5 Unbreakable Strategies for Building a Robust Retirement Portfolio

Related Articles: 5 Unbreakable Strategies for Building a Robust Retirement Portfolio

- 5 Essential Tips To Avoid First-Time Home Buyer Pitfalls

- Unmasking 5 Devious Financial Scams: A Powerful Guide To Staying Safe

- Master financial engineering epfl

- 5 Unstoppable Strategies To Unlock Your Wealth Potential

- The Devastating Power Of 5%: How Interest Rates Can Wreck Your Finances

Introduction

With great pleasure, we will explore the intriguing topic related to 5 Unbreakable Strategies for Building a Robust Retirement Portfolio. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Unbreakable Strategies for Building a Robust Retirement Portfolio

Retirement. It’s a word that evokes a mix of anticipation and trepidation. For many, it symbolizes a time of freedom, relaxation, and travel. However, the reality is that retirement can be a financial tightrope walk if not planned for meticulously. Building a robust retirement portfolio is crucial for ensuring a comfortable and fulfilling life beyond your working years.

This article delves into five unbreakable strategies to help you build a retirement portfolio that can weather any storm and stand the test of time.

1. Define Your Retirement Goals and Time Horizon

Before embarking on the journey of building a retirement portfolio, it’s essential to have a clear vision of your goals and the time horizon you’re working with. This involves asking yourself some crucial questions:

- What kind of lifestyle do you envision in retirement? Do you dream of traveling the world, pursuing hobbies, or simply enjoying a comfortable life at home?

- What are your estimated monthly expenses in retirement? Consider housing, healthcare, travel, entertainment, and other essential costs.

