Conquer Your Finances: A 5-Step Plan for Effortless Budgeting

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Conquer Your Finances: A 5-Step Plan for Effortless Budgeting. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquer Your Finances: A 5-Step Plan for Effortless Budgeting

Managing your finances can feel overwhelming, a daunting task that often gets pushed to the back burner. But what if I told you that creating a budget doesn’t have to be a stressful chore? With a structured approach and the right tools, budgeting can become a powerful tool to achieve your financial goals, whether it’s saving for a down payment, paying off debt, or simply having more peace of mind. This 5-step plan will empower you to take control of your money and build a brighter financial future.

Step 1: Track Your Spending – The Foundation of Financial Freedom

Before you can create a budget, you need to understand where your money is currently going. This crucial first step involves meticulously tracking your spending for at least one month. There are several ways to do this:

-

Manual Tracking: The old-fashioned way, using a notebook or spreadsheet, can be surprisingly effective. Record every transaction, noting the date, description, category (e.g., groceries, entertainment, transportation), and amount. Be thorough; even small purchases add up.

-

Budgeting Apps: Numerous apps are designed to simplify the tracking process. Many automatically categorize transactions from linked bank accounts and credit cards. Popular options include Mint, YNAB (You Need A Budget), Personal Capital, and EveryDollar. These apps often offer additional features like budgeting tools and financial analysis.

-

Bank and Credit Card Statements: While less detailed than manual tracking or app-based methods, reviewing your bank and credit card statements can provide a general overview of your spending habits. Look for recurring expenses and areas where you might be overspending.

Regardless of your chosen method, consistency is key. Don’t skip a day or a transaction. The more accurate your data, the more effective your budget will be. At the end of the month, analyze your spending. Identify areas where you’re spending more than anticipated and pinpoint potential areas for savings. This analysis will inform the next steps in creating your budget.

Step 2: Determine Your Income – Knowing Your Resources

Next, you need to accurately determine your monthly income. This includes your salary or wages, any freelance income, rental income, or other sources of revenue. Be realistic; don’t include potential income that’s not guaranteed. Consider any deductions, such as taxes, social security contributions, and health insurance premiums, to arrive at your net income (the amount you actually receive after deductions). This net income will be the basis for your budget. It’s important to be as precise as possible here to ensure your budget accurately reflects your financial reality.

Step 3: Allocate Your Funds – The 50/30/20 Rule and Beyond

Now comes the crucial part: allocating your income to different spending categories. A popular approach is the 50/30/20 rule:

-

50% Needs: Allocate 50% of your net income to essential expenses, such as housing (rent or mortgage), utilities (electricity, water, gas), groceries, transportation, and healthcare. These are the expenses you must cover to maintain your basic standard of living.

-

30% Wants: Allocate 30% to discretionary spending, including entertainment, dining out, hobbies, subscriptions, and clothing. These are the expenses that enhance your quality of life but are not essential for survival.

-

20% Savings and Debt Repayment: Dedicate 20% to savings and debt repayment. This is crucial for long-term financial security. Prioritize high-interest debt (like credit card debt) first. Savings can include emergency funds, retirement contributions, and investments.

The 50/30/20 rule is a guideline, not a rigid rule. You may need to adjust the percentages based on your individual circumstances. For example, if you have significant student loan debt, you might allocate a larger percentage to debt repayment. If you’re saving for a major purchase, you might increase your savings allocation. The key is to find a balance that works for you and allows you to meet your financial goals.

