5 Pillars of Unstoppable Financial Security: A Guide to Building a Life of Freedom and Abundance

Related Articles: 5 Pillars of Unstoppable Financial Security: A Guide to Building a Life of Freedom and Abundance

- The Crucial 5-Step Financial Plan For Couples: Unlocking Your Shared Dreams

- Unleashing The Power Of 1000: A Comprehensive Guide To Understanding Mutual Funds

- Mastering The 5 Key Strategies For Powerful Tax Planning

- 5 Unstoppable Ways To Invest Your Money And Build A Thriving Future

- Unlock 5 Powerful Strategies For Building Unstoppable Wealth: A Step-by-Step Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 5 Pillars of Unstoppable Financial Security: A Guide to Building a Life of Freedom and Abundance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Pillars of Unstoppable Financial Security: A Guide to Building a Life of Freedom and Abundance

The desire for financial security is a universal one. We all dream of a life free from financial worries, where we can pursue our passions, travel the world, and leave a legacy for our loved ones. But achieving this dream often feels like an insurmountable mountain, shrouded in confusion and fear.

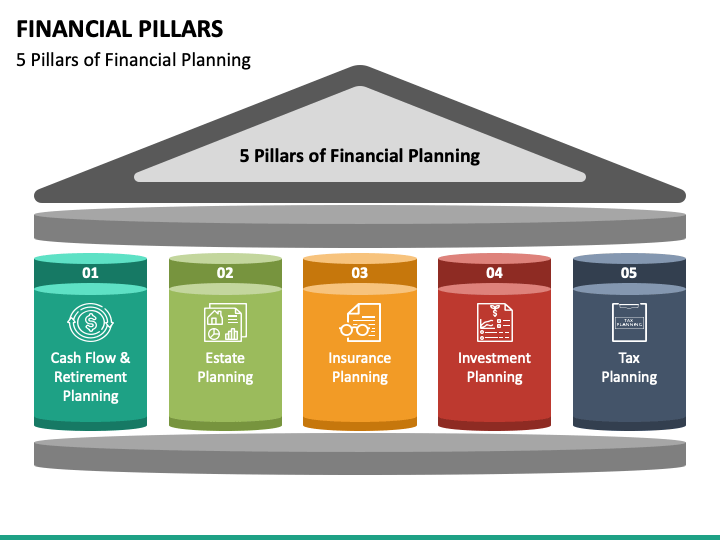

This article aims to dispel the myths and illuminate the path towards financial security. We will delve into five pillars that, when firmly established, will create an unshakable foundation for a life of freedom and abundance. This is not about quick fixes or get-rich-quick schemes; this is about building a sustainable system that empowers you to take control of your financial future.

Pillar 1: Building a Solid Foundation: Mastering the Basics

The first step towards financial security is to understand the fundamentals. This involves:

-

- Budgeting: Track your income and expenses diligently. Identify areas where you can cut back and redirect those funds towards your financial goals.

- Saving: Establish an emergency fund to cover unexpected expenses. Aim for 3-6 months worth of living expenses.

- Debt Management: Prioritize paying off high-interest debt, like credit cards. Explore options like debt consolidation or balance transfers to lower interest rates.

- Investing: Start investing early, even if it’s a small amount. Choose investments that align with your risk tolerance and financial goals.

- Financial Literacy: Continuously educate yourself about personal finance. Read books, attend workshops, and follow reputable financial experts.

Pillar 2: The Power of Compound Interest: Your Money Works for You

Compound interest is the eighth wonder of the world. It’s the magic of earning interest on your initial investment, and then earning interest on that interest, and so on. This exponential growth can be a powerful tool for wealth creation.

-

- Start Early: The earlier you start investing, the more time your money has to compound. Even small, consistent contributions can yield significant returns over time.

- Maximize Your Contributions: Take advantage of employer-sponsored retirement plans like 401(k)s and maximize your contributions to reap the benefits of compound interest.

- Diversify Your Investments: Don’t put all your eggs in one basket. Diversify your portfolio across different asset classes like stocks, bonds, and real estate to reduce risk and maximize returns.

Pillar 3: Owning Your Time: Building Multiple Income Streams

Financial security is not just about accumulating wealth; it’s about achieving financial freedom. This means having the flexibility to choose how you spend your time and pursue your passions.

- Side Hustle: Explore opportunities to earn extra income outside your primary job. This could include freelancing, starting a small business, or investing in rental properties.

- Passive Income: Generate income streams that require minimal effort. This could include dividends from stocks, rental income from real estate, or royalties from creative works.

- Skill Development: Continuously invest in your skills and knowledge. This will make you more valuable in the job market and open up new income-generating opportunities.

Pillar 4: Building a Safe Haven: Protecting Your Assets

Building wealth is only half the battle. It’s equally important to protect what you’ve earned.

- Insurance: Secure adequate insurance coverage for your home, car, health, and life. This will protect you from financial ruin in case of unexpected events.

- Estate Planning: Create a will and trust to ensure your assets are distributed according to your wishes and minimize estate taxes.

- Financial Security Measures: Implement measures to protect your finances from fraud and identity theft. This includes using strong passwords, monitoring your credit reports, and being cautious about phishing scams.

Pillar 5: Cultivating a Growth Mindset: Embracing Continuous Learning and Adaptability

Financial security is not a destination; it’s a journey. To achieve and maintain financial security, you need to embrace continuous learning and adapt to changing circumstances.

- Stay Informed: Keep abreast of economic trends, market fluctuations, and changes in tax laws.

- Seek Professional Advice: Consult with financial advisors and tax professionals to make informed decisions about your finances.

- Be Flexible: The financial landscape is constantly evolving. Be prepared to adjust your strategies and goals as needed.

Building a Financially Secure Life: A Journey of Empowerment

The path to financial security is not always easy. It requires discipline, patience, and a willingness to learn. But the rewards are well worth the effort. By embracing the five pillars outlined above, you can build a solid foundation for a life of freedom, abundance, and peace of mind. Remember, it’s not about achieving a specific number in your bank account; it’s about creating a life where money is no longer a source of stress but a tool to empower you to pursue your dreams.

Beyond the Pillars: A Holistic Approach

While the five pillars provide a strong framework, financial security is also influenced by other factors:

- Mental and Emotional Well-being: Financial stress can have a detrimental impact on your mental and emotional health. Prioritize self-care and seek support when needed.

- Relationships: Strong relationships with family and friends can provide emotional support and financial stability.

- Community Involvement: Engaging in your community can build social connections and create opportunities for financial growth.

A Final Word:

Building a financially secure life is a marathon, not a sprint. It’s about making consistent, informed decisions over time. By embracing the principles outlined in this article, you can empower yourself to take control of your financial future and create a life of freedom and abundance. Remember, your journey is unique, and there is no one-size-fits-all approach. Stay curious, stay informed, and most importantly, stay focused on your goals.

Closure

Thus, we hope this article has provided valuable insights into 5 Pillars of Unstoppable Financial Security: A Guide to Building a Life of Freedom and Abundance. We hope you find this article informative and beneficial. See you in our next article!

google.com