The Pros and Cons of Leasing vs Buying a Car

Related Articles: The Pros and Cons of Leasing vs Buying a Car

- Conquer Debt: 5 Powerful Strategies To Achieve Financial Freedom Faster

- 5 Powerful Reasons Why Multiple Income Streams Are A Game-Changer For Financial Freedom

- Master financial engineering epfl

- Unleash Financial Freedom: 7 Powerful Steps To Master Your Monthly Budget

- 5 Powerful Strategies For Effortless Real Estate Investing: A Beginner’s Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Pros and Cons of Leasing vs Buying a Car. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The 5 Crucial Factors That Will Transform Your Car Ownership Decision: Leasing vs. Buying

The decision to lease or buy a car is a significant one, impacting your finances, lifestyle, and transportation needs for years to come. While the allure of a brand-new car every few years may tempt you towards leasing, the long-term benefits of ownership can be equally compelling. This article will delve into the 5 crucial factors that can help you make the right decision for your unique circumstances, revealing the pros and cons of each option and empowering you to make a choice that truly fits your needs.

1. Financial Considerations:

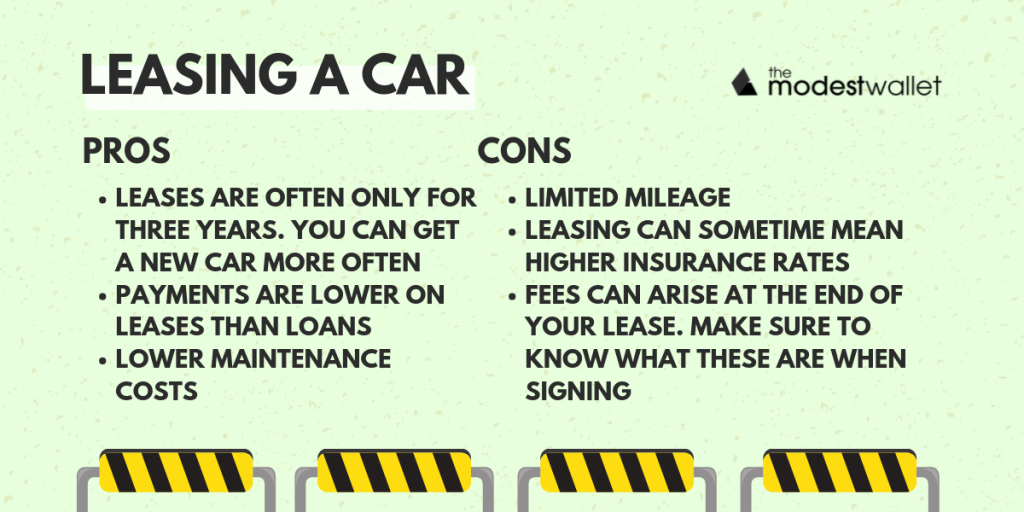

Leasing:

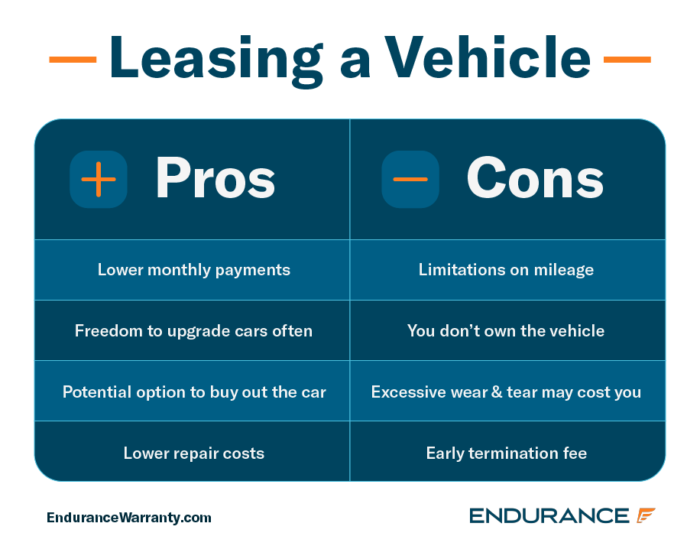

- Lower Monthly Payments: Leasing often involves lower monthly payments compared to financing a purchase, as you’re only paying for the depreciation of the car during the lease term. This can be attractive for individuals with limited budgets or those seeking a more affordable monthly expense.

- No Down Payment Required: Some lease agreements may not require a down payment, further reducing your initial financial burden.

- Potential Tax Advantages: Depending on your profession and usage, leasing can offer tax benefits, especially for businesses and self-employed individuals.

