7 Unstoppable Financial Management Tips to Transform Your Finances

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 7 Unstoppable Financial Management Tips to Transform Your Finances. Let’s weave interesting information and offer fresh perspectives to the readers.

7 Unstoppable Financial Management Tips to Transform Your Finances

The pursuit of financial freedom is a journey, not a destination. It requires a consistent effort, a strategic mindset, and a commitment to making smart financial decisions. While the path may seem daunting, it’s not an insurmountable challenge. By adopting effective financial management strategies, you can gain control over your finances, achieve your financial goals, and build a secure future.

This article outlines seven powerful financial management tips that can help you transform your financial landscape and set you on the path to financial independence.

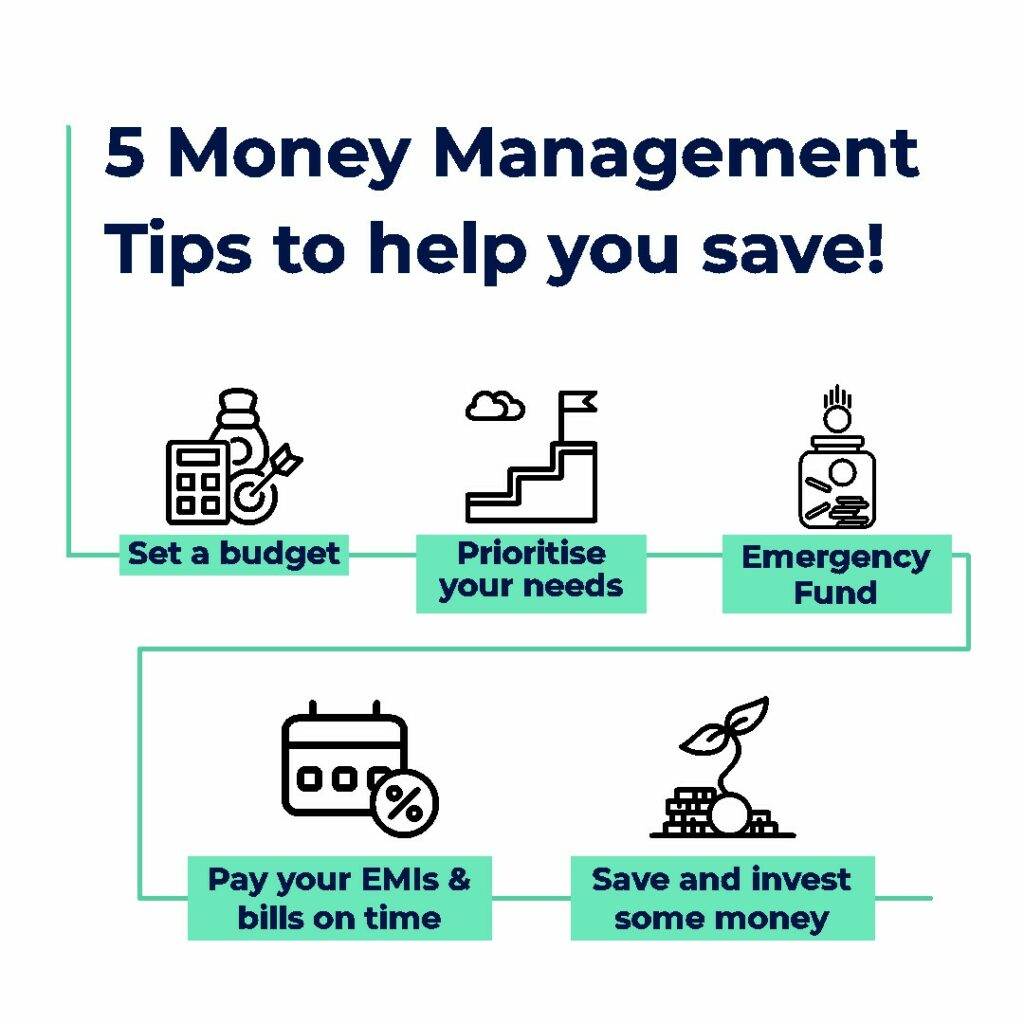

1. Embrace the Power of Budgeting

A budget is the cornerstone of sound financial management. It provides a clear picture of your income and expenses, allowing you to identify areas where you can save and allocate your funds effectively.

Here’s how to create a winning budget:

- Track Your Expenses: For a month, meticulously track every dollar you spend. Utilize a budgeting app, a spreadsheet, or a simple notebook. This will provide a realistic snapshot of your spending habits.

- Categorize Your Expenses: Organize your spending into categories like housing, transportation, food, entertainment, and debt payments. This will reveal where your money is going and highlight areas for potential savings.

- Set Financial Goals: Define your financial objectives, whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund.

- Allocate Your Income: Allocate your income to each category based on your financial goals and priorities. Prioritize essential expenses, such as housing and utilities, and allocate funds to savings and debt repayment.

- Review and Adjust Regularly: Review your budget monthly and make adjustments as needed. Your financial circumstances may change, and your budget should reflect these changes.

2. Conquer Debt with a Strategic Approach

Debt can be a significant financial burden, hindering your ability to save and achieve your goals.

Here’s how to tackle debt effectively:

- Prioritize High-Interest Debt: Focus on paying down debt with the highest interest rates first, such as credit card debt. This will minimize the amount of interest you accrue over time.

- Utilize Debt Consolidation: Consider consolidating high-interest debt into a lower-interest loan. This can streamline your payments and reduce your overall interest burden.

- Implement the Snowball Method: Pay the minimum payment on all your debts, then allocate any extra funds to the debt with the smallest balance. As you pay off each debt, you gain momentum and confidence.

