Conquer the Stock Market: 5 Crucial Steps to Financial Freedom

Introduction

With great pleasure, we will explore the intriguing topic related to Conquer the Stock Market: 5 Crucial Steps to Financial Freedom. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquer the Stock Market: 5 Crucial Steps to Financial Freedom

The stock market. A phrase that evokes a whirlwind of emotions: excitement, fear, greed, and hope. For many, it feels like a mysterious, impenetrable fortress guarded by Wall Street titans and complex algorithms. But the truth is, understanding the basics of the stock market is far more accessible than you might think. This article will break down five crucial steps to help you navigate this powerful tool and potentially achieve significant financial freedom.

Step 1: Grasping the Fundamentals – What is a Stock and Why Does it Matter?

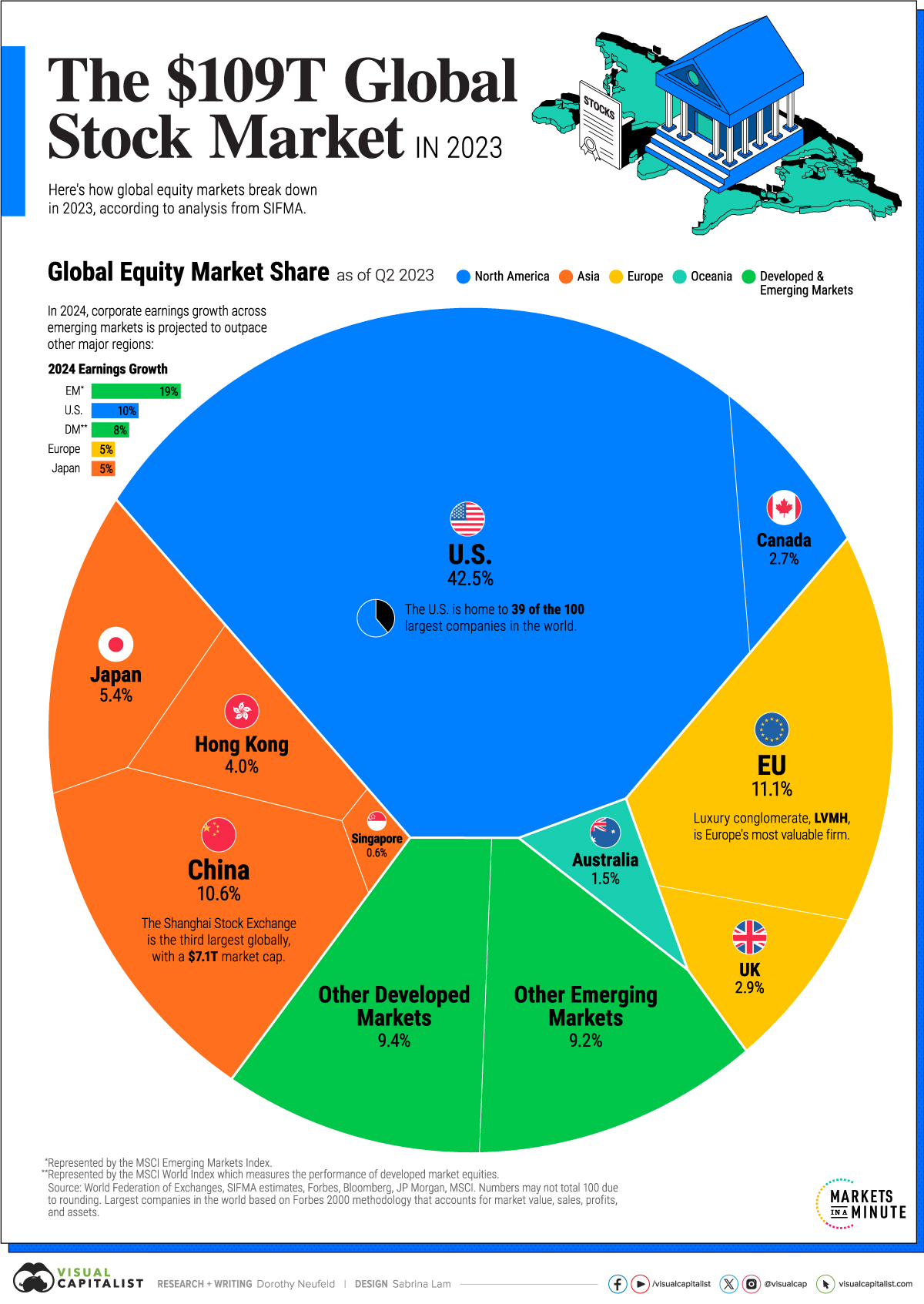

At its core, a stock represents a tiny slice of ownership in a publicly traded company. When you buy a stock, you become a shareholder, entitled to a portion of the company’s profits (through dividends) and a vote in major company decisions (though your individual vote’s impact is usually minimal unless you own a significant percentage). Companies issue stock to raise capital for expansion, research and development, or debt repayment.

