Conquer Your Debt: A 5-Step Plan to Financial Freedom

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Conquer Your Debt: A 5-Step Plan to Financial Freedom. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquer Your Debt: A 5-Step Plan to Financial Freedom

Debt. The word itself can trigger feelings of anxiety, stress, and even despair. Millions grapple with the weight of outstanding loans, credit card balances, and other financial obligations, often feeling trapped in a seemingly endless cycle. But conquering debt isn’t a pipe dream; it’s achievable with a strategic plan, unwavering discipline, and a healthy dose of self-compassion. This 5-step plan provides a powerful roadmap to financial freedom, empowering you to reclaim control of your finances and build a brighter future.

Step 1: Facing the Music – A Realistic Assessment of Your Debt

The first, and arguably most crucial, step is honestly assessing your current financial situation. Denial only prolongs the struggle. Gather all your financial statements – credit card bills, loan statements, medical bills, etc. Compile a comprehensive list detailing:

- Creditor: The name of each entity you owe money to.

- Balance: The current outstanding balance for each debt.

- Interest Rate: The annual percentage rate (APR) charged on each debt. This is critical for prioritizing repayment strategies.

- Minimum Payment: The minimum monthly payment required for each debt.

- Due Date: The date each payment is due.

Once you have this information organized, calculate your total debt. This might be a daunting number, but seeing it in black and white is the first step towards taking control. Don’t be discouraged; this is not a judgment; it’s a starting point.

Many find budgeting apps helpful in this process. These apps can automatically categorize your spending, track your income and expenses, and provide a clear picture of your financial health. Mint, Personal Capital, and YNAB (You Need A Budget) are popular options.

Step 2: Creating a Realistic Budget – Spending Less Than You Earn

With a clear understanding of your debt, the next step is to create a realistic budget. A budget isn’t about restriction; it’s about conscious spending and aligning your expenses with your income. This involves tracking your spending habits for a month or two to identify areas where you can cut back.

Consider using the 50/30/20 rule as a guideline:

- 50% Needs: Allocate 50% of your after-tax income to essential expenses like housing, utilities, groceries, transportation, and healthcare.

- 30% Wants: Allocate 30% to non-essential expenses like entertainment, dining out, and subscriptions. This is where you can identify areas for potential reductions.

- 20% Savings and Debt Repayment: Dedicate 20% to savings (emergency fund) and debt repayment. This is crucial for building a financial safety net and accelerating your debt reduction journey.

Remember, this is a guideline; you may need to adjust these percentages based on your individual circumstances. The key is to spend less than you earn, creating a surplus that can be directed towards debt repayment.

Step 3: Prioritizing Your Debt – Choosing the Right Strategy

There are several debt repayment strategies you can employ. The best approach depends on your individual circumstances and risk tolerance:

-

Avalanche Method: This method prioritizes paying off the debt with the highest interest rate first, regardless of the balance. This saves you the most money in the long run, but it can be demotivating if you have a large high-interest debt.

-

Snowball Method: This method prioritizes paying off the debt with the smallest balance first, regardless of the interest rate. This can be more motivating because you see quicker wins, providing a psychological boost to keep you going.

-

Debt Consolidation: This involves combining multiple debts into a single loan, often with a lower interest rate. This can simplify your payments and potentially reduce your overall interest payments. However, be cautious; ensure the new loan terms are favorable and that you don’t accumulate more debt.

-

Balance Transfer: This involves transferring high-interest credit card balances to a card with a lower introductory APR. This can save you money during the introductory period, but be mindful of the regular APR after the introductory period expires and any balance transfer fees.

Choose the strategy that best suits your personality and financial situation. Remember, consistency is key, regardless of the method you choose.

Step 4: Negotiating with Creditors – Exploring Options for Relief

If you’re struggling to make your payments, don’t hesitate to contact your creditors. Many are willing to work with you to create a payment plan that fits your budget. This could involve reducing your monthly payments, extending your repayment period, or even lowering your interest rate. Be polite, honest, and proactive in your communication. Explain your situation clearly and propose a realistic solution.

You can also explore options like debt management plans (DMPs) offered by credit counseling agencies. These agencies negotiate with your creditors on your behalf to reduce your payments and consolidate your debts. However, be sure to choose a reputable, non-profit credit counseling agency to avoid scams.

