5 Amazing Personal Finance Apps to Conquer Your Finances

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Amazing Personal Finance Apps to Conquer Your Finances. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Amazing Personal Finance Apps to Conquer Your Finances

Managing personal finances can feel like a daunting task, a never-ending uphill battle against debt and insufficient savings. But what if we told you there’s a powerful arsenal of tools at your fingertips, ready to transform your financial life? This article explores five amazing personal finance apps that can help you conquer your finances, turning that uphill struggle into a confident stride towards financial freedom. These apps offer a range of features, from simple budgeting to sophisticated investment tracking, catering to various needs and experience levels.

1. Mint: The All-in-One Financial Hub

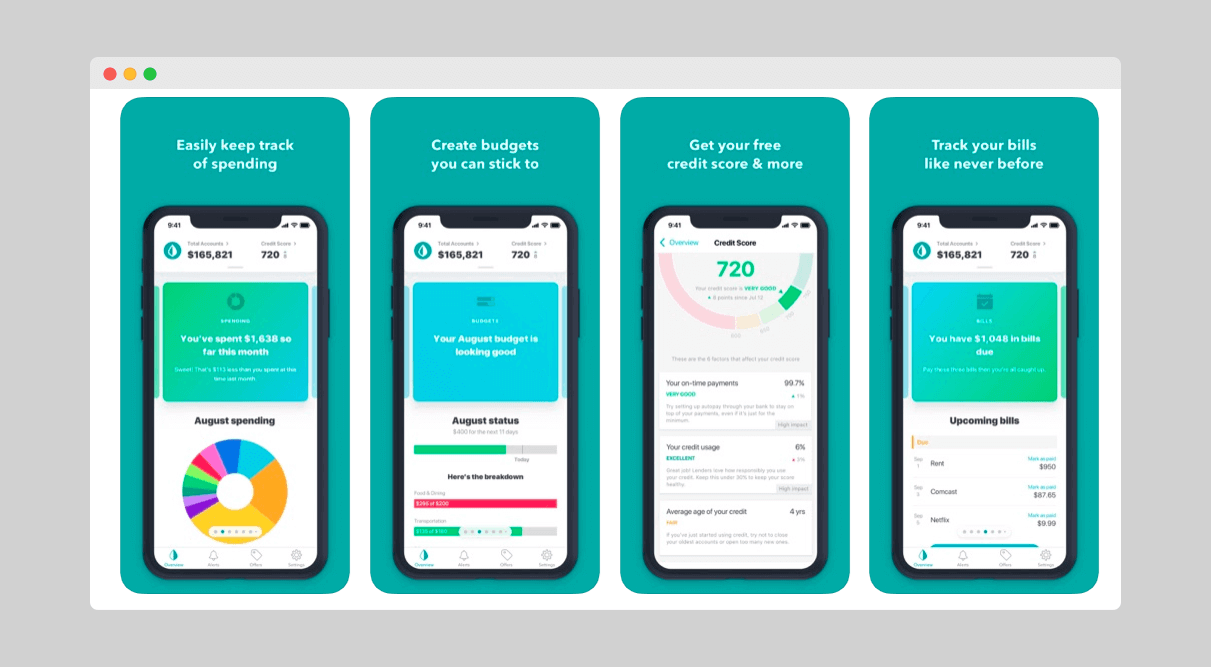

Mint, a product of Intuit (the makers of TurboTax), is a veteran in the personal finance app arena. Its strength lies in its comprehensive approach. It’s a one-stop shop for tracking spending, budgeting, and monitoring your credit score. The app seamlessly connects to your bank accounts, credit cards, and investment accounts, automatically importing transaction data. This eliminates the tedious manual entry often associated with other budgeting apps.

Mint’s budgeting tools are user-friendly and intuitive. You can set budgets for various categories, track your progress visually, and receive alerts when you’re nearing your spending limits. The app also provides insightful visualizations of your spending habits, helping you identify areas where you might be overspending. Beyond budgeting, Mint offers features like bill payment reminders, investment tracking, and a credit score monitor. While the free version offers a robust set of features, a paid version (MintPlus) offers additional perks such as identity theft monitoring and a higher credit score update frequency.

Pros:

- Comprehensive features: Budgeting, spending tracking, bill reminders, investment tracking, credit score monitoring.

- Automatic data import: Eliminates manual data entry.

- User-friendly interface: Easy to navigate and understand.

- Free version available: Offers a substantial amount of functionality without cost.