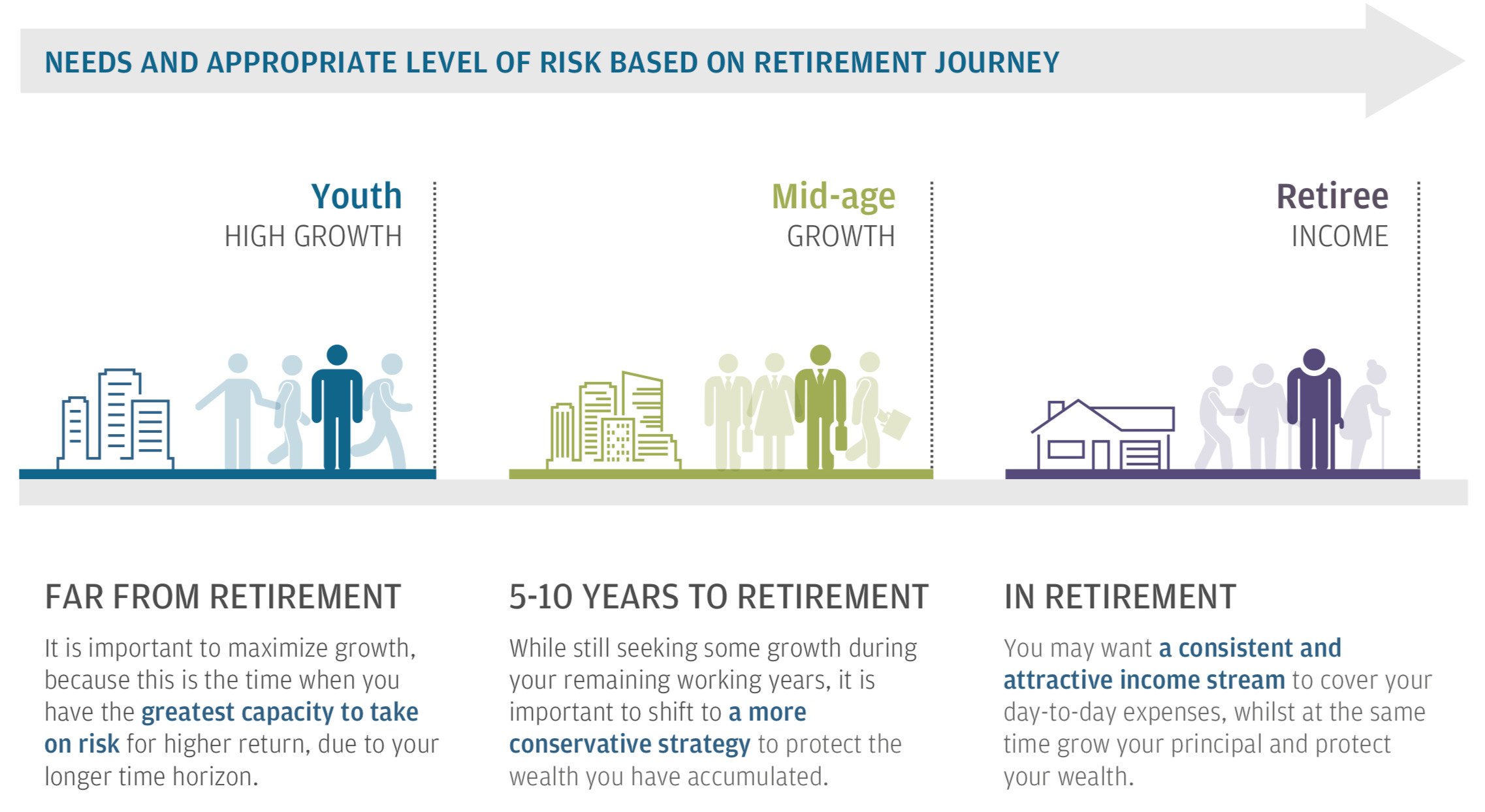

- When do you plan to retire? This will determine your investment timeframe and risk tolerance.

Once you have a firm grasp of your retirement goals and time horizon, you can start making informed decisions about your portfolio allocation.

