Conquer Your Finances: A 5-Step Budget Blueprint for Ultimate Financial Freedom

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Conquer Your Finances: A 5-Step Budget Blueprint for Ultimate Financial Freedom. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquer Your Finances: A 5-Step Budget Blueprint for Ultimate Financial Freedom

Financial anxiety is a pervasive problem, impacting millions worldwide. Feeling overwhelmed by bills, unsure of where your money goes, or constantly living paycheck to paycheck is not only stressful but also actively hinders your ability to achieve your dreams – whether that’s buying a home, traveling the world, or simply enjoying greater financial security. But the good news is that regaining control of your finances is entirely within your reach. This comprehensive guide provides a five-step blueprint to create a powerful budget that will empower you to conquer your finances and pave the way for a brighter financial future.

Step 1: Track Your Spending – The Foundation of Financial Awareness

Before you can effectively budget, you need to understand where your money is currently going. This crucial first step involves meticulously tracking your spending for at least one month. While some prefer using pen and paper, numerous free and paid apps are available to simplify this process. Mint, Personal Capital, YNAB (You Need A Budget), and EveryDollar are just a few popular options. These tools often categorize your expenses automatically, making analysis easier.

What to track? Every single expense, no matter how small. This includes:

- Fixed Expenses: These are predictable, recurring costs like rent or mortgage payments, loan repayments, insurance premiums, subscriptions (Netflix, Spotify, etc.), and regular utility bills (electricity, water, gas).

- Variable Expenses: These fluctuate from month to month and include groceries, dining out, entertainment, clothing, transportation (gas, public transport), and personal care items.

- Discretionary Spending: This category encompasses non-essential purchases – that latte, that new book, impulse buys online. Understanding this area is vital for identifying areas where you can cut back.

Be honest and thorough. Don’t gloss over small purchases; they add up surprisingly quickly. At the end of the month, review your spending data. Identify the categories where you spend the most money. Are you surprised by any of the numbers? This initial analysis provides the crucial foundation for building an effective budget.

Step 2: Determine Your Income – The Fuel for Your Financial Engine

Next, calculate your total monthly income from all sources. This includes your salary, any side hustles, investments, and other income streams. Be realistic and use your net income (after taxes and deductions) rather than your gross income. This figure represents the total amount of money you have available to allocate each month.

