Amazing! 5 Powerful Steps to Start Investing and Secure Your Financial Future

Introduction

With great pleasure, we will explore the intriguing topic related to Amazing! 5 Powerful Steps to Start Investing and Secure Your Financial Future. Let’s weave interesting information and offer fresh perspectives to the readers.

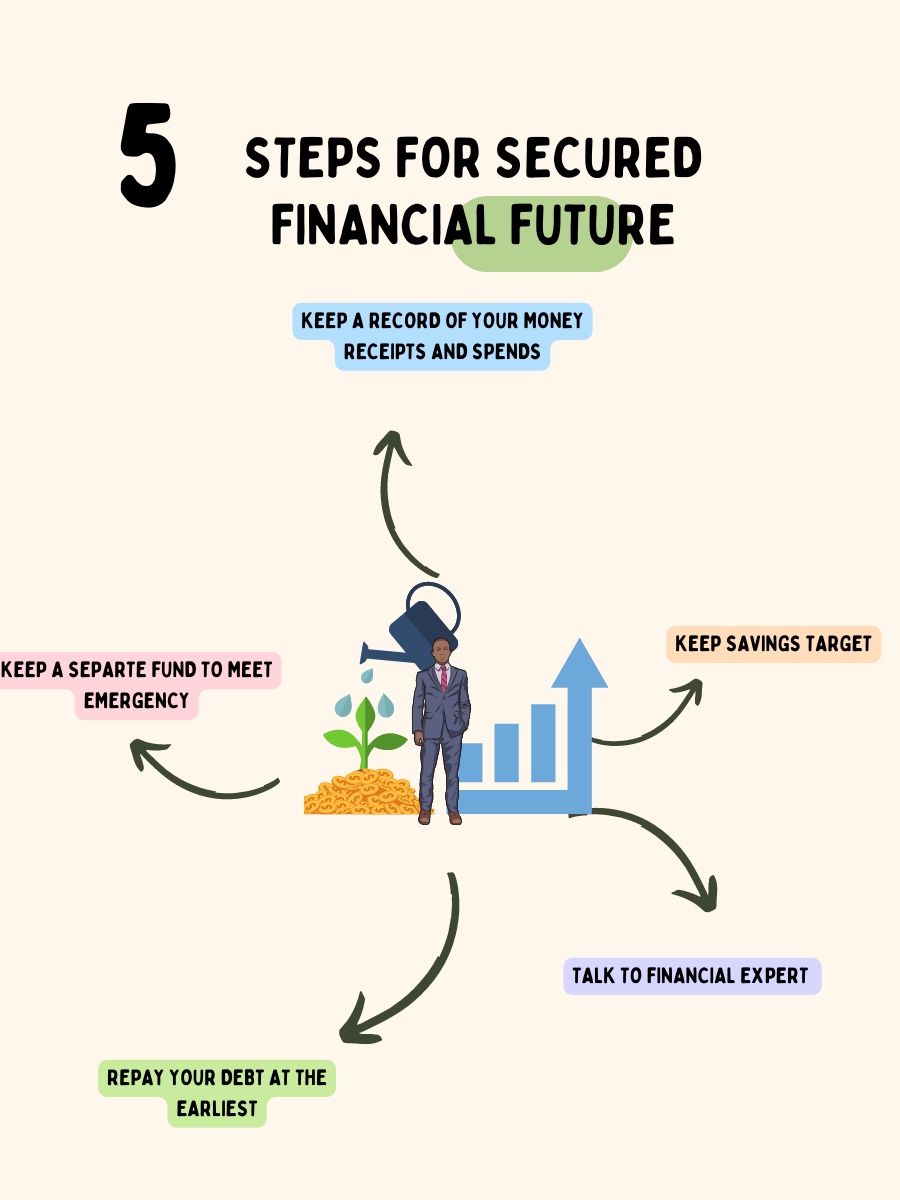

Amazing! 5 Powerful Steps to Start Investing and Secure Your Financial Future

Investing can seem daunting, a world of jargon and complex strategies reserved for the wealthy and experienced. But the truth is, investing is for everyone, regardless of age, income, or experience. It’s the key to building a secure financial future, achieving your dreams, and achieving financial freedom.