Step 5: Maintaining Financial Discipline – Building a Sustainable Future

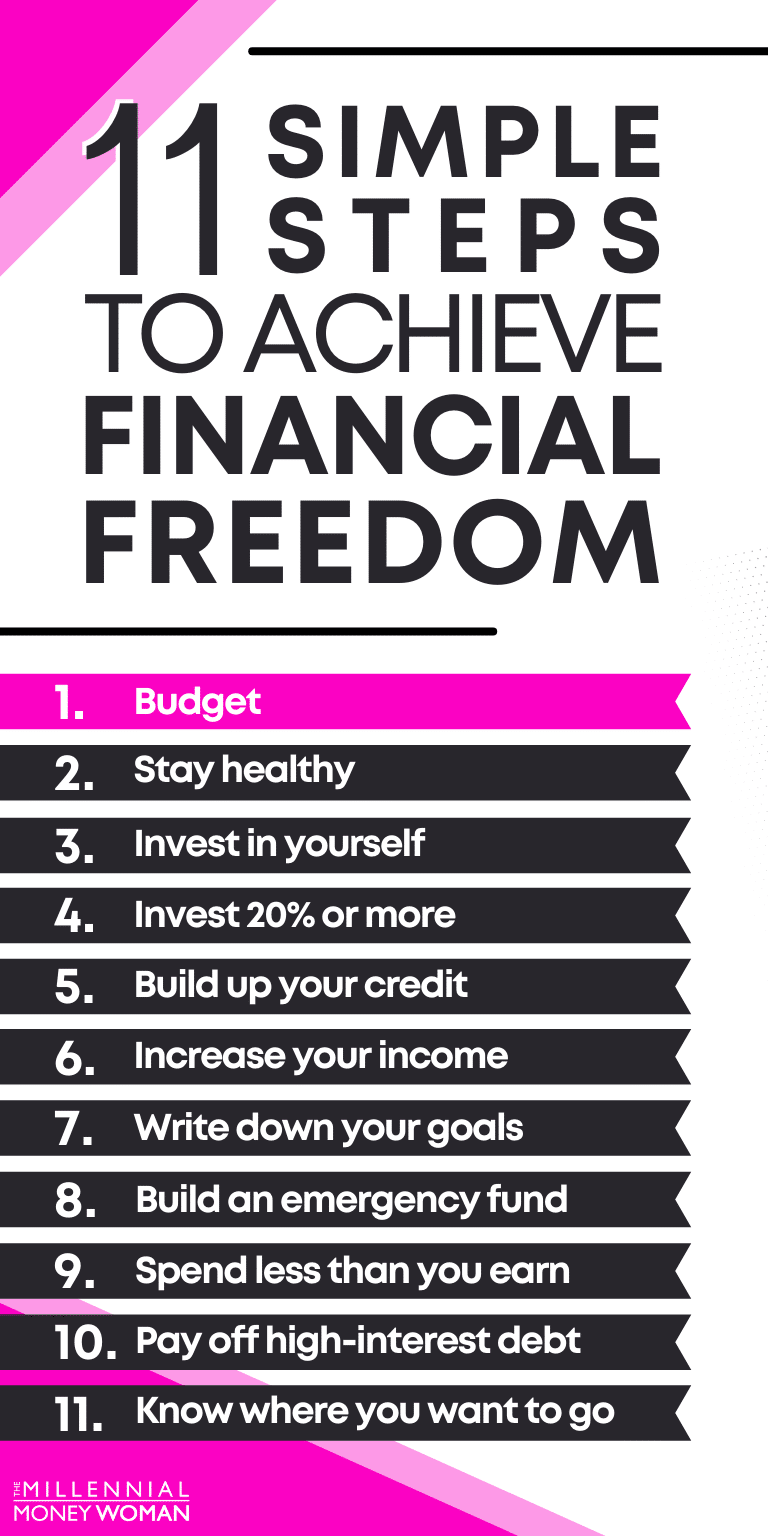

Conquering debt is a marathon, not a sprint. Once you’ve successfully paid off your debts, it’s crucial to maintain financial discipline to prevent falling back into debt. This involves:

- Continuing to budget: Regularly review and adjust your budget to ensure it aligns with your income and expenses.

- Building an emergency fund: Aim to save 3-6 months’ worth of living expenses in a readily accessible account to cover unexpected costs and avoid resorting to debt.

- Monitoring your credit score: Regularly check your credit report for errors and track your credit score to ensure you’re maintaining good financial health.

- Avoiding impulsive purchases: Practice mindful spending and avoid making unnecessary purchases.

- Seeking professional help: If you’re struggling to manage your finances, don’t hesitate to seek professional help from a financial advisor or credit counselor.

Conquering debt is a journey that requires commitment, discipline, and a willingness to make changes. By following these five steps, you can take control of your finances, build a brighter future, and finally achieve the financial freedom you deserve. Remember, you are not alone in this journey, and with perseverance and the right strategies, you can successfully conquer your debt and build a more secure and prosperous life.

Closure

Thus, we hope this article has provided valuable insights into Conquer Your Debt: A 5-Step Plan to Financial Freedom. We thank you for taking the time to read this article. See you in our next article!

google.com