The Crucial Importance of Strong Financial Accountability: A 5-Step Framework for Success

Related Articles: The Crucial Importance of Strong Financial Accountability: A 5-Step Framework for Success

- 5 Powerful Financial Tools And Apps That Can Transform Your Finances

- 5 Powerful Reasons Why Automatic Savings Plans Are A Game-Changer For Your Financial Future

- Continuous Demand Finance Careers from now to 100 years into the future

- Unlocking Your Financial Power: 5 Proven Strategies To Boost Your Financial IQ

- Holiday shopping archives

Introduction

With great pleasure, we will explore the intriguing topic related to The Crucial Importance of Strong Financial Accountability: A 5-Step Framework for Success. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Crucial Importance of Strong Financial Accountability: A 5-Step Framework for Success

The world of finance is complex and often shrouded in mystery. For many, the mere mention of budgets, investments, and debt can trigger anxiety and a sense of overwhelm. Yet, navigating this landscape effectively is not only crucial for individuals but also for businesses, organizations, and even entire nations. This is where the concept of financial accountability comes into play, acting as a guiding light in the often turbulent waters of financial management.

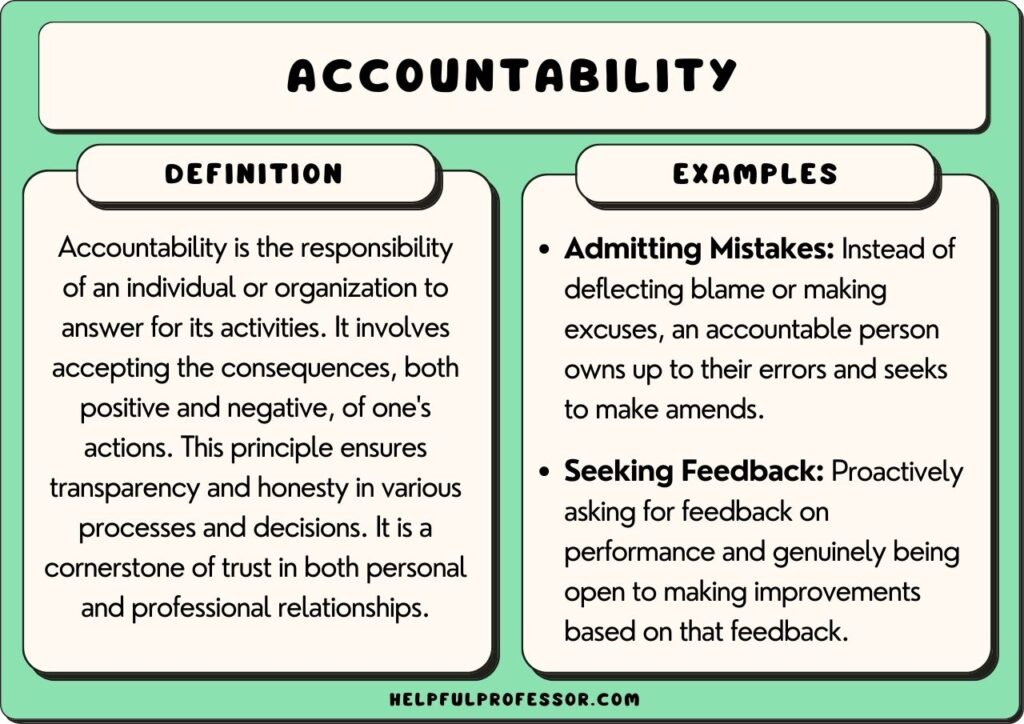

Financial accountability, in its simplest form, is the practice of taking responsibility for one’s financial decisions and actions. It’s about being transparent and honest with yourself and others about your financial situation, and about being proactive in managing your money to achieve your goals. While this might seem straightforward, the reality is that achieving strong financial accountability requires a concerted effort, a clear understanding of the principles involved, and a commitment to adopting a structured approach.

