Conquer the 101 of Capital Gains: A Powerful Guide to Understanding Your Investment Returns

Introduction

With great pleasure, we will explore the intriguing topic related to Conquer the 101 of Capital Gains: A Powerful Guide to Understanding Your Investment Returns. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquer the 101 of Capital Gains: A Powerful Guide to Understanding Your Investment Returns

Understanding capital gains is crucial for anyone who invests, whether it’s in stocks, real estate, or even collectibles. It’s the profit you make when you sell an asset for more than you paid for it. While the concept sounds simple, the intricacies of capital gains taxation can be daunting. This comprehensive guide will empower you to confidently navigate the world of capital gains and make informed decisions about your investments.

What are Capital Gains?

In essence, capital gains represent the increase in value of an asset over time. This increase can be due to various factors, including market growth, appreciation in value, or simply a successful investment strategy. When you sell an asset for a higher price than your initial purchase price, the difference is your capital gain.

Types of Capital Gains:

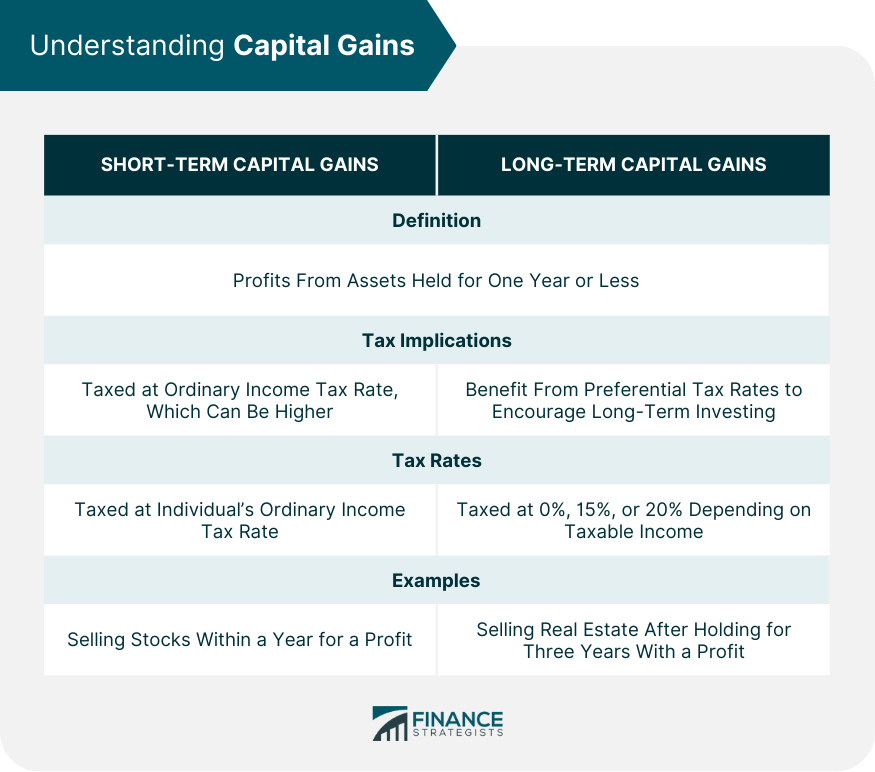

There are two primary categories of capital gains:

- Short-Term Capital Gains: These arise from the sale of assets held for less than one year. They are taxed at your ordinary income tax rate, which can be significantly higher than long-term capital gains rates.

- Long-Term Capital Gains: These occur when you sell assets held for more than one year. They are generally taxed at lower rates than short-term capital gains. The exact rate depends on your income bracket and the current tax laws.

Understanding Capital Gains Taxation:

Capital gains are subject to taxation, and the specific rules can vary depending on your jurisdiction. Here’s a breakdown of key aspects:

- Holding Period: As mentioned earlier, the length of time you hold an asset determines whether your gains are classified as short-term or long-term. This significantly impacts your tax liability.

- Tax Rates: Capital gains are taxed at different rates based on your income level and the type of gain (short-term or long-term). You can find the current tax rates for capital gains on the official website of your tax authority.

- Exemptions and Deductions: Depending on your location and specific circumstances, you might be eligible for certain exemptions or deductions that can reduce your capital gains tax liability. These can include things like capital losses, charitable donations, and tax-advantaged investment accounts.

Calculating Capital Gains:

Calculating your capital gains is relatively straightforward:

- Cost Basis: This is the original purchase price of your asset, including any associated costs like brokerage fees or commissions.

- Sale Price: This is the price at which you sell your asset.

- Capital Gain: Subtract your cost basis from your sale price. If the result is positive, you have a capital gain. If the result is negative, you have a capital loss.

Example:

Let’s say you bought 100 shares of a company at $50 per share (cost basis = $5,000). You sell these shares a year later for $70 per share (sale price = $7,000). Your capital gain would be $2,000 ($7,000 – $5,000).

Strategies for Managing Capital Gains:

Understanding capital gains is essential for optimizing your investment strategy. Here are some tips:

- Long-Term Investments: Holding assets for a longer period can qualify you for lower long-term capital gains rates.

- Tax-Loss Harvesting: Selling losing investments can offset capital gains and reduce your overall tax liability.

- Tax-Advantaged Accounts: Utilizing retirement accounts like IRAs or 401(k)s can defer capital gains taxes until retirement.

- Investment Timing: Consider the tax implications when selling assets, especially around year-end or major life events.

Capital Gains: A Powerful Tool for Wealth Building:

Capital gains are not just about taxes; they represent the growth of your investments. By understanding how capital gains work, you can:

- Maximize Your Returns: Strategic investment choices and timing can lead to higher returns and lower tax burdens.

- Build Long-Term Wealth: Capital gains are a cornerstone of wealth creation through investments.

- Achieve Financial Goals: Capital gains can help you reach your financial goals, whether it’s buying a house, retiring early, or leaving a legacy.

Conclusion:

Conquering the 101 of capital gains empowers you to make informed investment decisions and navigate the complexities of taxation. By understanding the basics of capital gains, you can harness the power of these returns to build a strong financial future. Remember to seek professional advice from a financial advisor or tax professional to ensure you’re maximizing your investment potential while minimizing your tax liability.

Closure

Thus, we hope this article has provided valuable insights into Conquer the 101 of Capital Gains: A Powerful Guide to Understanding Your Investment Returns. We appreciate your attention to our article. See you in our next article!

google.com