- Negotiate Lower Interest Rates: Contact your creditors and explore the possibility of negotiating lower interest rates. Many lenders are willing to work with borrowers to reduce their interest burden.

3. Build a Robust Emergency Fund

Life is unpredictable, and unexpected expenses can arise at any time. An emergency fund acts as a safety net, providing financial stability during unforeseen circumstances.

Here’s how to build a strong emergency fund:

- Start Small: Begin by setting aside a small amount of money each month, even if it’s just $20 or $50.

- Automate Savings: Set up automatic transfers from your checking account to your savings account. This will ensure consistent contributions to your emergency fund.

- Aim for 3-6 Months of Expenses: Ideally, strive to build an emergency fund equivalent to 3-6 months of your essential living expenses.

- Don’t Touch It (Unless Absolutely Necessary): Your emergency fund is meant to be a safety net, not a discretionary spending account. Resist the temptation to dip into it unless it’s truly an emergency.

4. Harness the Power of Compound Interest

Compound interest is the eighth wonder of the world, and it’s a powerful tool for wealth building. It allows your money to grow exponentially over time, earning interest on both your principal and accumulated interest.

Here’s how to leverage compound interest:

- Invest Early and Often: Start investing as early as possible to give your money more time to grow. Even small, consistent contributions can make a significant difference over the long term.

- Choose High-Growth Investments: Invest in assets that have the potential for significant growth, such as stocks, mutual funds, or real estate.

- Be Patient and Consistent: Compounding takes time, so be patient and consistent with your investment strategy. Avoid making impulsive decisions based on short-term market fluctuations.

5. Embrace the Benefits of Diversification

Diversification is a key principle of investing that involves spreading your investments across different asset classes, sectors, and geographies. This helps mitigate risk and enhance potential returns.

Here’s how to diversify your investment portfolio:

- Allocate Funds to Different Asset Classes: Invest in a mix of stocks, bonds, real estate, and other assets. This will reduce the impact of any single asset’s performance on your overall portfolio.

- Invest in Different Sectors: Spread your investments across different industries, such as technology, healthcare, and consumer goods.

- Consider International Investments: Investing in global markets can provide exposure to different economic growth opportunities and reduce portfolio risk.

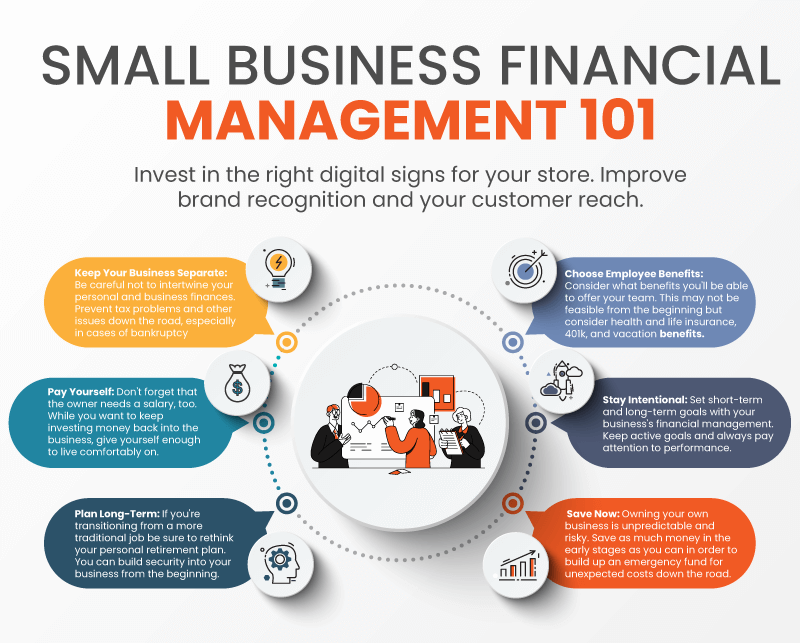

6. Take Advantage of Employer-Sponsored Retirement Plans

Employer-sponsored retirement plans, such as 401(k)s and 403(b)s, offer valuable tax advantages and employer matching contributions.

Here’s how to maximize your retirement savings:

- Contribute the Maximum: Contribute the maximum amount allowed by your employer-sponsored plan to take advantage of the tax benefits and employer matching contributions.

- Choose Wisely: Select investment options that align with your risk tolerance and long-term financial goals.

- Don’t Withdraw Early: Avoid withdrawing funds from your retirement plan before retirement, as this can incur penalties and taxes.

7. Seek Professional Financial Advice

Navigating the complex world of personal finance can be challenging. Seeking professional financial advice can provide valuable guidance and support.

Here’s how to find a qualified financial advisor:

- Seek Recommendations: Ask friends, family, and colleagues for referrals to trusted financial advisors.

- Check Credentials: Ensure the advisor is licensed and has the necessary qualifications.

- Schedule a Consultation: Meet with several advisors to discuss your financial goals and determine if their services align with your needs.

- Consider Fees: Inquire about the advisor’s fees and compensation structure.

Conclusion

Transforming your financial life requires a commitment to sound financial management principles. By embracing budgeting, tackling debt strategically, building an emergency fund, leveraging compound interest, diversifying your investments, maximizing retirement savings, and seeking professional advice, you can gain control over your finances, achieve your financial goals, and build a secure future. Remember, the journey to financial freedom is a marathon, not a sprint. Stay committed, stay focused, and you will achieve your financial aspirations.

Closure

Thus, we hope this article has provided valuable insights into 7 Unstoppable Financial Management Tips to Transform Your Finances. We hope you find this article informative and beneficial. See you in our next article!

google.com