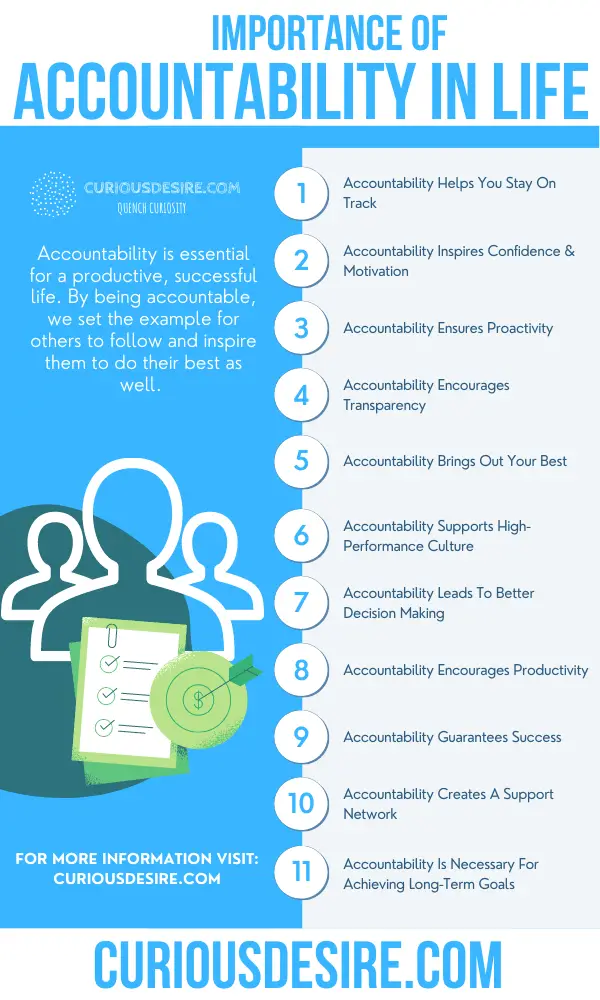

Why is Financial Accountability So Important?

The importance of financial accountability cannot be overstated. It serves as the bedrock for financial stability, growth, and ultimately, achieving financial freedom. Here are just a few reasons why it’s essential:

-

- Reduced Financial Stress: Lack of financial accountability often leads to feelings of anxiety, worry, and stress. Knowing where your money is going, understanding your financial obligations, and having a plan in place to manage your finances can significantly reduce these negative emotions.

- Improved Financial Well-being: Financial accountability empowers you to make informed decisions about your money. This leads to better financial health, allowing you to meet your financial obligations, save for the future, and achieve your financial goals.

- Increased Transparency and Trust: Financial accountability fosters transparency and trust, both within individuals and within organizations. It ensures that financial resources are used responsibly and ethically, building confidence and credibility.

- Enhanced Decision-Making: When you’re financially accountable, you’re equipped with the information and understanding necessary to make sound financial decisions. This can range from choosing the right investments to negotiating better terms for loans and credit cards.

- Improved Financial Performance: For businesses and organizations, financial accountability is essential for achieving profitability and sustainability. It enables them to track their financial performance, identify areas for improvement, and make informed decisions about resource allocation.

The 5-Step Framework for Achieving Strong Financial Accountability

While the concept of financial accountability may seem daunting at first, it’s a skill that can be learned and honed over time. Here’s a 5-step framework to guide you on your journey towards stronger financial accountability:

1. Track Your Spending: The first step to gaining control of your finances is to understand where your money is going. This involves keeping track of all your income and expenses, whether it’s through a simple spreadsheet, a dedicated budgeting app, or a traditional budgeting method.

* **Tips for Effective Spending Tracking:** * **Choose a method that works for you:** There are numerous tools available, so find one that suits your preferences and lifestyle.

* **Be consistent:** Make tracking your spending a habit, ideally done daily or at least weekly.

* **Categorize your expenses:** This will help you identify areas where you might be overspending and make adjustments accordingly.

* **Don't be afraid to track small expenses:** Even seemingly insignificant purchases can add up over time.

* **Choose a method that works for you:** There are numerous tools available, so find one that suits your preferences and lifestyle.

* **Be consistent:** Make tracking your spending a habit, ideally done daily or at least weekly.

* **Categorize your expenses:** This will help you identify areas where you might be overspending and make adjustments accordingly.

* **Don't be afraid to track small expenses:** Even seemingly insignificant purchases can add up over time.2. Create a Budget: Once you have a clear picture of your spending habits, it’s time to create a budget. This is a plan that outlines how you’ll allocate your income to cover your essential expenses, save for your goals, and manage any debt you may have.

* **Tips for Effective Budgeting:**

* **Set realistic goals:** Don't aim for perfection right away; start with small, achievable goals.

* **Prioritize your needs:** Make sure you're allocating enough money to cover essential expenses like rent, utilities, and groceries.

* **Be flexible:** Life happens, so be prepared to adjust your budget as needed.

* **Review your budget regularly:** It's essential to review your budget at least once a month to ensure it's still working for you.3. Manage Your Debt: Debt can be a significant burden on your financial well-being. Managing your debt effectively is crucial for achieving financial accountability.

* **Tips for Effective Debt Management:**

* **Create a debt repayment plan:** Prioritize your debts based on interest rates and create a plan to pay them off as quickly as possible.

* **Consider debt consolidation:** This can help you lower your interest rates and make debt repayment more manageable.