- Predictable Monthly Costs: Leasing provides a fixed monthly payment, making it easier to budget for your transportation expenses.

- Access to Newer Vehicles: Leasing allows you to drive a new car every few years, giving you access to the latest technology and features without the commitment of ownership.

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Cons of Leasing:

-

- Limited Mileage: Leases typically come with a predetermined mileage allowance. Exceeding this limit can result in significant penalties.

- No Ownership Equity: At the end of the lease term, you don’t own the car. You essentially “rent” it for a set period.

- Hidden Fees: Leasing agreements can contain numerous hidden fees, such as disposition fees, wear and tear charges, and excess mileage penalties, which can add to your overall cost.

- Early Termination Penalties: Breaking a lease agreement before the end of the term can result in hefty penalties.

- Potential for Higher Long-Term Costs: While monthly payments may be lower, the cumulative cost of multiple leases over the years can exceed the total cost of purchasing a car.

Buying:

Pros of Buying:

- Ownership Equity: When you buy a car, you build equity as the value depreciates over time. You can eventually sell the car for a profit or trade it in for a newer model.

- No Mileage Restrictions: You can drive your car as much as you want without worrying about mileage penalties.

- Flexibility: You have the freedom to modify, customize, or even sell your car at any time.

- Potential for Long-Term Savings: The total cost of buying a car can be lower than the cost of multiple leases over the years, especially if you keep the car for an extended period.

- Tax Advantages: You can deduct certain expenses associated with owning a car, such as interest on your car loan and property taxes, on your tax return.

Cons of Buying:

- Higher Initial Costs: Purchasing a car requires a significant upfront investment, including the down payment, financing costs, and any associated taxes and fees.

- Depreciation: Cars depreciate in value over time, and you may lose a significant portion of your investment when you sell or trade it in.

- Maintenance and Repair Costs: You are responsible for all maintenance and repair costs, which can add up over time.

- Insurance Costs: Insurance premiums for owned vehicles can be higher than those for leased vehicles.

- Less Frequent Model Upgrades: Buying a car means you’ll be driving the same vehicle for a longer period, potentially missing out on the latest features and technology.

2. Driving Habits and Needs:

- Mileage: If you anticipate driving a significant amount, leasing might not be the best option due to mileage limitations. Buying a car provides greater freedom and flexibility in terms of mileage.

- Vehicle Type: Leasing is often more suitable for popular and readily available models, while buying offers greater flexibility in choosing less common or specialized vehicles.

- Driving Style: If you tend to drive aggressively or frequently encounter harsh conditions, leasing might be riskier due to potential wear and tear charges.

3. Personal Financial Situation:

- Credit Score: A good credit score is essential for securing favorable lease or loan terms.

- Down Payment: Buying a car typically requires a larger down payment than leasing.

- Income and Debt: Your income and existing debt obligations will influence your ability to afford monthly car payments, whether through leasing or financing.

- Long-Term Financial Goals: Consider your long-term financial goals, such as saving for retirement or purchasing a home. Leasing might not be the most financially prudent option if you’re prioritizing saving and investing.

4. Lifestyle and Preferences:

- Desire for a New Car: If you enjoy driving new vehicles and want to upgrade regularly, leasing might be appealing.

- Customization and Modification: Buying a car gives you the freedom to customize and modify it to your liking.

- Sense of Ownership: Some individuals value the sense of ownership that comes with buying a car, allowing them to build equity and enjoy the long-term benefits of their investment.

5. Environmental Considerations:

- Fuel Efficiency: Leasing can sometimes provide access to more fuel-efficient vehicles, reducing your environmental footprint.

- Vehicle Lifespan: Buying a car allows you to keep it for a longer period, reducing the number of new cars produced and contributing to a more sustainable approach to transportation.

Conclusion:

The decision to lease or buy a car is highly personal and depends on your individual circumstances, preferences, and financial situation. By carefully analyzing the pros and cons of each option and considering the 5 crucial factors outlined in this article, you can make an informed decision that aligns with your needs and goals.

Ultimately, the best choice for you will depend on your priorities:

- If you value affordability, flexibility, and access to the latest technology, leasing might be the better option.

- If you prioritize long-term savings, ownership equity, and the freedom to customize and modify your vehicle, buying may be the more suitable choice.

Remember to research thoroughly, compare options, and consult with a financial advisor to make the most informed decision for your unique situation. By weighing the benefits and drawbacks of leasing vs. buying, you can confidently navigate this important car ownership decision and achieve a solution that provides you with the best possible transportation experience.

Closure

Thus, we hope this article has provided valuable insights into The Pros and Cons of Leasing vs Buying a Car. We thank you for taking the time to read this article. See you in our next article!

google.com