This article will guide you through the five essential steps to start investing, breaking down the process into manageable chunks and empowering you to take control of your financial future.

1. Understand Your Financial Situation and Goals

Before you dive into the world of investments, it’s crucial to understand your current financial situation and set clear goals. This involves:

- Assessing your income and expenses: Create a detailed budget to understand your monthly cash flow. Track your income sources and identify areas where you can potentially cut back on unnecessary expenses.

- Evaluating your existing debts: High-interest debt can significantly hinder your investment progress. Prioritize paying down debt, especially those with high-interest rates, before actively investing.

- Determining your risk tolerance: Your risk tolerance is your capacity to handle potential losses in your investments. Are you comfortable with volatile investments that have the potential for high returns, or do you prefer a more conservative approach with lower potential returns but less risk?

- Defining your financial goals: What do you want to achieve with your investments? Are you saving for retirement, a down payment on a house, or your child’s education? Having specific goals will help you choose the right investment strategies and track your progress.

2. Build an Emergency Fund

Before you start investing, it’s crucial to have a healthy emergency fund. This is a safety net that protects you from unexpected financial emergencies, such as job loss, medical bills, or car repairs.

- Aim for 3-6 months of living expenses: This amount should cover your essential expenses, including rent, utilities, groceries, and transportation, for a period of 3 to 6 months.

- Keep your emergency fund liquid: Choose a high-yield savings account or a money market account for your emergency fund, ensuring easy access to the funds when needed.

3. Learn the Basics of Investing

Investing is not just about throwing money at the stock market and hoping for the best. It requires understanding fundamental concepts and developing a strategy.

- Types of investments: Explore different investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, and precious metals. Each investment type has its own risk profile, potential returns, and liquidity.

- Diversification: Diversifying your portfolio by investing in different asset classes reduces your overall risk. By spreading your investments across various sectors, industries, and geographical locations, you minimize the impact of a single investment’s poor performance.

- Compounding: This powerful concept allows your investments to grow exponentially over time. When your investments earn returns, those returns are reinvested, generating further returns, creating a snowball effect that accelerates your wealth accumulation.

- Investment strategies: Research different investment strategies, such as value investing, growth investing, and index investing. Choose a strategy that aligns with your risk tolerance, time horizon, and financial goals.

4. Choose the Right Investment Accounts

Once you understand the basics of investing, it’s time to choose the right investment accounts. Here are some popular options:

- Brokerage accounts: These accounts allow you to buy and sell stocks, bonds, ETFs, and other securities. They offer a wide range of investment options and tools for managing your portfolio.

- Robo-advisors: These automated investment platforms offer personalized investment portfolios based on your risk tolerance and financial goals. They use algorithms to select and manage your investments, making investing more accessible for beginners.

- Retirement accounts: These tax-advantaged accounts, such as 401(k)s and IRAs, are designed for long-term savings for retirement. They offer tax benefits and potential for tax-deferred growth.

5. Start Small and Be Patient

Don’t feel pressured to invest a large sum of money initially. Start small and gradually increase your investment amount as you become more comfortable and confident.

- Dollar-cost averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This helps you average out your purchase price and reduce the risk of buying high and selling low.

- Be patient and disciplined: Investing is a long-term game. Don’t expect to get rich quick. Stay disciplined, stick to your investment plan, and avoid making impulsive decisions based on market volatility.

- Seek professional advice: If you’re unsure about where to start or need guidance on your investment strategy, consult a qualified financial advisor. They can help you develop a personalized plan that aligns with your goals and risk tolerance.

Investing is a journey, not a destination. It requires continuous learning, adaptation, and patience. By following these five steps, you can embark on your investment journey with confidence and build a secure financial future for yourself and your loved ones.

Remember: Investing involves risks, and there is no guarantee of returns. It’s essential to conduct thorough research, understand the risks involved, and make informed decisions.

Start your investment journey today and unlock the potential for financial freedom!

Closure

Thus, we hope this article has provided valuable insights into Amazing! 5 Powerful Steps to Start Investing and Secure Your Financial Future. We appreciate your attention to our article. See you in our next article!

google.com