5 Powerful Reasons Why Automatic Savings Plans Are A Game-Changer for Your Financial Future

Related Articles: 5 Powerful Reasons Why Automatic Savings Plans Are A Game-Changer for Your Financial Future

- Continuous Demand Finance Careers from now to 100 years into the future

- 5 Powerful Reasons Why Multiple Income Streams Are A Game-Changer For Financial Freedom

- Finance financial company financials traditional training capital venture business approach modern management non stock funds blocks reasons properly deal money

- 7 Powerful Strategies For A Radiant Retirement: Securing Your Future With Confidence

- Conquer Debt: 5 Powerful Strategies To Achieve Financial Freedom Faster

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Powerful Reasons Why Automatic Savings Plans Are A Game-Changer for Your Financial Future. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Powerful Reasons Why Automatic Savings Plans Are A Game-Changer for Your Financial Future

Saving money can feel like an uphill battle. Between bills, unexpected expenses, and the allure of instant gratification, it’s easy to let your savings goals fall by the wayside. But what if there was a way to make saving effortless, even enjoyable? That’s where automatic savings plans come in.

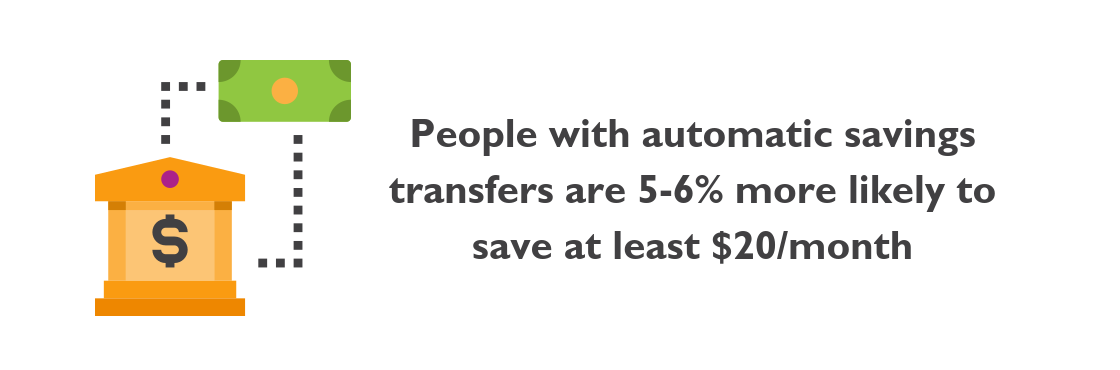

Automatic savings plans, also known as recurring transfers or scheduled savings, are a powerful tool for building wealth. They take the guesswork out of saving by automatically transferring a set amount of money from your checking account to your savings account on a regular basis. This simple act can have a profound impact on your financial well-being, unlocking a world of benefits that will set you on a path towards financial freedom.

1. The Power of Habit: Building a Consistent Savings Routine

The human brain loves routines. We thrive on predictability, and when it comes to our finances, consistency is key. Automatic savings plans tap into this inherent love of routine, making saving a non-negotiable part of your financial life.

Imagine this: you set up an automatic transfer of $100 from your checking account to your savings account every week. It happens without you even thinking about it, becoming as routine as brushing your teeth or making your morning coffee. This effortless consistency builds momentum, allowing you to steadily accumulate wealth without having to actively think about it.

Why This Matters:

-

- Eliminates procrastination: We all know the feeling of putting off saving for “later.” Automatic savings plans eliminate this procrastination trap by taking control and making saving a non-optional part of your monthly budget.

- Creates a sense of accomplishment: Seeing your savings grow consistently, even if it’s just a small amount each week, can be incredibly motivating. It reinforces the positive habit of saving and fuels your desire to continue building wealth.

- Avoids the temptation to spend: When you have to actively transfer money from your checking account to your savings, you’re more likely to be tempted to spend it on something else. Automatic transfers remove this temptation, ensuring that your savings goals remain top of mind.