Step 3: Create Your Budget – Allocating Resources Strategically

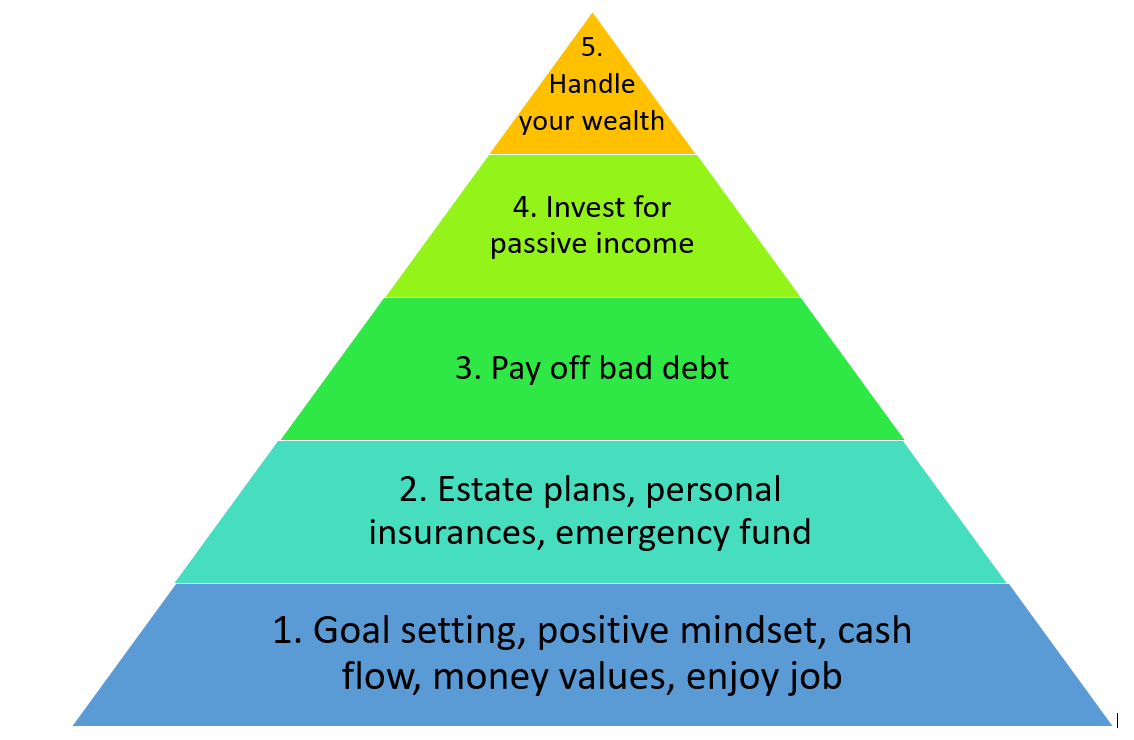

Now comes the core of the process: creating your budget. There are several budgeting methods, and the best one depends on your personal preferences and financial situation. Here are three popular approaches:

- The 50/30/20 Rule: This simple rule suggests allocating 50% of your after-tax income to needs (housing, food, transportation, utilities), 30% to wants (entertainment, dining out, hobbies), and 20% to savings and debt repayment. While a good starting point, it may need adjustments based on your individual circumstances.

- Zero-Based Budgeting: This method involves allocating every dollar of your income to a specific category, ensuring that your income minus expenses equals zero. This approach promotes mindful spending and helps prevent overspending. Software like YNAB is particularly well-suited for zero-based budgeting.

- Envelope System: This classic method involves assigning cash to different categories (groceries, entertainment, etc.) and placing it in separate envelopes. Once the cash in an envelope is gone, that category’s spending is finished for the month. This promotes visual awareness of spending and helps prevent overspending.

Regardless of the method you choose, ensure your budget includes:

- Emergency Fund: Aim for 3-6 months’ worth of living expenses in a readily accessible savings account. This fund provides a crucial safety net for unexpected events like job loss or medical emergencies.

- Debt Repayment: If you have outstanding debts (credit cards, loans), allocate a portion of your income towards repayment. Prioritize high-interest debts to minimize overall interest paid.

- Savings Goals: Define your short-term and long-term savings goals (down payment on a house, retirement, vacation). Allocate funds accordingly.

- Investing: Once you have an emergency fund and are making progress on debt repayment, consider investing a portion of your income for long-term growth.

Step 4: Regularly Review and Adjust Your Budget – Adaptability is Key

A budget is not a static document; it’s a living tool that requires regular review and adjustment. At least once a month, compare your actual spending to your budgeted amounts. Identify any discrepancies and analyze the reasons behind them. Were there unexpected expenses? Did you overspend in a particular category? Use this information to refine your budget for the following month. Life throws curveballs; your budget needs to be flexible enough to adapt to these changes.

Step 5: Celebrate Your Successes and Learn from Setbacks – Maintain Momentum

Budgeting is a journey, not a destination. There will be times when you stick to your budget perfectly, and times when you fall short. Don’t beat yourself up over occasional slip-ups. Instead, learn from your mistakes, adjust your budget accordingly, and keep moving forward. Celebrate your successes, no matter how small. Acknowledge your progress and reinforce positive financial habits. Reward yourself appropriately (within your budget, of course!). The key is consistency and perseverance.

Creating a budget is a powerful step towards achieving financial freedom. It empowers you to take control of your finances, reduce stress, and work towards your financial goals. By diligently following these five steps, you can transform your relationship with money, build a solid financial foundation, and unlock a future filled with financial security and peace of mind. Remember, the journey to financial freedom starts with a single, well-planned budget. Start today and begin conquering your finances!

Closure

Thus, we hope this article has provided valuable insights into Conquer Your Finances: A 5-Step Budget Blueprint for Ultimate Financial Freedom. We appreciate your attention to our article. See you in our next article!

google.com