Conquer Your Financial Future: 5 Essential Steps to Master Personal Finance

Introduction

With great pleasure, we will explore the intriguing topic related to Conquer Your Financial Future: 5 Essential Steps to Master Personal Finance. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquer Your Financial Future: 5 Essential Steps to Master Personal Finance

In the whirlwind of modern life, it’s easy to get caught up in the day-to-day and neglect our financial well-being. But taking control of your finances is not just about saving for a rainy day; it’s about securing your future, achieving your dreams, and living a life free from financial stress. This article will guide you through five essential steps to master personal finance, empowering you to conquer your financial future.

1. Know Your Money: Building a Foundation of Awareness

The first step towards financial mastery is understanding where your money goes. This requires a clear picture of your income and expenses.

- Track Your Spending: The most effective way to gain insight into your spending habits is to track every dollar you spend. This can be done manually using a notebook or spreadsheet, or with the help of budgeting apps like Mint, Personal Capital, or YNAB.

- Categorize Your Expenses: Once you’ve tracked your spending, categorize it into different areas like housing, food, transportation, entertainment, etc. This will reveal spending patterns and highlight areas where you can potentially cut back.

- Analyze Your Income: Beyond tracking your expenses, it’s crucial to understand your income sources. Analyze your salary, any side hustles, or passive income streams to create a complete picture of your financial resources.

2. Budgeting: Taking Control of Your Money

Budgeting is the cornerstone of personal finance. It involves creating a plan for how you’ll spend your money, ensuring that your expenses don’t exceed your income.

- Zero-Based Budgeting: This method involves allocating every dollar of your income to a specific category, leaving no room for unplanned spending. While it requires more effort upfront, it can help you gain control over your spending and avoid overspending.

- 50/30/20 Rule: This popular budgeting rule allocates 50% of your income to needs (essentials like housing, food, utilities), 30% to wants (entertainment, dining out, hobbies), and 20% to savings and debt repayment.

- Envelope System: This method involves dividing your cash into physical envelopes labeled with different spending categories. Once the money in an envelope is spent, you can’t spend more in that category until the next pay period.

3. Debt Management: Breaking Free from Financial Chains

Debt can be a significant obstacle to achieving financial freedom. Managing debt effectively is crucial for long-term financial stability.

- Prioritize Debt Repayment: Focus on paying down high-interest debt first, like credit cards, as they can quickly accumulate interest charges. Consider debt consolidation strategies to simplify your repayment process.

- Snowball Method: This method involves paying off the smallest debt first, then rolling the payment amount into the next smallest debt, creating a snowball effect that builds momentum.

- Avalanche Method: This method focuses on paying down the debt with the highest interest rate first, leading to significant savings on interest charges over time.

4. Saving and Investing: Building a Secure Future

Saving and investing are essential for achieving financial goals, whether it’s buying a home, retiring comfortably, or securing your children’s future.

- Emergency Fund: An emergency fund is a crucial safety net for unexpected expenses like medical bills, car repairs, or job loss. Aim to save 3-6 months’ worth of living expenses in an easily accessible account.

