Conquer Your Finances: A 5-Step Budget Blueprint for Ultimate Financial Freedom

Introduction

With great pleasure, we will explore the intriguing topic related to Conquer Your Finances: A 5-Step Budget Blueprint for Ultimate Financial Freedom. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquer Your Finances: A 5-Step Budget Blueprint for Ultimate Financial Freedom

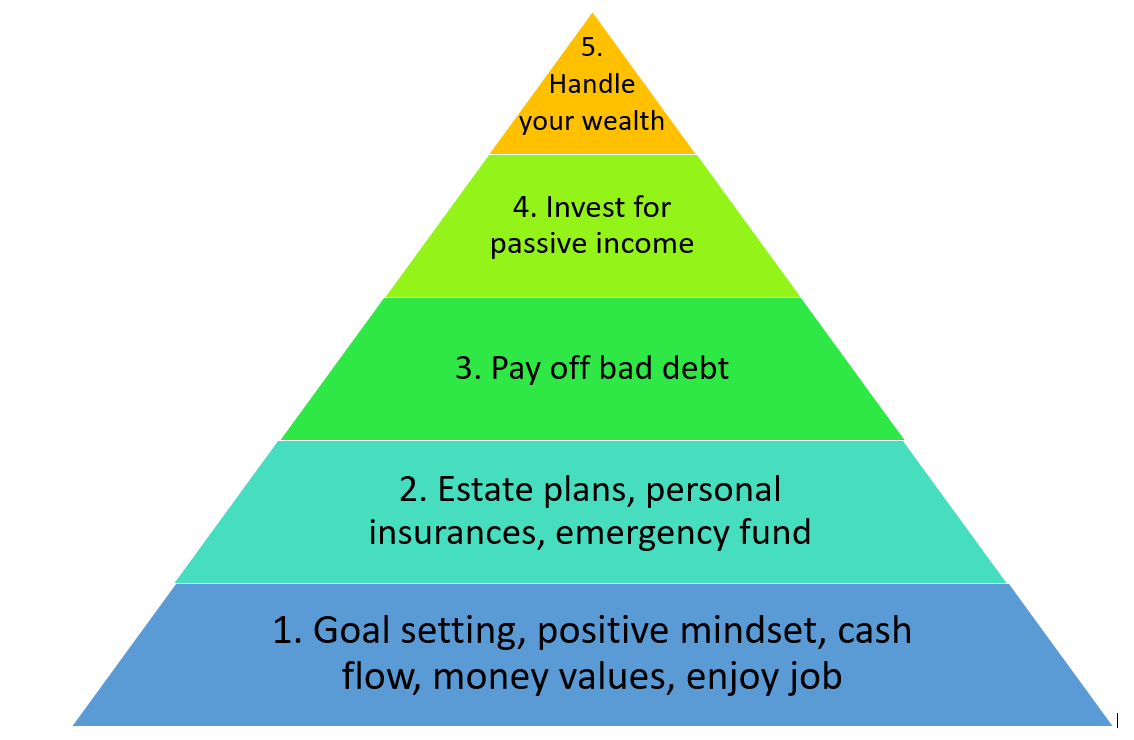

Financial anxiety is a pervasive problem, leaving many feeling overwhelmed and powerless. But what if we told you that reclaiming control of your finances is entirely achievable? This isn’t about deprivation; it’s about empowerment. This 5-step budget blueprint will guide you towards financial freedom, providing a clear, actionable plan to conquer your spending and build a secure financial future.

Step 1: The Honest Assessment – Understanding Your Current Financial Landscape

Before you can build a strong financial foundation, you need to understand the ground you’re standing on. This involves a thorough assessment of your current financial situation. This isn’t a pleasant task for everyone, but it’s crucial for effective budgeting.

