7 Deadly Investment Mistakes to Avoid for a Thriving Portfolio

Related Articles: 7 Deadly Investment Mistakes to Avoid for a Thriving Portfolio

- Finance financial company financials traditional training capital venture business approach modern management non stock funds blocks reasons properly deal money

- Non profit organization development plan Non profit financial plan template

- Master financial engineering epfl

- Unleash Your Inner Entrepreneur: 5 Powerful Steps To Launching A Thriving Side Hustle

- 5 Powerful Budgeting Tips To Conquer Student Debt And Achieve Financial Freedom

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 7 Deadly Investment Mistakes to Avoid for a Thriving Portfolio. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

7 Deadly Investment Mistakes to Avoid for a Thriving Portfolio

Investing is a journey, not a destination. It’s a long-term game that requires patience, discipline, and a strategic approach. However, even the most seasoned investors can fall prey to common pitfalls that can derail their financial goals.

These mistakes often stem from emotional impulses, a lack of understanding, or simply not having the right information. The good news is, by understanding these pitfalls and taking proactive steps to avoid them, you can significantly increase your chances of achieving financial success.

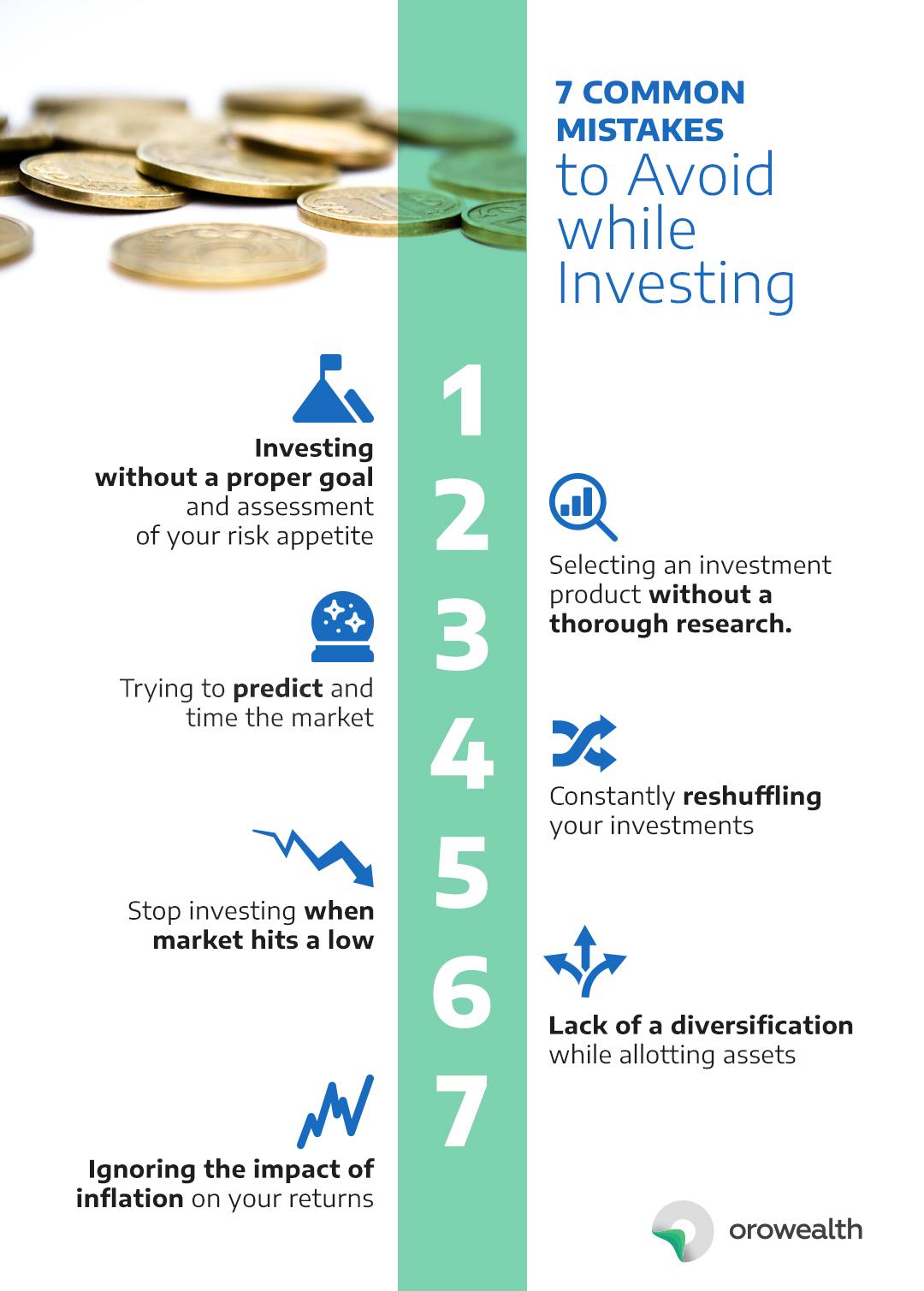

This article will delve into 7 common investment mistakes that can seriously impact your portfolio’s performance. We’ll explore the reasons behind these mistakes, their potential consequences, and most importantly, provide actionable strategies to help you steer clear of them.

1. Failing to Diversify:

Diversification is the cornerstone of any sound investment strategy. It involves spreading your investments across different asset classes, sectors, and geographies. This reduces your overall risk by mitigating the impact of any single investment’s underperformance.

Why it’s a mistake:

-

- Concentration risk: Putting all your eggs in one basket, or focusing on a single sector or asset class, exposes you to significant losses if that particular investment performs poorly.

- Market volatility: Diversification helps cushion the blow of market fluctuations. When one asset class is down, another might be up, balancing out your overall portfolio performance.