Cons:

- Data security concerns: As with any app that connects to your financial accounts, there are inherent security risks. While Mint employs robust security measures, it’s crucial to be aware of these potential risks.

- Overwhelming for beginners: The sheer number of features might feel overwhelming to users new to personal finance management.

2. YNAB (You Need A Budget): The Zero-Based Budgeting Champion

YNAB (You Need A Budget) takes a different approach to budgeting, employing the zero-based budgeting method. This method involves allocating every dollar you earn to a specific category, ensuring that your income equals your expenses. This approach promotes mindful spending and helps you prioritize your financial goals.

Unlike Mint’s automated approach, YNAB requires more active participation. You manually categorize your transactions and assign each dollar a purpose. This process, while initially time-consuming, fosters a deeper understanding of your spending habits and encourages responsible financial planning. YNAB offers features like goal setting, debt tracking, and progress visualization, all designed to support its zero-based budgeting philosophy.

Pros:

- Zero-based budgeting method: Promotes mindful spending and financial prioritization.

- Detailed transaction categorization: Encourages a deeper understanding of spending habits.

- Goal-oriented approach: Helps you track progress towards specific financial goals.

- Excellent customer support: Known for its responsive and helpful support team.

Cons:

- Requires manual data entry: Can be time-consuming, especially for users with many transactions.

- Subscription-based model: There’s no free version; a subscription is required to use the app.

- Steeper learning curve: The zero-based budgeting method requires a shift in mindset and may take time to master.

3. Personal Capital: The Investment Tracking Powerhouse

Personal Capital stands out as a powerful tool for those interested in actively managing their investments. While it offers basic budgeting and spending tracking features, its real strength lies in its comprehensive investment tracking capabilities. The app seamlessly connects to your brokerage accounts, providing a consolidated view of your investment portfolio, including asset allocation, performance, and fees.

Personal Capital’s sophisticated investment analysis tools provide valuable insights into your portfolio’s performance and potential risks. It offers features like retirement planning projections, helping you estimate your retirement readiness and make informed decisions about your investments. While the core features are free, Personal Capital also offers financial advisory services for a fee.

Pros:

- Robust investment tracking: Provides a comprehensive overview of your investment portfolio.

- Sophisticated investment analysis: Offers insights into portfolio performance and risk.

- Retirement planning tools: Helps you estimate your retirement readiness.

- Free version available: Offers many valuable features without cost.

Cons:

- Focus on investments: Budgeting and spending tracking features are less comprehensive than other apps.

- Advisory services can be expensive: The fee-based advisory services might not be suitable for everyone.

