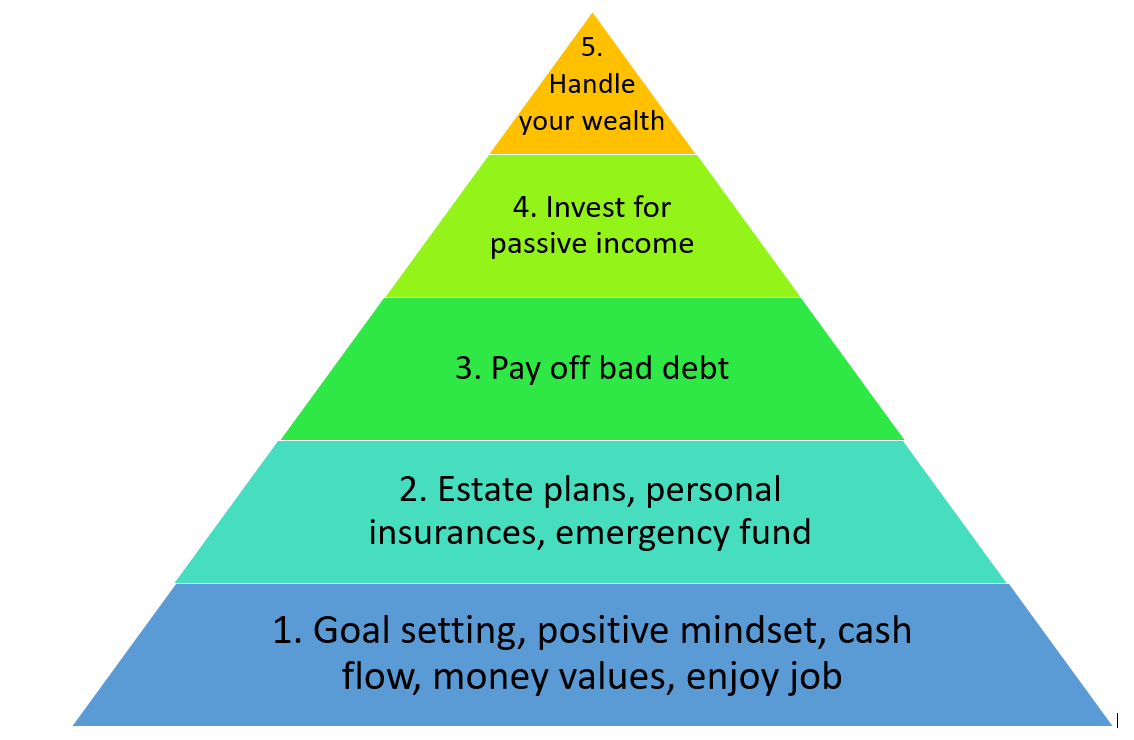

Conquer Your Finances: A 5-Step Power Plan for Financial Freedom

Introduction

With great pleasure, we will explore the intriguing topic related to Conquer Your Finances: A 5-Step Power Plan for Financial Freedom. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquer Your Finances: A 5-Step Power Plan for Financial Freedom

Financial anxiety is a common ailment, leaving many feeling overwhelmed and powerless. But taking control of your finances doesn’t have to be a daunting task. With a well-structured plan and a commitment to consistent action, you can achieve financial freedom and build a secure future. This 5-step power plan will guide you through the process, empowering you to conquer your financial anxieties and build a brighter tomorrow.

Step 1: Honest Assessment – Facing the Financial Reality

Before you can build a strong financial foundation, you need to understand the current state of your finances. This step requires brutal honesty and a willingness to confront any uncomfortable truths. Begin by gathering all relevant financial documents:

- Bank statements: Review the past three to six months of statements from all your accounts – checking, savings, credit cards, and investment accounts. Note your income, expenses, and any recurring charges.

- Credit reports: Obtain your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion). Check for errors and review your credit score. A low credit score can impact your ability to secure loans and credit at favorable rates.

- Debt records: List all your debts, including credit card balances, loans, and any other outstanding payments. Note the interest rates, minimum payments, and total balances.

- Investment statements: If you have any investments, gather statements detailing your portfolio’s performance and asset allocation.

- Income documentation: Collect pay stubs, tax returns, and any other documentation related to your income.