The value of a stock fluctuates constantly based on supply and demand. Many factors influence this: company performance (earnings reports, new product launches, etc.), industry trends, economic conditions (interest rates, inflation), and even investor sentiment (overall optimism or pessimism in the market). Understanding these influencing factors is key to making informed investment decisions.

Think of it like buying a piece of a pizza. If the pizza is delicious and popular (a successful company), more people will want a slice, driving up the price. Conversely, if the pizza is bland or the pizzeria is struggling (a failing company), the price of a slice will likely decrease.

Step 2: Types of Investments and Risk Tolerance – Finding Your Comfort Zone

The stock market isn’t a monolithic entity. There are various ways to invest, each carrying different levels of risk and potential reward. Understanding your risk tolerance is paramount.

-

Individual Stocks: Investing directly in individual companies offers the highest potential returns but also carries the highest risk. A single poorly performing stock can significantly impact your portfolio.

-

Mutual Funds: These funds pool money from multiple investors to invest in a diversified portfolio of stocks (and sometimes bonds). This diversification reduces risk compared to investing in individual stocks. Mutual funds are managed by professional fund managers who make investment decisions on behalf of the investors.

Exchange-Traded Funds (ETFs): Similar to mutual funds, ETFs track a specific index (like the S&P 500) or sector. They offer diversification and are generally more cost-effective than mutual funds. ETFs trade like individual stocks throughout the day.

-

Index Funds: These funds aim to mirror the performance of a specific market index, such as the S&P 500. They offer broad diversification and low expense ratios, making them a popular choice for long-term investors.

Your risk tolerance depends on your age, financial goals, and overall comfort level with potential losses. Younger investors with a longer time horizon can generally tolerate more risk, while those closer to retirement may prefer lower-risk investments.

Step 3: Research and Due Diligence – Don’t Jump In Blindly

Before investing in any stock or fund, thorough research is crucial. Don’t rely solely on tips or hearsay. Utilize reputable resources to gather information:

-

Company Financials: Analyze a company’s financial statements (income statement, balance sheet, cash flow statement) to assess its profitability, debt levels, and overall financial health. Understanding key financial ratios (like price-to-earnings ratio or P/E ratio) can provide valuable insights.

-

Industry Analysis: Research the industry in which the company operates. Is the industry growing or declining? What are the major competitive forces?

-

News and Analyst Reports: Stay updated on relevant news and read analyst reports (though remember that analyst opinions can be subjective and biased). Reputable financial news sources can provide valuable insights.

-

Company Management: Assess the quality of the company’s management team. A strong and experienced management team can significantly influence a company’s success.

Remember, no amount of research guarantees success, but it significantly increases your chances of making informed decisions.

Step 4: Developing a Long-Term Investment Strategy – Patience is Key

The stock market is a marathon, not a sprint. Short-term trading can be highly risky and often leads to losses. A long-term investment strategy is crucial for success.

-

Diversification: Don’t put all your eggs in one basket. Diversify your portfolio across different asset classes (stocks, bonds, real estate) and sectors to reduce risk.

-

Dollar-Cost Averaging: Instead of investing a lump sum, invest a fixed amount regularly (e.g., monthly). This strategy helps mitigate the risk of investing at market highs.

-

Rebalancing: Periodically review and rebalance your portfolio to maintain your desired asset allocation. This involves selling some assets that have performed well and buying assets that have underperformed.

-

Emotional Discipline: Avoid making impulsive decisions based on fear or greed. Stick to your investment plan and avoid panic selling during market downturns.

Step 5: Seeking Professional Advice – When to Get Help

While this article provides a foundation for understanding the stock market, it’s not a substitute for professional financial advice. Consider seeking help from a qualified financial advisor, especially if you’re new to investing or have complex financial needs. A financial advisor can help you develop a personalized investment plan tailored to your specific goals and risk tolerance.

Conclusion:

Conquering the stock market requires knowledge, discipline, and patience. By understanding the fundamentals, conducting thorough research, developing a long-term strategy, and seeking professional guidance when needed, you can significantly increase your chances of achieving your financial goals. Remember, investing in the stock market involves risk, and there’s no guarantee of profits. However, with careful planning and a long-term perspective, you can harness the power of the market to build wealth and secure your financial future.

Closure

Thus, we hope this article has provided valuable insights into Conquer the Stock Market: 5 Crucial Steps to Financial Freedom. We hope you find this article informative and beneficial. See you in our next article!

google.com