Conquer Your Fears: 5 Crucial Steps to Understanding Mortgages

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Conquer Your Fears: 5 Crucial Steps to Understanding Mortgages. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquer Your Fears: 5 Crucial Steps to Understanding Mortgages

Buying a home is often touted as the cornerstone of the American Dream, a significant milestone representing financial stability and personal accomplishment. However, the process can feel daunting, particularly when navigating the complex world of mortgages. Understanding mortgages doesn’t require a finance degree, but it does demand a clear grasp of key concepts and a willingness to ask questions. This article will equip you with five crucial steps to demystify the mortgage process, empowering you to make informed decisions and confidently navigate this significant financial undertaking.

Step 1: Defining Your Financial Landscape – Assessing Your Affordability

Before even considering specific mortgage products, you need a realistic understanding of your financial capabilities. This involves more than just looking at your monthly income; it requires a thorough assessment of your overall financial health. Here’s what you need to consider:

-

Credit Score: Your credit score is a crucial factor in determining your eligibility for a mortgage and the interest rate you’ll receive. A higher credit score typically translates to better terms and lower interest rates. Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) to identify and address any errors or negative marks. Dispute any inaccuracies promptly.

-

Debt-to-Income Ratio (DTI): Lenders carefully scrutinize your DTI, which is the percentage of your gross monthly income that goes towards debt payments (including credit cards, student loans, car payments, and other loans). A lower DTI is generally more favorable, indicating a greater capacity to manage additional debt. Aim for a DTI below 43%, although some lenders may have stricter requirements.

-

Down Payment: The down payment is the initial amount you pay upfront towards the purchase of the home. A larger down payment typically reduces the loan amount, leading to lower monthly payments and potentially a lower interest rate. While a 20% down payment is often considered ideal to avoid Private Mortgage Insurance (PMI), there are various mortgage options available with lower down payments, albeit with potentially higher costs.

-

Savings: Beyond the down payment, you’ll need savings to cover closing costs, which can range from 2% to 5% of the loan amount. These costs include appraisal fees, title insurance, loan origination fees, and other expenses. Having sufficient savings for unexpected repairs or maintenance after purchasing the home is also highly recommended.

-

Monthly Expenses: Carefully analyze your monthly expenses to determine how much you can comfortably afford to allocate towards a mortgage payment. Remember to factor in property taxes, homeowner’s insurance, and potential HOA fees. Using online mortgage calculators can provide estimates of your monthly payments based on different loan scenarios.

Step 2: Exploring Mortgage Types – Finding the Right Fit

There’s a wide array of mortgage options available, each with its own terms, benefits, and drawbacks. Understanding the differences is crucial to selecting the mortgage that best aligns with your financial situation and goals. Some common types include:

-

Fixed-Rate Mortgages: These offer a consistent interest rate throughout the loan term, providing predictable monthly payments. They are generally preferred for their stability and predictability.

-

Adjustable-Rate Mortgages (ARMs): ARMs feature an interest rate that adjusts periodically based on market conditions. While they may offer lower initial interest rates, the fluctuating rates can lead to unpredictable monthly payments. ARMs can be a viable option for those who plan to sell or refinance their home before the interest rate adjusts significantly.

-

FHA Loans: Backed by the Federal Housing Administration, FHA loans are designed to assist first-time homebuyers and those with lower credit scores. They typically require lower down payments and more lenient credit requirements.

-

VA Loans: Offered to eligible veterans and active-duty military personnel, VA loans often require no down payment and offer competitive interest rates.

-

USDA Loans: These loans are available to eligible homebuyers in rural areas and often require no down payment.

Researching and comparing different mortgage types is essential to finding the one that best suits your individual circumstances. Consult with a mortgage lender to discuss your options and receive personalized advice.

Step 3: Shopping for the Best Mortgage Rate – Comparing Offers

Once you’ve identified a suitable mortgage type, it’s time to shop around for the best interest rate and terms. Don’t settle for the first offer you receive. Contact multiple lenders, including banks, credit unions, and mortgage brokers, to compare their rates, fees, and closing costs.

-

Pre-approval: Getting pre-approved for a mortgage before you start house hunting demonstrates your seriousness to sellers and provides you with a clearer understanding of your borrowing power.

-

Interest Rate: The interest rate is a crucial factor determining your monthly payment. Even small differences in interest rates can significantly impact the total cost of your mortgage over time.

-

Points: Mortgage points are prepaid interest that can buy you a lower interest rate. Weigh the benefits of paying points against the potential savings in interest over the life of the loan.

-

Closing Costs: These are the upfront fees associated with securing a mortgage. Compare closing costs across different lenders to identify the most cost-effective option.

