5 Amazing Budgeting Apps That Will Transform Your Finances

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Amazing Budgeting Apps That Will Transform Your Finances. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Amazing Budgeting Apps That Will Transform Your Finances

Taking control of your finances can feel overwhelming, but it doesn’t have to be. With the right tools, budgeting can become a manageable and even enjoyable process. Enter budgeting apps, your new financial allies in the fight against overspending and financial stress.

These digital assistants offer a range of features to help you track spending, set goals, and gain a clear picture of your financial health. But with so many options available, choosing the right one can feel daunting.

This article will guide you through the amazing world of budgeting apps, highlighting five top contenders that can transform your financial journey. We’ll delve into their unique features, pros and cons, and pricing structures, empowering you to make an informed decision.

1. Mint: The All-in-One Financial Management Powerhouse

Mint, a popular choice among budgeting enthusiasts, goes beyond basic expense tracking. It acts as a comprehensive financial management platform, offering features like:

- Automatic Categorization: Mint automatically categorizes your transactions, saving you time and effort.

- Budgeting and Goal Setting: Set budgets for various categories and create financial goals, like saving for a down payment or paying off debt.

- Bill Reminders: Never miss a bill payment with Mint’s timely reminders.

- Credit Score Monitoring: Keep an eye on your credit score with regular updates and insights.

- Investment Tracking: Monitor your investment portfolio and track its performance.

Pros:

- Free: Mint’s core features are completely free.

- User-Friendly Interface: The app is designed for ease of use, making it accessible for both beginners and seasoned budgeters.

- Comprehensive Features: Mint offers a wide range of features, making it a one-stop shop for your financial needs.

Cons:

- Limited Customization: While Mint offers some customization options, they are not as extensive as some other apps.

- Potential for Errors: Mint relies on automatic categorization, which can sometimes lead to inaccuracies.

2. Personal Capital: The Investment-Focused Budgeting App

Personal Capital shines when it comes to investment management and financial planning. It provides a comprehensive view of your entire financial picture, including:

- Investment Tracking: Personal Capital aggregates all your investment accounts, providing a clear overview of your portfolio performance.

- Retirement Planning: Utilize Personal Capital’s retirement planning tools to estimate your future retirement income and adjust your savings strategy accordingly.

- Net Worth Tracking: Monitor your net worth and track your financial progress over time.

- Budgeting and Expense Tracking: While not its primary focus, Personal Capital offers basic budgeting and expense tracking features.

Pros:

- Free for Investment Tracking: Personal Capital’s investment tracking features are free, making it a valuable tool for investors.

- Detailed Financial Insights: The app provides insightful reports and analysis, helping you make informed financial decisions.

- Retirement Planning Tools: Personal Capital’s retirement planning tools are comprehensive and user-friendly.

Cons:

- Limited Budgeting Features: Personal Capital’s budgeting features are less robust compared to other dedicated budgeting apps.

- Free Version Limitations: While the investment tracking features are free, the budgeting and planning tools have limitations in the free version.

3. YNAB (You Need a Budget): The Zero-Based Budgeting Champion

YNAB (You Need a Budget) takes a unique approach to budgeting, emphasizing the "zero-based" method. This means allocating every dollar of your income to a specific purpose, leaving no room for unplanned spending:

- Zero-Based Budgeting: YNAB encourages you to budget every dollar of your income, ensuring you’re not overspending.

- Goal-Oriented Approach: Set specific financial goals and track your progress towards achieving them.

- Debt Management Tools: YNAB offers tools to help you manage and pay off debt effectively.

- Cloud-Based Syncing: Access your budget from any device with YNAB’s cloud-based syncing feature.

Pros:

- Effective Budgeting Method: YNAB’s zero-based budgeting approach promotes financial discipline and helps you stay on track.

- Comprehensive Budgeting Tools: YNAB offers a wide range of features designed to support your budgeting journey.

- Excellent Customer Support: YNAB is known for its responsive and helpful customer support.

Cons:

- Subscription-Based: YNAB requires a paid subscription to access its full features.

- Steeper Learning Curve: The zero-based budgeting method can be challenging for beginners.

4. EveryDollar: The Budget-Friendly Budgeting App

EveryDollar, created by renowned financial expert Dave Ramsey, focuses on creating a simple and effective budgeting plan:

- Envelope System: EveryDollar utilizes the traditional "envelope system" to allocate your income to different spending categories.

- Debt Snowball Method: Follow Dave Ramsey’s debt snowball method to prioritize and pay off debt quickly.

- Budgeting and Expense Tracking: Track your spending and stay within your allocated budget.

- Financial Education: EveryDollar provides access to Dave Ramsey’s financial education resources.

Pros:

- Affordable: EveryDollar offers a free version with limited features and a paid subscription for full access.

- Simple and Easy to Use: The app’s interface is straightforward and user-friendly.

- Debt Management Focus: EveryDollar emphasizes debt management, providing tools and strategies to tackle debt effectively.

Cons:

- Limited Features: EveryDollar’s features are less comprehensive compared to some other budgeting apps.

- Dave Ramsey’s Approach: The app’s focus on Dave Ramsey’s methods may not appeal to everyone.

