Unstoppable Growth: 5 Powerful Investment Strategies for Long-Term Wealth

Related Articles: Unstoppable Growth: 5 Powerful Investment Strategies for Long-Term Wealth

- Budgeting Tips For The Future

- 7 Deadly Investment Mistakes To Avoid For A Thriving Portfolio

- Continuous Demand Finance Careers from now to 100 years into the future

- 10 Unbreakable Tips For Mastering Your Personal Finances: A Beginner’s Guide To Financial Freedom

- Master Your Finances: A 5-Step Guide To Creating A Powerful Family Budget

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unstoppable Growth: 5 Powerful Investment Strategies for Long-Term Wealth. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unstoppable Growth: 5 Powerful Investment Strategies for Long-Term Wealth

The pursuit of financial freedom and long-term wealth is a journey that requires a strategic approach. While the allure of quick riches might be tempting, sustainable wealth creation demands a disciplined and patient mindset. This article explores five powerful investment strategies that can propel your portfolio towards unstoppable growth, enabling you to achieve your financial goals and secure a prosperous future.

1. Embrace the Power of Diversification:

Diversification is the cornerstone of any sound investment strategy. It involves spreading your investment capital across various asset classes, industries, and geographic locations. This approach mitigates risk by reducing the impact of any single investment’s performance on your overall portfolio.

A. Asset Allocation:

The first step in diversification is asset allocation. This involves determining the percentage of your portfolio dedicated to different asset classes such as stocks, bonds, real estate, commodities, and cash. The ideal allocation depends on factors like your risk tolerance, investment horizon, and financial goals.

-

- Stocks: Stocks represent ownership in companies and offer the potential for high growth but also carry higher risk.

- Bonds: Bonds are debt securities issued by companies or governments. They offer lower risk and potential returns compared to stocks.

- Real Estate: Real estate can provide income through rent and appreciation in value, but it also involves significant upfront costs and illiquidity.

- Commodities: Commodities are raw materials like oil, gold, and agricultural products. They can serve as an inflation hedge but are subject to price fluctuations.

- Cash: Cash provides liquidity and stability, but its returns are often limited by inflation.

B. Sector Diversification:

Within each asset class, it’s essential to diversify across different sectors. For example, within the stock market, you can invest in sectors like technology, healthcare, energy, and consumer staples. This helps to mitigate the risk associated with specific industries.

C. Geographic Diversification:

Global diversification is crucial to mitigate the impact of economic downturns in specific regions. Investing in companies and assets located in different countries can help to reduce overall portfolio volatility.

2. Harness the Growth Potential of Index Funds:

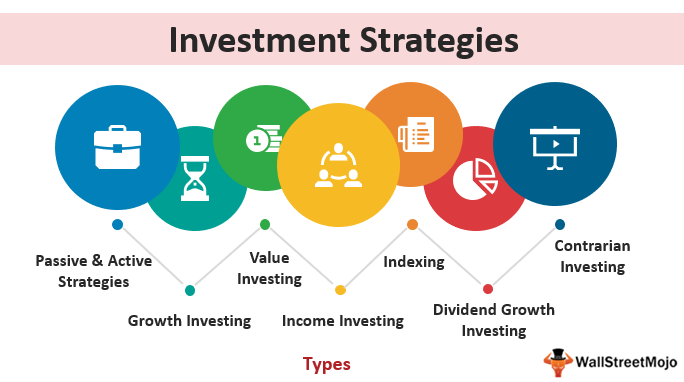

Index funds are a powerful tool for long-term growth. They track a specific market index, such as the S&P 500, and aim to mirror its performance. This passive investment approach offers several advantages:

A. Low Costs: Index funds have low expense ratios, which are annual fees charged by fund managers. These lower costs translate into higher returns for investors.

B. Diversification: Index funds automatically diversify your portfolio across a wide range of companies, providing broad market exposure.

C. Simplicity: Index funds are easy to understand and manage, making them suitable for both experienced and novice investors.

D. Long-Term Performance: Historical data consistently shows that index funds have outperformed actively managed funds over the long term.

3. Embrace the Power of Value Investing:

Value investing, championed by renowned investors like Warren Buffett, focuses on identifying undervalued companies with strong fundamentals. This approach involves:

A. Fundamental Analysis: Value investors meticulously analyze a company’s financial statements, industry trends, and competitive landscape to identify undervalued assets.

B. Margin of Safety: Value investors seek to purchase stocks at a significant discount to their intrinsic value, creating a margin of safety against potential losses.

C. Long-Term Perspective: Value investing is a patient approach that emphasizes long-term growth and avoids short-term market fluctuations.

D. Focus on Intrinsic Value: Value investors prioritize a company’s underlying worth, rather than its current market price.

4. Leverage the Growth Potential of Emerging Markets:

Emerging markets, such as China, India, and Brazil, offer significant growth potential due to their rapid economic development and expanding middle classes. Investing in emerging markets can provide:

A. Higher Growth Potential: Emerging markets often experience faster economic growth compared to developed economies, leading to higher potential returns for investors.

B. Diversification Benefits: Emerging markets offer diversification benefits by reducing portfolio correlation with developed market investments.

C. Long-Term Opportunities: Emerging markets represent a long-term growth story, with increasing consumer spending and infrastructure development driving economic expansion.

D. Access to Innovative Companies: Emerging markets are home to innovative companies that are disrupting industries and creating new growth opportunities.

5. Embrace the Power of Dollar-Cost Averaging:

Dollar-cost averaging is a systematic investment strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach helps to:

A. Reduce Market Volatility: Dollar-cost averaging smooths out market fluctuations by buying more shares when prices are low and fewer shares when prices are high.

B. Discipline and Consistency: By investing regularly, you develop a disciplined approach and avoid emotional investment decisions.

C. Reduce Timing Risk: Dollar-cost averaging eliminates the need to predict market peaks and troughs, reducing the risk of buying high and selling low.

D. Long-Term Perspective: Dollar-cost averaging encourages a long-term investment mindset, as it focuses on consistent investment rather than short-term market gains.

Conclusion:

The journey towards financial freedom and long-term wealth requires a strategic approach. The five investment strategies outlined in this article provide a powerful framework for building a robust and resilient portfolio. By embracing diversification, harnessing the growth potential of index funds, employing value investing principles, leveraging emerging markets, and implementing dollar-cost averaging, you can pave the way for unstoppable growth and achieve your financial goals.

Remember: Investing involves inherent risk, and past performance is not indicative of future results. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Unstoppable Growth: 5 Powerful Investment Strategies for Long-Term Wealth. We hope you find this article informative and beneficial. See you in our next article!

google.com