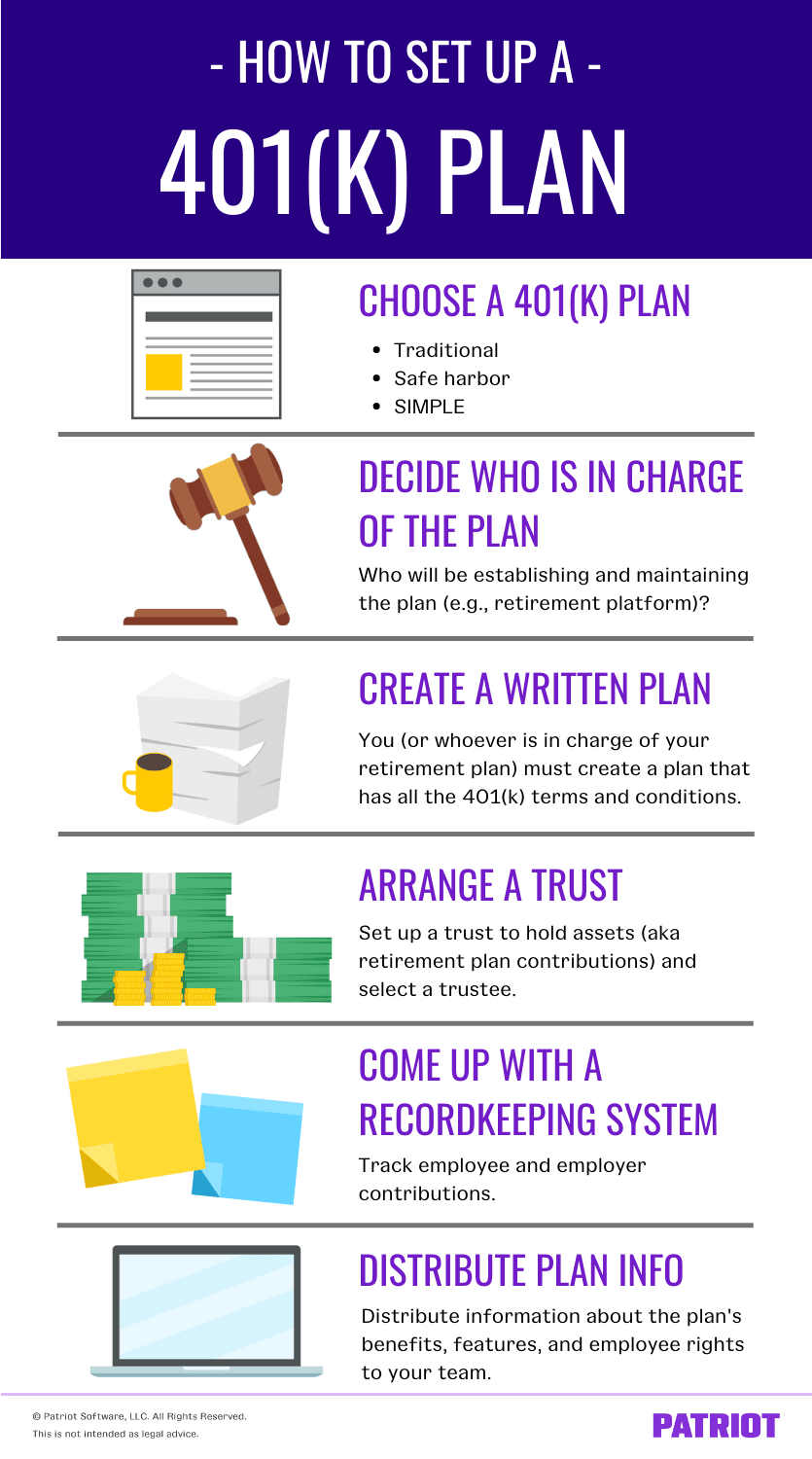

- Retirement Savings: Start saving for retirement as early as possible to benefit from the power of compound interest. Consider contributing to a 401(k) or IRA, taking advantage of employer matching contributions when available.

- Investing for Growth: Investing your savings in a diversified portfolio of stocks, bonds, and other assets can help your money grow over time. Consider seeking professional advice from a financial advisor to develop an investment strategy that aligns with your risk tolerance and financial goals.

5. Financial Planning: Charting Your Course to Success

Financial planning is the process of setting financial goals and developing a plan to achieve them. It involves considering your current financial situation, your future aspirations, and the steps you need to take to reach your goals.

- Set SMART Goals: Your financial goals should be Specific, Measurable, Achievable, Relevant, and Time-bound. This ensures that your goals are clear, actionable, and attainable.

- Develop a Financial Plan: Once you have defined your goals, create a comprehensive financial plan that outlines how you’ll achieve them. This plan should include budgeting, debt management, savings, and investment strategies.

- Regularly Review and Adjust: Life is unpredictable, and your financial situation may change over time. It’s essential to review your financial plan regularly and adjust it as needed to ensure it remains aligned with your evolving goals and circumstances.

Conclusion: Empowering Your Financial Future

Mastering personal finance is a journey, not a destination. It requires consistent effort, discipline, and a willingness to learn and adapt. By embracing the five essential steps outlined in this article, you can empower yourself to take control of your financial future, achieve your financial goals, and live a life free from financial stress. Remember, your financial well-being is a crucial foundation for a happy and fulfilling life. Start your journey today and watch your financial future flourish.

Closure

Thus, we hope this article has provided valuable insights into Conquer Your Financial Future: 5 Essential Steps to Master Personal Finance. We appreciate your attention to our article. See you in our next article!

google.com