Once you have gathered all this information, create a comprehensive overview of your financial situation. This might involve using budgeting software, spreadsheets, or even a simple notebook. Categorize your expenses to identify areas where you may be overspending. Common categories include:

- Housing: Rent or mortgage payments, property taxes, homeowners insurance.

- Transportation: Car payments, gas, insurance, public transportation.

- Food: Groceries, dining out.

- Utilities: Electricity, water, gas, internet, phone.

- Healthcare: Insurance premiums, medical expenses.

- Debt payments: Credit card payments, loan payments.

- Entertainment: Movies, concerts, subscriptions.

- Personal care: Clothing, toiletries.

- Savings and investments: Contributions to retirement accounts, savings accounts, investment accounts.

This detailed analysis will reveal your net worth (assets minus liabilities) and highlight areas for improvement. Don’t be discouraged by what you find; the goal is to gain a clear picture, not to judge yourself.

Step 2: Setting Realistic Goals – Defining Your Financial Future

With a clear understanding of your current financial situation, it’s time to set realistic goals. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Consider these examples:

- Short-term goals (within 1 year): Pay off a specific credit card, build an emergency fund of 3-6 months’ worth of living expenses, save for a down payment on a car.

- Mid-term goals (1-5 years): Pay off student loans, save for a down payment on a house, increase your investment portfolio.

- Long-term goals (5+ years): Retire comfortably, fund your children’s education, leave an inheritance.

Be realistic in setting your goals. Avoid setting overly ambitious targets that are likely to lead to discouragement. Break down larger goals into smaller, more manageable steps. For example, instead of aiming to pay off $20,000 in debt in one year, focus on paying off a certain amount each month.

Step 3: Budgeting and Expense Tracking – Mastering Your Money

Creating a budget is crucial for achieving your financial goals. A budget helps you track your income and expenses, ensuring that you’re spending less than you earn. There are various budgeting methods, including:

- 50/30/20 rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-based budgeting: Assign every dollar of your income to a specific category, ensuring that your income equals your expenses.

- Envelope system: Allocate cash to different categories and only spend the cash in each envelope.

Choose a method that suits your personality and lifestyle. The key is consistency. Regularly track your expenses and compare them to your budget. Identify areas where you can cut back and redirect funds towards your goals. Utilize budgeting apps or spreadsheets to simplify the process. Regularly review and adjust your budget as needed.

Step 4: Debt Management – Strategically Reducing Your Burden

High-interest debt can significantly hinder your financial progress. Develop a strategy for managing your debt effectively. Consider these options:

- Debt snowball method: Pay off your smallest debt first, then roll the payment amount into the next smallest debt. This method provides psychological motivation.

- Debt avalanche method: Pay off your highest-interest debt first to minimize the total interest paid. This method is mathematically more efficient.

- Debt consolidation: Combine multiple debts into a single loan with a lower interest rate.

- Balance transfer: Transfer high-interest credit card balances to a card with a lower introductory APR.

Remember to prioritize debt repayment while maintaining a healthy emergency fund. Avoid accumulating new debt whenever possible.

Step 5: Investing and Saving – Building Your Wealth

Once you have a handle on your spending and debt, it’s time to focus on building your wealth through saving and investing. Start by building an emergency fund, ideally 3-6 months’ worth of living expenses. This fund will provide a safety net in case of unexpected events.

Then, consider investing in various assets to grow your wealth. Options include:

- Retirement accounts: 401(k)s, IRAs, Roth IRAs. Maximize employer matching contributions if available.

- Stocks: Invest in individual stocks or mutual funds to participate in market growth.

- Bonds: Invest in bonds for a more conservative approach with lower risk.

- Real estate: Consider investing in rental properties or REITs.

Diversify your investments to minimize risk. Consider seeking professional financial advice if you need assistance managing your investments. Regularly review and adjust your investment strategy as needed.

Creating a financial plan is a journey, not a destination. Regularly review and adjust your plan as your circumstances change. Celebrate your successes along the way, and don’t be discouraged by setbacks. With dedication and consistent effort, you can conquer your financial anxieties and build a secure and prosperous future. Remember, financial freedom is within your reach.

Closure

Thus, we hope this article has provided valuable insights into Conquer Your Finances: A 5-Step Power Plan for Financial Freedom. We hope you find this article informative and beneficial. See you in our next article!

google.com