Conquer Your Finances: 5 Crucial Financial Goals for Ultimate Success

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Conquer Your Finances: 5 Crucial Financial Goals for Ultimate Success. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquer Your Finances: 5 Crucial Financial Goals for Ultimate Success

Financial security. The very phrase evokes feelings of comfort, stability, and freedom. Yet, for many, it remains an elusive dream. Achieving true financial well-being requires planning, discipline, and a clear understanding of what you want to achieve. This article outlines five crucial financial goals that, when strategically pursued, can transform your relationship with money and pave the way for a brighter, more secure future. These aren’t just aspirations; they are actionable steps towards building a robust financial foundation.

1. Eradicate High-Interest Debt:

High-interest debt, like credit card debt and payday loans, is a financial vampire, slowly draining your resources and hindering your progress towards other goals. The crippling interest rates can make it feel like you’re running on a financial treadmill, constantly paying but never getting ahead. Therefore, aggressively tackling high-interest debt should be your top priority.

Several strategies can help you conquer this financial foe:

-

The Debt Avalanche Method: This method prioritizes paying off the debt with the highest interest rate first, regardless of the balance. While it might take longer to pay off smaller debts, the significant savings on interest in the long run make it a highly effective strategy. Focus your extra income and any windfalls on this high-interest debt until it’s eliminated.

-

The Debt Snowball Method: This method focuses on paying off the smallest debt first, regardless of the interest rate. The psychological boost of quickly eliminating a debt can provide the motivation to continue tackling the larger ones. This method is particularly effective for those who need a quick win to stay motivated.

-

Debt Consolidation: Consider consolidating your high-interest debts into a lower-interest loan, such as a personal loan or balance transfer credit card. This can simplify your payments and potentially lower your monthly expenses, freeing up more money to allocate towards debt repayment. However, carefully compare interest rates and fees before consolidating. A seemingly lower rate could be offset by high fees.

Negotiating with Creditors: Don’t be afraid to contact your creditors and explain your financial situation. They may be willing to work with you, offering a lower interest rate or a payment plan to help you get back on track. Be prepared to negotiate and be honest about your circumstances.

Successfully eliminating high-interest debt is a monumental achievement. It frees up significant cash flow, reduces financial stress, and allows you to focus on building wealth rather than just surviving.

2. Build an Emergency Fund:

Life throws curveballs. Unexpected job loss, medical emergencies, car repairs – these unforeseen events can quickly derail your financial stability if you’re not prepared. An emergency fund acts as a safety net, providing a cushion to absorb these shocks without plunging you into debt.

Aim to save 3-6 months’ worth of living expenses in a readily accessible account, such as a high-yield savings account or money market account. This fund should cover essential expenses like rent, utilities, groceries, and transportation.

Building an emergency fund requires discipline and consistent saving. Start small, even if it’s just a few dollars a week. Automate your savings by setting up recurring transfers from your checking account to your savings account. Every little bit helps, and the peace of mind it provides is invaluable.

3. Invest for Your Future:

While paying down debt and building an emergency fund are crucial short-term goals, investing for your future is essential for long-term financial security. Investing allows your money to grow over time, providing a foundation for retirement, major purchases, or other long-term aspirations.

Several investment options are available, each with its own level of risk and potential return:

-

Retirement Accounts: Retirement accounts, such as 401(k)s and IRAs, offer tax advantages that can significantly boost your investment returns. Contribute regularly to maximize the benefits of employer matching (if applicable) and tax deductions.

-

Stocks: Stocks represent ownership in a company and offer the potential for high returns, but also carry higher risk. Diversify your stock investments across different companies and sectors to mitigate risk.

-

Bonds: Bonds are less risky than stocks but generally offer lower returns. They represent a loan to a company or government and pay interest over a set period.

-

Real Estate: Real estate can be a good long-term investment, offering both rental income and potential appreciation. However, it requires significant capital and carries considerable risk.

Before investing, research different investment options and consider your risk tolerance and time horizon. Consider consulting with a financial advisor to develop an investment strategy tailored to your individual needs and goals.

4. Plan for Retirement:

Retirement may seem far off, but it’s never too early to start planning. The longer you invest, the more time your money has to grow, thanks to the power of compounding. Retirement planning involves several key steps:

-

Determine Your Retirement Needs: Estimate your expenses in retirement and determine how much you’ll need to save to maintain your desired lifestyle.

-

Choose Retirement Savings Vehicles: Maximize contributions to employer-sponsored retirement plans and open individual retirement accounts (IRAs).

-

Develop an Investment Strategy: Invest your retirement savings in a diversified portfolio of assets to balance risk and return.

-

Regularly Review and Adjust Your Plan: Your retirement plan should be a living document, regularly reviewed and adjusted to reflect changes in your circumstances and financial goals.

5. Protect Your Assets:

Unexpected events can significantly impact your financial well-being. Protecting your assets through insurance is crucial to mitigating potential losses.

-

Health Insurance: Health insurance protects you from the high costs of medical care.

-

Disability Insurance: Disability insurance provides income replacement if you become unable to work due to illness or injury.

-

Life Insurance: Life insurance provides financial protection for your loved ones in the event of your death.

-

Homeowners or Renters Insurance: Homeowners or renters insurance protects your property and belongings from damage or theft.

-

Auto Insurance: Auto insurance protects you from financial liability in the event of a car accident.

Adequate insurance coverage is essential to safeguard your financial future and prevent unforeseen circumstances from derailing your progress.

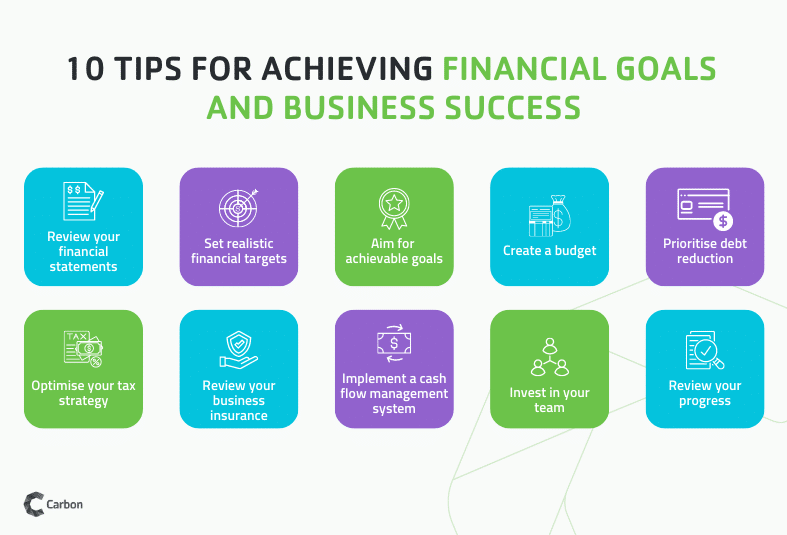

Achieving these five crucial financial goals requires dedication, discipline, and a long-term perspective. It’s a journey, not a sprint. By focusing on these key areas and taking consistent action, you can conquer your finances and build a brighter, more secure future for yourself and your loved ones. Remember to seek professional advice when needed; a financial advisor can provide personalized guidance and support to help you navigate the complexities of financial planning. The journey to financial success is within your reach; take the first step today.

Closure

Thus, we hope this article has provided valuable insights into Conquer Your Finances: 5 Crucial Financial Goals for Ultimate Success. We hope you find this article informative and beneficial. See you in our next article!

google.com