* **Avoid taking on new debt:** It's important to resist the temptation to accumulate more debt while you're working on paying off existing debt.4. Save for the Future: Financial accountability is not just about managing your current expenses; it’s also about planning for the future. This includes saving for retirement, emergencies, and other long-term goals.

* **Tips for Effective Saving:**

* **Set specific savings goals:** Having clear goals will motivate you to save more consistently.

* **Automate your savings:** Set up automatic transfers from your checking account to your savings account to ensure you're saving regularly.

* **Take advantage of employer-sponsored retirement plans:** If your employer offers a 401(k) or similar plan, contribute as much as you can to take advantage of employer matching.5. Seek Professional Advice: While the 5-step framework provides a solid foundation for achieving financial accountability, there may be times when you need additional guidance. Don’t hesitate to seek professional advice from a financial advisor, accountant, or other qualified professional.

* **Benefits of Seeking Professional Advice:**

* **Personalized guidance:** A professional can provide customized advice tailored to your specific financial situation and goals.

* **Expert insights:** They can offer valuable insights and strategies you may not have considered on your own.

* **Objective perspective:** They can provide an objective perspective on your finances, helping you avoid emotional decision-making.Financial Accountability: A Journey, Not a Destination

Achieving strong financial accountability is an ongoing process, not a one-time event. It requires consistent effort, discipline, and a commitment to learning and adapting. There will be setbacks along the way, but the key is to learn from your mistakes and keep moving forward.

The Impact of Financial Accountability: A Look Beyond the Personal

The importance of financial accountability extends far beyond the individual level. It plays a critical role in the success of businesses, organizations, and even entire nations.

- Businesses: Financially accountable businesses are more likely to thrive. They can make informed decisions about resource allocation, manage their finances effectively, and attract investors.

- Organizations: Non-profit organizations and charities rely on financial accountability to ensure that donations are used efficiently and ethically. This builds trust and confidence among donors and supporters.

- Nations: Governments are responsible for managing public finances. Financial accountability is essential for ensuring that tax dollars are used responsibly and that public services are funded adequately.

The Importance of Transparency and Disclosure

A key aspect of financial accountability is transparency. This means being open and honest about your financial situation, both with yourself and with others. It also involves providing clear and accurate financial information to stakeholders, whether they are investors, donors, or the general public.

- For Individuals: Transparency in your personal finances can help you stay accountable to yourself and to others. It can also help you build stronger relationships with family and friends.

- For Businesses: Transparent financial reporting builds trust with investors and stakeholders. It also helps to ensure that businesses are operating ethically and responsibly.

- For Organizations: Transparency in financial management is essential for non-profit organizations and charities. It helps to ensure that donations are used for their intended purpose and that the organization is accountable to its supporters.

- For Governments: Transparency in government finances is crucial for democratic accountability. It allows citizens to hold their elected officials accountable for how public funds are used.

The Role of Technology in Financial Accountability

Technology has played a transformative role in financial management, making it easier than ever to achieve financial accountability. There are countless apps, software programs, and online tools available to help you track your spending, create budgets, manage your debt, and invest your money.

- Budgeting Apps: These apps allow you to track your spending, create budgets, and set financial goals. They can also provide insights into your spending habits and help you identify areas where you might be overspending.

- Debt Management Tools: These tools can help you consolidate your debt, track your progress, and develop a repayment plan. They can also provide resources and support for managing debt effectively.

- Investment Platforms: Online investment platforms make it easier than ever to invest in stocks, bonds, and other assets. They offer a variety of features, such as automated investing, portfolio tracking, and research tools.

- Financial Management Software: This software can help businesses and organizations manage their finances more effectively. It can provide features such as accounting, budgeting, and reporting.

The Future of Financial Accountability

As technology continues to evolve, we can expect to see even more innovative tools and solutions that will help us achieve financial accountability. Artificial intelligence (AI) is already playing a role in financial management, and it’s likely to become even more important in the future. AI can help us automate tasks, identify patterns in our spending, and make better financial decisions.

Conclusion: Embracing the Power of Financial Accountability

Financial accountability is not just about managing money; it’s about taking control of your financial future and achieving your financial goals. By embracing the principles of financial accountability, you can create a solid foundation for financial stability, growth, and freedom. Whether you’re an individual, a business owner, or a member of a community, the power of financial accountability can help you navigate the complexities of the financial world and achieve success. Remember, financial accountability is not a destination, but a journey. It requires continuous effort, discipline, and a commitment to learning and adapting. By embracing this journey, you can unlock the transformative power of financial accountability and create a brighter financial future for yourself and those you care about.

Closure

Thus, we hope this article has provided valuable insights into The Crucial Importance of Strong Financial Accountability: A 5-Step Framework for Success. We thank you for taking the time to read this article. See you in our next article!

google.com