2. The Magic of Compounding: Letting Time Work for You

One of the most powerful forces in finance is compounding. It’s the snowball effect of earning interest on your interest, allowing your savings to grow exponentially over time. Automatic savings plans are the perfect vehicle to harness the power of compounding.

Think of it this way: you start saving $100 per month, and your savings account earns a modest 2% interest. Over time, the interest you earn starts to generate its own interest, creating a snowball effect that grows your savings faster than you might expect.

Why This Matters:

- Maximizes your returns: Compounding allows your savings to grow exponentially, making even small contributions work harder for you.

- Reduces the impact of inflation: Inflation erodes the purchasing power of your money over time. Compounding helps offset the effects of inflation, ensuring that your savings maintain their value.

- Creates a sense of financial security: As your savings grow, you’ll feel more secure about your financial future. This sense of security can lead to less stress and a greater sense of peace of mind.

3. The Power of Automation: Saving Time and Effort

Saving money often feels like a chore. It requires time, effort, and a conscious decision to prioritize saving over spending. Automatic savings plans take all the effort out of saving, freeing up your time and energy to focus on other aspects of your life.

Think about it: instead of manually transferring money to your savings account every month, you simply set it up once and forget about it. The system takes care of everything, allowing you to focus on your career, your family, or your hobbies.

Why This Matters:

- Reduces cognitive load: Our brains are constantly bombarded with information and decisions. Automatic savings plans reduce the cognitive load by taking the decision-making out of the equation.

- Promotes financial discipline: By automating your savings, you’re building financial discipline without having to actively think about it. This can lead to better financial habits overall.

- Frees up time and energy: Time is a precious commodity. Automatic savings plans allow you to reclaim your time and energy, focusing on things that are important to you.

4. The Benefits of Goal-Oriented Saving: Achieving Your Dreams

Automatic savings plans are incredibly effective for reaching specific financial goals, whether it’s a down payment on a house, a dream vacation, or a comfortable retirement.

By setting up a recurring transfer specifically for your goal, you can watch your progress unfold in real-time. This visual representation of your progress can be incredibly motivating, keeping you focused on your financial goals and driving you to achieve them.

Why This Matters:

- Keeps you on track: Automatic savings plans help you stay on track with your financial goals by ensuring that you’re consistently saving towards them.

- Increases motivation: Seeing your savings grow towards a specific goal can be incredibly motivating, making you more likely to stick with your savings plan.

- Provides a sense of control: Automatic savings plans give you a sense of control over your finances, knowing that you’re actively working towards your goals.

5. The Flexibility of Automatic Savings: Adapting to Your Needs

Automatic savings plans are incredibly flexible, allowing you to adjust your contributions and frequency to fit your changing financial circumstances.

You can easily increase or decrease your contributions as your income changes, or you can adjust the frequency of your transfers based on your needs. This flexibility ensures that your savings plan remains relevant and effective throughout your life.

Why This Matters:

- Adapts to life’s changes: Life is full of unexpected twists and turns. Automatic savings plans allow you to adjust your savings plan to accommodate these changes.

- Provides peace of mind: Knowing that you have a flexible savings plan in place can provide peace of mind, knowing that you’re prepared for whatever life throws your way.

- Encourages financial growth: As your financial situation improves, you can increase your savings contributions to accelerate your wealth-building journey.

Conclusion: Embracing the Power of Automatic Savings

Automatic savings plans are a powerful tool for building wealth and achieving your financial goals. They take the effort out of saving, make it effortless to build consistent savings habits, and help you maximize the power of compounding.

By embracing the power of automatic savings, you can take control of your financial future, creating a path towards financial freedom and security. The benefits are undeniable, making automatic savings plans a game-changer for anyone looking to achieve their financial dreams.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Reasons Why Automatic Savings Plans Are A Game-Changer for Your Financial Future. We hope you find this article informative and beneficial. See you in our next article!

google.com