-

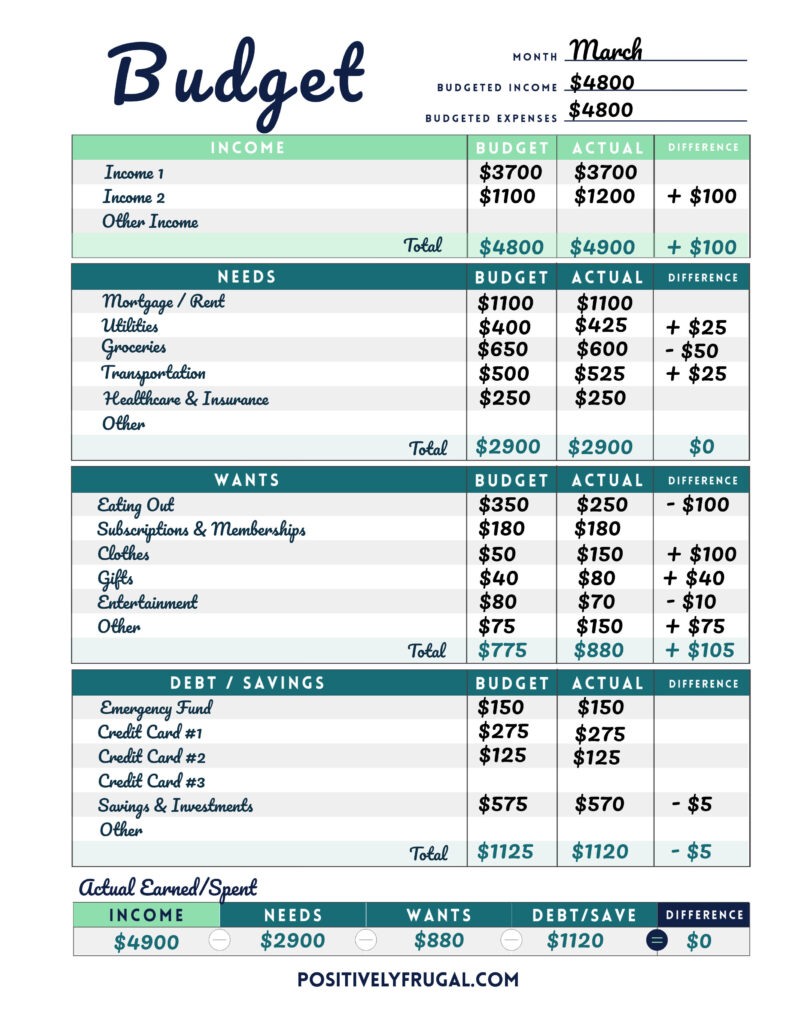

Track Your Spending: For at least a month, meticulously track every single penny you spend. Use a budgeting app (Mint, YNAB, Personal Capital are popular choices), a spreadsheet, or even a notebook. Categorize your expenses (housing, transportation, food, entertainment, etc.) to see where your money is actually going. Be brutally honest – even that daily coffee adds up! The more accurate your tracking, the more effective your budget will be.

-

Calculate Your Income: Determine your net income (income after taxes and deductions). This is the money you have available to spend and save. Consider all sources of income, including salary, freelance work, investments, and any other regular income streams.

-

List Your Assets and Liabilities: Identify all your assets (possessions with monetary value, like your home, car, savings accounts, investments) and liabilities (debts, like mortgages, student loans, credit card debt). Knowing your net worth (assets minus liabilities) provides a snapshot of your overall financial health.

-

Identify Areas for Improvement: Once you’ve gathered this data, analyze it. Where are your biggest expenses? Are there areas where you can easily cut back? Are there any recurring expenses you can eliminate or negotiate lower rates on (e.g., insurance, cable)? This honest self-assessment is the cornerstone of successful budgeting.

Step 2: Setting Realistic Financial Goals – Defining Your "Why"

A budget isn’t just a list of numbers; it’s a roadmap to achieving your financial goals. Defining clear, measurable, achievable, relevant, and time-bound (SMART) goals will provide the motivation and direction you need to stick to your budget.

-

Short-Term Goals (within 1 year): These could include paying off a small debt, saving for a vacation, building an emergency fund, or replacing a broken appliance.

-

Medium-Term Goals (1-5 years): These might involve saving for a down payment on a house, paying off a larger debt, funding your child’s education, or investing in a business.

-

Long-Term Goals (5+ years): Long-term goals could include early retirement, securing your financial future, leaving an inheritance, or achieving financial independence.

The clearer your goals, the more effectively you can allocate your resources. Writing down your goals and visualizing their achievement can significantly boost your motivation and commitment. Remember to regularly review and adjust your goals as your circumstances change.

Step 3: Creating Your Budget – Allocating Resources Strategically

Now that you understand your financial situation and have defined your goals, it’s time to create your budget. There are several budgeting methods you can choose from:

-

50/30/20 Rule: This popular method suggests allocating 50% of your after-tax income to needs (housing, food, transportation, utilities), 30% to wants (entertainment, dining out, hobbies), and 20% to savings and debt repayment.

-

Zero-Based Budgeting: This method involves allocating every dollar of your income to a specific category, ensuring that your income equals your expenses. This leaves no room for unplanned spending.

-

Envelope System: This involves allocating cash to different envelopes for specific categories (groceries, gas, entertainment). Once the cash is gone, you can’t spend any more in that category.

-

Pay Yourself First: This approach prioritizes saving and investing by automatically transferring a predetermined amount from your checking account to your savings or investment accounts each month, before you pay any other bills.

Choose the method that best suits your personality and lifestyle. Remember, consistency is key. Regularly review and adjust your budget as needed.

Step 4: Monitoring and Adjusting – Staying on Track

Creating a budget is only half the battle; monitoring and adjusting it is just as crucial. Regularly review your spending against your budget to ensure you’re staying on track.

-

Regular Check-ins: Schedule weekly or monthly check-ins to review your progress. Compare your actual spending to your budgeted amounts. Identify any discrepancies and analyze the reasons behind them.

-

Flexibility and Adjustments: Life happens. Unexpected expenses arise. Be prepared to adjust your budget as needed. Don’t get discouraged if you occasionally overspend; simply learn from it and adjust your spending habits accordingly.

-

Celebrate Successes: Acknowledge and celebrate your successes. Reaching milestones, no matter how small, can boost your motivation and keep you on track.

Step 5: Seeking Professional Help – When to Ask for Support

While this guide provides a comprehensive framework, seeking professional help can be invaluable. Consider consulting with a financial advisor if you’re struggling to manage your finances, have complex financial situations, or need personalized guidance.

-

Financial Advisors: Financial advisors can provide personalized advice tailored to your specific financial goals and circumstances. They can help you develop a comprehensive financial plan, manage investments, and make informed financial decisions.

-

Credit Counselors: If you’re struggling with debt, a credit counselor can help you develop a debt management plan and negotiate with creditors.

-

Debt Consolidation Companies: These companies can help you consolidate multiple debts into a single loan with a lower interest rate, making it easier to manage your repayments.

Building a strong financial foundation takes time, effort, and discipline. It’s a journey, not a destination. By consistently following these five steps, you’ll gain control of your finances, reduce financial stress, and pave the way for a more secure and fulfilling future. Remember, financial freedom isn’t a privilege; it’s a right, and with a well-structured budget, it’s entirely within your reach. Consistently applying these principles will empower you to not just survive financially, but to thrive. Start today and begin your journey towards ultimate financial freedom.

Closure

Thus, we hope this article has provided valuable insights into Conquer Your Finances: A 5-Step Budget Blueprint for Ultimate Financial Freedom. We thank you for taking the time to read this article. See you in our next article!

google.com