Escape the 5 Deadly Debt Traps: A Guide to Financial Freedom

Related Articles: Escape the 5 Deadly Debt Traps: A Guide to Financial Freedom

- Unbreakable: 5 Steps To Craft A Powerful Financial Plan For Your Business

- Unlock 5 Powerful Strategies To Supercharge Your Investment Portfolio

- The Unstoppable Power Of A Roth IRA: 5 Reasons Why It’s A Brilliant Retirement Strategy

- Worried about being abducted by aliens?

- The Crucial Power Of 5 Key Financial Literacy Skills

Introduction

With great pleasure, we will explore the intriguing topic related to Escape the 5 Deadly Debt Traps: A Guide to Financial Freedom. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Escape the 5 Deadly Debt Traps: A Guide to Financial Freedom

Debt. It’s a word that can send shivers down the spine of even the most financially savvy individuals. The allure of instant gratification, coupled with the ease of access to credit, can lead us down a slippery slope of accumulating debt, often without realizing the true cost. But fear not! This guide will empower you to navigate the treacherous waters of debt and emerge victorious, free from the shackles of financial burden.

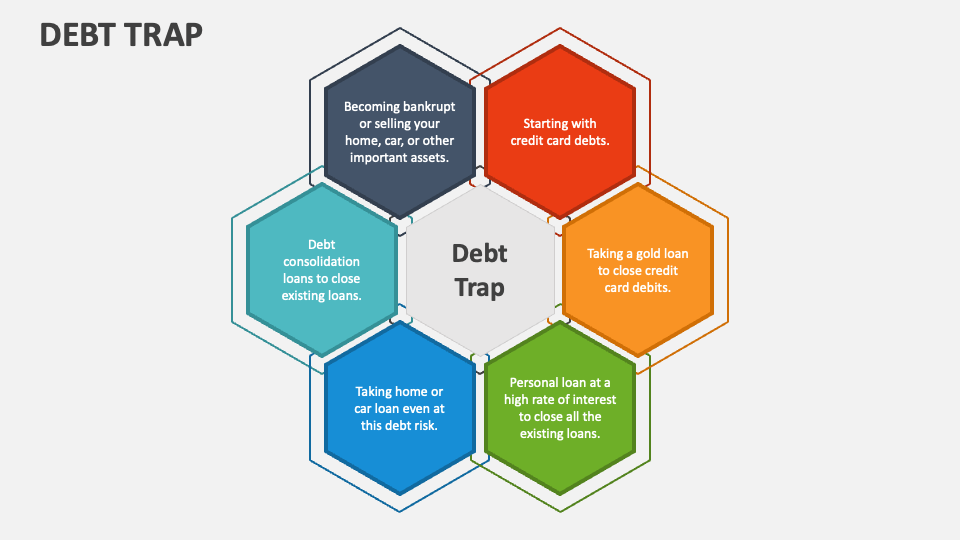

Understanding the Debt Trap: A Vicious Cycle

Before we delve into the escape plan, it’s crucial to grasp the nature of the debt trap. It’s a cyclical phenomenon where debt accumulation fuels further borrowing, creating a snowball effect that can quickly spiral out of control. Here’s how it works:

- The Trigger: Life throws curveballs. A sudden medical expense, a job loss, or even an unexpected home repair can leave you scrambling for cash.

- The Temptation: Easy access to credit, through credit cards, personal loans, or payday loans, offers a seemingly quick fix.

- The Trap: While these solutions provide immediate relief, they come with high interest rates and fees, creating a new debt burden.

- The Spiral: As you struggle to make minimum payments, the interest accumulates, making the principal debt seem insurmountable. This can lead to further borrowing to cover existing debt, perpetuating the cycle.

5 Deadly Debt Traps to Avoid:

1. The Credit Card Trap: Credit cards are a double-edged sword. They offer convenience and rewards, but their high interest rates can quickly turn them into a financial nightmare.

-

- The Lure: The ease of swiping a card for everyday purchases can lead to impulsive spending and overspending.

- The Danger: If you carry a balance, you’ll be charged exorbitant interest rates, making your debt grow exponentially.

- The Escape: Use credit cards responsibly. Pay off your balance in full each month to avoid interest charges. Set a spending limit and stick to it.

2. The Payday Loan Trap: Payday loans are marketed as quick solutions for emergencies, but they come with predatory interest rates and fees that can trap you in a cycle of debt.