2. Embrace the Power of Diversification

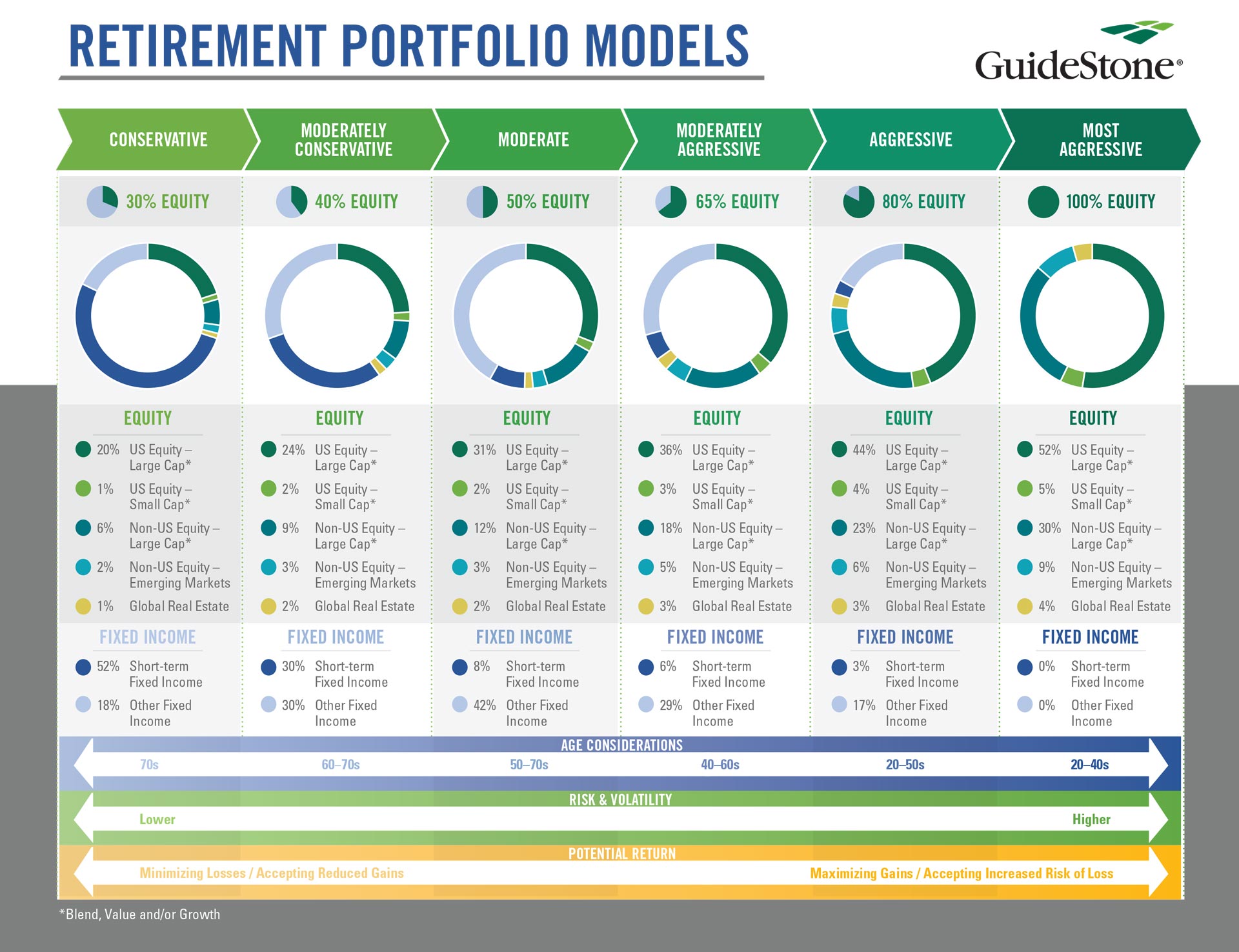

Diversification is the cornerstone of any successful investment strategy, and retirement investing is no exception. It involves spreading your investments across different asset classes, industries, and geographic regions. This helps mitigate risk by reducing your exposure to any single investment.

Here’s a breakdown of the key asset classes to consider:

-

- Stocks: Stocks represent ownership in companies and offer the potential for high returns over the long term. However, they also carry higher volatility than other asset classes.

- Bonds: Bonds are debt securities that pay a fixed interest rate. They offer a lower return than stocks but are generally considered less risky.

- Real Estate: Real estate can provide both income and appreciation potential. However, it’s a relatively illiquid asset class.

- Commodities: Commodities are raw materials like gold, oil, and agricultural products. They can act as a hedge against inflation.

- Cash: Cash provides liquidity and stability but typically offers lower returns.

The ideal asset allocation will depend on your individual risk tolerance, time horizon, and financial goals.

3. Understand Your Risk Tolerance

Risk tolerance is a critical factor in determining your investment strategy. It refers to your ability and willingness to accept potential losses in pursuit of higher returns.

- High-risk tolerance: Investors with a high risk tolerance are comfortable with significant fluctuations in their portfolio value. They are typically younger and have a longer time horizon to recover from potential losses.

- Low-risk tolerance: Investors with a low risk tolerance prefer investments with lower volatility and potential for lower returns. They are typically older and have a shorter time horizon before retirement.

It’s important to choose investments that align with your risk tolerance. If you’re uncomfortable with risk, you should avoid investments that are too volatile, even if they have the potential for high returns.

4. Harness the Power of Compounding

Albert Einstein famously called compounding “the eighth wonder of the world.” It’s the magic of earning interest on both your initial investment and the accumulated interest over time. The earlier you start investing, the more time your money has to compound, leading to exponential growth.

Here’s an example:

Imagine investing $10,000 at a 7% annual return. After 30 years, your investment will have grown to over $76,122. This is the power of compounding at work.

5. Regularly Review and Adjust Your Portfolio

Your retirement portfolio is a dynamic entity that needs to be regularly reviewed and adjusted to reflect changing market conditions, your financial goals, and your risk tolerance.

Here are some key factors to consider when reviewing your portfolio:

- Market performance: How have your investments performed compared to your expectations?

- Your financial goals: Have your goals changed since you initially set up your portfolio?

- Your risk tolerance: Has your risk tolerance changed due to age, life events, or other factors?

It’s advisable to seek professional advice from a qualified financial advisor to ensure your portfolio remains aligned with your goals and risk tolerance.

Additional Strategies for Building a Robust Retirement Portfolio:

- Save consistently: Make regular contributions to your retirement accounts, even if they are small amounts. The key is to develop a habit of saving consistently.

- Maximize employer contributions: If your employer offers a 401(k) or other retirement plan, take full advantage of any employer matching contributions. This is essentially free money that can significantly boost your retirement savings.

- Consider a Roth IRA: A Roth IRA allows you to contribute after-tax dollars, and your withdrawals in retirement are tax-free. This can be a valuable strategy for tax-efficient retirement planning.

- Don’t neglect your health: Maintaining good health is crucial for enjoying retirement. Factor in healthcare costs when planning your retirement budget.

- Plan for inflation: Inflation can erode the purchasing power of your savings over time. Consider investments that have the potential to outpace inflation, such as stocks and real estate.

Conclusion:

Building a robust retirement portfolio is not a one-time event but an ongoing journey that requires dedication, discipline, and a long-term perspective. By embracing the five unbreakable strategies outlined in this article, you can set yourself on a path towards a secure and fulfilling retirement. Remember, it’s never too early or too late to start planning for your future.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. It’s essential to consult with a qualified financial advisor to make informed investment decisions based on your individual circumstances.

Closure

Thus, we hope this article has provided valuable insights into 5 Unbreakable Strategies for Building a Robust Retirement Portfolio. We appreciate your attention to our article. See you in our next article!

google.com