Unlock Your Financial Freedom: 5 Powerful Steps to Achieve Your Goals

Introduction

With great pleasure, we will explore the intriguing topic related to Unlock Your Financial Freedom: 5 Powerful Steps to Achieve Your Goals. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlock Your Financial Freedom: 5 Powerful Steps to Achieve Your Goals

The pursuit of financial freedom is a universal desire. Whether it’s buying a dream home, retiring early, or simply achieving financial stability, having clear financial goals is crucial to reaching your aspirations. However, setting goals can feel daunting, especially if you’re unsure where to start.

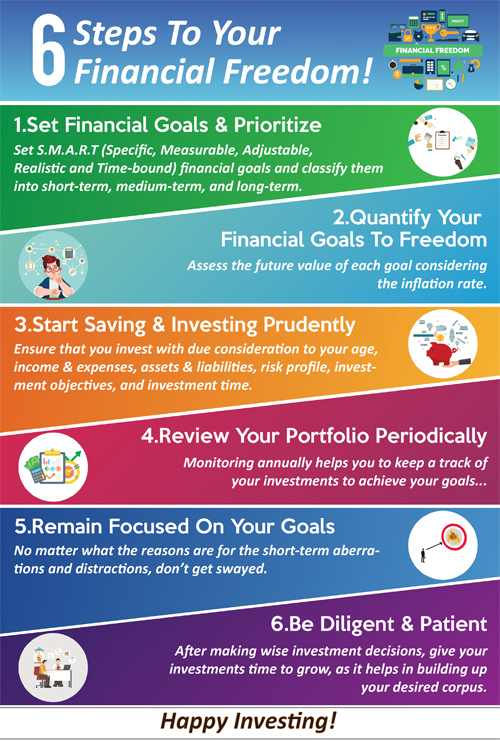

This article will guide you through a five-step process to set achievable and impactful financial goals, transforming your dreams into reality.

Step 1: Define Your "Why"

Before diving into specific numbers, take a moment to explore the underlying reasons behind your financial goals. What are you truly striving for? Why are these goals important to you?

- Emotional Connection: Connecting your goals to your values and emotions will provide the intrinsic motivation needed to stay focused and persevere through challenges. For example, if your goal is to buy a house, consider the emotional benefits it brings: a sense of security, a place to raise a family, or the freedom to create a space that reflects your personal style.

- Visualize the Outcome: Imagine yourself achieving your goals. How would your life be different? What would you be able to do or experience that you can’t currently? These visualizations will help you stay motivated and maintain a clear vision of your future.