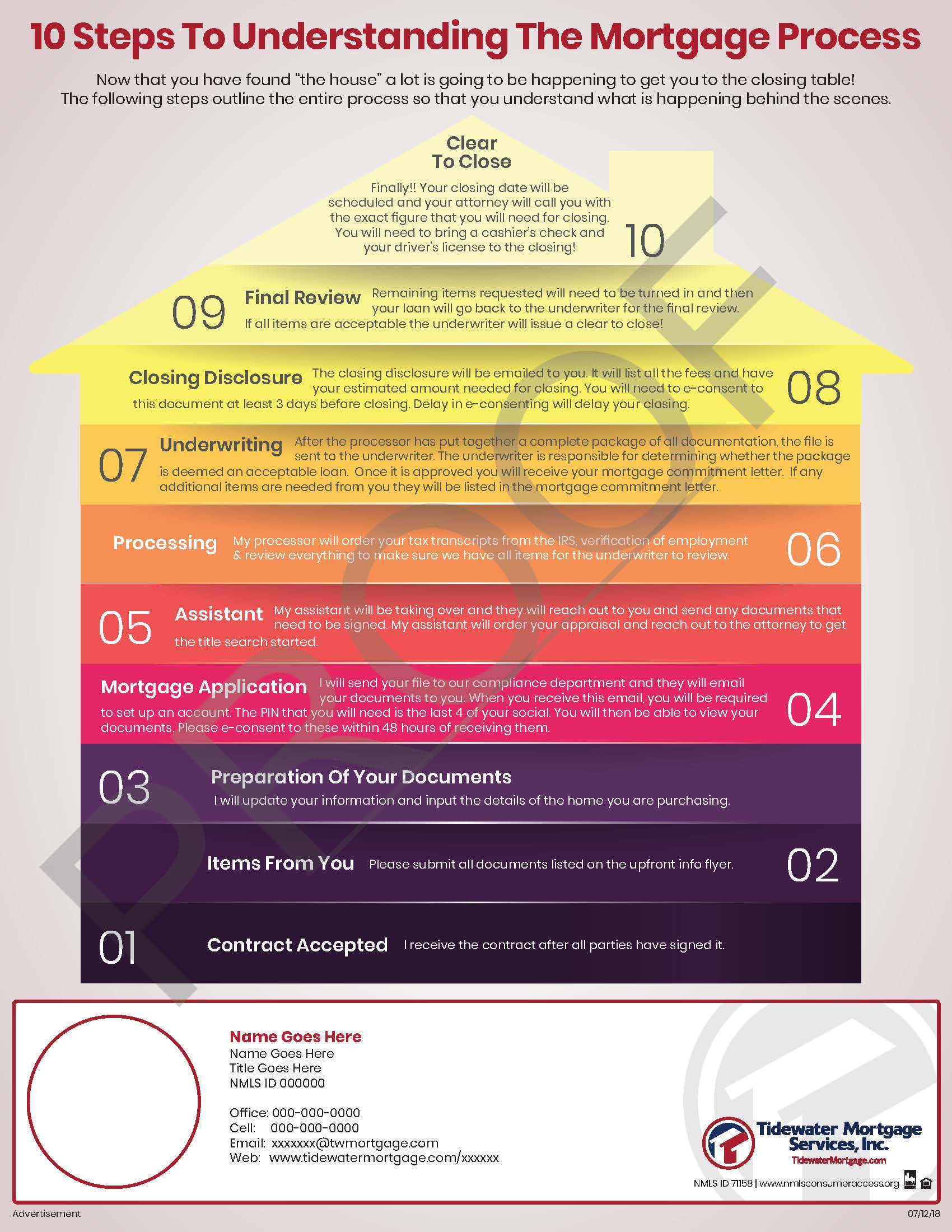

Step 4: Understanding the Mortgage Process – Navigating the Paperwork

Securing a mortgage involves a significant amount of paperwork and a series of steps. Understanding this process can help you stay organized and avoid delays.

-

Application: The application process involves providing detailed financial information, including income, employment history, and credit history.

-

Underwriting: The lender will review your application and assess your creditworthiness to determine your eligibility for a mortgage.

-

Appraisal: An appraisal will be conducted to determine the fair market value of the property.

-

Closing: This is the final step where you sign the mortgage documents and receive the keys to your new home.

Step 5: Long-Term Management – Maintaining Your Mortgage

Securing a mortgage is only the first step. Successfully managing your mortgage requires ongoing attention and responsible financial practices.

-

On-Time Payments: Making on-time payments is crucial for maintaining a good credit score and avoiding late fees.

-

Budgeting: Develop a realistic budget that accounts for your mortgage payment, property taxes, homeowner’s insurance, and other homeownership expenses.

-

Regular Monitoring: Regularly review your mortgage statement to ensure accuracy and identify any potential issues.

-

Refinancing: Consider refinancing your mortgage if interest rates drop significantly, allowing you to potentially lower your monthly payments or shorten the loan term.

Buying a home is a significant financial commitment, but by understanding the intricacies of mortgages and following these five crucial steps, you can conquer your fears, make informed decisions, and confidently embark on this exciting journey. Remember, seeking professional advice from a financial advisor or mortgage lender can provide invaluable support and guidance throughout the process. Don’t hesitate to ask questions and ensure you fully understand every aspect of your mortgage before signing on the dotted line.

Closure

Thus, we hope this article has provided valuable insights into Conquer Your Fears: 5 Crucial Steps to Understanding Mortgages. We hope you find this article informative and beneficial. See you in our next article!

google.com