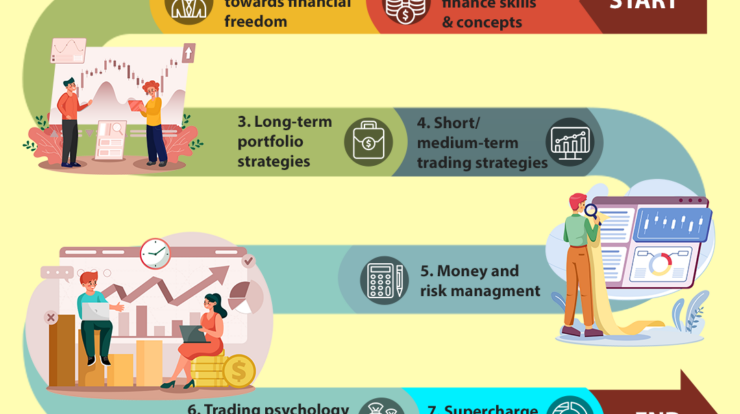

Conquer Your Finances: 7 Powerful Strategies for Financial Freedom

Introduction

With great pleasure, we will explore the intriguing topic related to Conquer Your Finances: 7 Powerful Strategies for Financial Freedom. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquer Your Finances: 7 Powerful Strategies for Financial Freedom

Managing your finances can feel overwhelming, a daunting task that leaves many feeling stressed and anxious. But what if we reframed it? What if instead of viewing it as a chore, we saw it as a powerful tool to unlock a life of freedom and opportunity? This article provides seven powerful strategies to help you conquer your finances and build a secure financial future. Taking control of your money isn’t just about saving; it’s about achieving your dreams and securing your peace of mind.

1. Create a Realistic Budget: The Foundation of Financial Freedom

The cornerstone of successful financial management is a well-defined budget. Forget generic budgeting apps; create a budget that genuinely reflects your lifestyle and spending habits. Start by tracking your expenses for at least a month. Use a spreadsheet, a notebook, or a budgeting app – whatever works best for you. Categorize your spending (housing, transportation, food, entertainment, etc.) to identify areas where you’re overspending.

Be honest with yourself. Don’t underestimate expenses or conveniently forget those impulse buys. Accurate tracking is crucial for creating a realistic budget. Once you have a clear picture of your spending, you can start allocating funds to different categories. The 50/30/20 rule is a popular guideline:

- 50% Needs: Allocate 50% of your after-tax income to essential expenses like housing, utilities, groceries, transportation, and debt payments.

- 30% Wants: This covers discretionary spending – entertainment, dining out, hobbies, etc. This is where you can adjust based on your priorities and financial goals.

- 20% Savings & Debt Repayment: Dedicate 20% to savings (emergency fund, retirement, investments) and debt repayment. Prioritize high-interest debt first.

Remember, your budget is a living document. Review and adjust it regularly (monthly or quarterly) to reflect changes in your income or spending habits. Flexibility is key.

2. Tackle Debt Aggressively: Breaking Free from the Weight of Debt

Debt can be a significant obstacle to financial freedom. High-interest debt, like credit card debt, can quickly spiral out of control. Develop a strategy to tackle your debt effectively. Consider these approaches:

- Debt Snowball Method: Focus on paying off the smallest debt first, regardless of interest rate. The psychological boost of eliminating a debt quickly can motivate you to continue.

- Debt Avalanche Method: Prioritize paying off the debt with the highest interest rate first. This method saves you money on interest in the long run, but it can be less motivating initially.

- Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate. This can simplify payments and potentially save you money on interest.

- Negotiate with Creditors: If you’re struggling to make payments, contact your creditors and explore options like payment plans or reduced interest rates.

3. Build an Emergency Fund: Your Financial Safety Net

An emergency fund is crucial for navigating unexpected expenses, like medical bills, car repairs, or job loss. Aim to save 3-6 months’ worth of living expenses in a readily accessible account (high-yield savings account or money market account). This fund acts as a safety net, preventing you from going into debt during unforeseen circumstances. Don’t underestimate the peace of mind that comes with having a financial cushion.

4. Invest Wisely: Growing Your Wealth for the Future

Once you’ve established an emergency fund and are making progress on your debt, it’s time to start investing. Investing allows your money to grow over time, helping you achieve long-term financial goals like retirement or buying a home. Consider these options:

- Retirement Accounts (401(k), IRA): Take advantage of employer-sponsored retirement plans and individual retirement accounts to maximize tax advantages and long-term growth.

- Stocks and Bonds: Diversify your investments across different asset classes to manage risk. Consider index funds or ETFs for broad market exposure.

- Real Estate: Real estate can be a valuable long-term investment, but it requires significant capital and research.

- Consult a Financial Advisor: If you’re unsure where to start, consider seeking professional advice from a qualified financial advisor.

5. Track Your Net Worth: Monitoring Your Financial Progress

Regularly tracking your net worth (assets minus liabilities) provides a clear picture of your financial progress. This helps you stay motivated and identify areas for improvement. Calculate your net worth at least annually, or more frequently if you’re making significant financial changes.

6. Automate Your Savings and Investments: Setting Yourself Up for Success

Automation is a powerful tool for consistent saving and investing. Set up automatic transfers from your checking account to your savings and investment accounts. This ensures that you save and invest regularly, even if you forget. Even small, consistent contributions can add up significantly over time.

7. Review and Adjust Regularly: Adapting to Life’s Changes

Your financial situation is dynamic; it changes with your income, expenses, and life goals. Regularly review your budget, debt repayment strategy, and investment portfolio to ensure they align with your current circumstances. Be prepared to adapt your strategies as needed. Life throws curveballs; your financial plan should be resilient enough to weather them.

Conclusion:

Conquering your finances is a journey, not a destination. It requires discipline, planning, and consistent effort. By implementing these seven powerful strategies, you can build a solid financial foundation, achieve your financial goals, and ultimately, secure a life of freedom and peace of mind. Remember, small changes can lead to significant results over time. Start today, and watch your financial future transform.

Closure

Thus, we hope this article has provided valuable insights into Conquer Your Finances: 7 Powerful Strategies for Financial Freedom. We appreciate your attention to our article. See you in our next article!

google.com