The Crucial 5-Step Financial Plan for Couples: Unlocking Your Shared Dreams

Related Articles: The Crucial 5-Step Financial Plan for Couples: Unlocking Your Shared Dreams

- 5 Powerful Strategies For Effortless Real Estate Investing: A Beginner’s Guide

- 5 Unbreakable Strategies For Building A Robust Retirement Portfolio

- Continuous Demand Finance Careers from now to 100 years into the future

- Unbreakable: 5 Steps To Craft A Powerful Financial Plan For Your Business

- Unleash Your Inner Entrepreneur: 5 Powerful Steps To Launching A Thriving Side Hustle

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Crucial 5-Step Financial Plan for Couples: Unlocking Your Shared Dreams. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Crucial 5-Step Financial Plan for Couples: Unlocking Your Shared Dreams

For couples embarking on the journey of life together, financial planning is not just a practical necessity, it’s a crucial foundation for a secure and fulfilling future. The shared responsibility of finances can be both empowering and daunting, but with a well-defined plan, couples can unlock the potential for financial stability, achieve their shared dreams, and navigate life’s inevitable challenges with confidence.

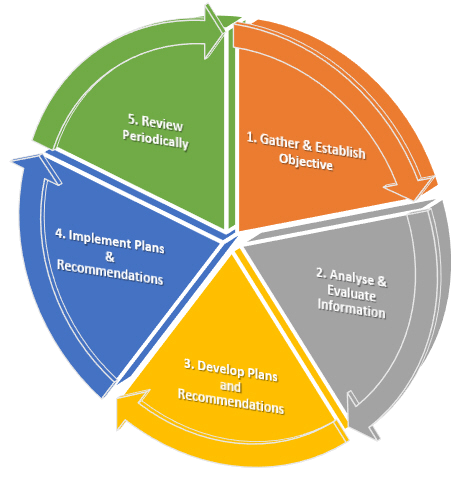

This article outlines a five-step financial plan designed specifically for couples, offering a roadmap to navigate the complexities of shared finances and build a strong financial foundation for a lifetime together.

1. Open Communication: Building a Foundation of Trust and Transparency

The cornerstone of any successful financial plan for couples is open and honest communication. Avoid the common pitfalls of financial secrecy and misunderstandings by establishing a culture of transparency from the very beginning.

-

- Discuss financial history: Share your individual financial histories, including income, debts, and assets. This includes any outstanding student loans, credit card debt, or previous financial mistakes.

- Define financial goals: What are your individual and shared dreams? Do you aspire to buy a home, travel the world, retire early, or start a family? Setting clear goals provides direction and motivation for your financial planning.

- Establish financial values: Discuss your attitudes towards money, spending, and saving. Do you prioritize short-term gratification or long-term financial security? Understanding these values will help you align your financial decisions.

- Agree on a budget: Create a budget that reflects your shared financial goals and values. This budget should include income, expenses, savings, and debt repayment plans.

- Regularly review and adjust: Life is dynamic, and your financial situation will change over time. Schedule regular reviews of your budget and financial plan to ensure it remains relevant and aligned with your evolving needs.

2. Combining Finances: The Art of Shared Responsibility

Once you’ve established open communication, it’s time to decide how you’ll manage your finances together. There are several approaches, each with its own advantages and disadvantages.

-

- Joint accounts: This approach involves combining your income into a single joint account. This simplifies bill payments, budgeting, and financial management. However, it requires a high level of trust and commitment.

- Separate accounts: This approach maintains individual accounts while still collaborating on shared expenses. This can be beneficial for couples who prefer more financial independence, but it requires careful coordination and communication to avoid overspending.

- Hybrid approach: This approach combines elements of both joint and separate accounts. For example, you might have a joint account for shared expenses and separate accounts for individual savings and discretionary spending.

The best approach will depend on your individual needs and preferences. It’s essential to discuss the pros and cons of each option and choose the one that best suits your relationship dynamics.

3. Building a Strong Financial Foundation: Budgeting, Saving, and Investing

A robust financial foundation is built upon a solid budget, consistent savings, and smart investing.

- Budgeting: A budget is a roadmap for your finances, helping you track income and expenses, identify areas for improvement, and allocate funds towards your goals. Use budgeting tools or apps to streamline this process.

- Savings: Saving is crucial for achieving your financial goals, from short-term aspirations like a vacation to long-term dreams like retirement. Establish an emergency fund to cover unexpected expenses, and set up separate savings accounts for specific goals.

- Investing: Investing allows your money to grow over time and potentially outperform inflation. Consider a diversified portfolio of investments, including stocks, bonds, real estate, and other asset classes. Consult a financial advisor to create an investment strategy that aligns with your risk tolerance and goals.

4. Tackling Debt: Strategic Repayment and Avoiding Future Indebtedness

Debt can be a major financial burden, hindering your progress towards your goals. Developing a strategic debt repayment plan is essential.

- Prioritize high-interest debt: Focus on paying down debt with the highest interest rates first, such as credit card debt, to minimize interest charges.

- Consolidate debt: Consider consolidating high-interest debt into a lower-interest loan to simplify repayment.

- Negotiate lower interest rates: Contact your creditors to see if you can negotiate lower interest rates or extended payment terms.

- Avoid future debt: Practice mindful spending habits, create a budget, and avoid unnecessary purchases to prevent accumulating more debt.

5. Planning for the Future: Retirement, Insurance, and Estate Planning

Looking ahead to the future is essential for financial security and peace of mind.

- Retirement planning: Start saving for retirement early and consistently. Take advantage of employer-sponsored retirement plans, such as 401(k)s, and consider individual retirement accounts (IRAs).

- Insurance: Ensure you have adequate insurance coverage, including health, disability, life, and property insurance. Review your coverage regularly to ensure it meets your current needs.

- Estate planning: Estate planning is crucial for protecting your assets and ensuring your wishes are carried out after your death. Consult with an estate planning attorney to create a will, trust, or other estate planning documents.

Conclusion: A Shared Journey Towards Financial Freedom

Financial planning for couples is not a one-size-fits-all endeavor. It requires open communication, shared responsibility, and a commitment to building a strong financial foundation together. By following the five steps outlined above, couples can navigate the complexities of shared finances, achieve their financial goals, and build a secure and fulfilling future together.

Remember, financial planning is an ongoing process. As your life changes, your financial needs will evolve as well. Regularly review and adjust your plan to ensure it remains relevant and aligned with your shared aspirations.

By embracing financial planning as a shared journey, couples can unlock the power of their combined resources and create a future filled with financial stability, security, and the freedom to pursue their dreams together.

Closure

Thus, we hope this article has provided valuable insights into The Crucial 5-Step Financial Plan for Couples: Unlocking Your Shared Dreams. We hope you find this article informative and beneficial. See you in our next article!

google.com