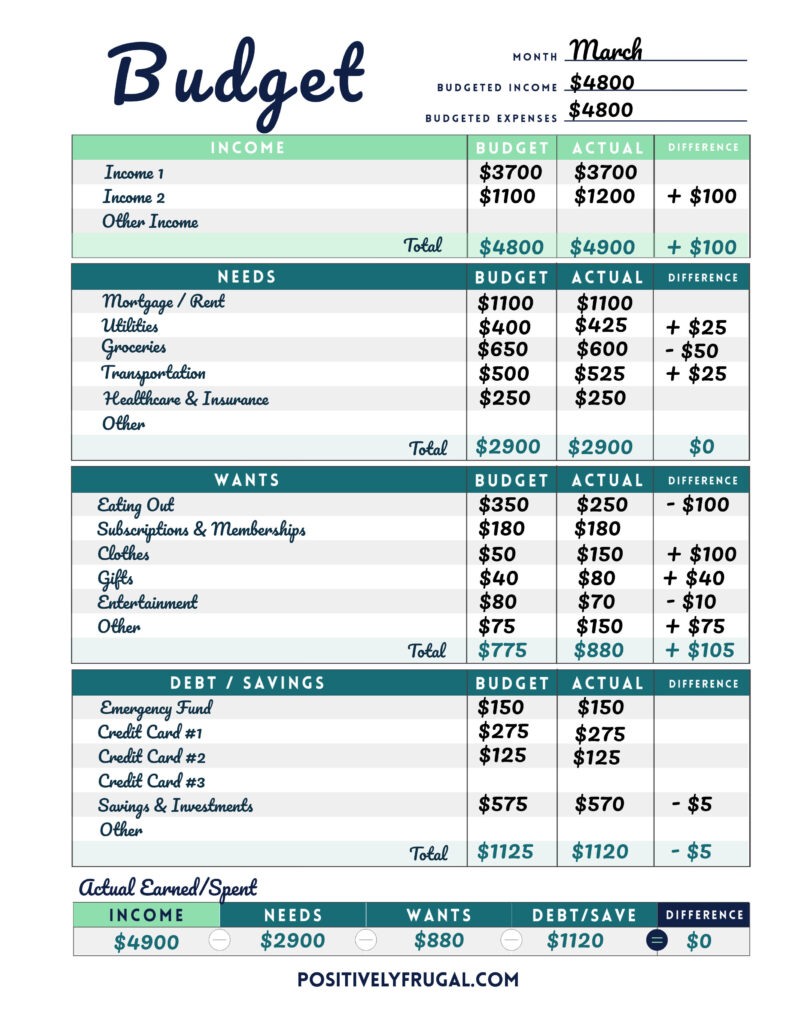

Step 4: Create Your Budget – Putting it All Together

Based on your income and spending analysis, create a detailed budget. This can be done using a spreadsheet, budgeting app, or even a simple notebook. List all your income sources and allocate them to your various expense categories. Be specific; instead of just "groceries," break it down further into "groceries," "eating out," and "coffee." This level of detail will provide a clearer picture of your spending habits. Regularly review and adjust your budget as needed. Life changes, and your spending habits will likely evolve over time.

Step 5: Monitor and Adjust – The Ongoing Process

Creating a budget is not a one-time event; it’s an ongoing process. Regularly monitor your spending to ensure you’re staying on track. Compare your actual spending to your budgeted amounts. If you’re overspending in certain areas, identify the cause and make adjustments. Perhaps you can cut back on non-essential expenses or find ways to increase your income. Don’t be discouraged by occasional setbacks. The important thing is to learn from your mistakes and keep refining your budget to better reflect your financial reality. Consider reviewing your budget monthly, or even weekly, depending on your needs and comfort level. Regular adjustments will ensure your budget remains relevant and effective in guiding your financial decisions.

Beyond the Basics: Advanced Budgeting Techniques

-

Zero-Based Budgeting: This method allocates every dollar of your income to a specific category, ensuring that you’re accounting for every penny. It’s a highly effective way to avoid overspending.

-

Envelope System: This involves allocating cash to different envelopes for various expense categories. Once the cash in an envelope is gone, you can’t spend any more in that category until the next pay period. This can be particularly helpful for visual learners and those who struggle with impulse spending.

-

Goal-Oriented Budgeting: Focus your budget on achieving specific financial goals, such as saving for a down payment, paying off debt, or investing for retirement. This can provide motivation and direction.

By consistently following these five steps, you’ll transform budgeting from a dreaded task into a powerful tool for achieving your financial aspirations. Remember, it’s a journey, not a race. Be patient with yourself, celebrate your successes, and learn from any setbacks. With dedication and the right approach, you can conquer your finances and build a secure and prosperous future.

Closure

Thus, we hope this article has provided valuable insights into Conquer Your Finances: A 5-Step Plan for Effortless Budgeting. We hope you find this article informative and beneficial. See you in our next article!

google.com