-

- The Lure: They offer fast cash without credit checks, making them appealing when you’re desperate.

- The Danger: Interest rates can exceed 400%, and fees can quickly add up, making the loan far more expensive than it initially seems.

- The Escape: Avoid payday loans at all costs. Explore alternative options like borrowing from friends or family, seeking a loan from a credit union, or negotiating a payment plan with your creditors.

3. The Student Loan Trap: Student loans are a significant investment in your future, but they can become a financial burden if not managed wisely.

- The Lure: The promise of a better future through education can make the debt seem worth it.

- The Danger: Student loan debt can be overwhelming, especially if you struggle to find a high-paying job after graduation.

- The Escape: Choose your degree carefully, considering the job market and earning potential. Explore scholarships and grants to minimize loan debt. Consider income-driven repayment plans or loan forgiveness programs.

4. The Auto Loan Trap: Car loans are a common form of debt, but they can quickly become a financial burden if you overextend yourself.

- The Lure: The desire for a new car, fueled by advertising and societal pressure, can lead to impulsive purchases.

- The Danger: High interest rates and long loan terms can trap you in debt for years, especially if you choose a luxury or expensive vehicle.

- The Escape: Buy a used car, negotiate a lower interest rate, and choose a shorter loan term. Consider financing through a credit union or bank instead of the dealership.

5. The Personal Loan Trap: Personal loans can offer quick access to cash, but they can come with high interest rates and fees if not used responsibly.

- The Lure: They can seem like a convenient way to consolidate debt or cover unexpected expenses.

- The Danger: If you take out a loan with a high interest rate, you could end up paying more in interest than the original amount borrowed.

- The Escape: Consider alternative options like borrowing from friends or family, seeking a loan from a credit union, or negotiating a payment plan with your creditors. If you do take out a personal loan, shop around for the lowest interest rate and fees.

Breaking Free from the Debt Trap: A Step-by-Step Guide

Now that you understand the dangers of debt traps, let’s explore how to escape their clutches.

1. Acknowledge the Problem: The first step is to admit that you have a debt problem. Don’t be ashamed, it’s a common issue. Once you acknowledge it, you can start taking action.

2. Track Your Spending: To understand your financial situation, track your income and expenses for a month or two. Use a budgeting app, spreadsheet, or even a notebook. This will help you identify areas where you can cut back.

3. Create a Budget: Based on your spending analysis, create a realistic budget that outlines your income and expenses. Allocate funds for essential expenses like housing, food, and transportation, and set aside money for debt repayment.

4. Prioritize Debt Repayment: Focus on paying down your highest-interest debt first. This will minimize the amount of interest you pay over time. Use the snowball method, which involves paying the minimum on all debts and focusing all extra payments on the smallest debt. Once that’s paid off, roll those payments into the next smallest debt.

5. Negotiate with Creditors: Don’t be afraid to reach out to your creditors and negotiate lower interest rates or payment plans. They may be willing to work with you if you demonstrate a genuine effort to repay your debt.

6. Seek Professional Help: If you’re struggling to manage your debt, consider seeking professional help from a credit counselor or financial advisor. They can provide personalized advice and guidance to help you create a plan for debt repayment.

7. Build Good Credit: Once you’ve started to pay down your debt, focus on building good credit. This will make it easier to borrow money in the future at lower interest rates. Pay your bills on time, keep your credit utilization ratio low, and avoid opening new credit accounts unless necessary.

8. Avoid Future Debt Traps: Once you’re debt-free, learn from your mistakes and avoid falling back into the trap. Practice responsible spending habits, set a budget, and stick to it. Make informed financial decisions, and don’t be swayed by impulsive purchases or marketing schemes.

Conclusion: Embracing Financial Freedom

Escaping debt traps requires commitment, discipline, and a willingness to make changes. But the rewards are immense: financial freedom, peace of mind, and the ability to pursue your dreams without the burden of debt. By following these steps, you can break free from the shackles of debt and create a brighter financial future for yourself. Remember, financial freedom is not a destination, it’s a journey. Embrace the journey, and enjoy the rewards along the way.

Closure

Thus, we hope this article has provided valuable insights into Escape the 5 Deadly Debt Traps: A Guide to Financial Freedom. We thank you for taking the time to read this article. See you in our next article!

google.com