7 Powerful Strategies for a Radiant Retirement: Securing Your Future with Confidence

Related Articles: 7 Powerful Strategies for a Radiant Retirement: Securing Your Future with Confidence

- Financial projections projection

- The Ultimate Guide To Conquering The Stock Market: 5 Steps To Smart Investing For Beginners

- What is a preferred provider organization (ppo)?

- 10 Unbreakable Tips For Mastering Your Personal Finances: A Beginner’s Guide To Financial Freedom

- Mastering retirement planning

Introduction

With great pleasure, we will explore the intriguing topic related to 7 Powerful Strategies for a Radiant Retirement: Securing Your Future with Confidence. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

7 Powerful Strategies for a Radiant Retirement: Securing Your Future with Confidence

Retirement. It’s a word that evokes a mix of emotions – excitement for newfound freedom, trepidation about financial security, and perhaps even a touch of apprehension about the unknown. While the prospect of leaving the daily grind behind can be alluring, ensuring a comfortable and fulfilling retirement requires careful planning and proactive action.

This article delves into seven powerful strategies that can help you navigate the complexities of retirement planning and build a foundation for a radiant and secure future.

1. Embrace the Power of Early Planning:

The earlier you begin planning for retirement, the more time your money has to grow. The magic of compounding works wonders over the long term, allowing even small contributions to accumulate substantial wealth.

- Start with a Realistic Assessment: Begin by honestly evaluating your current financial situation. This includes identifying your income, expenses, assets, and debts.

- Define Your Retirement Goals: What kind of lifestyle do you envision for retirement? Will you be traveling extensively, pursuing hobbies, or simply enjoying time with loved ones? Defining your goals will help you determine how much you’ll need to save.

- Utilize Online Retirement Calculators: These tools can provide estimates of how much you’ll need to save based on your desired retirement income, time horizon, and assumed investment returns.

2. Maximize Your Retirement Savings Contributions:

Retirement savings accounts, such as 401(k)s and IRAs, offer significant tax advantages and are designed to help you accumulate wealth for retirement.

-

- Contribute the Maximum Allowed: Take advantage of employer matching programs, which essentially provide free money. If your employer offers a 401(k) match, contribute enough to receive the full match.

- Consider a Roth IRA: Roth IRAs allow you to make contributions after taxes, but withdrawals in retirement are tax-free. This can be particularly advantageous if you expect to be in a higher tax bracket in retirement.

- Diversify Your Investments: Don’t put all your retirement eggs in one basket. Diversifying across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk and enhance potential returns.

3. Harness the Power of Budgeting:

A well-structured budget is essential for managing your finances and ensuring you’re saving enough for retirement.

-

- Track Your Spending: Start by tracking your expenses for a few months to identify areas where you can cut back.

- Create a Budget: Allocate your income to essential expenses, such as housing, food, and transportation, and then set aside a portion for savings and debt repayment.

- Use Budgeting Tools: Numerous apps and online tools can help you track your spending, create budgets, and set financial goals.

4. Pay Down High-Interest Debt:

High-interest debt, such as credit card debt, can significantly drain your financial resources and hinder your retirement savings efforts.

- Prioritize Debt Repayment: Focus on paying down high-interest debt as quickly as possible. Consider strategies like the debt snowball or debt avalanche method.

- Consolidate Debt: If you have multiple high-interest debts, consider consolidating them into a lower-interest loan.

- Avoid New Debt: Once you’ve paid down your high-interest debt, avoid accumulating new debt.

5. Embrace the Benefits of Social Security:

Social Security is a crucial source of income for many retirees.

- Understand Your Benefits: Visit the Social Security Administration website to estimate your potential benefits based on your earnings history.

- Delay Your Claim: If you can afford to wait, delaying your Social Security claim beyond your full retirement age (FRA) can significantly increase your monthly benefits.

- Consider Spousal Benefits: If your spouse has a higher earning history, you may be eligible for spousal benefits.

6. Explore Additional Income Streams:

Generating additional income can supplement your retirement savings and provide greater financial security.

- Part-Time Work: Consider taking on a part-time job or freelance work during retirement.

- Rental Income: Invest in rental properties to generate passive income.

- Start a Side Hustle: Turn your hobbies or skills into a side business to earn extra money.

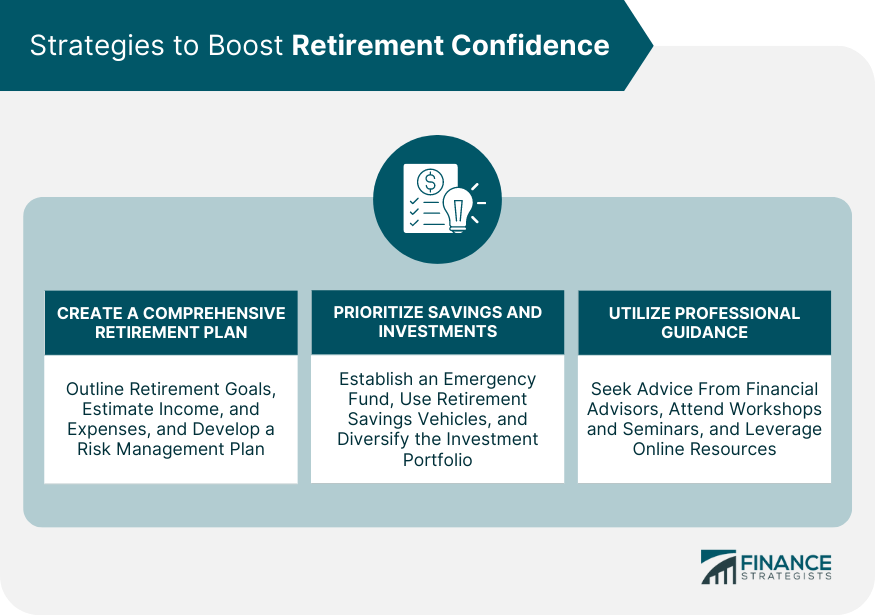

7. Seek Professional Guidance:

Navigating the complexities of retirement planning can be overwhelming. Seeking guidance from a qualified financial advisor can provide invaluable support and insights.

- Find a Certified Financial Planner: Look for a CFP professional who is experienced in retirement planning.

- Discuss Your Goals and Concerns: Clearly communicate your financial goals, risk tolerance, and any concerns you may have.

- Develop a Personalized Plan: A financial advisor can help you create a customized retirement plan that aligns with your individual needs and circumstances.

Retirement Planning: A Journey, Not a Destination

Retirement planning is an ongoing process, not a one-time event. As your circumstances change, you’ll need to adjust your plan accordingly. Regularly review your investments, update your budget, and consider seeking professional advice as needed.

Embracing the Power of Planning

By adopting these seven powerful strategies, you can lay the groundwork for a radiant and secure retirement. Remember, it’s never too early to start planning. The sooner you take action, the more time your money has to grow and the greater your chances of achieving your retirement goals.

Beyond Financial Security

While financial security is essential, retirement is also a time for personal growth, exploration, and fulfillment. Consider how you can invest in your physical and mental well-being, pursue your passions, and connect with loved ones.

A Radiant Future Awaits

Retirement doesn’t have to be a time of uncertainty or fear. With careful planning, proactive action, and a positive mindset, you can create a radiant future that is filled with joy, purpose, and financial security.

Closure

Thus, we hope this article has provided valuable insights into 7 Powerful Strategies for a Radiant Retirement: Securing Your Future with Confidence. We appreciate your attention to our article. See you in our next article!

google.com