The Astonishing Power of 10%: How Compound Interest Can Make You Rich

Introduction

With great pleasure, we will explore the intriguing topic related to The Astonishing Power of 10%: How Compound Interest Can Make You Rich. Let’s weave interesting information and offer fresh perspectives to the readers.

The Astonishing Power of 10%: How Compound Interest Can Make You Rich

Compound interest, often referred to as the "eighth wonder of the world," is a powerful force that can transform your financial future. It’s the magic of earning interest on your initial investment, and then earning interest on that interest, creating a snowball effect that grows exponentially over time. While the concept itself is simple, the impact of compound interest can be truly astounding, especially when combined with a long-term investment strategy.

Imagine you invest $10,000 today, earning a modest 10% annual return. In just 10 years, your initial investment would have grown to over $25,000. But that’s not all. If you leave that money invested for another 10 years, it will balloon to over $67,000! This is the power of compounding at work, turning a relatively small investment into a substantial sum over time.

The Early Bird Catches the Worm (and the Compounding Interest)

One of the most important aspects of compound interest is the concept of time. The earlier you start investing, the more time your money has to grow. This is why starting early is crucial for maximizing the benefits of compound interest. Even small, regular contributions made over a long period can yield impressive results.

Let’s take another example. Suppose you start saving $100 per month at age 25, earning a 10% annual return. By the time you reach retirement at age 65, you would have accumulated over $1.6 million! This is a testament to the power of consistent saving and the magic of compounding.

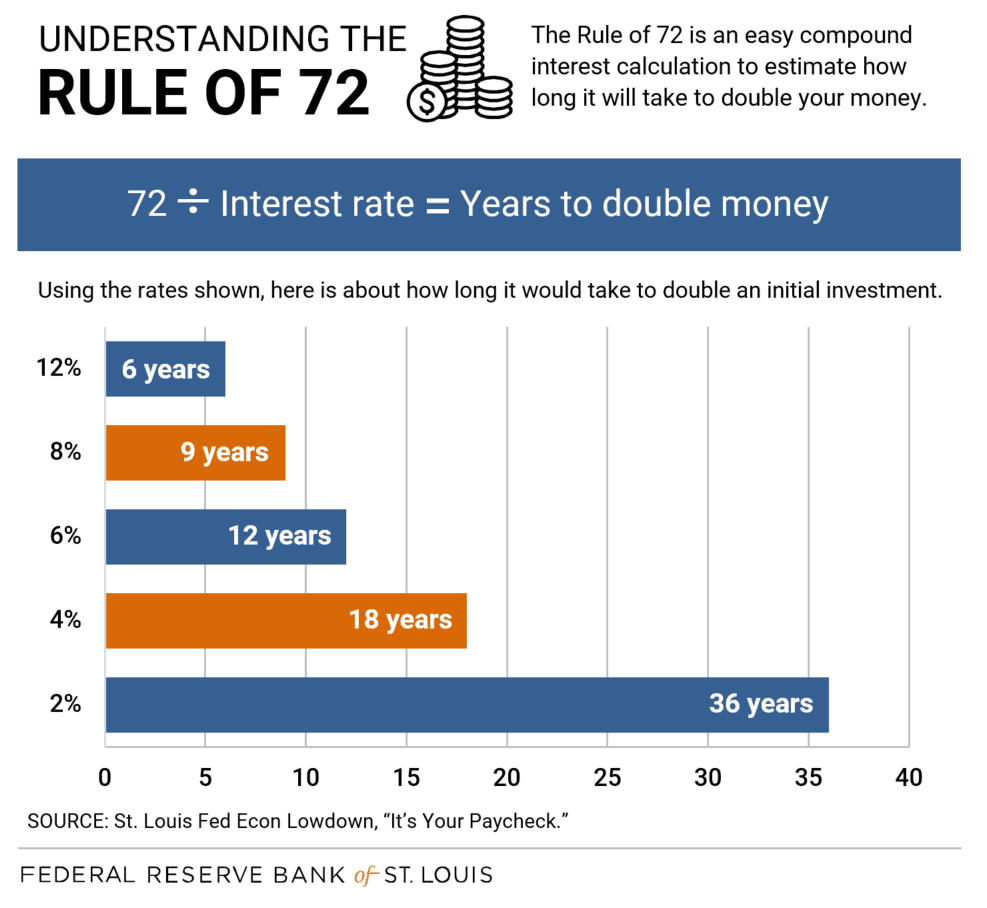

The 72 Rule: A Quick and Easy Calculation

To understand the power of compound interest, it’s helpful to use the Rule of 72. This simple rule allows you to estimate how long it will take for your investment to double in value. You simply divide 72 by the annual rate of return. For example, if you earn a 10% annual return, your investment will double in approximately 7.2 years (72/10 = 7.2).

Understanding the Different Types of Compound Interest

There are two main types of compound interest:

- Simple Interest: This is the most basic form of interest, where you only earn interest on your initial investment. The interest earned is not added back to the principal, so the growth is linear.

- Compound Interest: This is where the real magic happens. The interest earned is added back to the principal, and then interest is calculated on the new, larger principal. This creates an exponential growth pattern, leading to much faster accumulation of wealth.

The Importance of Choosing the Right Investments

While compound interest is a powerful force, it’s important to remember that it’s only one part of the equation. Choosing the right investments is crucial for maximizing your returns. Different investments carry different levels of risk and potential returns. It’s important to consider your risk tolerance, investment goals, and time horizon when selecting investments.

Diversification: Spreading the Risk

Diversification is another key factor in achieving long-term investment success. By investing in a variety of assets, you can reduce your overall risk and potentially increase your returns. This is because different asset classes tend to perform differently in various economic conditions.

Understanding the Costs Involved

It’s also important to consider the costs associated with investing. These costs can include fees charged by your broker, mutual fund expenses, and taxes on your investment income. These costs can significantly impact your overall returns, so it’s important to choose investments with low fees and tax-efficient structures.

The Importance of Staying Disciplined

The power of compound interest is not just about the math; it’s also about discipline and consistency. It requires a commitment to saving regularly and staying invested over the long term. Market fluctuations are inevitable, but it’s important to remain focused on your long-term goals and avoid making impulsive decisions based on short-term market movements.

The Impact of Inflation

While compound interest can help you grow your wealth, it’s important to consider the impact of inflation. Inflation erodes the purchasing power of money over time, meaning that your investment returns need to outpace inflation to maintain your real purchasing power.

Harnessing the Power of Compound Interest

Compound interest is a powerful tool that can help you achieve your financial goals. By understanding its principles, choosing the right investments, and staying disciplined, you can harness the power of compounding to build a secure financial future.

Here are some key takeaways to remember:

- Start early: The earlier you start investing, the more time your money has to grow.

- Invest consistently: Even small, regular contributions can yield impressive results over time.

- Choose the right investments: Select investments that align with your risk tolerance, investment goals, and time horizon.

- Diversify your portfolio: Spread your risk by investing in a variety of assets.

- Minimize costs: Choose investments with low fees and tax-efficient structures.

- Stay disciplined: Stick to your long-term investment plan and avoid making impulsive decisions.

The Future is Bright with Compound Interest

Compound interest is not just a financial concept; it’s a powerful force that can transform your life. By embracing the power of compounding and making smart financial decisions, you can create a future filled with financial freedom and security.

Closure

Thus, we hope this article has provided valuable insights into The Astonishing Power of 10%: How Compound Interest Can Make You Rich. We thank you for taking the time to read this article. See you in our next article!

google.com