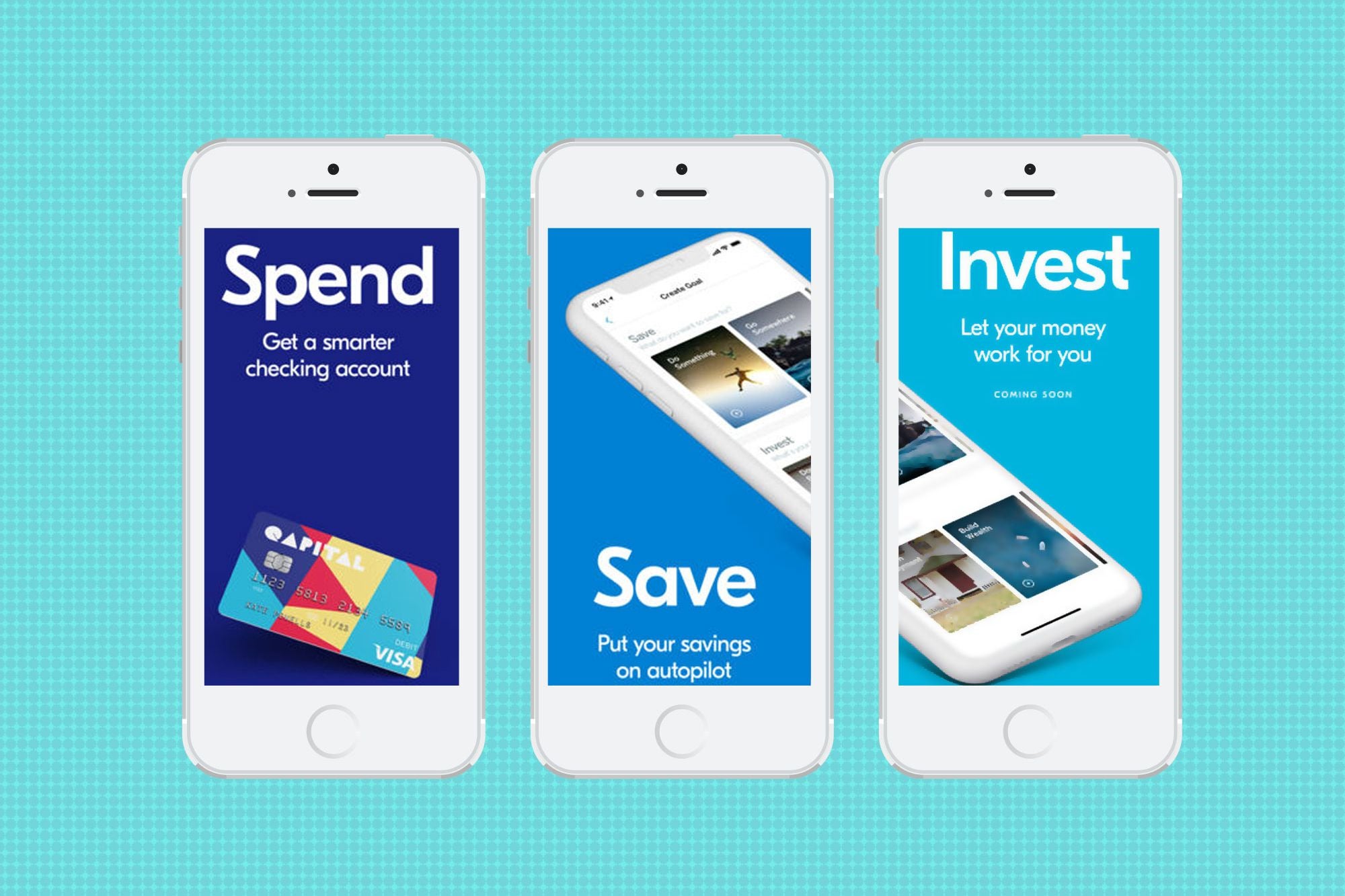

4. EveryDollar: Dave Ramsey’s Budgeting App

EveryDollar, created by Dave Ramsey, aligns with his popular financial principles. It emphasizes debt elimination and building wealth through disciplined saving and budgeting. The app employs a simple envelope budgeting system, where you allocate funds to specific categories, similar to YNAB’s zero-based approach but with a greater emphasis on debt reduction.

EveryDollar’s interface is clean and easy to use, making it accessible to users of all technical skill levels. It offers features like goal tracking, debt payoff calculators, and progress visualizations, all designed to support Ramsey’s financial philosophy.

Pros:

- Simple and user-friendly interface: Easy to learn and use, even for beginners.

- Focus on debt elimination: Prioritizes debt repayment as a key financial goal.

- Aligned with Dave Ramsey’s principles: Appeals to those who follow his financial teachings.

- Affordable subscription: Offers a relatively inexpensive subscription compared to other apps.

Cons:

- Limited features: Doesn’t offer as many features as some other apps, such as investment tracking.

- Rigid budgeting system: The envelope system might not be suitable for everyone’s spending style.

5. Simplifi by Quicken: AI-Powered Financial Management

Simplifi by Quicken leverages artificial intelligence to provide a more personalized and intelligent approach to financial management. The app connects to your financial accounts and uses AI to analyze your spending habits, identify areas for improvement, and offer personalized recommendations.

Simplifi goes beyond basic budgeting, offering features like subscription management, bill negotiation assistance, and insights into your spending patterns. Its AI-powered features make it a powerful tool for those looking for a more automated and intelligent approach to personal finance management.

Pros:

- AI-powered insights: Offers personalized recommendations based on your spending habits.

- Subscription management: Helps you track and manage your recurring subscriptions.

- Bill negotiation assistance: Assists in negotiating lower bills with providers.

- Clean and intuitive interface: Easy to navigate and use.

Cons:

- Subscription-based model: Requires a paid subscription to access all features.

- Reliance on AI: The accuracy of the AI’s recommendations depends on the quality of the data provided.

Choosing the right personal finance app depends on your individual needs and preferences. Consider your financial goals, tech savviness, and preferred budgeting style when making your selection. These five amazing apps offer a diverse range of features, ensuring there’s a perfect fit for everyone looking to take control of their finances and achieve financial freedom. Remember that these apps are tools; consistent effort and financial discipline are crucial for long-term success.

Closure

Thus, we hope this article has provided valuable insights into 5 Amazing Personal Finance Apps to Conquer Your Finances. We hope you find this article informative and beneficial. See you in our next article!

google.com