debt accumulation.

4. Loan Term: Choose a loan term that aligns with your repayment capabilities. Shorter terms generally mean higher monthly payments but lower overall interest costs.

5. Interest Rates and Fees: Compare interest rates and fees from different lenders to find the most competitive offer. Consider the APR (Annual Percentage Rate), which includes both the interest rate and any fees.

4. Types of Personal Loans: Exploring Your Options

Personal loans come in various forms, each catering to specific needs and circumstances:

- Unsecured Personal Loans: These are the most common type, offering flexibility without requiring collateral.

- Secured Personal Loans: These loans use an asset, like a car or savings account, as collateral, potentially leading to lower interest rates.

- Debt Consolidation Loans: Designed to combine multiple debts into a single loan with a lower interest rate, simplifying repayment and potentially saving you money.

- Home Equity Loans: These loans use your home’s equity as collateral, allowing you to borrow a significant amount at a lower interest rate.

5. Navigating the Application Process: Step-by-Step

Applying for a personal loan involves several steps:

- Gather Required Documents: Prepare your income verification, credit report, and other documentation requested by the lender.

- Complete the Application: Fill out the loan application form accurately and provide all necessary information.

- Credit Check and Approval: The lender will conduct a credit check and evaluate your application based on their criteria.

- Loan Agreement: Review the loan agreement carefully before signing. Understand the terms, interest rate, repayment schedule, and any fees.

- Disbursement of Funds: Once the loan is approved, the lender will deposit the funds into your account.

6. Managing Your Loan: Tips for Successful Repayment

Managing your personal loan effectively is essential for avoiding financial stress:

- Track Your Payments: Set up reminders and ensure timely payments to avoid late fees and damage to your credit score.

- Budgeting: Create a budget that incorporates your loan payments and other financial obligations.

- Prioritize Repayment: Consider making extra payments towards your loan principal to reduce the overall interest cost.

- Review Your Loan Terms: Periodically review your loan agreement and make sure you understand the terms and conditions.

7. Avoiding Common Pitfalls: A Word of Caution

While personal loans can be beneficial, it’s important to be aware of potential pitfalls:

- High Interest Rates: Be wary of lenders offering excessively high interest rates, especially if you have a lower credit score.

- Hidden Fees: Pay attention to any hidden fees or charges associated with the loan.

- Overborrowing: Avoid borrowing more than you need, as it can lead to financial strain and debt accumulation.

- Ignoring Loan Terms: Always read and understand the loan agreement before signing.

8. Exploring Alternatives to Personal Loans

Personal loans aren’t the only option for financial needs. Consider alternatives:

- Credit Cards: Use credit cards responsibly for short-term needs, ensuring you can pay off the balance in full each month.

- Home Equity Line of Credit (HELOC): Use your home’s equity as collateral for a flexible line of credit, offering lower interest rates than personal loans.

- Family and Friends: If you need a smaller loan, consider borrowing from family or friends, but ensure clear repayment terms and avoid straining relationships.

9. The Power of Personal Loans: A Final Thought

Personal loans can be a valuable tool for achieving your financial goals, but they require careful planning and responsible management. By understanding the intricacies of personal loans and considering the factors discussed above, you can make informed decisions that benefit your financial well-being. Remember, the power of personal loans lies in your ability to use them wisely and responsibly.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Power of 5: A Comprehensive Guide to Understanding Personal Loans. We thank you for taking the time to read this article. See you in our next article!

google.com