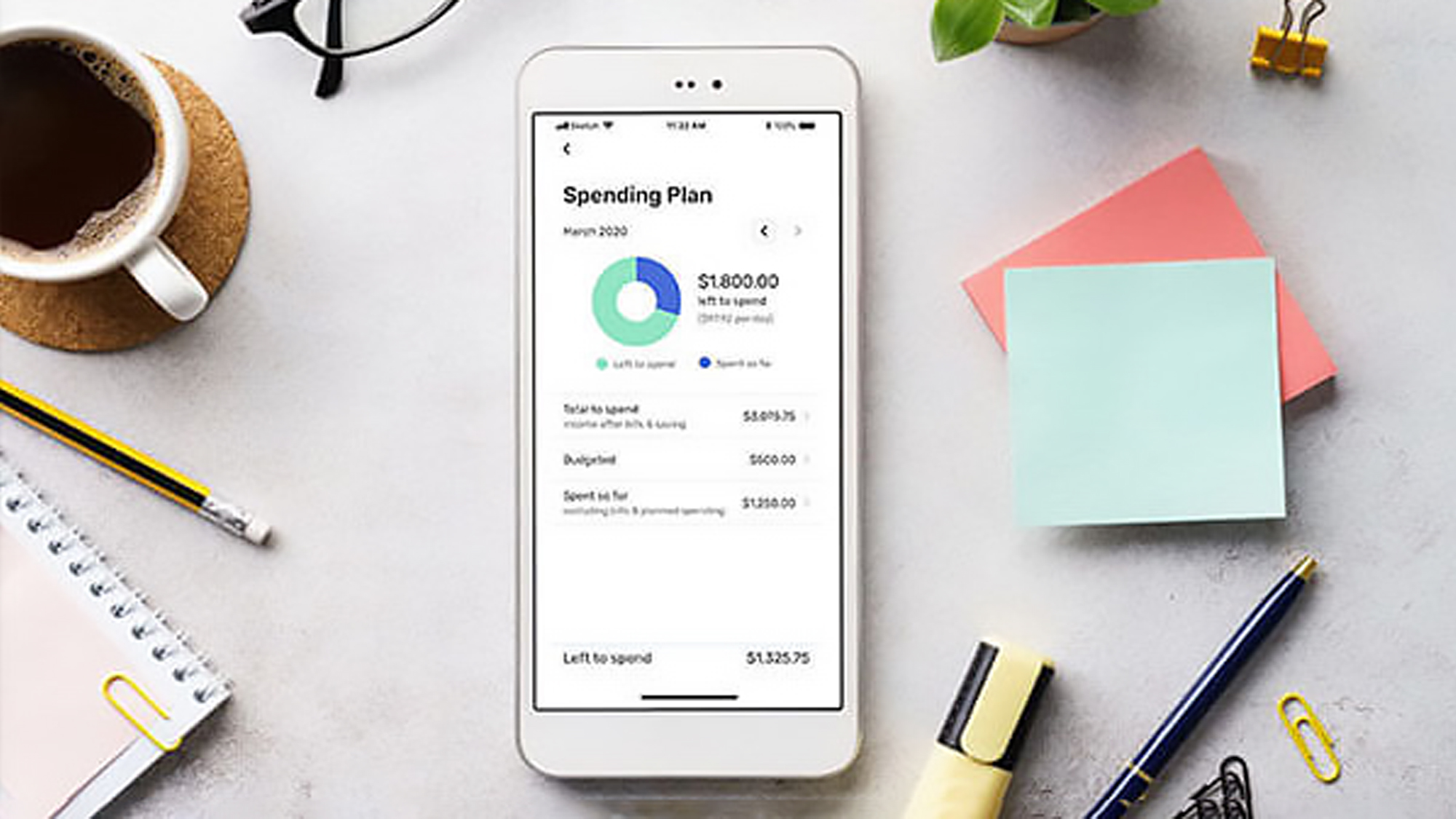

5. PocketGuard: The Spending Limit and Savings Goal App

PocketGuard focuses on helping you stay within your spending limits and reach your savings goals:

- Spending Limits: Set spending limits for different categories and receive alerts when you’re approaching your limit.

- Savings Goals: Create savings goals and track your progress towards achieving them.

- Automatic Savings: PocketGuard offers an automatic savings feature that transfers money to your savings account regularly.

- Debt Management Tools: Manage your debt and track your progress towards becoming debt-free.

Pros:

- Spending Limit Feature: PocketGuard’s spending limit feature is a unique and helpful tool for controlling spending.

- Savings Goal Tracking: The app provides a clear view of your savings progress.

- User-Friendly Interface: PocketGuard is designed for easy navigation and intuitive use.

Cons:

- Limited Budgeting Features: PocketGuard’s budgeting features are not as comprehensive as some other apps.

- Paid Subscription Required: To access all features, a paid subscription is required.

Choosing the Right Budgeting App for You

With so many excellent options available, choosing the right budgeting app can seem daunting. Consider these factors when making your decision:

- Features: Identify the features that are most important to you, such as automatic categorization, goal setting, debt management, or investment tracking.

- Pricing: Determine your budget for a budgeting app and choose one that fits your financial situation.

- User Interface: Opt for an app with a user-friendly interface that you find easy to navigate and understand.

- Personal Preferences: Consider your personal preferences and choose an app that aligns with your budgeting style and financial goals.

Embark on Your Financial Journey

Whether you’re a seasoned budgeter or just starting your financial journey, a budgeting app can be a powerful tool to help you gain control of your finances. By utilizing these digital assistants, you can track spending, set goals, and make informed financial decisions, ultimately leading to a more secure and prosperous future.

Closure

Thus, we hope this article has provided valuable insights into 5 Amazing Budgeting Apps That Will Transform Your Finances. We thank you for taking the time to read this article. See you in our next article!

google.com