- Lack of opportunity: Limiting your investment scope can prevent you from capitalizing on potential growth in other sectors or asset classes.

How to avoid it:

-

- Understand different asset classes: Explore options like stocks, bonds, real estate, commodities, and alternative investments.

- Create a balanced portfolio: Allocate your investments across different asset classes based on your risk tolerance and financial goals.

![]()

- Regularly rebalance: As your portfolio grows and market conditions change, adjust your allocations to maintain the desired balance.

2. Chasing Returns:

The allure of high returns can be tempting, especially during market rallies. However, chasing after the “hottest” investment without proper due diligence can lead to significant losses.

Why it’s a mistake:

- Short-term focus: Chasing returns often leads to short-term investment decisions based on hype rather than fundamental analysis.

- Overvaluation: High-flying investments often become overvalued, leading to a potential crash when reality sets in.

- Ignoring risk: The pursuit of high returns can overshadow the inherent risks associated with certain investments.

How to avoid it:

- Focus on long-term goals: Invest for the long haul and avoid chasing short-term gains.

- Conduct thorough research: Understand the fundamentals of any investment before putting your money in.

- Consider your risk tolerance: Don’t invest in assets that make you uncomfortable or exceed your risk appetite.

3. Emotional Investing:

Emotions like fear, greed, and excitement can cloud your judgment and lead to irrational investment decisions. This is known as emotional investing, and it can be detrimental to your portfolio’s long-term performance.

Why it’s a mistake:

- Selling low, buying high: Fear can lead to selling investments during market downturns, while greed can encourage buying at inflated prices.

- Panic-driven decisions: Emotional reactions to market volatility can lead to rash decisions that can erode your portfolio value.

- Ignoring market signals: Emotional bias can prevent you from recognizing and acting on market trends.

How to avoid it:

- Develop an investment plan: Having a clear plan and sticking to it can help you stay disciplined and avoid impulsive actions.

- Focus on the long-term: Don’t let short-term market fluctuations affect your long-term investment strategy.