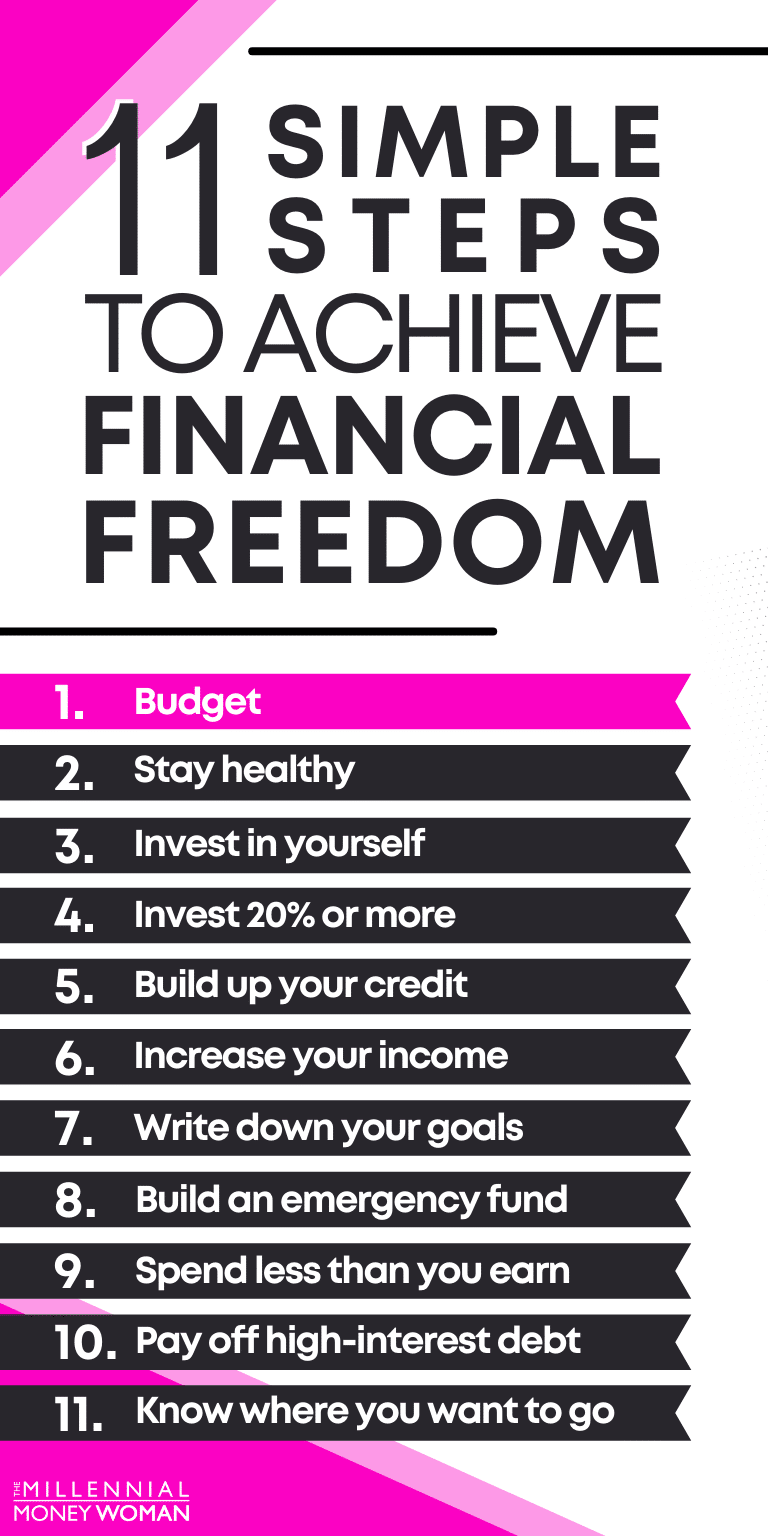

Step 2: Break Down Your Goals into Smaller, Achievable Steps

Large, overarching goals can feel overwhelming. To make them more manageable, break them down into smaller, actionable steps. This approach creates a sense of progress and provides tangible milestones to celebrate along the way.

- Example: If your goal is to retire comfortably with $1 million, break it down into yearly savings targets. Instead of feeling overwhelmed by the $1 million figure, focus on saving $50,000 per year. This smaller target feels more achievable and motivates you to take consistent action.

- SMART Goals: Use the SMART goal framework to ensure your smaller goals are specific, measurable, achievable, relevant, and time-bound. This structure helps you stay organized and track your progress effectively.

Step 3: Create a Budget and Track Your Spending

A budget is the foundation of any successful financial plan. It helps you understand your current financial situation, identify areas for improvement, and allocate your resources strategically.

- Track Your Expenses: Use a budgeting app, spreadsheet, or notebook to track your income and expenses for a few months. This will reveal spending patterns and help you identify areas where you can cut back.

- Prioritize Needs vs. Wants: Distinguish between essential needs (housing, food, utilities) and discretionary wants (entertainment, dining out). Allocate your budget based on your priorities, ensuring you’re meeting your essential needs before indulging in wants.

- Automate Savings: Set up automatic transfers from your checking account to your savings account. This ensures you consistently save a portion of your income without having to think about it.

Step 4: Invest Wisely

Once you’ve established a budget and have a consistent savings plan, it’s time to invest your money wisely. Investing allows your money to grow over time and helps you achieve your long-term financial goals.

- Understand Your Risk Tolerance: Consider your investment horizon and your comfort level with risk. If you’re investing for the long term, you can generally afford to take on more risk. However, if you need access to your money in the short term, a more conservative approach is recommended.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes, such as stocks, bonds, and real estate. This helps mitigate risk and potentially increase returns over time.

- Seek Professional Advice: If you’re unsure where to start, consider consulting with a financial advisor. They can help you create a personalized investment plan that aligns with your goals and risk tolerance.

Step 5: Review and Adjust Your Plan Regularly

Your financial goals and circumstances may change over time. It’s essential to review your plan regularly and make adjustments as needed.

- Life Events: Major life events, such as marriage, children, or job changes, can impact your financial goals. Re-evaluate your plan and adjust your budget and investment strategy accordingly.

- Market Fluctuations: The stock market is inherently volatile. Don’t panic sell during market downturns. Instead, focus on your long-term goals and adjust your investment strategy based on your risk tolerance and market conditions.

- Celebrate Milestones: As you achieve your smaller goals, take the time to celebrate your progress. This positive reinforcement will keep you motivated and on track to achieve your ultimate financial goals.

Tips for Setting Effective Financial Goals

- Be Realistic: Set goals that are achievable given your current financial situation. Don’t set yourself up for failure by aiming too high.

- Start Small: Begin with small, manageable goals and gradually increase the difficulty as you gain confidence.

- Be Patient: Building wealth takes time and effort. Don’t expect to achieve your goals overnight. Stay committed to your plan and trust the process.

- Seek Support: Talk to friends, family, or a financial advisor for support and guidance. Surrounding yourself with a supportive network can help you stay motivated and on track.

Conclusion

Setting and achieving financial goals is a journey, not a destination. By following these five steps, you can create a clear roadmap to financial freedom. Remember to be patient, persistent, and adaptable as you navigate the ups and downs of your financial journey. With dedication and a well-defined plan, you can unlock your financial potential and achieve your dreams.

Closure

Thus, we hope this article has provided valuable insights into Unlock Your Financial Freedom: 5 Powerful Steps to Achieve Your Goals. We thank you for taking the time to read this article. See you in our next article!

google.com