- Seek professional advice: Consulting a financial advisor can provide objective guidance and help you make rational decisions.

4. Ignoring Fees and Expenses:

Investment fees and expenses might seem insignificant at first, but they can accumulate over time and significantly impact your returns.

Why it’s a mistake:

- Hidden costs: Fees can be hidden in various forms, such as management fees, transaction costs, and fund expenses.

- Compounding effect: Even small fees can compound over time, eroding your investment gains.

- Reduced returns: High fees can eat into your profits, leaving you with less money to reinvest and grow your wealth.

How to avoid it:

- Compare fees and expenses: Carefully evaluate different investment options and compare their fees before making a decision.

- Choose low-cost funds: Opt for index funds or exchange-traded funds (ETFs) that typically have lower expense ratios.

- Negotiate fees: If you’re working with a financial advisor, negotiate their fees to ensure they are reasonable.

5. Lack of Financial Literacy:

A lack of financial knowledge can make it difficult to make informed investment decisions. Understanding basic investment concepts, market dynamics, and risk management is crucial for success.

Why it’s a mistake:

- Misinformed decisions: Without proper knowledge, you might invest in unsuitable assets or make decisions based on misinformation.

- Inability to assess risk: Lack of financial literacy can hinder your ability to understand and manage the risks associated with your investments.

- Limited investment opportunities: A lack of knowledge can prevent you from exploring different investment options and maximizing your potential returns.

How to avoid it:

- Educate yourself: Read books, articles, and online resources to learn about investing basics, different asset classes, and market analysis.

- Attend workshops and seminars: Participate in financial education programs to gain practical knowledge and insights.

- Seek professional guidance: Consult with a financial advisor who can provide tailored advice and help you navigate the complexities of investing.

6. Not Rebalancing Regularly:

As your portfolio grows and market conditions change, it’s essential to rebalance your investments to maintain your desired asset allocation.

Why it’s a mistake:

- Drifting allocations: Over time, your portfolio’s asset allocation can drift away from your original plan due to market fluctuations.

- Increased risk: Unbalanced portfolios can become overly concentrated in specific assets, increasing your risk exposure.

- Missed opportunities: Rebalancing allows you to sell overperforming assets and invest in underperforming ones, capturing potential growth opportunities.

How to avoid it:

- Set a rebalancing schedule: Determine a regular frequency for rebalancing, such as annually or semi-annually.

- Monitor your portfolio: Keep track of your investments and their performance to identify any significant shifts in allocation.

- Adjust your investments: Buy or sell assets as needed to restore your desired asset allocation.

7. Failing to Review and Adjust Your Plan:

Your investment strategy shouldn’t be set in stone. As your financial goals, risk tolerance, and life circumstances change, so should your investment plan.

Why it’s a mistake:

- Stale strategies: A stagnant investment plan can become outdated and no longer align with your current needs and goals.

- Missed opportunities: Failing to review and adjust your plan can prevent you from capitalizing on new investment opportunities.

- Unnecessary risk: A plan that hasn’t been updated might expose you to unnecessary risks or fail to adequately protect your investments.

How to avoid it:

- Review your plan annually: Regularly assess your investment plan and make adjustments based on your current situation.

- Re-evaluate your goals: Consider your long-term financial goals, risk tolerance, and time horizon.

- Seek professional advice: Consult with a financial advisor to ensure your plan remains relevant and aligned with your evolving needs.

Conclusion:

Investing is a journey that requires constant learning, adaptation, and discipline. By understanding and avoiding these common investment mistakes, you can set yourself on a path to achieve your financial goals and build a thriving portfolio. Remember, patience, consistency, and a long-term perspective are essential for success in the investment world. Don’t let these deadly mistakes derail your financial future.

Closure

Thus, we hope this article has provided valuable insights into 7 Deadly Investment Mistakes to Avoid for a Thriving Portfolio. We appreciate your attention to our article. See you in our next article!

google.com